Market manipulation has been a buzzword this cycle.

From Official Trump’s [TRUMP] launch to Bitcoin [BTC] chopping around, whales and market makers are being blamed for extracting value through volatility, often at the expense of retail participants left underwater.

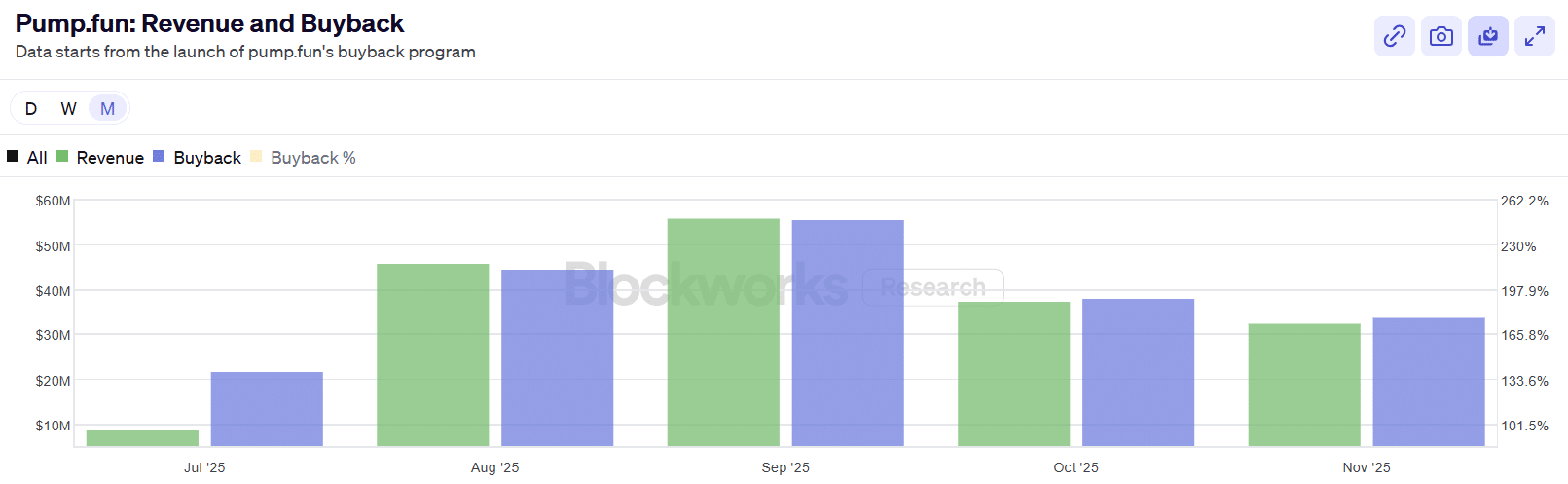

That said, not all intervention is bad. Pump.fun [PUMP], for instance, has been strategically implementing buybacks to support the market, with $72 million deployed in buybacks across October and November alone.

Naturally, the expectation would be some form of price stabilization.

Instead, the technicals continue to lag. PUMP dropped 22.39% in October and another 36.19% in November. That’s a combined 60% drawdown, effectively wiping out all gains from Q3, when PUMP peaked near $0.06.

Notably, this divergence has split sentiment. Some chalk it up to a standard bearish cycle, while others see signs of a broader profit “extraction” phase.

Either way, downside pressure on PUMP looks like it’s only getting started.

PUMP’s massive USDC transfers stir market concerns

Despite the hype, the memecoin launchpad is closing 2025 on a sour note.

At the macro level, Pump.fun’s recent legal issues have rattled confidence. On-chain, the micro picture isn’t much better. In Q4, Pump.fun moved $615 million in USDC to Kraken, including a recent $50 million transfer.

That’s a solid cashout. Normally, with the memecoin launchpad executing 100% of revenue in buybacks, a $615 million transfer would signal bullish momentum, giving stakeholders confidence in portfolio gains.

Instead, weak technicals are raising red flags, leaving the market cautious.

As mentioned earlier, even with the recent buybacks, PUMP’s price hasn’t shown bullish momentum. Add to that the $615 million cashout, and the market’s suspicion of a possible “profit extraction” cannot be ignored.

For the memecoin launchpad, the trouble may just be starting. With legal issues already in play, this extraction could further shake confidence and put a deeper breakdown squarely on the table.

Final Thoughts

- Despite $72 million in buybacks, PUMP dropped 60% in Q4, raising concerns over price support and potential profit extraction.

- Ongoing legal issues and massive USDC transfers to Kraken signal that PUMP’s downside risk may be just beginning.