Will the crypto industry be doing well in 2026?

Original Title: "Will the Crypto Industry Be Good in 2026?"

Original Author: Viee Xiaowei, Biteye

In the last few months of 2025, the atmosphere of a bear market began to spread.

Bitcoin slid from its peak of $120,000, ETF inflows stalled at times, various tokens showed divergent trends, and the once emotion-driving Meme coins began to be neglected. Compared to the end of 2021, this time there was no sudden regulatory crackdown, and aside from the 1011 crash, there seemed to be no severe liquidity crisis, yet something still felt off.

If the crypto world of 2025 was a recalibration of true and false value, then will crypto be better in 2026?

This article attempts to find the answer. Perhaps we need to accept a fact: the crypto industry may be entering an era that is no longer driven by unilateral price surges or "casino narratives."

1. Macro Trends Recovering, Bitcoin Still in the Spotlight

Over the past year, both the price performance and market positioning of Bitcoin have changed significantly.

After reaching a historic high of $120,000, the market began to pull back, volatility increased, and market sentiment gradually cooled. Unlike previous rallies driven by retail investors, this round was led by institutional funds behind ETFs. In terms of holding costs, CryptoQuant analyst Axel Adler Jr. pointed out last month that the average holding cost for US ETFs is $79,000, and many consider this a support range for the price. Therefore, Bitcoin's current trend increasingly resembles a highly volatile institutional asset: on one hand, it has an anti-inflation positioning similar to gold; on the other, like tech stocks, it is affected by macro sentiment and risk appetite, showing β attributes.

From a broader macro perspective, 2025 is a year of warming sentiment for global risk assets. AI is the main theme, US stocks keep hitting new highs, and the Federal Reserve announced three rate cuts in December, bringing the market back into a phase of warming liquidity expectations. The FOMC's year-end economic forecast shows that the US GDP growth expectation for 2026 has also been raised from 1.8% to 2.2%–2.5%. The general expectation is for continued easing next year, which may be positive for assets like Bitcoin.

But the market is not without risks. If the economy suddenly weakens in 2026, or if inflation unexpectedly rebounds, risk assets could still face significant corrections.

2. Regulatory Turning Point: US and Hong Kong Policy Trends

Another important change in 2025 is the formal establishment of regulatory frameworks.

In the US, two key bills have been enacted. The first is the Stablecoin Act (GENIUS Act), which clarifies the definition of stablecoins, reserve requirements, and issuance qualifications, providing a compliance path for mainstream stablecoin issuers. This act was signed into law by the President in July 2025 and will take effect either 18 months after signing or 120 days after the final rules are issued by regulators. The second is the Crypto Asset Market Structure Act (CLARITY Act), which systematically delineates the boundaries between "security tokens" (regulated by the SEC) and "commodity tokens" (regulated by the CFTC), and proposes tiered regulation. This act will be submitted to the Senate for review in January, and may require the President's signature, with the effective date yet to be determined. Meanwhile, the SEC is also accelerating the approval of more crypto ETFs, opening channels for institutional products.

In Hong Kong, regulatory steps are also accelerating. In 2025, the HKMA launched a regulatory regime for stablecoin issuers, requiring all Hong Kong-based stablecoin issuers to be licensed. This means that future issuance of USD or RMB stablecoins in Hong Kong must meet certain capital and compliance requirements. In addition, HashKey has been listed on the Hong Kong Stock Exchange, becoming the first compliant platform with crypto trading as its core business to IPO in Hong Kong, marking a milestone.

Overall, the regulatory trends in both the US and Hong Kong are to curb illegal speculation while opening up legal business channels, pushing the industry toward institutionalization and compliance.

3. Three Main Tracks: Stablecoins, Prediction Markets, On-chain US Stocks

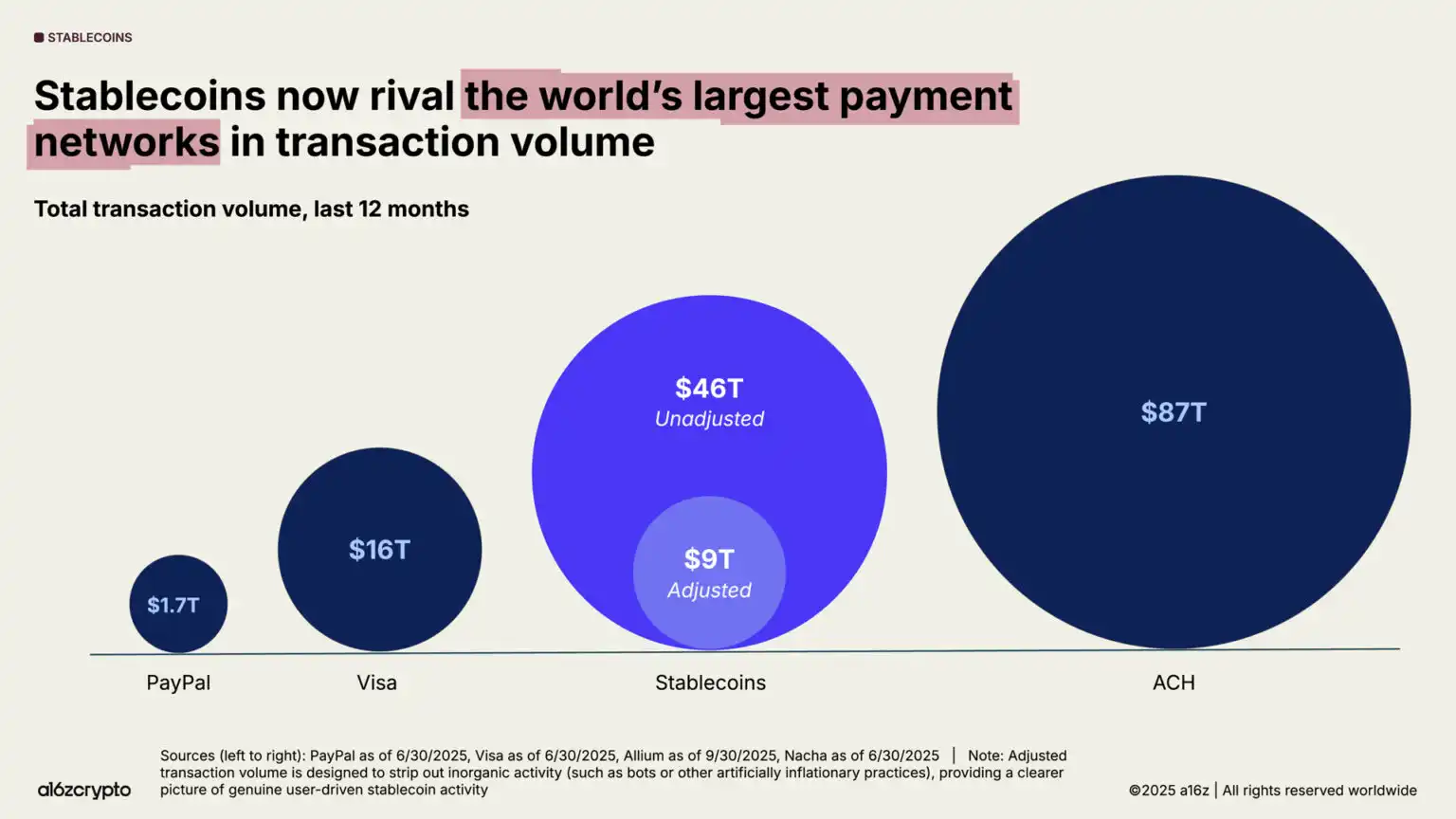

In recent years, the most stable growth curve in the crypto industry has actually been stablecoins.

By 2025, global stablecoin issuance has exceeded $300 billion, with USDT and USDC together accounting for over 80%. Stablecoins are becoming part of the global payment network. Whether USDT or USDC, these stablecoins have penetrated daily merchants and cross-border settlements.

In 2026, stablecoins are likely to be even closer to the real world, as traditional giants like Visa, Stripe, and PayPal are already using stablecoins for settlement. For example, Stripe already supports merchants subscribing with stablecoins, and there are real services in place.

Image source: a16z

In addition, with clearer regulation, treasury-backed stablecoins (backed by high-quality assets) and regional stablecoins are expected to emerge, such as digital currency bridge projects promoted by Japan and the EU.

Another area worth watching is prediction markets.

Originally, most people thought prediction markets were too niche or non-compliant. But now, they are gradually becoming a combination of "on-chain betting + pricing tools" under themes such as the US election, sports events, and economic data.

For example, Kalshi has obtained a formal futures license from the US CFTC, allowing it to legally launch prediction trading related to macroeconomic data, and its valuation has climbed to $11 billion. Polymarket, leveraging topics like the US election and entertainment events, has also become a place for many users to bet and gauge public opinion.

