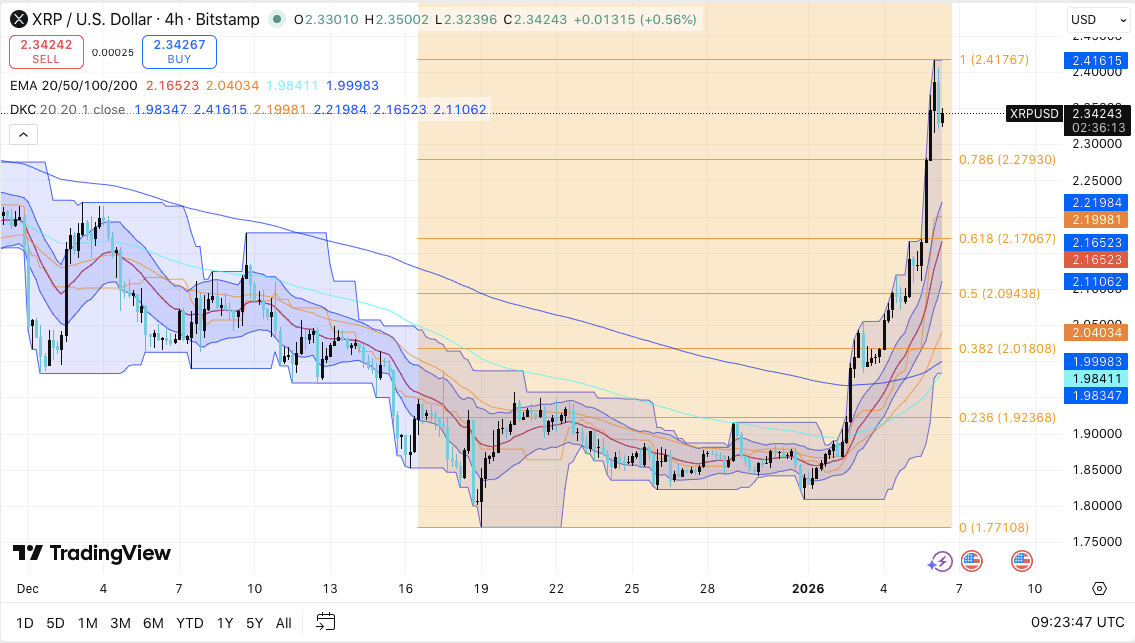

XRP continues to trade within a constructive technical structure as buyers defend higher levels following a strong upside move. Market data shows the token stabilizing near $2.34 on the 4-hour Bitstamp chart. This consolidation follows a sharp rally from the $1.85–$1.90 base, which marked a decisive shift in momentum.

Significantly, price behavior suggests controlled cooling rather than exhaustion. Traders now focus on whether XRP can extend gains or pause for a deeper reset. Besides price action, derivatives and spot flow data provide additional context for short-term expectations.

XRP maintains a clear bullish structure defined by higher highs and higher lows. Consequently, market participants continue to view pullbacks as corrective moves. Price remains firmly above the 20, 50, 100, and 200-period exponential moving averages. This alignment confirms strong trend participation across timeframes.

Moreover, the recent vertical advance reflects aggressive demand rather than gradual accumulation. Such moves often lead to sideways consolidation before continuation. Hence, the current range near $2.34 fits a typical post-rally digestion phase.

XRP Price Dynamics (Source: Trading View)

XRP Price Dynamics (Source: Trading View)

Key resistance now sits between $2.42 and $2.45, where sellers previously capped upside. Additionally, a break above this zone could expose $2.60 as a psychological extension. If momentum accelerates with volume, traders may target $2.75 next. However, failure to clear resistance may extend consolidation without damaging the broader trend.

Related: Ethereum Price Prediction: ETH Finds Balance as Open Interest Cools…

On the downside, XRP finds immediate support between $2.28 and $2.30. This area has acted as a short-term base during consolidation. Moreover, the $2.17–$2.20 region aligns with the 0.618 Fibonacci retracement.

Traders often treat this level as a key trend defense. A deeper pullback could test $2.04, which marks the 0.5 retracement. Consequently, losing that level would signal a broader consolidation phase. The $1.99–$2.00 zone remains the final support before bullish invalidation.

Source:

Source:

Futures positioning adds another layer to the outlook. Open interest expanded sharply during the rally, peaking above $10 billion as leveraged traders entered aggressively. However, recent data shows open interest easing toward $4.5 billion. This shift reflects position trimming rather than forced liquidations. Hence, leverage appears controlled while price consolidates.

Source:

Source:

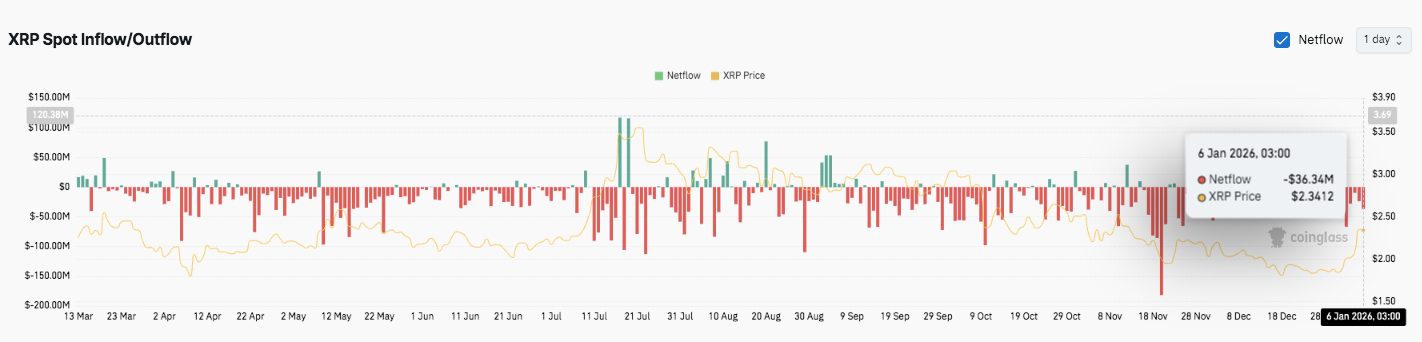

Spot flow data paints a more cautious picture. Persistent net outflows dominate recent sessions, including a notable $36 million outflow near current prices. Additionally, brief inflow spikes during rebounds fail to sustain accumulation. Consequently, spot buyers show limited conviction despite technical strength.

XRP’s technical structure remains constructive as price consolidates above prior breakout support.

Key upside levels stay well-defined, with $2.42–$2.45 acting as the immediate resistance zone. A confirmed breakout above this range could extend gains toward $2.60, followed by $2.75 if momentum and volume expand.

On the downside, $2.28–$2.30 serves as the first support area, while the $2.17–$2.20 zone marks a critical Fibonacci-based trend defense. A deeper pullback toward $2.04 would still preserve the bullish structure.

The near-term XRP price outlook depends on buyers defending the $2.17–$2.20 region and reclaiming $2.45 with strength. Compression near highs suggests volatility expansion ahead.

Failure to hold $2.04, however, could trigger broader consolidation. For now, XRP remains at a pivotal technical zone.

Related: