Hyperliquid personally reconciles accounts; behind the perfect PR is a fundamental crackdown on competitors.

Accusations of "insolvency" and "backdoors" have pushed the currently hottest derivatives protocol, Hyperliquid, into the spotlight. But this is not just a PR crisis; it is also a stress test of the boundaries of transparency for high-performance DeFi.

Written by: angelilu, Foresight News

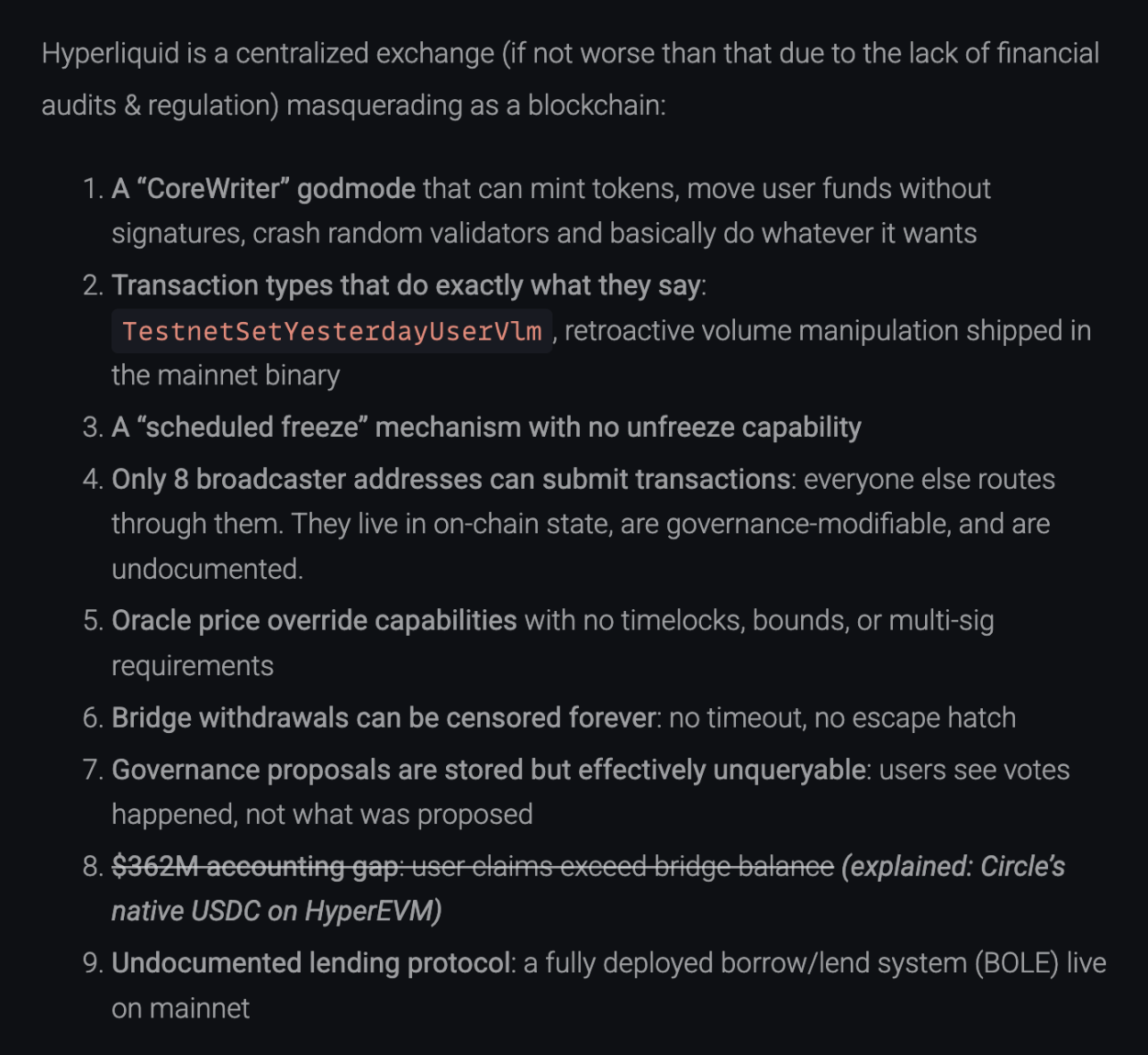

On December 20, 2025, a technical article titled "Reverse Engineering Hyperliquid" published on blog.can.ac directly deconstructed Hyperliquid's binary files through reverse engineering, accusing it of nine serious issues ranging from "insolvency" to a "god mode backdoor." The article bluntly stated: "Hyperliquid is a centralized exchange disguised as a blockchain."