In 2026, prediction markets may move beyond pure speculation. Users may not just bet on wins or losses, but use money to vote and express their judgment on the probability of certain outcomes. This collective intelligence pricing method could be referenced by media, research institutions, and even trading strategies. In addition, AI will open up new possibilities for prediction markets, allowing them to not only rely on human bets but also automatically analyze data, place orders, and even generate new markets. This will make prediction markets faster and smarter, gradually turning them into tools for assessing risk and trends, not just places to gamble.

The last area that cannot be ignored is the development of on-chain US stocks.

Simply put, the crypto industry is now not only trading crypto assets but also bringing real-world assets on-chain. For example, Securitize plans to launch the first fully compliant on-chain stock trading platform in 2026, where tokens purchased on-chain correspond to real company stocks, with voting rights and dividends.

4. Emerging Narratives: New Directions That May Take Off in 2026

Meanwhile, there are some seemingly marginal directions worth watching, as referenced from the article "a16z: 17 Structural Changes in the Crypto Industry."

Image source: a16z

1. The Identity Problem of AI Agents

As AI agents begin to participate in trading, browsing, placing orders, and even interacting with smart contracts, a key question arises: how do these non-human identities prove "who they are"?

The "Know Your Agent" (KYA) concept proposed by a16z aims to solve this problem. On-chain, any agent initiating a transaction must have clear permissions and attribution, requiring cryptographic signature credentials to trade. In 2026, this may become a prerequisite for large-scale deployment of on-chain AI.

2. x402 Protocols and Micropayments

a16z predicts that as AI Agents widely trade data, call computing power, and access interfaces, we will enter an era of "automatic settlement + programmable payments."

No more manual payments are needed; AI Agents can identify needs and automatically execute payments. This is the real-world problem that protocols like x402 are addressing. In 2026, their presence will become increasingly strong.

3. Privacy Chains Will Receive More Attention

a16z points out a key trend: compared to converging performance competition, privacy will become the core moat for future public chains. In the past, people worried that privacy chains were not conducive to regulation and lacked transparency. But now, the problem has reversed: business data is too sensitive, and without privacy protection, compliant institutions dare not go on-chain. For this reason, chains with built-in privacy protection are becoming attractive. Once users adopt these chains, their data won't be easily leaked, migration costs are higher, and new user stickiness naturally forms—this is a kind of network effect.

4. Staked Media

In the era of massive AI-generated content, judging whether a statement is reliable cannot depend solely on who says it, but also on whether there is a cost to making the statement. Therefore, a16z proposes a new media model: content creators not only speak but also "stake" their positions through locking tokens, prediction markets, NFT credentials, etc.

For example, if you post a bullish view on ETH, you also lock your own ETH as collateral; if you make an election prediction, you also bet on-chain. These public interest bindings make content more than just talk. If this model works, it may become the new normal for on-chain media in the future.

Of course, the a16z report proposes far more than these directions. This article focuses on four representative trends, but other directions are also worth attention, such as: stablecoin on/off-ramp upgrades, RWA crypto-native transformation, stablecoins driving bank ledger system upgrades, diversified wealth management, the rise of AI research assistants, real-time content sharing mechanisms for AI agents, decentralized quantum-resistant communication, "privacy as a service" becoming infrastructure, DeFi security paradigm shifts, intelligent prediction markets, verifiable cloud computing, emphasis on product-market fit (PMF), and crypto legislation unlocking more blockchain potential.

Interested readers can refer to the original a16z report for further insights.

5. The Crypto Industry Is Breaking Out of Its Internal Cycle

The early growth of the crypto industry was mostly built on a self-reinforcing system—token issuance, rebates, and airdrops all tried to attract more insiders to stay, but this closed loop is gradually being broken by reality.

From Polymarket to USDT, and then to the cross-border applications of USDC, we see more and more people who are not Web3 users using blockchain tools. Street vendors in Lagos may not understand wallet structures, but they know that using USDT is much faster than bank transfers. In high-inflation countries, depositors flock to USDC for risk aversion rather than speculation. One of the most intuitive changes appears in payment scenarios in developing countries, such as the partnership between the Philippine trading platform Coins.ph and Circle to open a low-cost USDC remittance channel.

This trend shows that crypto technology is being embedded in real scenarios such as cross-border payments and remittance channels. The true future of crypto may lie in how technology solves real problems, allowing more ordinary people to use blockchain unconsciously.

