News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

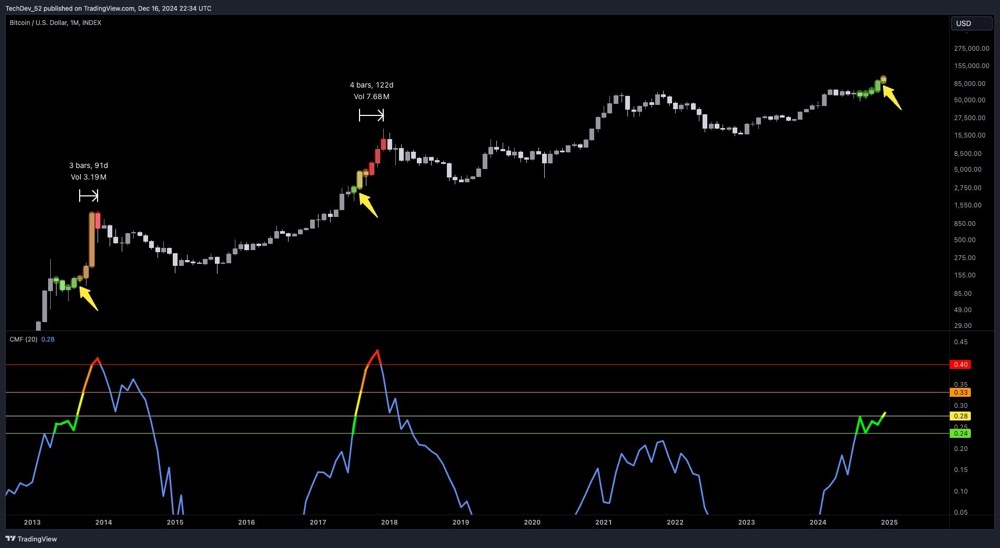

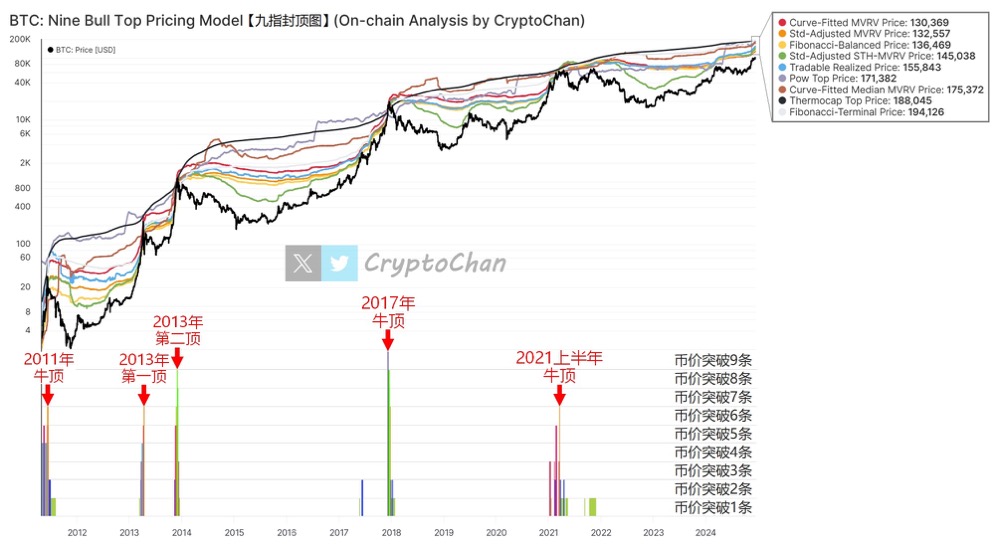

Bitcoin's key signal flashes: historical data suggests a sharp rise in 3-4 months

TechDev·2024/12/17 09:59

Analysis of $arc: Is it hype or a revolution in AI infrastructure based on Rust

西格玛学长·2024/12/16 09:36

Flash

- 09:54Analysis: The market is betting on $80,000 as strong support and $100,000 as strong resistanceBlockBeats News, November 30, on-chain data analyst Murphy stated that options trading data shows a large amount of $80,000 Calls (bullish options) being bought, and a significant increase in both $100,000 Calls (bullish options) being sold and Puts (bearish options) being bought. The market is betting on $80,000 as a strong support level, with bulls positioning at the bottom. Meanwhile, $100,000 is being bet as a strong resistance level by the market, with bears believing this price is difficult to break through and increasing protection against a breakout risk.

- 09:53A trader's $6.5 million MON long position was liquidated, resulting in a loss of $1.9 million.BlockBeats News, November 30, according to monitoring by Lookonchain, due to the decline in MON price, trader 0xccb5's entire long position of 244.38 million MON (worth $6.5 million) was liquidated, resulting in a loss of $1.9 million.

- 09:5324-hour spot capital inflow/outflow ranking: ETH net outflow of $139 million, ZEC net outflow of $11.58 millionBlockBeats News, November 30, according to Coinglass data, the net outflow rankings of crypto spot funds in the past 24 hours are as follows: ETH net outflow of $139 million; BTC net outflow of $60.75 million; XRP net outflow of $39.25 million; SOL net outflow of $37.38 million; ZEC net outflow of $11.58 million. The net inflow rankings of crypto spot funds are as follows: ENA net inflow of $5.48 million; ADA net inflow of $3.92 million; BNB net inflow of $2.22 million; MNT net inflow of $1.52 million; BCH net inflow of $1.33 million.