Bitget Daily News: Whales accumulate approximately $660 million worth of ETH in one week, Trust Wallet extension suspected of supply chain attack

Author: Bitget

Today's Preview

Pantera Capital has released 12 major predictions for the crypto industry in 2026, including:

- Capital-efficient consumer credit: Crypto lending that combines on-chain and off-chain credit modeling, modular design, and AI behavioral learning will become the new frontier.

- Prediction market differentiation: Prediction markets will split into "financial" directions (integrated with DeFi, supporting leverage and staking) and "cultural" directions (more localized and long-tail interests).

- Agentic Commerce and x402: The payment framework based on x402 will expand, and Solana may surpass Base in x402 transaction volume.

- AI becomes the crypto interface layer: AI-assisted trading and analysis will become widespread, while LLM-driven trading AI remains in the experimental stage.

- The rise of tokenized gold: Tokenized gold becomes a popular asset for hedging against inflation and dollar-related issues.

Macro & Hot Topics

1. Record growth in bitcoin-related SEC filings in 2025, with legislative progress driving institutional on-chain adoption. Bitcoin-related content accounts for the highest proportion, reflecting institutions' active expansion of crypto products after the launch of spot bitcoin ETFs.

2. Spot silver broke through $75/ounce, hitting a new all-time high, while gold continued to rise to $4,504/ounce.

3. CoinGlass: The crypto market's liquidation scale will reach $150 billions in 2025, with a daily average of about $400-500 millions.

Market Trends

1. In the past 24 hours, the entire crypto market saw $138 millions in liquidations, with long positions accounting for $90 millions. BTC liquidations amounted to about $31 millions, and ETH liquidations about $23 millions.

2. Due to the US stock market Christmas holiday, the US stock market has not yet opened.

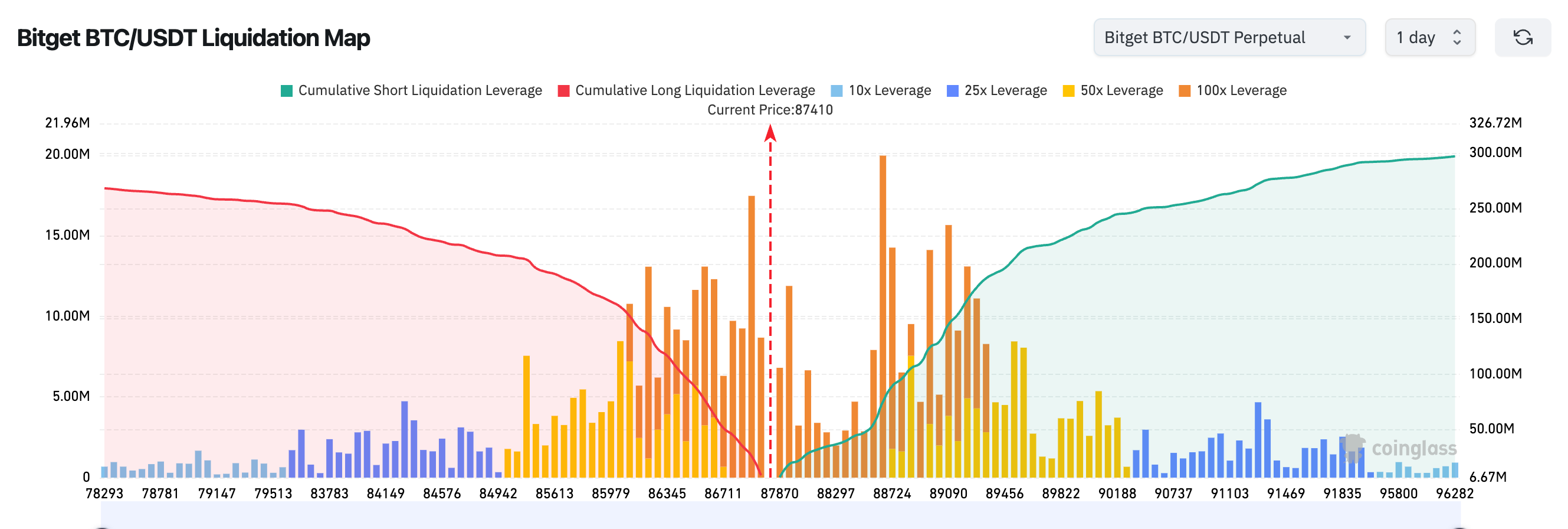

3. Bitget BTC/USDT liquidation map shows: The current price around 87,400 is at the core zone of the long-short battle. In the 88,000–90,000 range above, a large number of 50x–100x leveraged short positions are concentrated. If there is a breakout with volume, it is easy to trigger a chain of short covering, leading to a rapid price surge. In the 86,000–87,000 range below, long leveraged positions are dense. If the price falls below this range, it may trigger concentrated stop-losses for long positions, causing the market to quickly drop. Overall, the structure shows "risk zones both above and below, with amplified volatility."

