News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

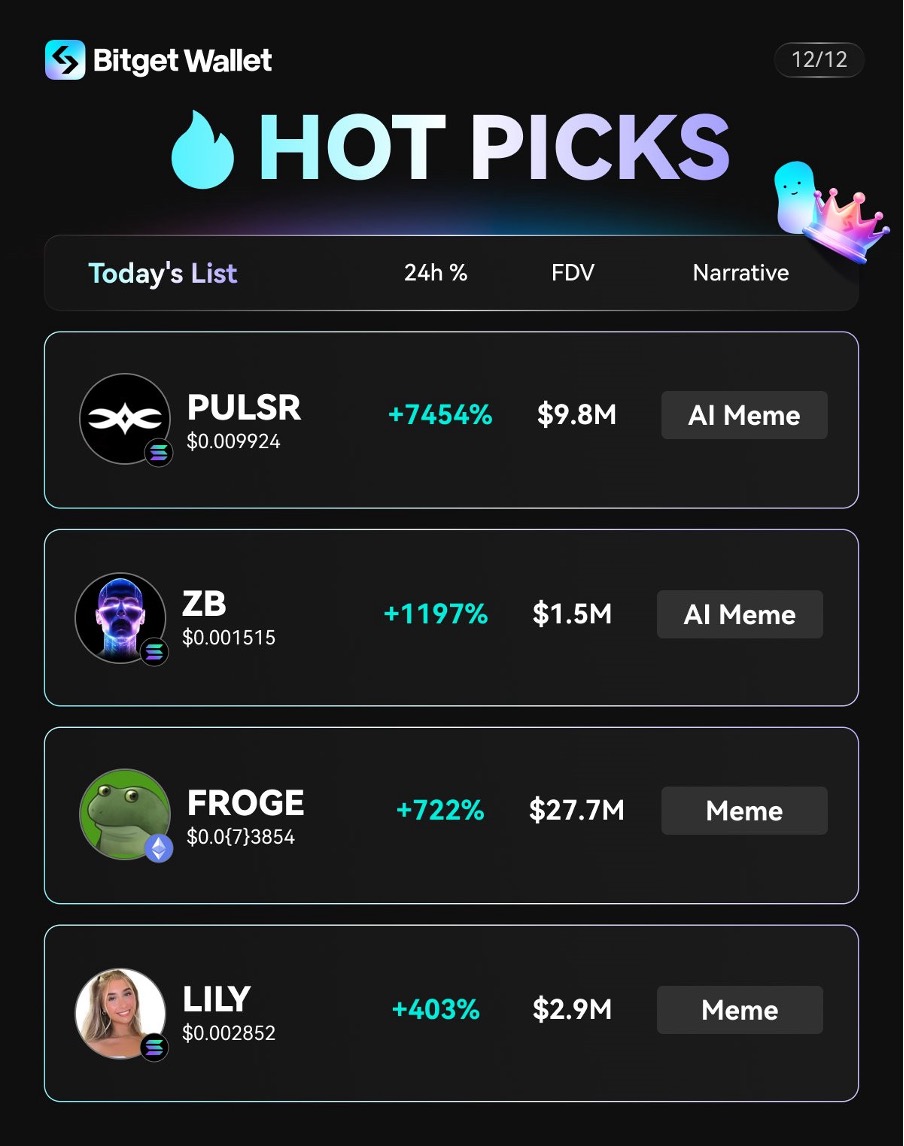

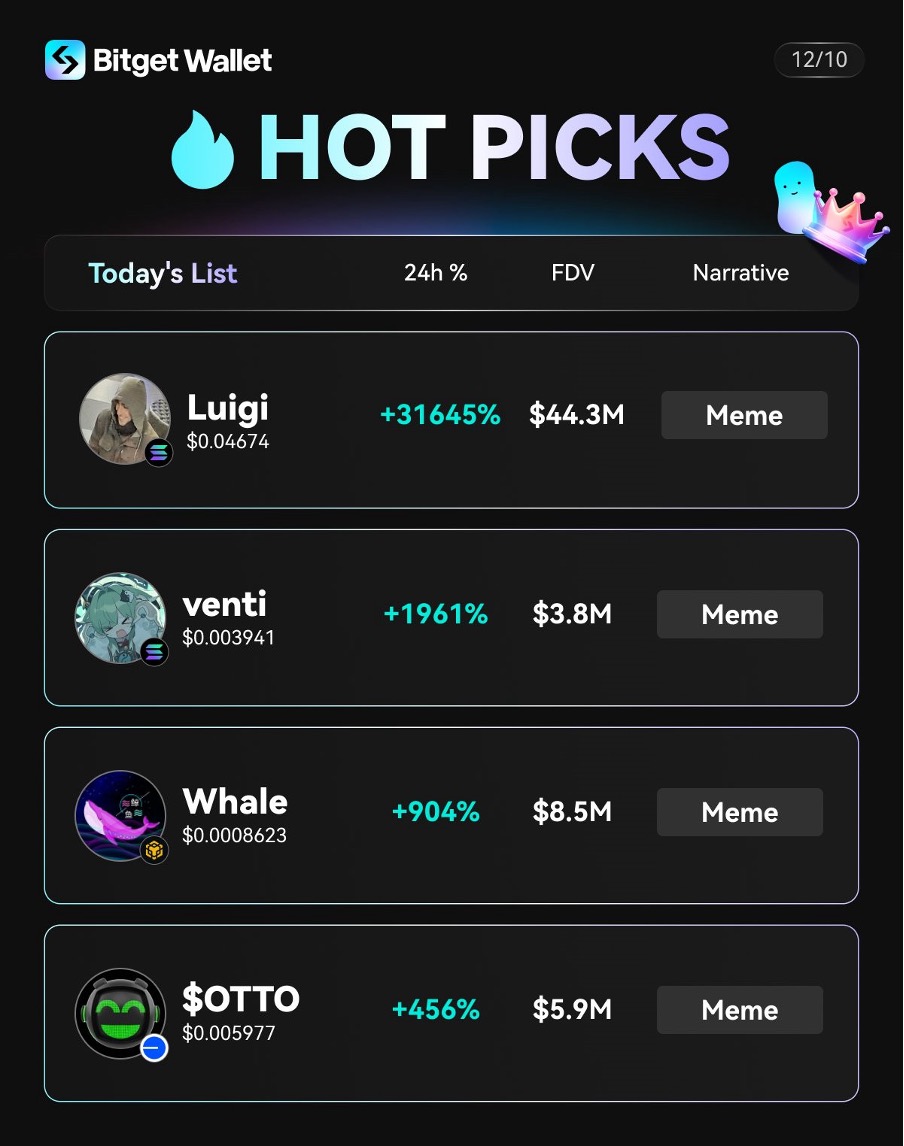

Today's popular MEME list

币币皆然 ·2024/12/12 10:18

Today's Popular MEME Inventory

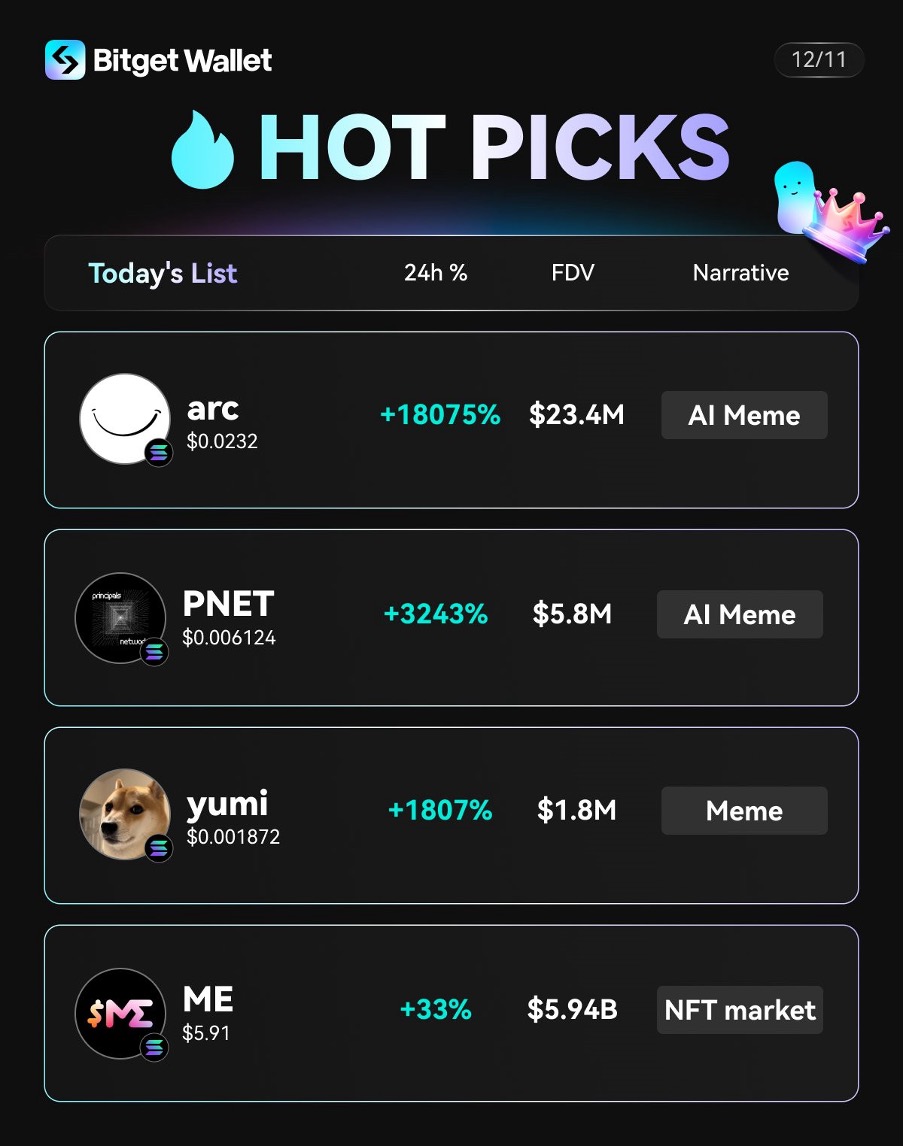

币币皆然 ·2024/12/11 11:05

Today's Popular MEME Inventory

币币皆然·2024/12/10 10:12

Flash

- 14:42Fidelity's Ethereum-based tokenized fund surpasses $250 million in scale, with a 15% monthly growthJinse Finance reported that Fidelity's Ethereum-based tokenized US Treasury fund has grown by 15% in the past month, with its scale surpassing $250 million. According to the report, 2025 is considered the year of RWA, and the total on-chain value of RWA has now exceeded $3.6 billion, more than doubling since the beginning of this year. This market consists of tokenized US Treasuries, bonds, and private credit. Among them, private credit accounts for more than half of the industry's market value, reaching $1.87 billion. In terms of how these assets are tokenized, Ethereum holds a dominant position, with $1.16 billion worth of risk-weighted assets (RWA), accounting for more than 63.7% of the industry's total.

- 14:20WBTC officially listed on JustLend DAOAccording to ChainCatcher, official sources report that WBTC has now officially launched on JustLend DAO. Users can now deposit or borrow WBTC on the platform, unlocking more efficient asset strategies and diversified yield combinations. This move not only injects the liquidity of a top global crypto asset into the TRON ecosystem, but also expands the strategic dimensions of on-chain finance, providing community users with richer earning opportunities and more flexible asset portfolio options.

- 14:20Data: Early Ethereum whale deposits 1,000 ETH to CEX, worth approximately $3.03 millionAccording to ChainCatcher, on-chain analyst @ai_9684xtpa monitored that an early Ethereum whale deposited 1,000 ETH to a CEX half an hour ago, worth $3.03 million. In the past month, he has cumulatively sold 10,500 ETH through exchanges and on-chain, with a total value of $35.39 million. He currently still holds 110,081 ETH, with a total value exceeding $335 million.