BlackRock Details ‘Most Obvious’ Megaforce Shaping Markets in 2026, Firm Remains Overweight US Stocks and AI

Asset management giant BlackRock says one powerhouse sector of the market is going strong heading into 2026.

In a new report, BlackRock says the next year will be defined by artificial intelligence (AI), which the firm says is growing at an unprecedented rate and will help push the US stock market to heights it has never seen before.

“We’ve long argued we’re in a world of structural transformation shaped by a few mega forces, including geopolitical fragmentation, the future of finance and the energy transition. But the most obvious now is AI, with a buildout of a potentially unprecedented speed and scale.

This shift to capital-intensive growth from capital-light is profoundly changing the investment environment and pushing limits on multiple fronts – physical, financial and socio-political. A few big macro drivers implies a few big market drivers.

Today’s market concentration reflects underlying economic concentration. That means investors can’t avoid making big calls, in our view. AI is the dominant mega force right now, helping propel U.S. stocks to all-time highs this year…

We stay overweight U.S. stocks and the AI theme, supported by robust earnings expectations. The capex (capital expenditure) may pay off overall even if not for individual companies. The next phase may be more about energy and resolving bottlenecks.”

However, BlackRock notes that AI does face challenges, such as its extremely high rate of energy consumption.

“AI data centers could use 15-20% of current U.S. electricity demand by 2030 – a scale sure to test the limits of power grid, fossil and materials industries…

Some estimates even suggest data centers could use a quarter of current electricity demand. Rising power demand collides with a backlog of projects waiting to connect with the electric grid and generally slow permitting in the West. Capex plans could be walked back if such limits bite, crimping ambition around the AI buildout.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Novogratz Warns XRP and ADA Must Prove Real Value Now

UNIfication Greenlights 100M UNI Burn and Switches On Protocol Fees

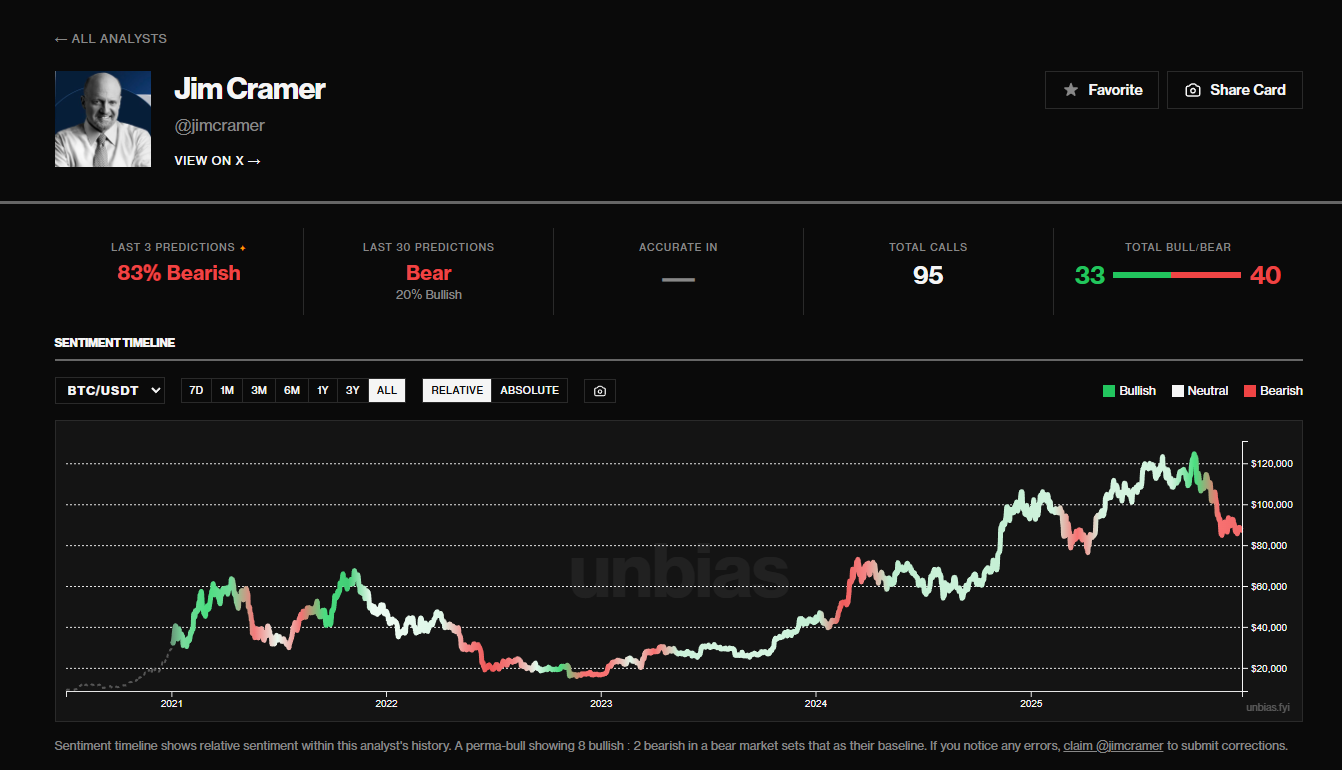

Jim Cramer's Bitcoin Bear Growl: Time to Buy the Dip? – Kriptoworld.com

Dive into Dogecoin’s Dramatic Decline and its Potential Rebound Signals