Ethereum December 17 Prediction: ETH Must Hold This Support Level to Reach $3,500

In the past 24 hours, Ethereum's price has shown little volatility and is currently trading at $2,943. The crypto asset has risen by 0.7% in the past 24 hours, with an intraday price range between $2,902 and $2,971. Over the past week, Ethereum's performance has been relatively flat, down 11.4%.

Over the past 14 days, Ethereum's price has dropped by 3.7%, reflecting the overall market trend and sentiment. Its market capitalization remains robust at $355.8 billions, highlighting Ethereum's leading position as a market leader. In the coming trading days, traders will explore how Ethereum will respond to its long-term price trend.The future direction of Ethereum.

Ethereum Price Prediction

Ethereum's recent price action has shown some key technical signals indicating it is in a retracement phase. Currently, the support level around $2,800 is holding strong, with the price rebounding near this level in recent trading days. This suggests that if Ethereum can hold this support, it may attempt a rebound and potentially test the resistance above $3,300. If this resistance is broken, the price could further rise to $3,500.

ETHUSD Price Chart

ETHUSD Price Chart In addition, the Relative Strength Index (RSI) is currently at 41.20, indicating a neutral market state. This means Ethereum is neither overbought nor oversold, but is close to the lower end of the RSI range. If buying pressure increases, it could signal a price reversal. However, if the RSI continues to decline, it may indicate that bearish momentum will persist and support levels will be tested more aggressively.

Furthermore, the Moving Average Convergence Divergence (MACD) indicator is giving a bearish signal, with the MACD line at -44.47, below the signal line at -38.24. This bearish crossover indicates that the current downward momentum is stronger, as also reflected by the negative histogram. If the MACD line crosses back above the signal line, a momentum shift may occur.

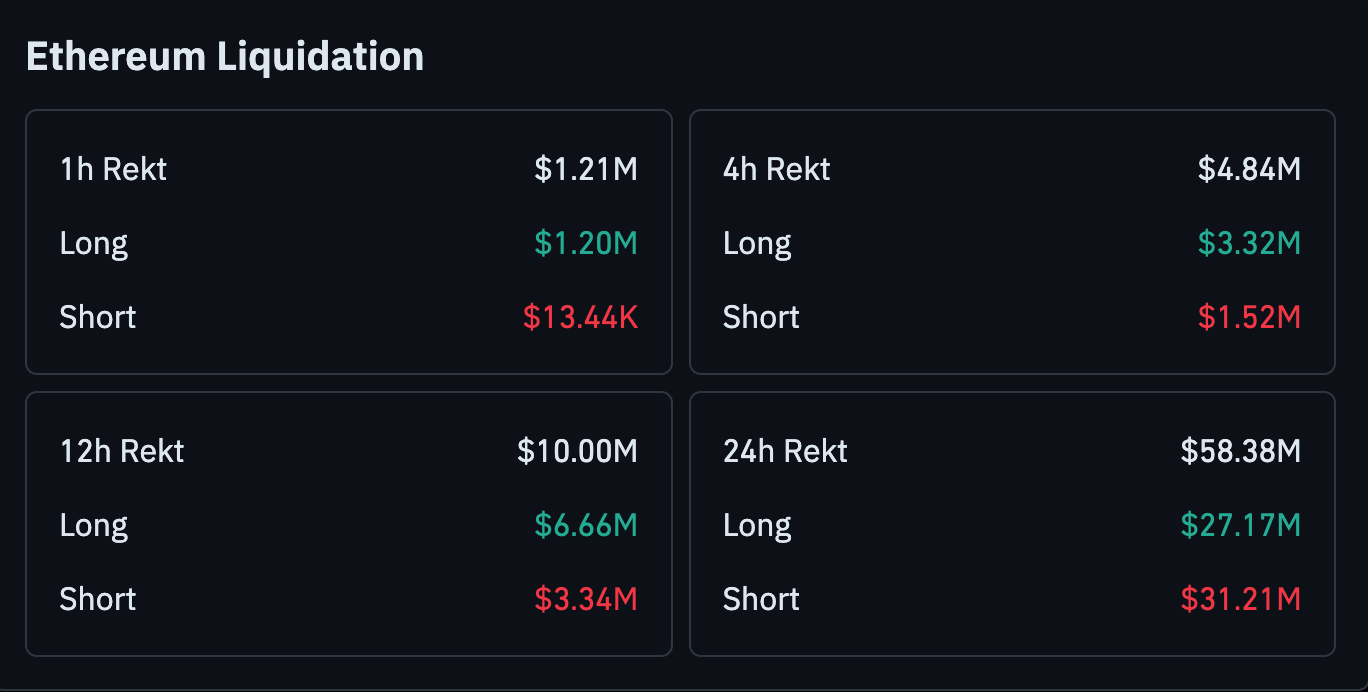

Ethereum Liquidation Data

Meanwhile, there have been significant changes in the Ethereum market.Liquidation amountsover different time periods highlight volatility and the pressure faced by both long and short positions. In 12 hours, the liquidation amount reached $10 million, with long positions accounting for $6.66 million and short positions for $3.34 million.

Ethereum Liquidation

Ethereum Liquidation 24-hour liquidation data shows that the total liquidation amount reached $58.38 million, with long positions liquidated for as much as $27.17 million and short positions for $31.21 million. This imbalance indicates increased market volatility, with long positions suffering the most losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The strengthening of the Chinese yuan may support bitcoin prices

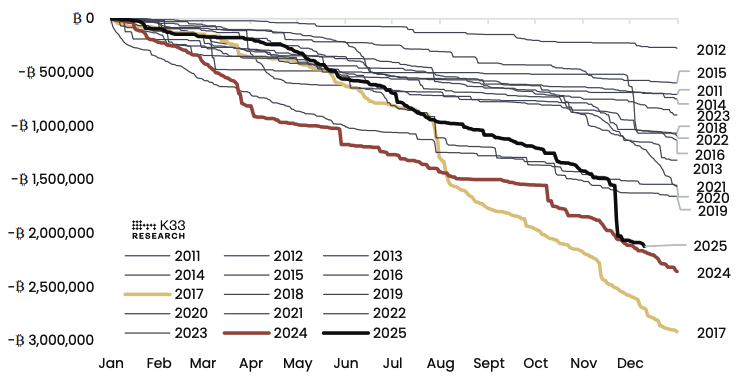

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX