Venezuela news adds more pressure to Oil prices – ING

Venezuelan Oil Developments Impact Global Markets

Recent events in Venezuela are making waves in the energy sector, adding downward pressure to global oil prices. According to ING commodity analysts Ewa Manthey and Warren Patterson, President Trump has announced plans for the US to purchase up to 50 million barrels of sanctioned Venezuelan oil. This move could also have immediate effects on Canadian crude oil shipments to the United States.

US Increases Control Over Venezuelan Oil Shipments

Allowing Venezuelan oil to flow directly to the US could ease the country's difficulties in bringing its oil to market, which have been exacerbated by a US-imposed blockade on sanctioned tankers. By redirecting these shipments, Venezuela may be able to avoid production cuts that would otherwise be necessary due to limited storage capacity.

The US Department of Energy has confirmed that it has already started marketing Venezuelan oil internationally. Additionally, the US energy secretary under Trump has stated that the US plans to maintain control over future Venezuelan oil sales for the foreseeable future. This intention is underscored by the continued blockade on sanctioned vessels, with two more tankers reportedly seized just yesterday. The US's increasing influence over Venezuela's oil sector also casts uncertainty on Venezuela's ongoing participation in OPEC.

US Oil Inventory and Refined Product Trends

Data from the Energy Information Administration (EIA) shows that US crude oil stocks dropped by 3.83 million barrels last week, marking the largest decline since late October. On the other hand, inventories of refined products painted a less optimistic picture. Gasoline reserves rose by 7.7 million barrels, and distillate fuel oil stocks increased by 5.6 million barrels. These inventory builds suggest that refinery operations remain robust, even as implied demand for these fuels softened over the past week. For more details on refinery run rates, see the latest EIA report.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI isn’t a ‘business destroyer’: The reason Wall Street is investing in software shares in 2026

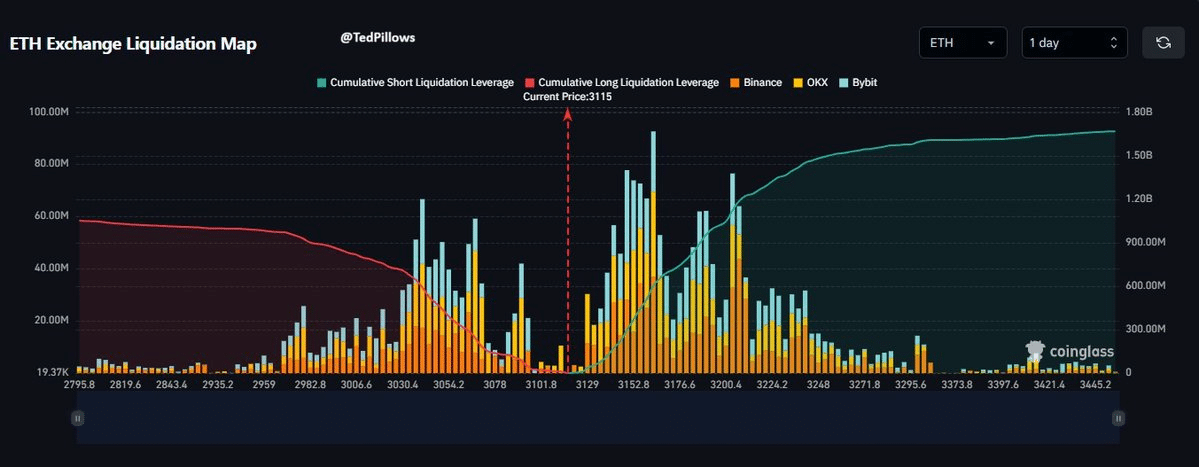

Ethereum’s $1B+ liquidity wall tests its fundamentals – Will utility beat hype?

Best Crypto to Invest in: Tapzi Draws Attention as Pi Network Faces Ongoing Market Pressure

Bitcoin Triangle Pattern – Key Support Levels at $93K and $88K Signal Critical Trading Zone