Analyst: The current BTC rally benefits from reduced selling pressure, but if it rises to $100,000 it will face selling from short-term holders.

ChainCatcher news, CryptoQuant analyst Axel stated on social media that the current situation reflects that the selling pressure from key groups (short-term holders) is being suppressed, and there is no clear confirmation of demand. The critical deterioration trigger is the SMA continuously closing below the zero axis, which will mark the transition to the distribution range.

The Short-Term Holder Realized Price (STH Realized Price) refers to the average acquisition cost of holders who have held their coins for less than 155 days. The current BTC price is trading below this price, meaning the average short-term holder is in a loss position. Short-term holders being “underwater” limits this group’s potential to take profits, and the $100,000 level forms a local resistance. At present, this reduces selling pressure and explains why, despite price corrections, the oscillator can still remain in the accumulation zone where selling pressure is suppressed.

Once the price reaches $100,000 and this group returns to breakeven, short-term holders will begin to sell, thereby creating price pressure. A key confirmation signal for a strengthening market is the price closing above the short-term holder realized price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

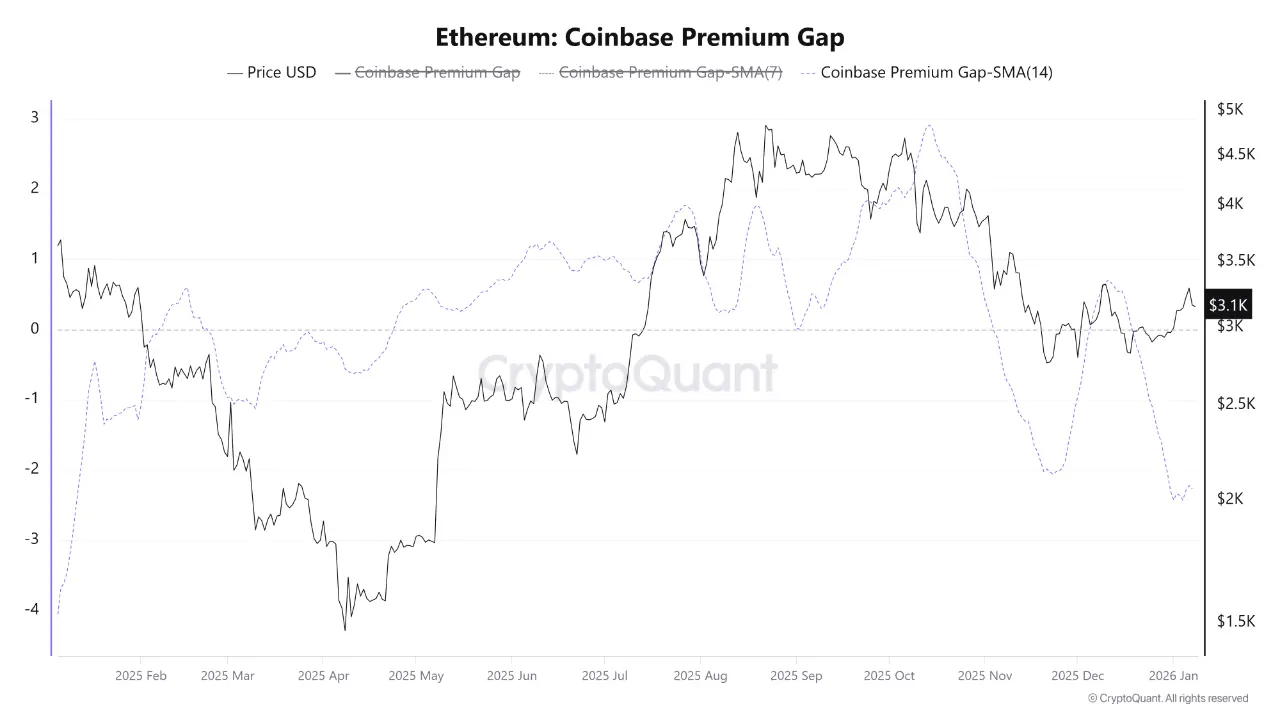

CryptoOnchain issues bearish alert for Ethereum: premium indicator on a certain exchange hits 10-month low

Ethereum exchange premium gap drops to a 10-month low