Nvidia faces setbacks at the start of 2026; Wall Street remains divided over its $6 trillion market cap target

Show original

By:格隆汇

Glonghui Jan 6|As the company with the highest market capitalization in the world, Nvidia (NVDA.US) did not have a stable start to the stock market in 2026. Since hitting an all-time high on October 29, Nvidia's share price has dropped by 9.1%, significantly underperforming the S&P 500 Index. The reason is that investors are increasingly concerned about the sustainability of AI spending and the chip giant's control over the market. "The risks have clearly risen," said JoAnne Feeney, Partner and Portfolio Manager at Advisors Capital Management, which manages $1.3 billion in assets. Nvidia's sluggishness will affect most stock investors. Nevertheless, demand for Nvidia's stock remains strong, and despite very high earnings expectations, its valuation is still lower than many other large tech peers. The Santa Clara, California-based company expects sales to grow 53% and profits to grow 57% in the next fiscal year ending January 2027. In contrast, both of these metrics for Apple are expected to grow by around 10%. Wall Street has not abandoned Nvidia either. Of the 82 analysts tracking the company, 76 have a "buy" rating and only one suggests selling. The average target price on Wall Street implies a 37% upside over the next 12 months, which would push its market capitalization past $6 trillion.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

ArtGis Finance and OptiView Form Strategic Alliance for Improved Web3 Assets Intelligence

BlockchainReporter•2026/01/08 08:03

Ethereum Price Prediction: 129,100 ETH Vanishes from CEXs – Could a Major Breakout Be Hours Away?

Coinspeaker•2026/01/08 08:00

Trump’s World Liberty Financial Applies for National Banking Charter in Push for USD1 Stablecoin

Coinspeaker•2026/01/08 07:54

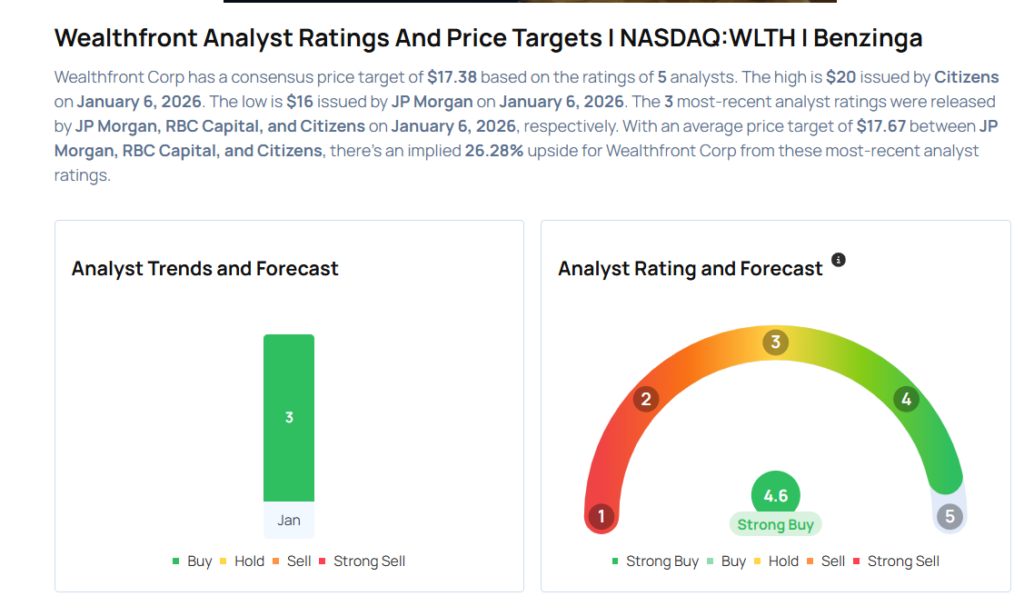

Top Wall Street analysts adjust their Wealthfront outlook prior to Q3 earnings release

101 finance•2026/01/08 07:51

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,406.46

-2.58%

Ethereum

ETH

$3,125.15

-3.98%

Tether USDt

USDT

$0.9987

-0.03%

XRP

XRP

$2.12

-6.93%

BNB

BNB

$884.42

-3.72%

Solana

SOL

$135.77

-2.58%

USDC

USDC

$0.9996

+0.01%

TRON

TRX

$0.2959

+0.46%

Dogecoin

DOGE

$0.1442

-4.27%

Cardano

ADA

$0.3950

-5.80%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now