The CIOs of Two Major Companies Answered the Question, “Has the Four-Year Cycle in Bitcoin Ended?” – “A 10-Year Rise…”

The “four-year cycle” theory in Bitcoin, one of the most established investment strategies in the cryptocurrency market, is facing a serious test with the entry of institutional investors into the sector.

Appearing on CNBC’s Crypto World program, Matt Hougan, Chief Investment Officer (CIO) of Bitwise Asset Management, and Sebastian Bea, CIO of ReserveOne, offered striking insights into the future of Bitcoin and the changing market dynamics.

Bitwise CIO Matt Hougan argued that Bitcoin’s historical four-year price cycle, based on halving events, is no longer valid. Hougan stated, “The four-year cycle is being replaced by a ‘ten-year bull run’.”

According to Hougan, ETFs (Exchange Traded Funds) approved in early 2024, progress in regulation, and the rise of stablecoins have become far more dominant than past cyclical forces. Noting that BTC has become even less volatile than Nvidia in the last year, Hougan stated that institutional adoption is still in its infancy. He argued that the average institutional investor goes through an evaluation process lasting approximately eight meetings (or eight quarters) before making a Bitcoin allocation.

ReserveOne CIO Sebastian Bea stated that it might be too early to say the cycle is completely over, but the market structure has fundamentally changed. Bea noted that individual investors generally act based on price (momentum-based), while institutional investors operate on the principle of “strategic asset allocation.”

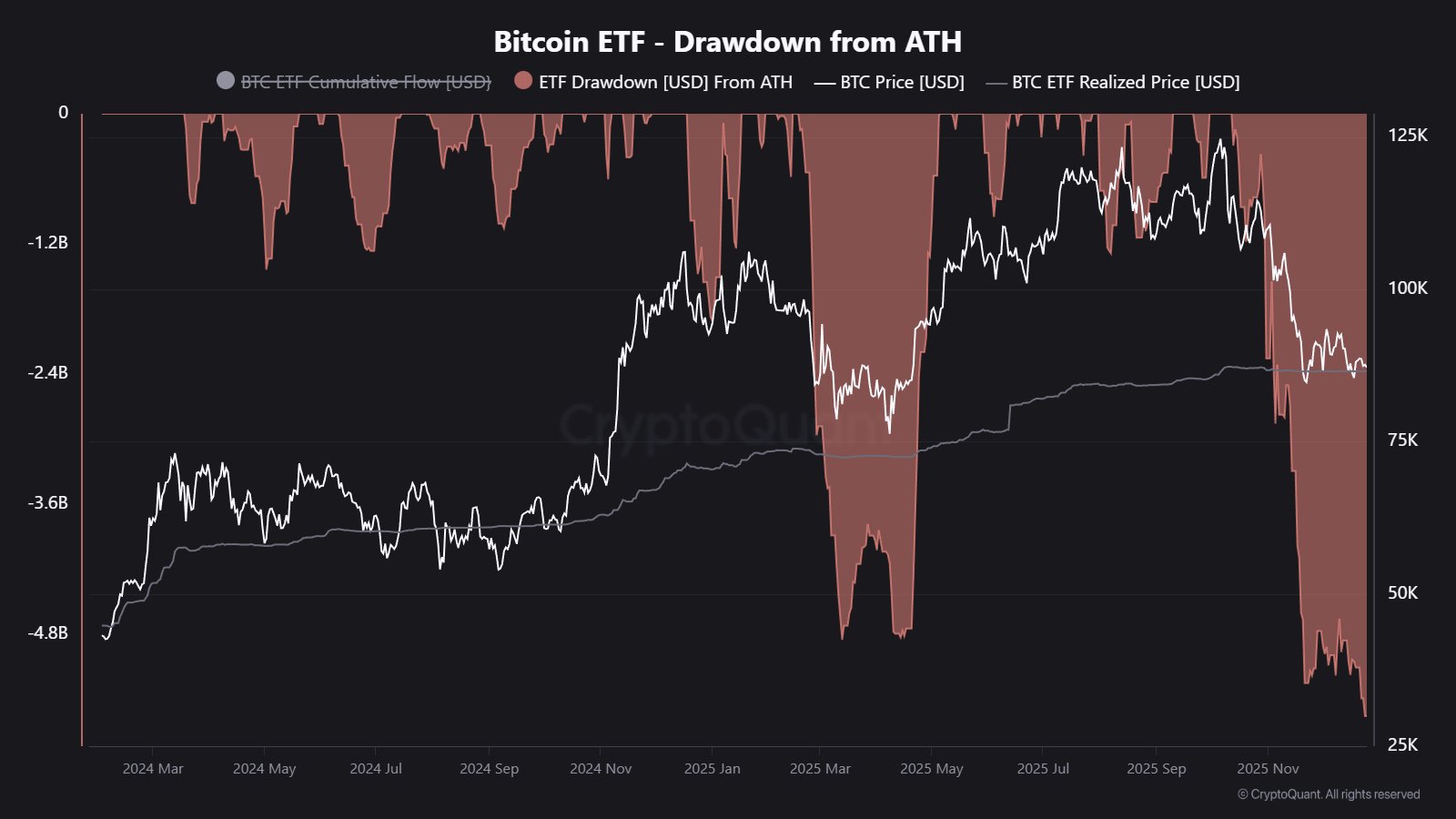

According to Bea, institutions create a stabilizing force in the market by buying Bitcoin to maintain portfolio balance when the price falls. This allows BTC to experience smoother pullbacks, replacing the sharp 60-80% drops of the past.

Both speakers agree that the nature of discussions with institutional investors has completely changed in the last five years. Matt Hougan recalls that five years ago, investors asked basic technical questions like “What is BTC?” or “How is it mined?”, but today the discussions have evolved into professional application questions such as “How does Bitcoin affect correlations in a portfolio?” or “Where does it fit as a hedge against inflation?”

The discussion also addressed the effects of the new US administration and the Fed’s interest rate decisions. Sebastian Bea noted that Bitcoin is now clearly recognized as a “commodity,” and regulatory uncertainty has decreased. However, he added that the market is now focused not only on political statements but also on liquidity conditions and the Fed’s actions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Gears Up for a Monumental Leap in 2026

Bitcoin drops 32% as ETF money exits – Yet THIS group isn’t backing off

Comparing Crypto Yield Models: Staking Returns of Digitap ($TAP), Ethereum and USDT

Crypto Market Dynamics: A Shift in Focus for 2026