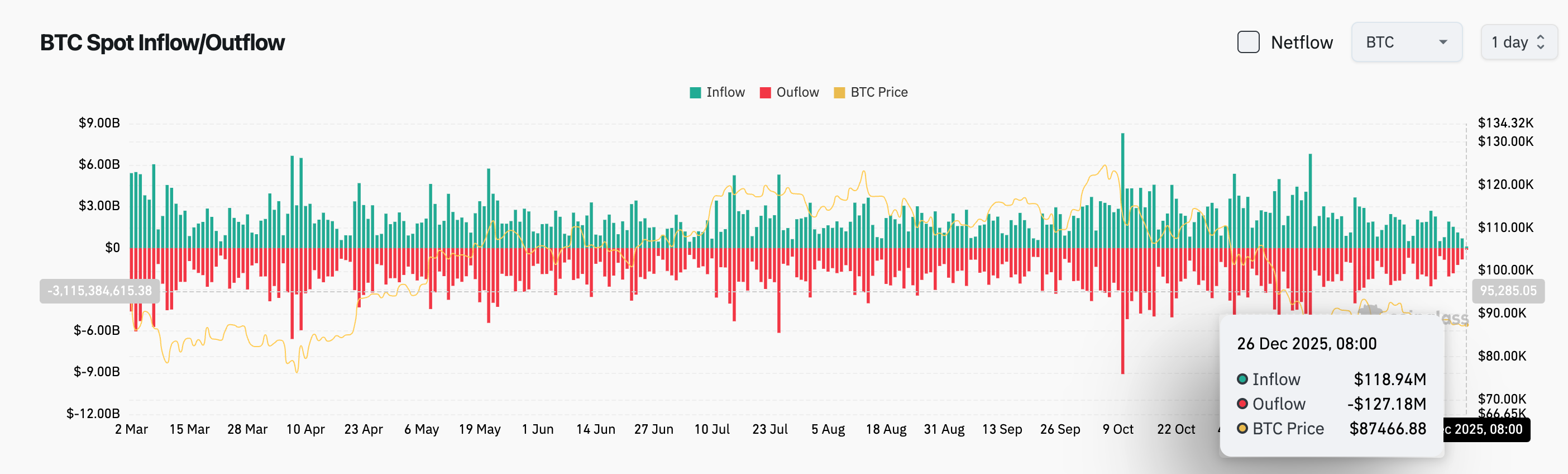

4. In the past 24 hours, BTC spot inflows were about $119 millions, outflows about $127 millions, with a net inflow of $20 millions.

News Updates

1. AI-themed crypto tokens have seen a sharp correction since their 2024 highs, with a full-year drop of 75% in 2025, market cap shrinking by about $5.3 billions, and nearly $1 billions lost in December alone.

2. Trend Research's holding of 645,000 ETH is currently at a floating loss of $143 millions.

3. Crypto analyst Ali Charts: It takes about 364 days for bitcoin to move from top to bottom, and it may bottom out and fall back to $37,500 in October 2026.

Project Developments

1. Wintermute founder spoke out on the Aave governance controversy, clearly opposing the current proposal. Reasons include the proposal's lack of specific governance mechanisms and unclear value capture logic. He criticized both sides for accusing each other of "malicious takeover," causing community division, and believes political accusations should stop and the discussion should be refocused on fundamentally solving AAVE token value capture and governance structure issues.

2. The Uniswap protocol fee switch proposal UNIfication has passed with an overwhelming majority.

3. Analysis: Trust Wallet's extension wallet is suspected of a supply chain attack, with malicious code stealing mnemonic phrases, resulting in user funds being stolen in excess of $6 millions.

4. Injective ecosystem HodlHer has completed a $1.5 millions financing round and will build an AI-driven Web3 operating system.

5. Humanity (H) completed the unlocking of 105 millions tokens yesterday, worth about $14.8 millions; Plasma (XPL) unlocked 88.89 millions tokens on the same day, worth about $11.7 millions.

6. BTSE COO: If the Federal Reserve maintains interest rates unchanged in Q1 2026, bitcoin may fall to $70,000.

7. Yesterday, bitcoin ETF saw a net outflow of $124 millions, and ethereum ETF saw a net outflow of $72.36 millions.

8. Ethereum will undergo the Glamsterdam and Hegota forks in 2026, with the gas limit expected to increase to 200 millions.

9. Data: In the past week, whales have accumulated 220,000 ETH, worth about $660 millions.

10. CryptoQuant: Bitcoin RSI is approaching the bear market boundary, and falling below the 4-year moving average usually signals the possibility of entering a deeper bear market phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Faces Uncertain December: Will It Break the Cycle?

HYPE price prediction – Why ‘trapped shorts’ could be key to next price breakout

Cardano Founder Highlights Midnight as Strategic Priority

Altcoins Experience Brief Resurgence as Market Dynamics Shift