In response to the FUD, Hyperliquid's official team released a lengthy statement. Perhaps this is not just a simple rumor refutation, but a declaration of war over "who is the real decentralized trading facility." Although the team successfully clarified the issue of fund security, there remain some intriguing "blank spaces" in certain sensitive areas of decentralization.

Where Did $362 Million Go? The Audit Blind Spot Under "Dual Ledgers"

The most damaging accusation is: user assets within the Hyperliquid system are $362 million less than the on-chain reserves. If true, this would mean it is a "partially reserved on-chain FTX."

However, after verification, this is a misunderstanding caused by information asymmetry due to an "architectural upgrade." The auditor's logic was: Hyperliquid reserves = USDC balance on the Arbitrum cross-chain bridge. Based on this logic, they checked the bridge address and found the balance was indeed less than total user deposits.

Hyperliquid responded that it is undergoing a full evolution from an "L2 AppChain" to an "independent L1." In this process, asset reserves have become dual-track:

The accuser completely ignored the native USDC on HyperEVM. According to on-chain data (as of press time):

- Arbitrum cross-chain balance: 3.989 billion USDC (verifiable)

- HyperEVM native balance: 362 million USDC (verifiable on Hyperevmscan)

- HyperEVM contract balance: 59 million USDC

Total solvency = 3.989 billion + 362 million + 59 million ≈ 4.351 billion USDC

This number matches exactly with the Total User Balances on HyperCore. The so-called "$362 million gap" is precisely the native assets that have already migrated to HyperEVM. This is not a disappearance of funds, but a transfer of funds between different ledgers.

9 Accusations Reconciled: What Was Clarified? What Was Avoided?

Accusations That Have Been Clarified

Accusation: "CoreWriter" god mode: Allegedly able to mint tokens out of thin air and misappropriate funds.

Response: The official explanation is that this is the interface for L1 and HyperEVM interaction (such as staking), with restricted permissions and no ability to misappropriate funds.

Accusation: $362 million funding gap.

Response: As mentioned above, this is due to not counting Native USDC.

Accusation: Unpublished lending protocol.

Response: The official team pointed out that the spot/lending feature (HIP-1) documentation has been published and is in the pre-release stage, not secretly running.

Accusations Admitted but Reasonably Explained

Accusation: Binary file contains "modify trading volume" code (TestnetSetYesterdayUserVlm).

Response: Admitted. Explained as leftover code from the testnet, used to simulate fee logic. The mainnet node has physically isolated this path and cannot execute it.

Accusation: Only 8 broadcast addresses can submit transactions.

Response: Admitted. Explained as an anti-MEV (Maximal Extractable Value) measure to prevent users from being frontrun. Promised to implement a "multi-proposer" mechanism in the future.

Accusation: The chain can be "planned frozen" with no rollback function.

Response: Admitted. Explained as a standard process for network upgrades, requiring the entire network to pause and switch versions.

Accusation: Oracle prices can be instantly overwritten.

Response: Explained as a system security design. In order to promptly liquidate bad debts during extreme volatility (like 10/10), validator oracles indeed do not have a time lock.

Missing/Vague Responses

In our review, there are two accusations that were not directly addressed or fully resolved in the official response:

Accusation: Governance proposals are unqueryable; users can only see that a vote occurred, but on-chain data does not include the specific text of the proposal.

Response: The official statement did not address this point. This means that Hyperliquid's governance is still a "black box" for ordinary users—you can only see the result, not the process.

Accusation: The cross-chain bridge has no "escape hatch," meaning withdrawals may be subject to indefinite review and users cannot forcibly withdraw back to L1.

Response: The official team explained that the bridge was locked during the POPCAT incident for security reasons, but did not refute the architectural fact of "no escape hatch." This indicates that at the current stage, user asset inflows and outflows are highly dependent on validator approval, lacking the censorship-resistant forced withdrawal capability of L2 Rollups.

Criticizing Competitors

The most interesting aspect of this incident is that it forced Hyperliquid to reveal its hand, giving us a chance to re-examine the Perp sector landscape. In its response, the official team unusually criticized competitors, targeting Lighter, Aster, and even industry giant Binance.

They stated, "Lighter uses a single centralized sequencer, and both its execution logic and zero-knowledge proof (ZK) circuits are not public. Aster uses centralized matching and even offers dark pool trading, which can only be achieved with a single centralized sequencer and unverifiable execution. Some other protocols with open-source contracts have unverifiable sequencers."

