Bitcoin sits out Santa rally as stocks and precious metals set records

A year-end rally across global markets has pushed U.S. stocks and precious metals to fresh record highs, but bitcoin has been left out in the cold, drifting lower as traders pull back risk into the holiday period.

Bitcoin traded around $87,200 on Friday, down roughly 6.5% from its 2025 open near $93,000, according to The Block’s price data, despite having reached an all-time high above $126,000 in early October. Price action has remained subdued through the holiday week, with the cryptocurrency continuing to oscillate below the $90,000 level.

Bitcoin (BTC) price chart. Source: The Block/TradingView

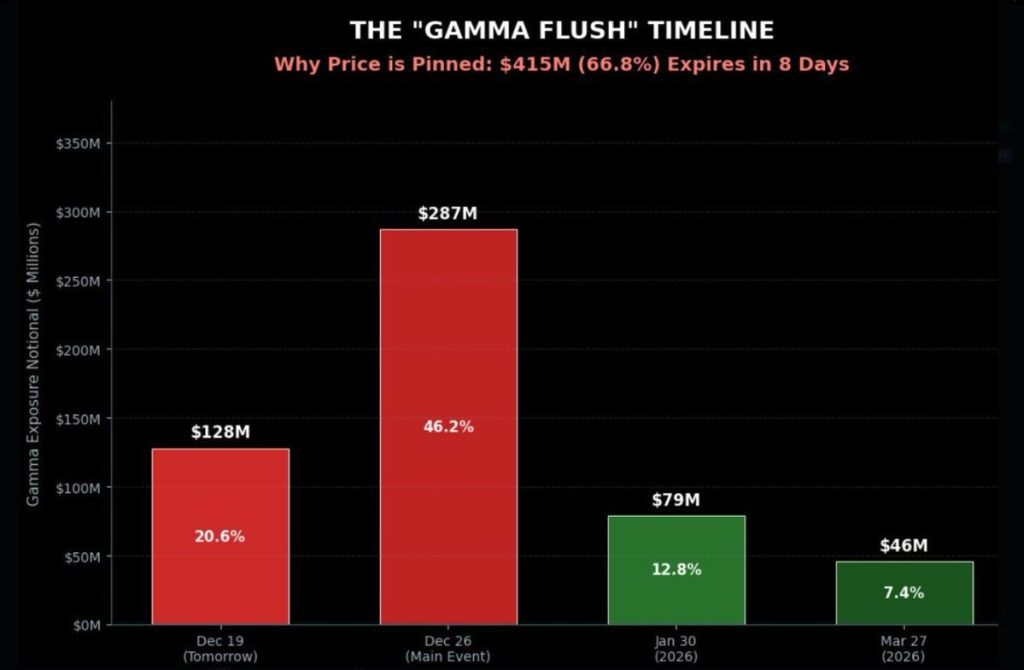

Analysts have pointed to Friday’s record $28 billion crypto options expiry as the dominant short-term catalyst, amplifying price swings in thin year-end trading.

“The tone remains defensive,” BRN head of research Timothy Misir said earlier this week, noting that upside attempts have struggled to gain follow-through.

Wall Street flows have echoed that caution, with U.S. spot bitcoin ETFs seeing roughly $500 million in net outflows this week and about $4.3 billion pulled over the final two months of the year, alongside a more than $1.2 trillion decline in total crypto market value.

Historic precious metals rally

While bitcoin has drifted lower, precious metals have surged.

Gold climbed to a record above $4,580 per troy ounce on Friday, while silver pushed past $75, setting new all-time highs. Silver is up roughly 160% from its 2025 open near $30, while gold has gained over 70% this year.

The rally has been driven by escalating geopolitical tensions, a weaker U.S. dollar and year-end liquidity conditions that have amplified price moves, according to analysts. Central-bank purchases, ETF inflows and expectations for further Federal Reserve rate cuts in 2026 have also supported demand for non-yielding assets, according to a recent Bloomberg report.

Silver’s advance has been particularly sharp, with speculative inflows and lingering supply dislocations following an October short squeeze continuing to pressure physical markets.

Stocks hold near record highs

U.S. equities, meanwhile, have remained resilient into the final trading sessions of the year.

The S&P 500 and Dow Jones Industrial Average closed the shortened Christmas Eve session at record highs, extending a multi-day rally that has lifted major indexes through late December.

The S&P 500 is up roughly 18% year-to-date, while the Nasdaq has gained more than 20% in 2025, according to Google Finance.

S&P 500 chart. Source: Google Finance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Founder Calls XRP ‘Unfakeable’, Says It’s Built for a $10 Trillion Market

Bancor Network (BNT) Token Price Prediction 2026, 2027-2030: Will BNT Recover?

Cardano Founder Signals Major Midnight Push, Says 2026 “Is Not Ready”

Bitcoin Price Enters a Post-Expiry Window—Why This Weekend Could Decide BTC’s Next Move