The RMB exchange rate returns to the "6" era

Author: Ba Jiuling, Wu Xiaobo Channel

The suspense itself was not significant, only one last step remained.

After nearly a month of expectations that the "RMB is about to break 7," analysts from Goldman Sachs provided a key boost.

Recently, Goldman Sachs released its "2026 Global Equity Outlook." When mentioning the RMB, based on its dynamic equilibrium exchange rate model (GSDEER), Goldman Sachs calculated the fair value of the RMB, showing that the RMB is undervalued by nearly 30% against the US dollar.

However, slogans are more attractive than numbers. The report stated:

The degree of undervaluation of the RMB exchange rate against the US dollar is comparable to that of the mid-2000s.

In 2000, the average annual exchange rate of the US dollar to RMB was about 8.28. Subsequently, the RMB entered a nearly decade-long appreciation cycle, with the exchange rate rising to around 6.1 against the dollar.

Goldman Sachs' calculations gave the market more confidence to be bullish, causing the offshore RMB, already in an appreciation channel, to suddenly surge.

On the morning of December 25, the US dollar to offshore RMB exchange rate quickly broke through the 7.0 threshold, reaching a new high in 15 months and officially re-entering the "6 era."

USD/RMB Trend 2005—2025

Image source: Juheng.com

Meanwhile, the onshore RMB exchange rate hit a low of 7.0053, just one step away from "breaking 7." The central parity rate of the RMB against the US dollar announced by the China Foreign Exchange Trade System was also raised by 79 basis points. Now, with the "shoe" finally dropping, we can finally ask these questions:

Why was the RMB able to chart an independent course in 2025? As the exchange rate enters the "6" era, what changes does this mean for our corporate operations and personal asset allocation?

"Breaking 7": Short-term or Long-term?

Looking at the whole year, the RMB exchange rate has been quite unusual.

In April this year, the RMB exchange rate touched a low of 7.429, and the market was still worried about the risk of RMB depreciation. Unexpectedly, as the year-end approached, the RMB exchange rate reversed course.

This was influenced by timing.

As usual, near the end of the year, domestic export companies need to settle accounts with suppliers, converting the US dollars earned throughout the year into RMB for "closing accounts" and paying year-end bonuses, which triggers seasonal settlement demand.

As more and more people "need" RMB, starting from the end of November, the "price" of the RMB has risen sharply, and the timeline matches up.

December 24, busy operations at a foreign trade container terminal

In addition, due to the recent "impressive" rise of the RMB, export companies that had previously hoarded US dollars, in order to avoid further exchange losses, have been rushing to "settle," which further pushed up the RMB's appreciation.

It is worth noting that this year's demand is clearly larger than in previous years.

According to data released by the General Administration of Customs, in the first 11 months of this year, China's goods trade maintained growth, with a total import and export value of 41.21 trillion yuan, up 3.6% year-on-year. For the first 11 months, China's trade surplus exceeded 1 trillion US dollars for the first time.

This means that some export companies have more foreign exchange income than in previous years.

Wang Qing, Chief Macro Analyst at Dongfang Jincheng, believes that as the year-end approaches, increased corporate settlement demand is also driving the seasonal strengthening of the RMB; especially after the recent continuous appreciation of the RMB against the US dollar, the accumulated settlement demand from previous high export growth may be accelerating its release.

However, Huatai Futures wrote in its "Huatai Futures - Forex Annual Report: Gradually Improving, RMB Enters Appreciation Channel": Due to the inverted interest rate spread between China and the US, the cost-effectiveness of settlement versus holding foreign currency is closer, and corporate settlement strategies tend to be more differentiated and balanced. Therefore, although this year's year-end "settlement wave" will provide marginal support for the RMB in stages, it does not constitute a dominant trend factor.

The RMB's appreciation also has some geographical advantages.

