As the year draws to a close, Bitcoin has caught attention by surpassing the $90,999 mark in conditions of weak liquidity. This movement, however, is attributed more to technical factors than to a strong market breakout. Throughout December, Bitcoin, the largest asset in the cryptocurrency market, has been fluctuating within a narrow price band. Short-term purchases during this period have had a disproportionate impact on its price. Traders point to decreased trading volume due to the Christmas and New Year holidays, suggesting a temporary increase in volatility. Nevertheless, Bitcoin’s search for direction seems far from over.

Bitcoin Breaks New Price Levels Under Unforeseen Factors

The Technical Response of December and Limited Movement Space

Bitcoin briefly hit $90,200 in the early hours of the day, marking a 2.8% rise within 24 hours, before giving back some of its gains. Analysts assert that the breach of the $90,000 threshold was not due to a fundamental development but rather the technical reclamation of a long-watched resistance level. This volatility led to the closing of short positions and accelerated momentum-focused purchases.

Throughout December, Bitcoin displayed a trapped appearance between approximately $86,500 and $90,000. The expiration of options, the correlation effects in the altcoin market, and the reactivation of technical support levels fed the upward response in price. Despite these factors, low trading volumes in the final weeks of the year have set the stage for even minor transactions to quickly push prices upward.

During this period, Bitcoin has underperformed compared to traditional markets. While U.S. stocks hit record highs, a similar acceleration was not observed in the cryptocurrency market. Analysts suggest this divergence indicates that risk appetite has not fully returned to cryptocurrencies.

Weak Liquidity, Sentiment, and 2026 Expectations

Market sentiment has gradually shifted from extreme fear levels observed in mid-December to a more balanced outlook. The improvement in the Crypto Fear and Greed Index suggests that investors are cautiously re-entering positions. However, the end-of-year low liquidity environment hinders the formation of a stable trend in prices.

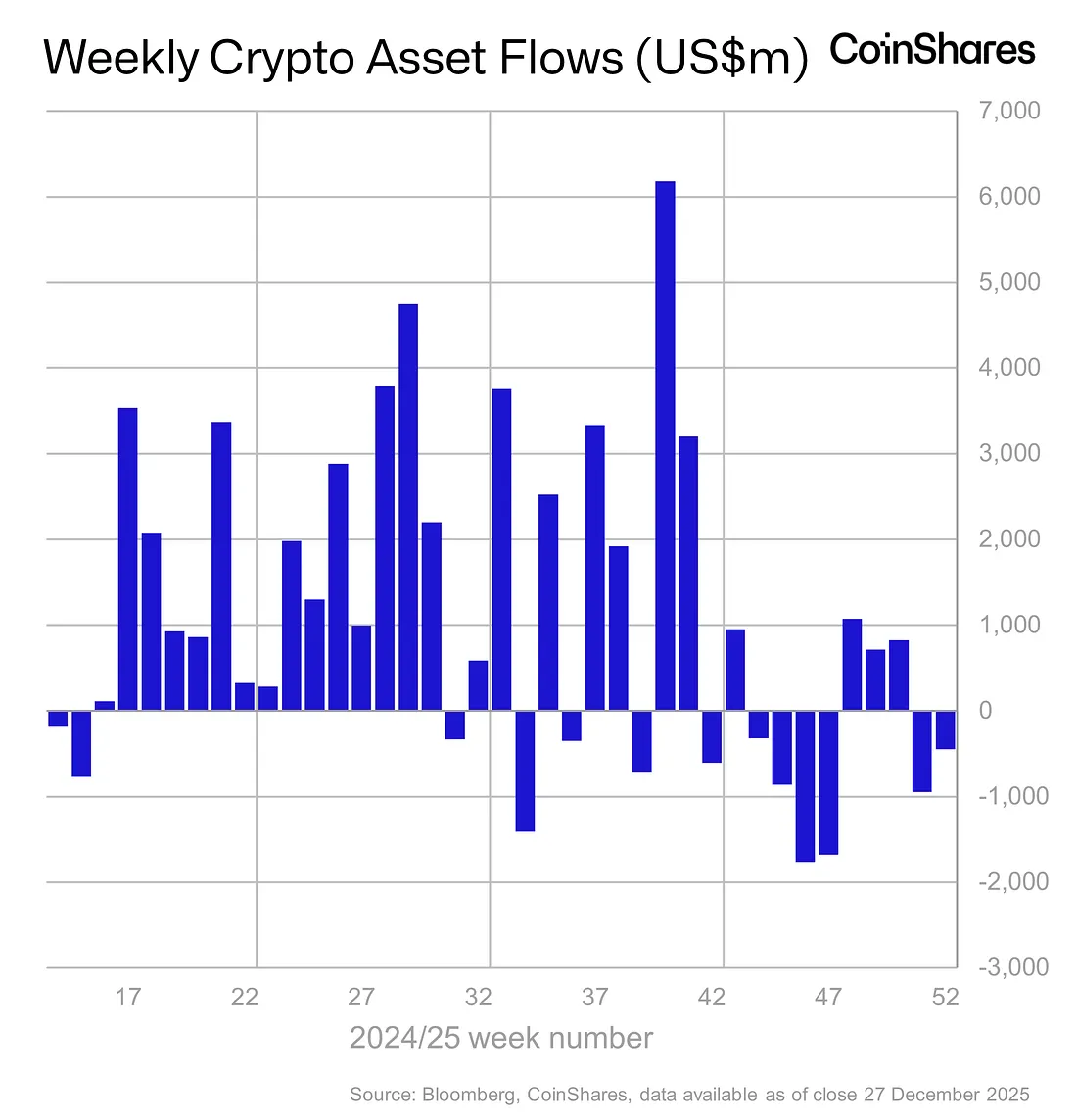

Analysts are closely monitoring whether Bitcoin can sustainably hold above $90,000 as it enters the new year. Trading volumes are expected to remain limited in the early days of January, making daily closes above this level essential for technical outlooks. It’s also noted that tax-related ETF outflows pressured prices in December, but this effect may lessen in the new year.

In the longer term, attention is drawn to the beginning of 2026. Potential ETF inflows, regulatory advancements, and the Federal Reserve’s monetary policy are key factors influencing institutional investor interest in the market. Analysts believe that if these factors become clear and favorable for the market, a more structural bullish phase for cryptocurrencies might emerge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Digital Asset Funds See Mixed Flows Amid Ongoing Market Caution

Strategy Adds 1,229 BTC as Schiff Questions Funding Source

Cango Secures $10.5M Equity Investment as Bitcoin Mining and AI Strategy Expands

'Back to Orange': Strategy buys another 1,229 bitcoin for about $109 million after brief pause