Bitcoin has faced intense selling pressure, with the asset down 32% from its high of $126,000 on the 6th of October.

Exchange-traded funds (ETFs) remain a key channel for gauging Bitcoin market sentiment. This time, however, the behavior of investors behind these ETFs suggests deeper dynamics at play.

Bitcoin ETFs hit record outflows

U.S. Spot Bitcoin exchange-traded funds (ETFs) have remained on the bearish side of the market, recording significant outflows even as Bitcoin’s price attempts to stabilize.

Bitcoin [BTC] Spot ETFs are facing renewed pressure as traditional investors pull back capital while still maintaining exposure to the asset.

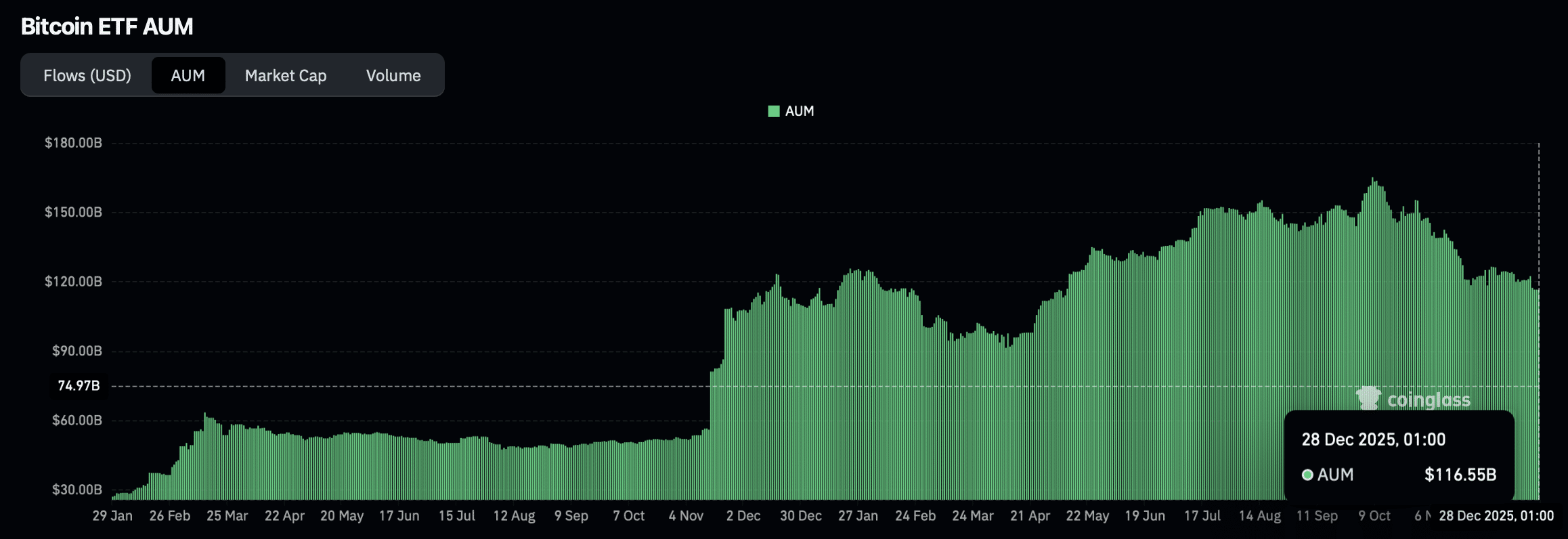

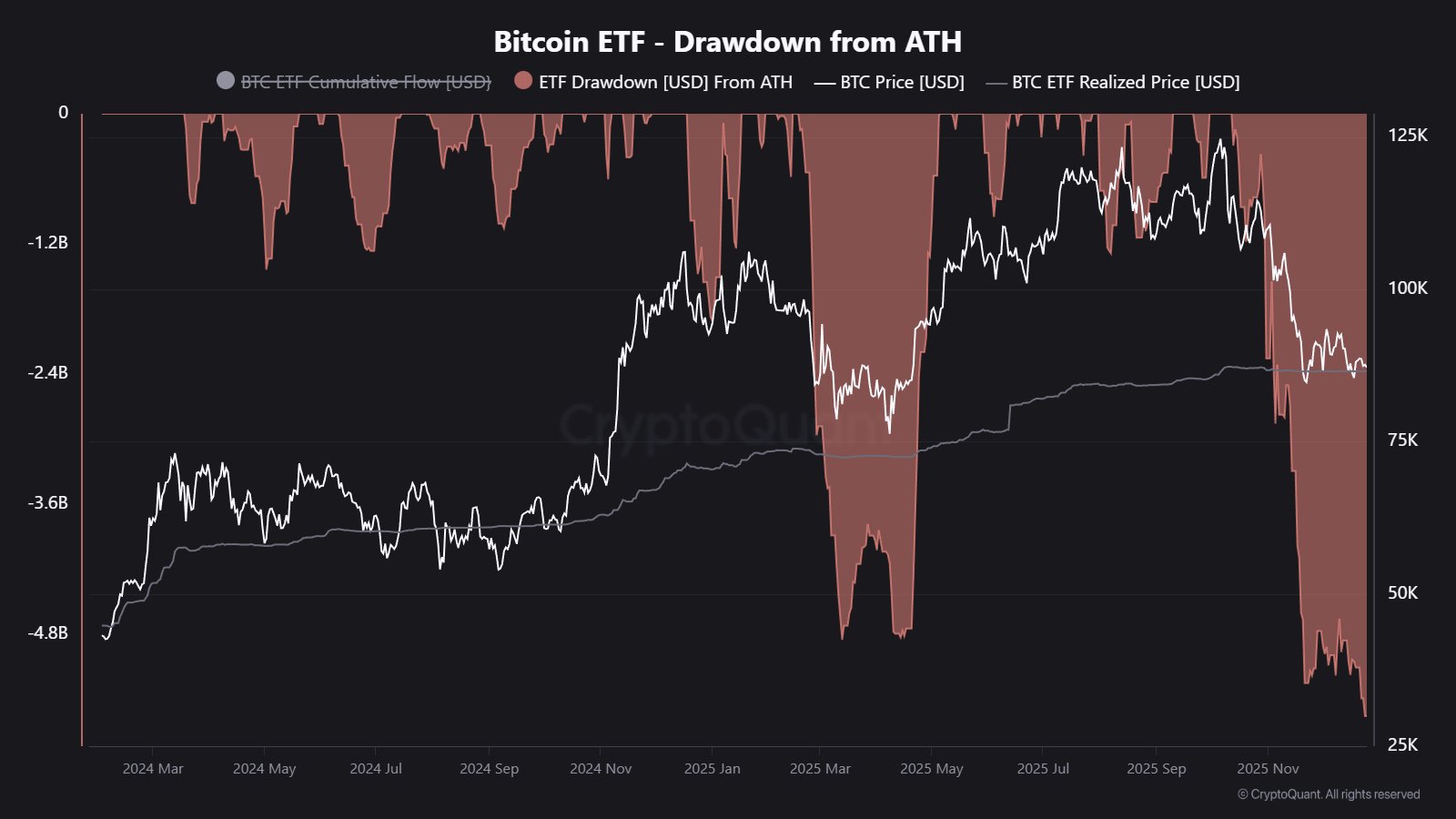

According to CryptoQuant, Cumulative Outflows from Bitcoin ETFs have reached $5.5 billion from their all-time high. As a result, total Assets Under Management (AUM) have dropped to $116.58 billion, down from a peak of $163.27 billion.

Source: CoinGlass

This trend confirms that traditional investors, operating through institutional ETFs, have scaled back capital inflows into the market.

Such outflows are expected during periods of weak market sentiment, especially as Bitcoin continues to range between $85,000 and $90,000.

BlackRock investors hold their ground

Despite broader ETF outflows, traditional investors with exposure to BlackRock’s U.S. spot Bitcoin ETF continue to dominate market activity.

Over the past twelve days, these investors have purchased more BTC than any other institutional group in the market.

