European Council Agrees on Legal Framework for Digital Euro

The EU Council approved its negotiating position on the introduction of the digital euro while simultaneously strengthening the role of cash, laying the legal foundation for transforming Europe’s monetary system in the context of digitalization.

The European Council agreed on its position regarding two key initiatives — the creation of a legal framework for the potential issuance of the digital euro and the clarification of the status of cash as legal tender. These measures aim to strengthen the EU’s strategic autonomy, economic security, and the resilience of its payment system.

Under the approved mandate, the digital euro is considered a complement to cash, not a replacement. It’ll be available to citizens and businesses for online and offline payments across the euro area, including transactions without an internet connection. The new instrument will be directly backed by the European Central Bank (ECB), preserving central bank money as the main anchor of trust in the payment system.

As highlighted in the EU Council’s materials, the digital euro will ensure a high level of privacy, coexist with private payment solutions, such as bank cards and apps, and enhance the resilience of Europe’s payment infrastructure. At the same time, the ECB will set limits on the amount of digital euros that can be held in accounts and wallets to prevent the new form of money from being used as a store of value and to reduce risks to financial stability. These limits will be reviewed at least once every two years.

Payment service providers will be prohibited from charging consumers for basic operations, including opening and closing digital wallets and executing payments. For merchant service fees, a transitional period of at least five years is set, during which tariffs will be capped at the level of comparable payment instruments. After that, fees will be calculated based on actual costs.

The EU Council reaffirmed its commitment to protecting cash. Euro banknotes and coins remain the sole legal tender in the euro area. The document provides for an effective ban on refusing cash in retail trade and services, except for distance and fully automated sales. EU member states are required to monitor access to cash and develop plans to ensure its use in the event of large-scale disruptions to electronic payment systems.

The next stage will be the start of negotiations between the EU Council and the European Parliament. The final decision on issuing the digital euro will be taken by the ECB, based on the approved legal framework and the readiness of the infrastructure.

Additional context was provided by a speech delivered two days earlier by ECB Executive Board Member

The ECB plans a two-stage strategy:

- Preparation for the issuance of the digital euro for retail payments and the launch of settlement in central bank money for DLT-based transactions starting as early as 2026.

- Development of cross-border instant payments through the integration of the TIPS system with payment infrastructures in other countries.

Subject to the adoption of the relevant regulation by the European Parliament and the EU Council, pilot operations with the digital euro could begin in mid-2027, with the first issuance expected in 2029.

In October 2025, the ECB announced the conclusion of framework agreements with companies that will develop the core technical elements of the digital euro.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

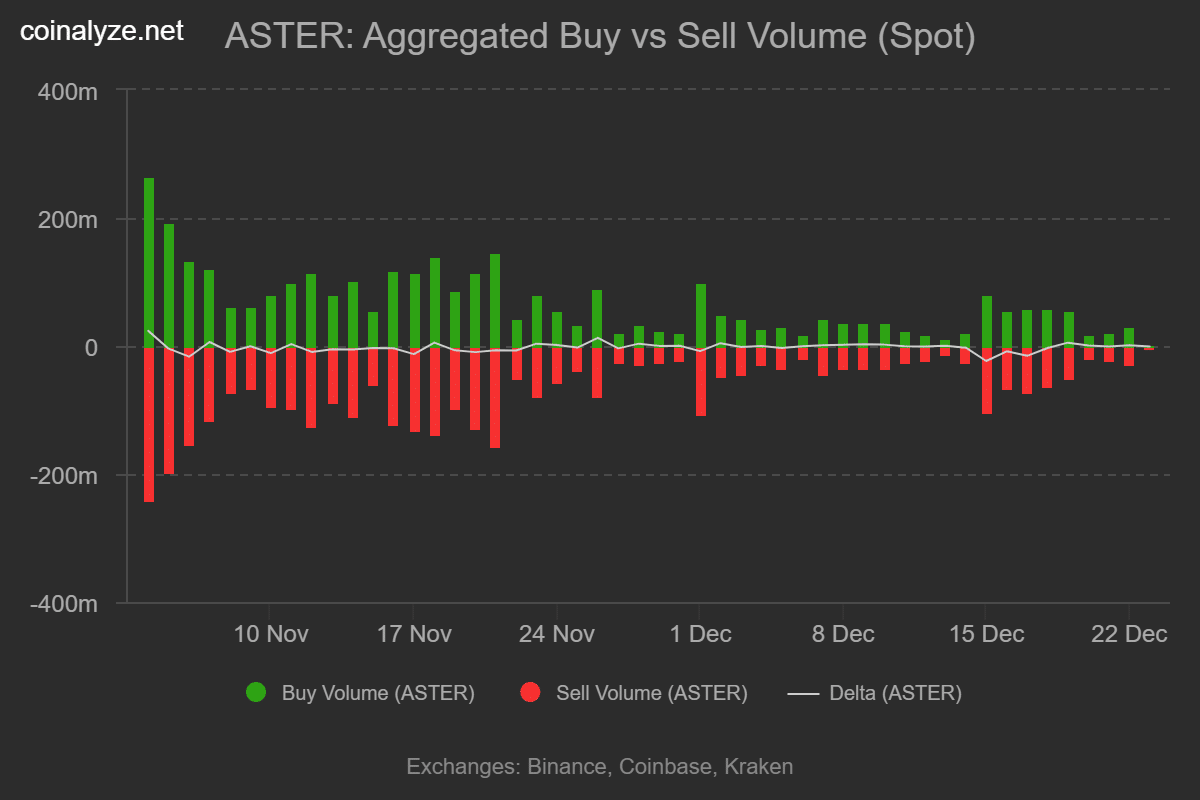

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share

Top Crypto Gainers December 23 – CRV Leads with 4.46% Surge as Gold Tokens Rise