降息≠牛市,市場這次不吃那一套

Original source: Crypto Market Watch

Original title: Why did the market keep falling after the rate cut?

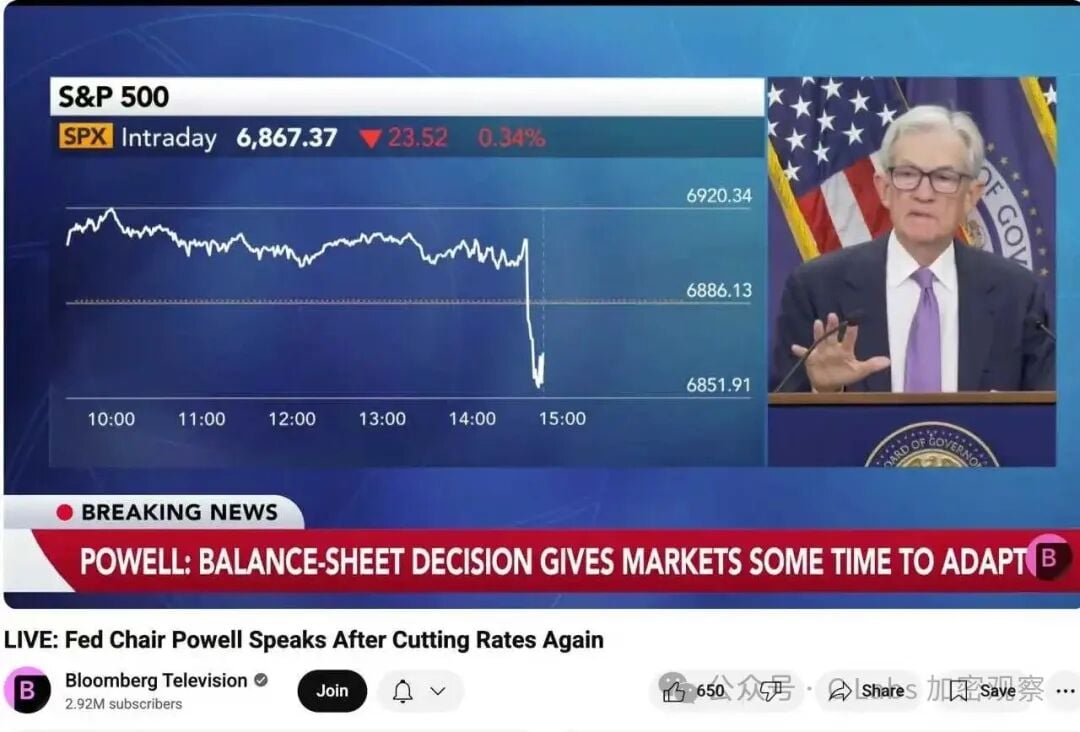

In the early hours of today in the East 8th District, the Federal Reserve announced—a 25 basis point rate cut, lowering the federal funds rate range to 4.00%–4.25%.

At the same time, the Federal Reserve also stated: Quantitative Tightening (QT) will officially end on December 1.

Logically, this should have been “bullish”: rate cuts, ending balance sheet reduction, and improved liquidity expectations. But the result left many people puzzled—why did the stock market, cryptocurrencies, and even gold not rise, but instead all fell?

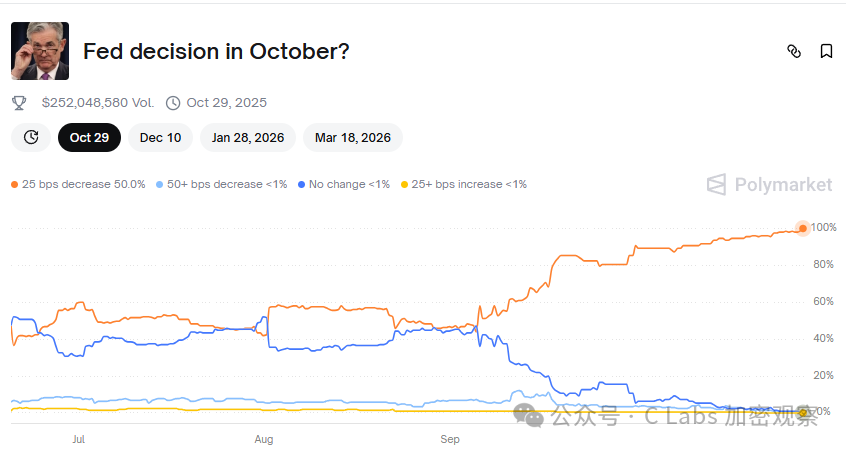

01. The market’s “bullish expectations” have long been priced in

In fact, the market had already “bet” on this rate cut at the beginning of the month. According to CME FedWatch data, before the meeting, the market believed:

The probability of a 25bp rate cut was as high as 95%, and about 40% of investors expected the Federal Reserve to immediately announce the start of QE (balance sheet expansion again).