Data showed that within this period, the group recorded six separate BTC ETF inflows, with total net inflows amounting to 1.32 million Bitcoin, valued at approximately $1.16 billion.

This trend remains a key indicator, particularly as BlackRock controls the largest share of BTC among institutional investors.

Source: CryptoQuant

As of press time, this group held $67.56 billion worth of Bitcoin, reinforcing a bullish undercurrent that continues to influence other ETF participants in the market.

Notably, retail investors trading Bitcoin directly through centralized exchanges are also showing signs of renewed confidence.

Since the start of December, this group has consistently accumulated BTC week after week. Last week alone, purchases totaled approximately $891.61 billion, according to Glassnode.

While this reflects broader global retail investor behavior, it confirms sustained confidence in the asset class, marked by four consecutive weeks of consistent supply absorption.

Outlook remains uncertain

BlackRock may still expand its involvement with Bitcoin, as CEO Larry Fink has publicly shifted his stance on the cryptocurrency.

Fink, who previously described Bitcoin as an “index for money laundering” and a tool for “thieves,” had a change in perspective during a recent interview at the DealBook Summit 2025.

He noted that BTC now presents a “huge future use case,” signaling growing institutional openness. While the scope of these use cases remains unclear, the shift highlights a potential long-term opportunity for current investors.

Final Thoughts

- Bitcoin’s ETF flows now reflect fragmentation rather than consensus.

- Traditional investors retreat from Bitcoin ETFs, though accumulation persists beneath the surface.