In 2025, the Federal Reserve implemented three rate cuts, directly causing the US dollar index to weaken. As of December 25, the US dollar index had fallen 9.69% this year, not only breaking below the 100 mark to close at 97.97, but also recording the largest single-year drop in nearly eight years.

December 10, the Federal Reserve's third rate cut

The exchange rate is a "seesaw." When the US dollar weakens, it means that non-US currencies, including the RMB, strengthen, resulting in "passive appreciation" of the RMB.

Another boost came when Trump took office and launched a global "tariff war," undermining the global trade system that had operated for years based on existing rules.

When trade flows become uncertain, the cost of trade settlement and supply chain financing denominated in US dollars naturally rises, further shaking the foundation of the US dollar as the ideal trade settlement currency.

Coupled with the 35-day US government shutdown and Moody's, one of the three major rating agencies, downgrading the US sovereign credit rating, global funds began to seek safe havens, and US dollar assets flowed out of the US on a large scale—RMB and RMB assets thus ushered in their own "revaluation."

According to data from global fund flow monitoring agency EPFR Global, from May to October 2025, stock funds focused on Hong Kong stocks saw a cumulative net inflow of 67.7 billion Hong Kong dollars, completely reversing the net outflow trend of the same period in 2024.

More importantly, the RMB's appreciation is about people.

On December 11, the World Bank raised China's GDP growth forecast by 0.4% in its latest China Economic Brief, and the International Monetary Fund (IMF) raised this year's China GDP growth forecast by 0.2%, expecting it to reach 5%.

The simultaneous upward revision of China's economic outlook by two international institutions is clearly a full affirmation of China's current economic performance and long-term development potential.

Among these, stable exports provide the most fundamental support for the RMB's appreciation.

On one hand, a record trade surplus is a solid foundation for the RMB exchange rate; on the other hand, the quality of exports has also improved.

According to data from the General Administration of Customs: In the first 11 months of this year, China exported integrated circuits worth 1.29 trillion yuan, up 25.6%; automobiles worth 896.91 billion yuan, up 17.6%. This means that the mainstay of exports has shifted from traditional labor-intensive products to high-end manufacturing such as shipbuilding, integrated circuits, and new energy vehicles.

Export vehicles parked at the port

Guan Tao, Global Chief Economist at BOC Securities, believes: The increased diversification of export markets, accelerated transformation and upgrading of domestic manufacturing, and enhanced competitiveness of export products have enabled China's exports to maintain rapid growth, providing important support for China's stable or rising share in the global market.

RMB Appreciation and Personal Investment

Next, let's answer the question everyone cares about most—Is this round of RMB appreciation good or bad for A-shares?