In the end, the Federal Reserve only chose a “mild” rate cut.

In other words:

This rate cut is not a “new bullish factor”, but “below expectations”.

When expectations are met but there are no surprises, the market often chooses to take profits. This is also a typical “Buy the rumor, sell the news” scenario.

02. Stopping balance sheet reduction ≠ starting liquidity injection

Many people see “QT ending” and think it means a “liquidity flood” is coming. But in fact, the Federal Reserve’s statement this time was very cautious:

“We will end balance sheet reduction, but will not start a new asset purchase program for now.”

That is to say:

From the “tightening” phase to the “wait-and-see” phase.

In the language of financial markets, this means:

Liquidity is no longer deteriorating, but it has not improved either.

And for investment markets to rise, just “stopping the fall” is not enough—“incremental funds” are needed. This is the biggest gap at present.

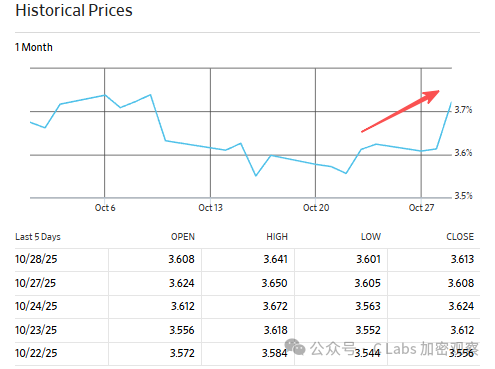

03. The rate cut has not been transmitted to the “actual funding rate”

Theoretically, a rate cut will lower short-term rates and reduce funding costs. But this time is a bit special—although the nominal policy rate was cut by 25 points, medium- and long-term funding costs did not fall in sync.

For example, the five-year Treasury yield rose from 3.6% to 3.7%:

The ten-year Treasury yield soared above 4%:

What does this mean? It means that real market liquidity is still tight, and investment institutions have not felt that “there is more money”. The Federal Reserve’s rate cut is still just “talk”, and has not really “flowed into the market”.

04. The hidden worry behind the “rate cut”: economic downward pressure remains high

From a more macro perspective, this rate cut by the Federal Reserve is actually a “defensive operation”. Recent US economic data shows:

-

Real estate and manufacturing have experienced negative growth for two consecutive quarters;

-

The job market has slowed, and the unemployment rate has risen again to 4.6%;

-

Corporate profit growth has almost stalled.

This means that the Federal Reserve has chosen to slightly ease monetary policy to cushion downside risks between “maintaining growth” and “controlling inflation”.

But this operation also sends a signal:

The US economy may have entered a “mild recession period”.

In this case, the market would rather lock in profits first than easily increase positions in risk assets.

05. Summary: Rate cut ≠ bull market, liquidity is the core variable

This rate cut, the market’s reaction actually gives the clearest logic:

Short-term policy easing ≠ abundant liquidity ≠ asset price increases.

What can really drive a full reversal in the stock and crypto markets is the central bank restarting asset expansion (QE), or fiscal stimulus combined with large-scale capital inflows.

Before that, a rate cut is only “neutral to slightly positive”—it can stabilize confidence, but is not enough to trigger a new bull market.

The market wants not a 25-point rate cut, but a real liquidity injection.

Before that, ‘risk assets’ still have to wait.

免責聲明:文章中的所有內容僅代表作者的觀點,與本平台無關。用戶不應以本文作為投資決策的參考。

您也可能喜歡

KRWQ 成為穩定幣創新領域的先驅

IQ與Frax推出了KRWQ,這是一種與韓國圓掛鉤的穩定幣。多鏈運行的KRWQ旨在填補現有穩定幣市場的空白。然而,南韓的監管立場仍然阻止當地用戶接觸KRWQ。

100%勝率巨鯨以BTC 13倍、ETH 10倍和SOL 10倍多單擴展2.75億美元加密貨幣投資組合

21Shares向SEC申請批准Hyperliquid ETF,隨著Altcoin市場活動擴大

Fight Fight Fight LLC正洽談收購Republic美國業務,TRUMP代幣瞄準初創融資推動