Large Chainlink withdrawals from Binance recently revealed a clear shift towards long-term holding. Especially as big wallets reduce exchange supply and ease selling pressure. In fact, a newly created wallet removed over 329k LINK, immediately reducing liquid supply.

At the same time, the Chainlink Reserve added nearly 90k LINK, pushing total holdings above 1.32M LINK. Together, these moves drain exchange-side availability from two directions.

However, the price has not reacted impulsively to the same – A sign of deliberate accumulation rather than speculative chasing.

Moreover, reduced exchange balances often dampen sell pressure during pullbacks. As supply tightens, sellers lose leverage.

Consequently, downside extensions struggle to gain momentum. Such a setup favors stability and patience.

Over time, persistent absorption tends to pressure price upwards, especially when demand remains consistent under the resistance level.

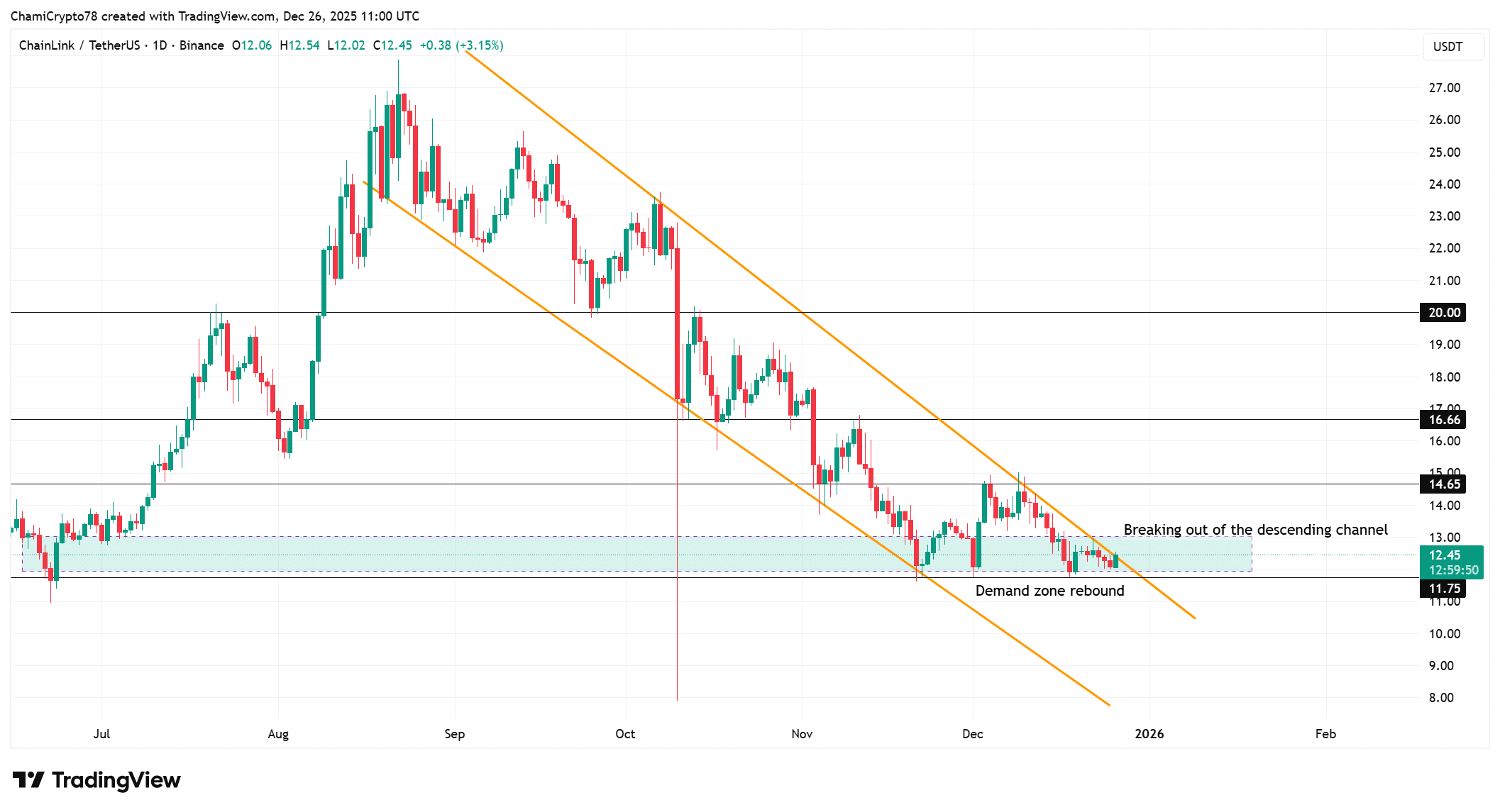

Chainlink challenges channel ceiling after demand bounce

Chainlink, once upon a time, was trading within a demand zone – One where buyers repeatedly stepped in to defend structure. This zone halted the broader decline and forced price stabilization.