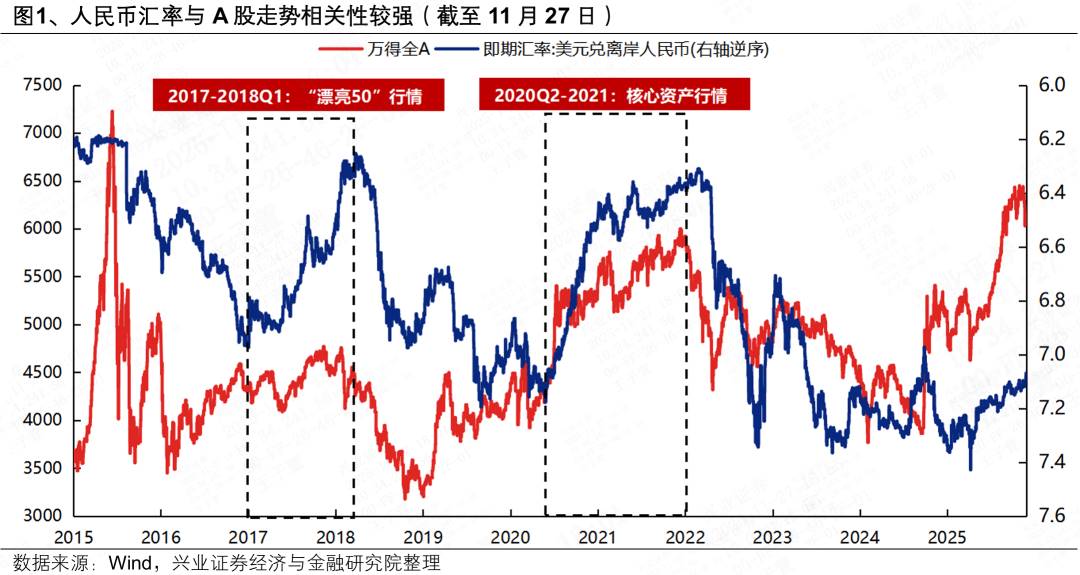

There has been much research over the years on the impact of exchange rates on A-share trends. The Xingzheng Strategy team led by Zhang Qiyao believes that since the 2015 exchange rate reform, the RMB exchange rate and A-share trends have shown a significant positive correlation.

From the chart of the correlation between the RMB exchange rate and A-share trends, we can also see that since 2017, the correlation between the RMB and A-shares has become quite apparent.

For example, during the "Beautiful 50" period from 2017 to Q1 2018, and during the RMB appreciation trend from Q2 2020 to 2021, A-shares were in a bull market. Correspondingly, foreign capital became an important incremental driver for the rise of China's stock market.

In addition, Goldman Sachs once conducted a study on US stocks, concluding: In the absence of fundamental divergence, a 0.1 percentage point rise in the exchange rate increases stock valuations by 3%—5%.

Of course, since the mechanism of influence between exchange rates and stock prices is quite complex, we cannot assert that as long as the RMB appreciates, individual stocks and the broader market will definitely rise. But based on various judgments, this round of RMB appreciation is expected to stimulate further gains in A-shares.

However, RMB appreciation will have tangible effects on different industries, thereby affecting the stock prices of related listed companies.

Offshore RMB appreciation means that Chinese goods priced in local currency become more expensive in international markets, making them pricier for foreign buyers and naturally weakening price competitiveness, which may reduce export orders.

Especially for traditional export-oriented industries such as home appliances and textiles, since these industries have thin profit margins and are more sensitive to exchange rate fluctuations, the profit impact on these industries will be more pronounced.

Everything has two sides. RMB appreciation is also a big positive for certain industries. For example, domestic industries that rely on imports can directly benefit from it.

According to import and export data from the National Bureau of Statistics, China's "net import" industries, including energy, agriculture, and materials, directly benefit from this appreciation.

At the same time, industries with more US dollar liabilities also benefit from RMB appreciation, such as those within the Hong Kong Stock Connect scope with a high proportion of short- and medium-term US dollar debt, including internet, shipping, aviation, utilities, and energy sectors.

In addition, RMB appreciation will also change the trading style of individual investors.

At the beginning of the year, "US dollar deposits" and US dollar bonds were very popular. Some investors converted a lot of RMB into US dollars for investment, but as the RMB appreciated significantly, US dollar deposits became "negative yield," and even if US dollar bonds enjoyed a 5% yield, after accounting for exchange rate losses, the return was only about the same as a one-year fixed deposit rate.

Of course, some people ask, since the RMB is strong now, can we take advantage of the appreciation and buy more US dollars for future use?

For individuals, if it's for cross-border shopping, it might be a good choice. RMB appreciation is equivalent to enjoying a discount when spending abroad, and when shopping overseas and settling in US dollars, paying in RMB will be 5%—10% cheaper than before.

But if it's purely for speculation, it's better to be cautious. Because the probability of large fluctuations in the RMB exchange rate is low, don't convert RMB into US dollar deposits for speculation, blindly chasing gains and cutting losses.

Where to Next After "Breaking 7"?

It is worth noting that the appreciation we are talking about now mainly refers to the RMB appreciating only against the US dollar, not "strengthening across the board."

