Global Digital Asset Investment Products Close 2025 Near Record Inflows

Quick Breakdown

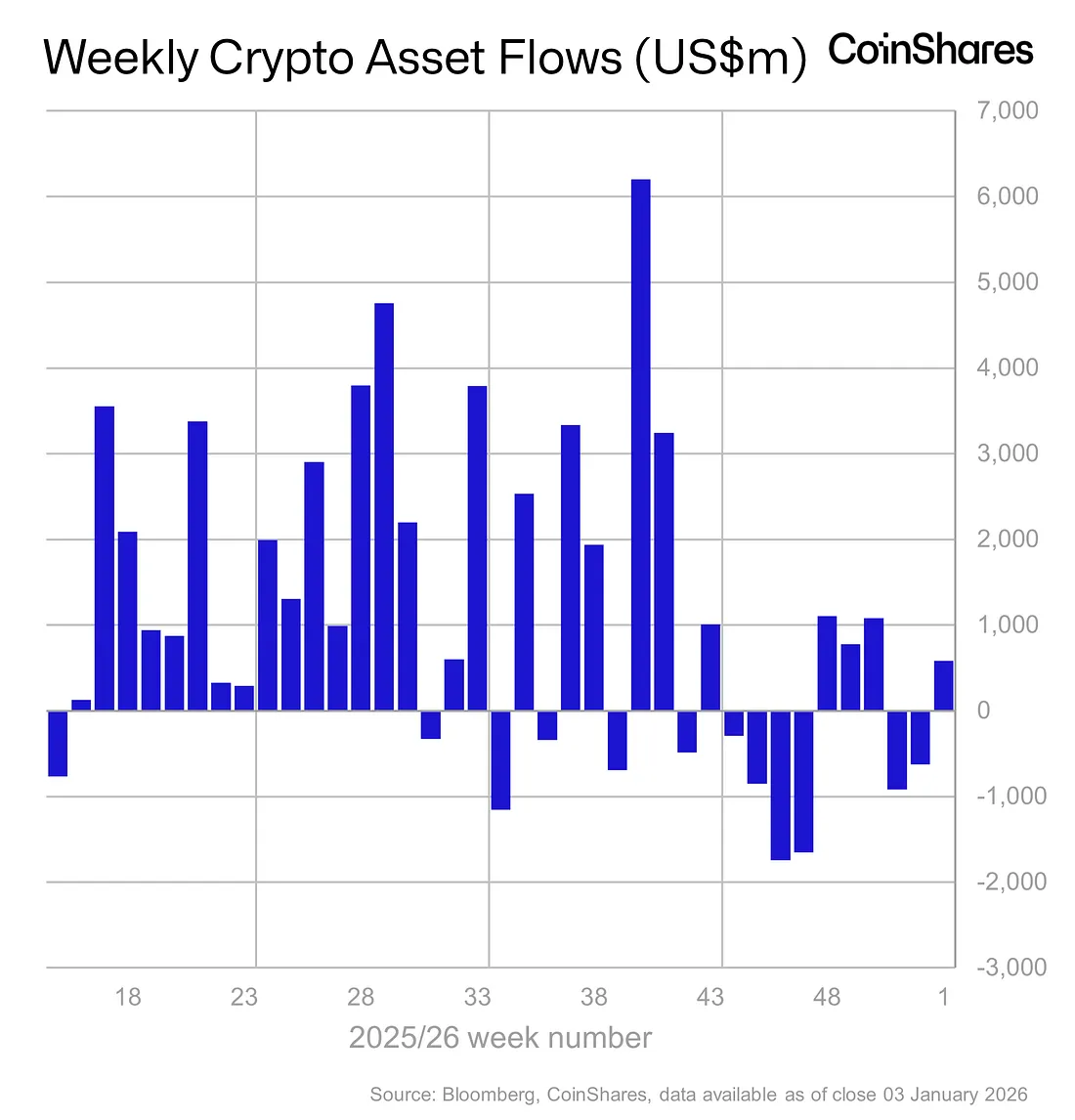

- Digital asset inflows reached $47.2B in 2025, just below the 2024 record of $48.7B.

- Ethereum, XRP, and Solana drove growth, while Bitcoin inflows fell 35% year-on-year.

- Germany, Canada, and Switzerland saw notable inflow recoveries, signaling rising global adoption.

Global digital asset investment products ended 2025 with total inflows of $47.2 billion, just shy of 2024’s record of $48.7 billion, Research. While investor interest in Bitcoin declined, select altcoins saw substantial growth, signaling a shift in market focus.

Source

:

Coinshares

Source

:

Coinshares

Select altcoins lead 2025 investment growth

The United States remained the largest source of inflows, totalling $47.2 billion, a 12% decrease from 2024. Meanwhile, Germany and Canada reversed prior outflows, contributing $2.5 billion and $1.1 billion, respectively. Switzerland also recorded a modest rise, with $775 million flowing into digital assets—an 11.5% year-on-year increase.

Bitcoin, historically the dominant crypto investment vehicle, saw inflows fall 35% to $26.9 billion. Short Bitcoin products recorded $105 million in inflows over the year, although total assets under management remain limited at $139 million.

In contrast, Ethereum spearheaded the altcoin rally, attracting $12.7 billion in inflows—a 138% increase from 2024. XRP and Solana posted remarkable gains, with inflows of $3.7 billion (up 500%) and $3.6 billion (up 1,000%), respectively. Other altcoins collectively experienced a 30% decline in year-on-year inflows.

Market trends and outlook

The data reflects a broader rotation from Bitcoin to high-potential altcoins, as investors seek diversification and exposure to emerging blockchain projects. Analysts note that the growing popularity of Ethereum, XRP, and Solana corresponds with expanded adoption of decentralized finance (DeFi) applications, NFT platforms, and Layer-1 scalability solutions.

Despite midweek market volatility, digital asset fund inflows remained resilient throughout 2025, demonstrating increasing investor confidence in regulated crypto products and institutional-grade vehicles. CoinShares highlights that selective altcoin investment could continue to dominate in 2026, particularly as blockchain innovation accelerates across DeFi, gaming, and tokenized financial products.

In the final week of 2025, digital asset investment products recorded their strongest weekly performance on record, attracting $5.95 billion in inflows as institutional investors responded to weak U.S. employment data and renewed macroeconomic uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Price Prediction: Analyst Warns of $50 Drop As Morgan Stanley Files ETF Application

Bitcoin Price Eyes $99k Next: Will Whales Block Bullish Outlook?

Wells Fargo Buys $383M in Bitcoin ETFs as Retail Fear Peaks

Last mile provider FAST Group’s post-merger meltdown: PE-backer freezes fund amid financial red flags