Hyperliquid bluntly categorized these competitors together, saying they all rely on a "Centralized Sequencer." The official team emphasized: on these platforms, no one except the sequencer operator can see the full state snapshot (including order book history and position details). In contrast, Hyperliquid attempts to eliminate this "privilege" by having all validators execute the same state machine.

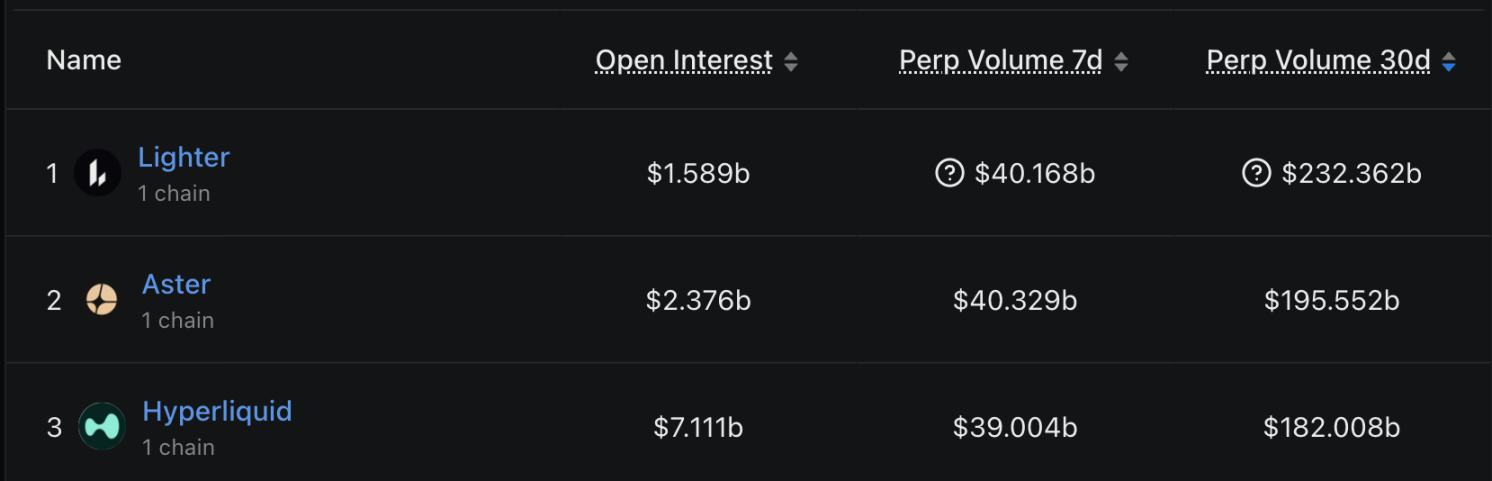

This round of "criticism" may also stem from Hyperliquid's concern over its current market share. According to DefiLlama's trading volume data from the past 30 days, the market landscape has become a three-way rivalry:

- Lighter: $232.3 billion in trading volume, currently ranked first, accounting for about 26.6%.

- Aster: $195.5 billion in trading volume, ranked second, accounting for about 22.3%.

- Hyperliquid: $182 billion in trading volume, ranked third, accounting for about 20.8%.

Facing the rising trading volumes of Lighter and Aster, Hyperliquid is trying to play the "transparency" card—"Although I have 8 centralized broadcast addresses, my full state is on-chain and verifiable; whereas you can't even check yours." However, it is worth noting that although Hyperliquid lags slightly behind the top two in trading volume, it dominates in open interest (OI).

Public Opinion Response: Who Is Shorting HYPE?

In addition to technical and funding issues, the community is most concerned about recent rumors that HYPE tokens have been shorted and dumped by "insiders." In response, a Hyperliquid team member gave a qualitative response on Discord for the first time: "The address starting with 0x7ae4 that shorted belongs to a former employee," who was once a team member but was dismissed in early 2024. The former employee's personal trading behavior is unrelated to the current Hyperliquid team. The platform emphasized that extremely strict HYPE trading restrictions and compliance reviews are currently enforced for all active employees and contractors, strictly prohibiting insider trading using their positions.

This response attempts to downgrade the accusation of "team wrongdoing" to "former employee's personal behavior," but the community may still expect more detailed disclosure regarding the transparency of token distribution and unlocking mechanisms.

