Polymarket announces its own L2—has Polygon lost its trump card?

Original Title: "The Economic Calculation Behind Polymarket's Exit from Polygon"

Original Author: Azuma, Odaily

On December 22, a development regarding the leading prediction market Polymarket attracted widespread attention in the market—Polymarket team member Mustafa confirmed in the Discord community that Polymarket plans to migrate from Polygon and launch an Ethereum Layer2 network named POLY, which is currently the project's top priority.

An Expected "Breakup"

Polymarket's decision to leave Polygon is not surprising. One is a hot application-layer representative, the other is a gradually declining old base layer; there has always been a mismatch in market popularity and value expectations between the two. As Polymarket has grown into a new giant, Polygon's insufficiently stable network performance (the most recent outage occurred on December 18) and its relatively weak ecosystem have objectively become constraints for the former.

For Polymarket, building its own portal means a win-win choice in both product and economic dimensions.

On the product side, besides seeking a more stable operating environment, building its own Layer2 network allows Polymarket to customize underlying features in reverse according to its platform needs, thus more flexibly adapting to future upgrades and iterations of the platform.

More importantly, the significance lies in the economic aspect. Building its own network means Polymarket can consolidate all economic activities and peripheral services derived from its platform within its own system, preventing related value from leaking to external networks and gradually accumulating as its own systemic advantage.

Explicit and Implicit Economic Contributions

As an application layer, Polymarket's explosive popularity once brought Polygon considerable direct economic contributions. According to historical data compiled by data analyst dash on Dune:

· Polymarket had 419,309 active users this month, with a total historical user count of 1,766,193;

· There were 19.63 million transactions this month, with a total historical transaction count of 115 million;

· The total trading volume this month was $1.538 billion, with a total historical trading volume of $14.3 billion.

As for how to evaluate Polymarket's contribution to the Polygon ecosystem economy, Odaily found a rather coincidental ratio when compiling data for both parties.

· First, in terms of locked funds, Defillama data shows that the current total position value of Polymarket across the platform is about $326 million, accounting for about a quarter of Polygon's total network TVL of $1.19 billion;

· Next is gas consumption. Coin Metrics reported last October that transactions related to Polymarket were estimated to consume 25% of Polygon's total network gas;

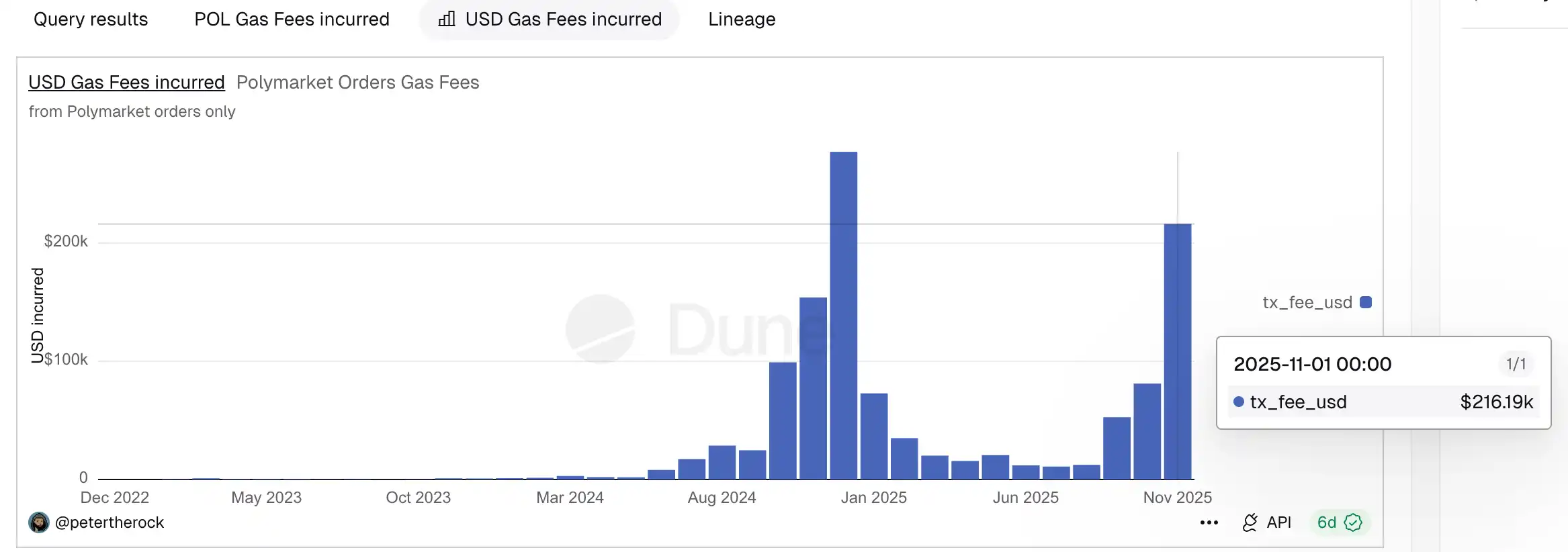

· Considering this data is somewhat outdated, we checked recent changes. According to statistics compiled by data analyst petertherock on Dune, Polymarket-related transactions consumed about $216,000 in gas in November, while Token Terminal reported that Polygon's total network gas consumption that month was about $939,000, again close to a quarter (about 23%).

There may be coincidences caused by statistical methods and time windows, but the similar results across dimensions can to some extent serve as a reference for estimating Polymarket's economic significance to Polygon.

In addition to quantifiable indicators such as active users, locked funds, transaction volume, and gas contribution, Polymarket's economic significance to Polygon is also reflected in a series of less directly measurable but equally real implicit contributions.

First is the revitalization of stablecoin liquidity. All Polymarket transactions are settled in USDC, and its high-frequency, continuous trading behavior has objectively and significantly increased the demand for USDC circulation and usage scenarios on the Polygon network; second is the behavioral value of retained users. Besides the prediction market itself, these users may also turn to using other products in the Polygon DeFi ecosystem for convenience, thereby enhancing the overall ecosystem value of the Polygon network. These contributions are difficult to quantify with concrete data, but they constitute the "real demand" most valued and scarce for base layer networks.

Why Now? The Answer Is Not Hard to Guess

In fact, judging solely from user scale, data performance, and market buzz, Polymarket is fully capable of establishing its own portal. This is no longer a question of "should we leave," but rather "when to leave."

The reason for choosing to migrate at this point in time is likely due to the imminent Polymarket TGE. On one hand, once Polymarket completes its token launch, its governance structure, incentive system, and economic model will become relatively fixed, and the cost and complexity of subsequent base layer migration will rise significantly; on the other hand, upgrading from a "single application" to a "full-stack system of application + base layer" itself means a change in valuation logic, and building its own Layer2 undoubtedly opens up a higher ceiling for Polymarket in terms of narrative and capital.

In summary, Polymarket's departure from Polygon is essentially not just a simple base layer migration, but a microcosm of structural changes in the crypto industry. When top applications begin to independently carry users, traffic, and economic activity, if the base layer network cannot provide additional value, it will inevitably be "backstabbed."

Nothing more, just the pursuit of profit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock Elevates Bitcoin ETF to Major Theme Despite Market Dip

Crypto Market Sees $250M in Liquidations Ahead of U.S. GDP Release

Gold Silver Rally but Bitcoin Fails to Catch Up: Weak Liquidity or Market Manipulation?

Chainlink Faces Uncertain Times in the Cryptocurrency Market