From there, LINK rebounded towards the descending channel resistance near $13.20–$13.50. And yet, the structure still seemed to respect overhead levels on the price charts.

For LINK, the $14.65 resistance remains the first upside hurdle, followed by $16.66, which previously acted as a distribution pivot.

Above that, $20 stands as the macro reclaim level. Meanwhile, failure to hold above $12 would reopen downside risk towards demand.

Therefore, acceptance above channel resistance might carry far more weight than short-lived breakout wicks. Such a phase often precedes trend transitions when demand persists.

Buy-side absorption persists under overhead resistance

Spot taker CVD over the 90-day period seemed to be firmly positive, indicating sustained buy-side aggression despite sideways price action.

At press time, the indicator continued to show taker buy dominance, meaning market buyers might be consistently absorbing sell orders.

This behavior matters because it highlights accumulation, rather than distribution. However, the price did not surge – Confirmation of patience instead of hesitation.

Additionally, the absence of sharp CVD reversals suggested that buyers have maintained conviction, without relying on leverage. As a result, the selling pressure has struggled to expand. Instead, the price might be compressing into tighter ranges.

Over time, persistent buy-side absorption beneath resistance often increases the probability of a directional breakout.

Source: CryptoQuant

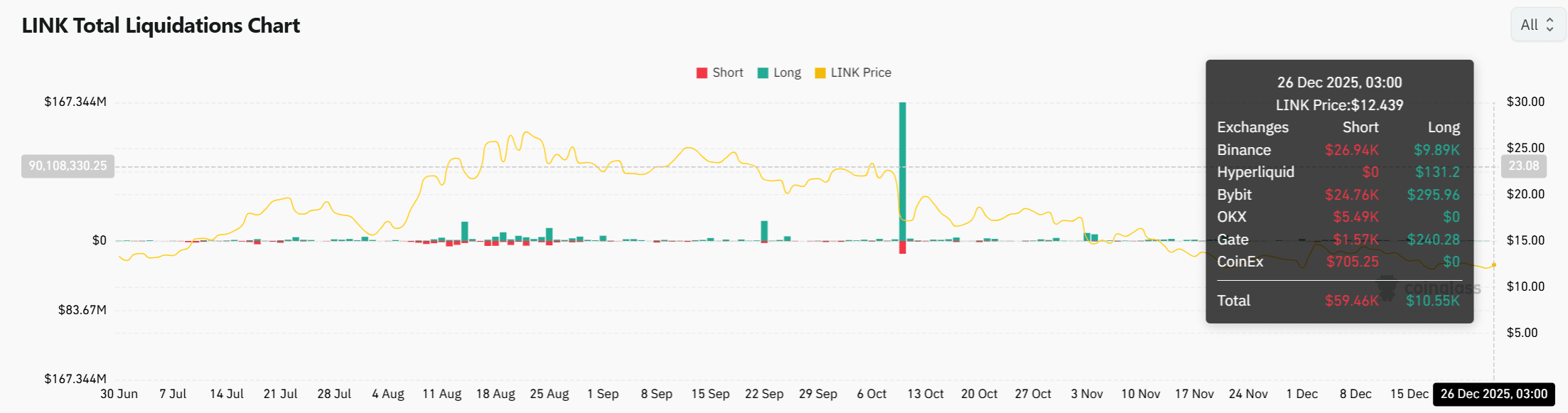

Short liquidations outweigh longs as pressure fades

Finally, liquidation data confirmed fading downside stress across derivatives markets. On 26 December, total short liquidations reached approximately $59.46k, while long liquidations totalled just $10.55k.

Binance alone accounted for $26.94k in short liquidations, compared to $9.89k on the long side.

Bybit recorded $24.76k in shorts liquidated, while long liquidations remained minimal across venues. This imbalance showed that sellers absorbed most forced exits. Meanwhile, longs stayed largely intact, signaling confidence rather than panic.

Moreover, liquidation spikes stayed modest, confirming controlled leverage. This environment might just favor stabilization, while reducing the risk of cascading downside moves.

Source: CoinGlass

In conclusion, Chainlink seemed to be trading in a key zone between $11.75 support and $14.65 resistance. Exchange outflows and reserve accumulation have been reducing selling pressure too.

Price consolidation below resistance underlined balance, not weakness. While buyers have continued to step in, liquidation data highlighted limited downside risk. As long as LINK holds above $11.75, the downside will remain contained.

A clean move above $14.65 would likely allow the price to push towards $16.66, with supply conditions supporting further upside rather than a deeper pullback.

Final Thoughts

- A fall in exchange supply and steady buying continue to limit downside risk for LINK.

- Structural compression hinted that a directional move may emerge as selling pressure fades.