Top 3 Technology Stocks That May Deliver Your Highest Returns This Month

Top Oversold Technology Stocks: Opportunities for Value Investors

Stocks in the information technology sector that are currently oversold may offer attractive entry points for investors seeking undervalued opportunities.

The Relative Strength Index (RSI) is a momentum-based tool that evaluates a stock’s performance by comparing gains on up days to losses on down days. When the RSI drops below 30, it often signals that a stock is oversold and could be poised for a short-term rebound. This threshold is widely recognized by market analysts, including those at Benzinga Pro.

Below is a roundup of notable technology companies with RSI readings at or near the oversold level of 30.

Apple Inc (NASDAQ: AAPL)

- According to Goldman Sachs, Apple’s App Store net revenue growth slowed to 5.7% year-over-year in December, down from 6.1% in November. Spending patterns varied across Apple’s key markets. Analyst Michael Ng continues to rate Apple as a Buy, maintaining a $320 price target. Over the last month, Apple’s share price declined by roughly 6%, reaching a 52-week low of $169.21.

- RSI: 25.5

- Recent Price Movement: Apple shares slipped 0.8% to close at $260.35 on Wednesday.

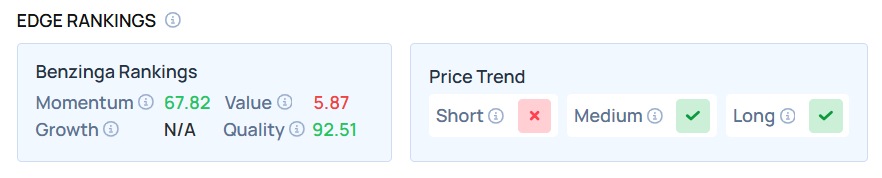

- Edge Stock Ratings: Momentum score of 91.92 and Value score of 93.51.

Hewlett Packard Enterprise Co (NYSE: HPE)

- On December 4, Hewlett Packard Enterprise released mixed results for its fourth quarter and provided first-quarter earnings and sales forecasts that fell short of expectations. CFO Marie Myers highlighted record gross profit, strong non-GAAP operating profit, and free cash flow that surpassed projections. The stock dropped about 6% over the past week and hit a 52-week low of $11.96.

- RSI: 28

- Recent Price Movement: Hewlett Packard Enterprise shares declined 5.7% to close at $22.43 on Wednesday.

- Trend Analysis: Benzinga Pro’s charting tools have identified this downward trend in HPE shares.

Skyworks Solutions Inc (NASDAQ: SWKS)

- On November 11, Mizuho analyst Vijay Rakesh upgraded Skyworks Solutions from Underperform to Neutral and increased the price target from $65 to $73. The stock has fallen approximately 14% over the past month, reaching a 52-week low of $47.93.

- RSI: 22.2

- Recent Price Movement: Skyworks Solutions shares dropped 9.7% to close at $59.82 on Wednesday.

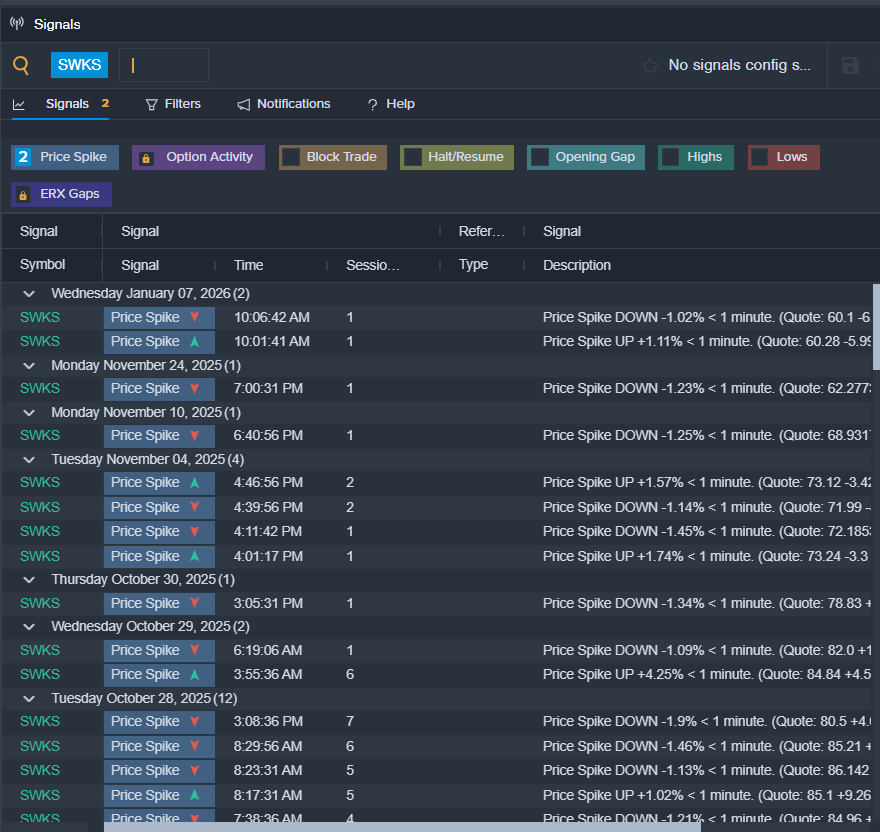

- Breakout Alert: Benzinga Pro’s signals feature flagged a potential breakout in SWKS shares.

Interested in how other technology stocks compare?

Further Reading

Image credit: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

While Zcash Struggles, XRP and Solana See Institutional Booms

Pi Network Price Prediction: Developer SDK Launch Meets $20M Token Unlock As Price Holds Trendline

Record Inflows Into XRP Spot ETFs, But Analyst Issues Bearish Statement – ‘Not Enough Developers’