Coinbase Institutional’s latest market assessment signals a shift in cryptocurrency market dynamics as we approach 2026. Moving away from traditional cycle narratives, the market is now more heavily influenced by structural dynamics. Authored by Global Research Director David Duong and Research Analyst Colin Basco, the report suggests that price behavior is increasingly determined by market infrastructure and institutional participation, alongside individual speculation. The institution views 2026 as a period that will test the scalability and risk management capacities of the core cryptocurrency market under stringent financial conditions.

Derivatives at the Heart of Price Discovery

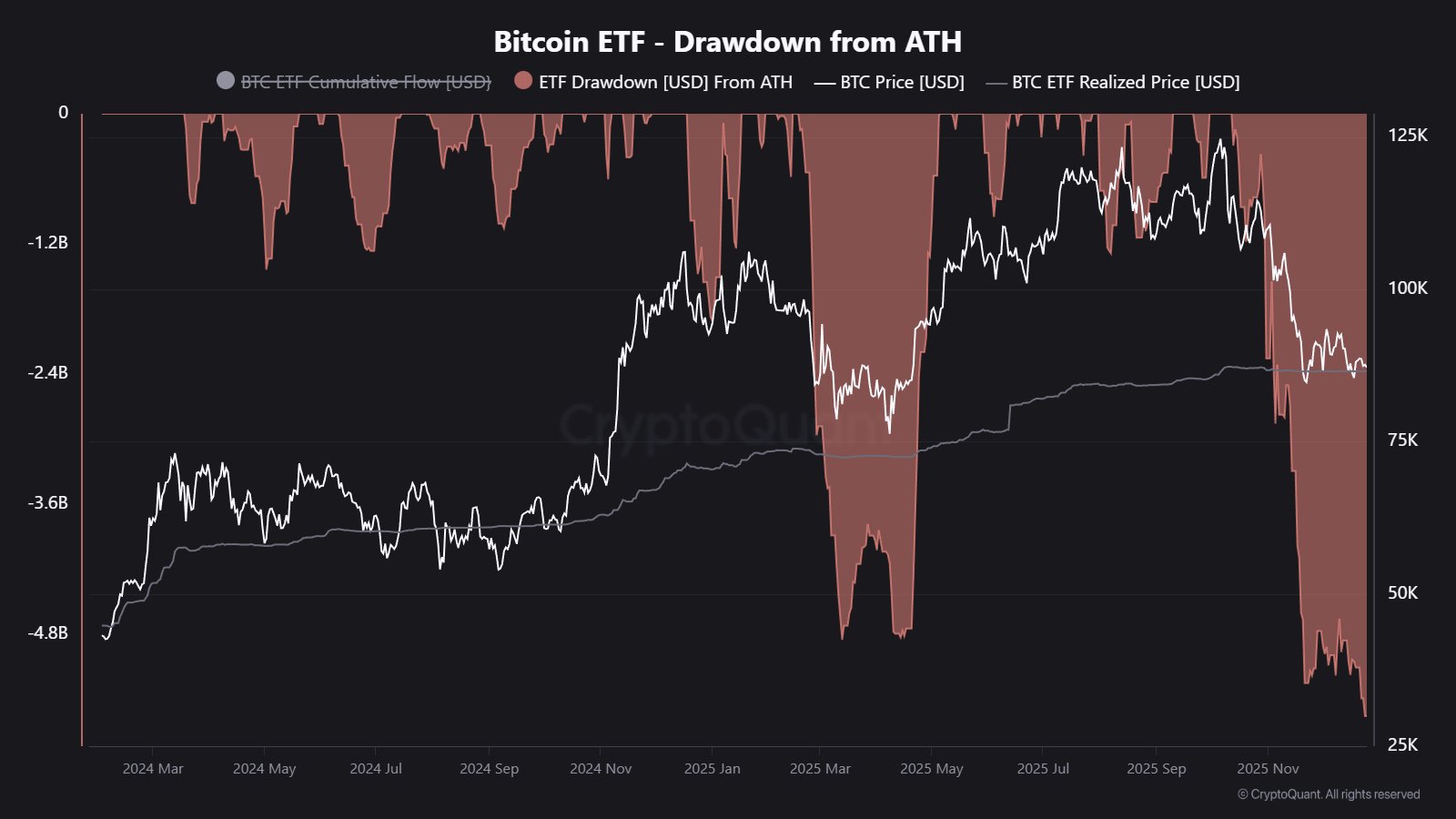

Coinbase Institutional emphasizes that price discovery in the crypto market is increasingly occurring via perpetual futures. The report notes that derivative products form the majority of the total volume on major trading platforms, with price formation becoming more tied to positioning, funding rates, and liquidity conditions.

Duong and Basco point out that leverage levels sharply declined following liquidation waves in late 2025. The institution describes this decline not as a retreat but as a “structural reset.” Excessive speculation has been purged; however, participation in perpetual futures has shown resilience.

The report reveals that stricter collateral requirements and improved risk controls contribute to more efficient shock absorption. It posits that with derivative markets continuing to be the dominant liquidity source, 2026 might see price movements interpreted more through market microstructure than narrative momentum.

Prediction Markets and Stablecoin Payments Carve Permanent Niches

According to Coinbase Institutional, prediction markets are shedding their experimental product image, evolving into a more robust financial infrastructure. The institution sees increasing nominal volumes and deepening liquidity as indications of strengthened information discovery and risk transfer functions.

The report highlights that fragmentation among prediction platforms augments the need for aggregation and efficiency. As regulatory frameworks in some regions become clearer, a rise in interest from more sophisticated participants is noted, extending usage beyond the crypto-native investor base.

The report also underscores stablecoins and payments as a third pillar of growth. Coinbase Institutional notes that stablecoin transaction volumes are shifting from speculative trading to focus on settlement, cross-border transfer, and liquidity management. The integration of payment flows with automated trading strategies and next-generation applications, according to the firm, might establish a fundamental backbone guiding the cryptocurrency market’s operations beyond 2026.