6. The Crypto Industry from the Perspective of KOLs

The recent discussion about "whether spending years in the crypto industry is worth it" is essentially a collective industry review.

Nic Carter, partner at Castle Island Ventures, continued his reflection on "whether eight years in crypto was wasted," admitting that only Bitcoin, stablecoins, DEXs, and prediction markets have truly achieved significant PMF (product-market fit) so far. He chooses to maintain pragmatic idealism, accepting that bubbles and hype are part of the path, but not all of it.

Dragonfly partner Haseeb was more direct, pointing out that the problem is not the existence of casinos, but that if you only focus on the glamour of casinos, you will miss the real transformation of the industry. He believes crypto is a better vehicle for finance and will forever change the nature of money, hoping the industry remains patient: "The Industrial Revolution took 50 years to change productivity; we've only had 15."

XHunt & Biteye founder DeFiTeddy2020's summary is also very realistic. In his view, the crypto industry quickly exposes the essence of finance, facing project failures, price decoupling from fundamentals, and even insider trading, manipulation, and exploitation. It is not a hotbed of idealism, but a market that constantly educates participants with real money, greatly honing one's mindset.

Regarding the industry's future direction, KOL "Crypto Goddess" xincctnnq offers a long-term perspective: what crypto truly tries to solve are long-term issues such as monetary systems, contract execution, digital property rights, capital market efficiency, and financial inclusion. Even if the results are distant and the process rough, it is worth continuous attempts.

Additionally, trader & analyst CryptoPainter provided a more market-structure-oriented explanation: the crypto market repeats its usual cycle of "value investing" - "belief investing" - "emotional speculation" - "complete disappointment," then starts over. This cycle occurred in 2018 and 2022 and is bound to happen again. Gamblers and casinos are not anomalies but part of the process of consuming bubbles and completing market self-adjustment.

Figment Capital member DougieDeLuca's stance is like a phased summary. He bluntly states that "Crypto is dead" does not mean prices go to zero or blocks stop running, but that "Crypto as a closed industry form is dying." True success should be crypto technology integrating into ordinary people's daily lives.

From a more institutional perspective, KOL & researcher Blue Fox lanhubiji mentioned that as old users begin to exit, newcomers with traditional financial backgrounds are entering. In their view, crypto is a long-term trend that has entered a path of standardization, interoperability, and scale. In three years, a brand new era of on-chain finance, an on-chain Wall Street, will gradually emerge.

LD Capital founder Jackyi_ld's judgment is closer to the current cycle. He points out that the recent crypto downturn is more due to the temporary resonance of liquidity and macro events. Currently, the bearish factors are gradually being digested, and with the dual benefits of rate cut expectations and crypto policies, he remains optimistic about the subsequent market.

On a more macro regulatory and industry structure level, Hashkey Group Chairman Xiao Feng's judgment is particularly systematic. He proposes three major trends for the future:

First, the global crypto regulatory trend is shifting from "voluntary acceptance" to "mandatory supervision," with governments gradually clearing offshore gray areas and crypto trading moving toward licensing. For example, in Hong Kong, since June 2023, all unlicensed trading platforms must exit the market.

Second, crypto is no longer just native assets like BTC and ETH; more traditional financial assets are migrating on-chain through tokenization, forming a new regulated and compliant securities market.

Third, moving from "off-chain" to "on-chain," he predicts that the second half of 2026 may be the key node for the emergence of an "on-chain Wall Street."

7. Conclusion

Will crypto be good in 2026?

If you expect "coin prices to skyrocket," the answer may be uncertain.

But if you ask whether the industry is moving toward a more real and useful direction, the answer may be yes.

From crypto ETFs to stablecoin payments, from on-chain treasuries to prediction markets, from on-chain agents to decentralized AI, all these indicate one thing:

The crypto industry may be starting to land in more real-world directions, and may increasingly resemble a parallel financial system to the real-world financial system, resonating with the stock market, macro liquidity, policy expectations, and even the AI cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Lido Community Approves Crucial Safe Harbor Agreement to Shield $26 Billion from Hackers

Unlock Rewards: DLP Labs Launches EV Rewards System on Sui Blockchain

Tron DAO Integrates with Base: Unlock Seamless DEX Trading Now

XRP Whale Selling Pressure Crushes ETF Optimism: Price Could Plummet to $1.50