According to data from the China Foreign Exchange Trade System, since the beginning of this year, the RMB exchange rate against the CFETS RMB Index, the BIS currency basket RMB Index, and the SDR currency basket RMB Index have all declined, with the two major indices falling below 100.

These three indices are the "average report card" measuring the RMB's comprehensive value against a basket of foreign currencies.

The weakening of the indices means that although the RMB has appreciated significantly against the US dollar, its overall value level is declining against other currencies, such as the pound, euro, and other foreign currencies in the basket.

But institutions including Goldman Sachs have a consensus that, with the continued development of China's economy and the deepening internationalization of the RMB, "moderate appreciation" of the RMB is expected to become a major trend.

For example, Yuekai Securities believes that in the past two years, domestic prices have been sluggish while overseas inflation has been high, and the central value of the CFETS RMB Index has even shifted downward, so the RMB exchange rate has momentum for a catch-up rally. In 2026, the RMB exchange rate against the US dollar is expected to remain strong, and "6.8" may be a key level.

According to Bloomberg's summary, experts from six major international investment banks generally believe that the US dollar will continue to weaken against major currencies, and by the end of 2026, the US dollar index will fall by about 3%—which will form a trend of continued passive strengthening of the RMB.

However, regardless of whether the RMB continues to appreciate or fluctuates in the future, it is unlikely to see any overly unexpected moves.

The recently held Central Economic Work Conference has emphasized for four consecutive years the need to "maintain the basic stability of the RMB exchange rate at a reasonable and balanced level."

As the central bank also stated: "The RMB exchange rate has a solid foundation in the medium and long term. We will continue to adhere to the decisive role of the market in exchange rate formation, maintain exchange rate flexibility, strengthen expectation guidance, prevent excessive exchange rate adjustment risks, and keep the RMB exchange rate basically stable at a reasonable and balanced level."

Even Goldman Sachs stated: "We expect RMB appreciation to be gradual and managed, but even so, we believe it is still likely to outperform forward pricing."

For individual investors, we should not focus on predicting the exact exchange rate level, but on understanding the trend, adapting to industrial upgrading, and making good use of hedging tools, so as to seize the opportunities brought by appreciation and guard against the risks brought by volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet Extension Bug Triggers $6M+ Crypto Losses, Forces Emergency Upgrade to Version 2.69

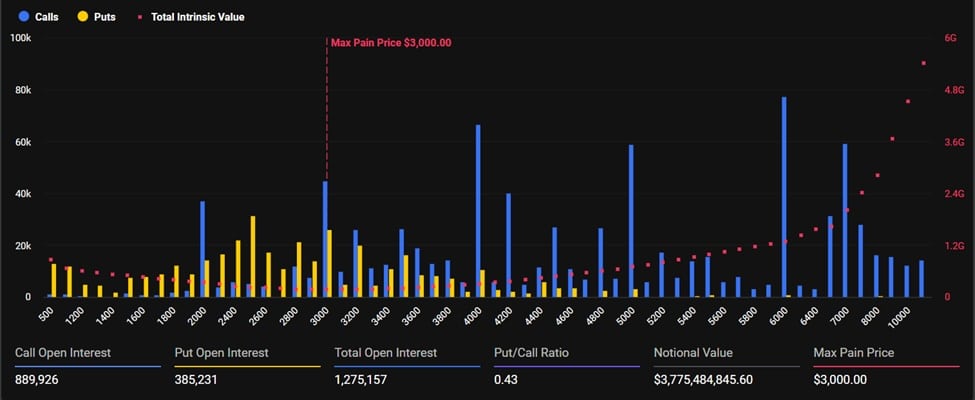

Bitcoin (BTC) Options Expiry Fuels Volatility Spike

From Vision to Void: The Story of Sam Bankman-Fried

Dive into Solana and Cardano’s Quest for Future Growth