Don't Trust, Verify

This clarification post by Hyperliquid is a textbook example of crisis PR—not relying on emotional output, but on data, code links, and architectural logic. It did not stop at proving its innocence, but went on the offensive by comparing competitor architectures, strengthening its own "full state on-chain" brand and advantages.

Although the FUD has been debunked, the implications for the industry are profound. As DeFi protocols evolve toward independent application chains (AppChains), architectures are becoming more complex and asset distribution increasingly fragmented (Bridge + Native). The traditional method of "just checking the contract balance" for audits is no longer effective.

For Hyperliquid, proving "the money is there" is only the first step. The real challenge is how to gradually transfer the permissions of those 8 submission addresses while maintaining high performance and MEV resistance, truly achieving the leap from "transparent centralization" to "transparent decentralization"—the only way to become the "ultimate DEX."

For users, this incident once again confirms the iron law of the crypto world: don't trust any narrative—verify every byte.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana: Short-term pain, long-term hope? SOL faces liquidation test

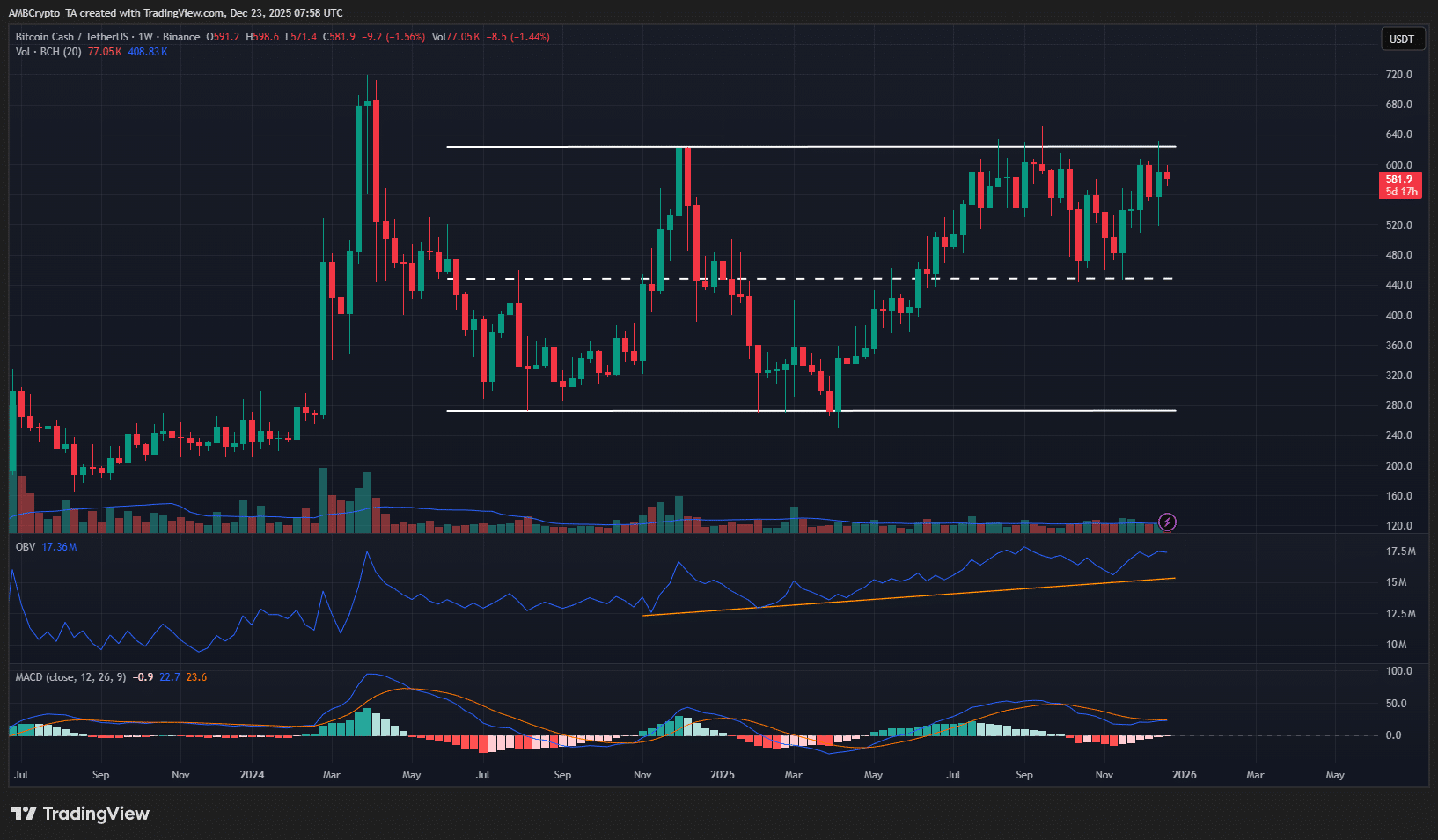

Bitcoin Cash – Why buying BCH before a $624 breakout is risky

Falcon Finance Strengthens USDF Expansion Through Chainlink Price Feeds and CCIP

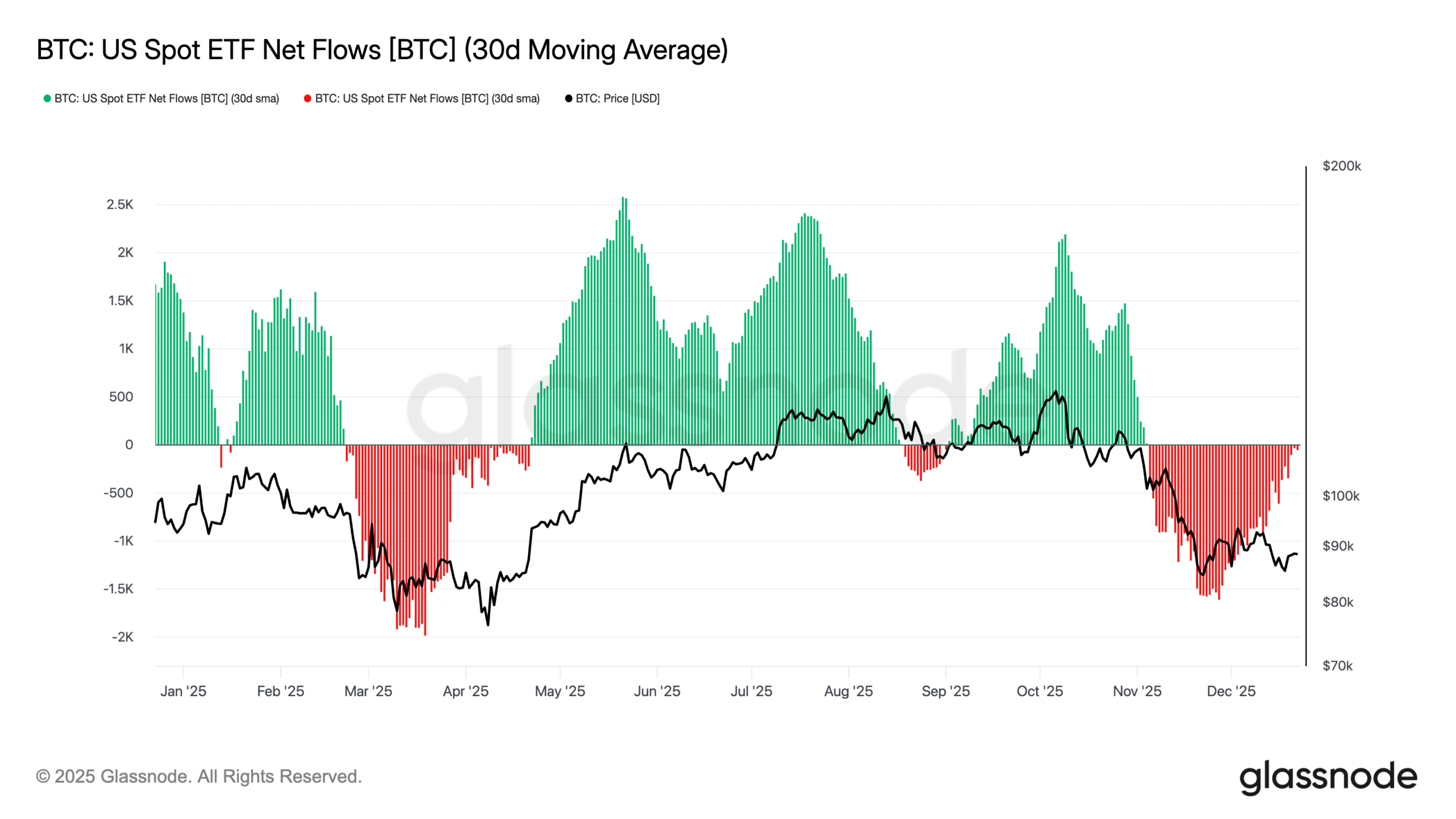

Bitcoin and Ethereum ETFs see persistent outflows as institutional appetite weakens