AAVE Price Prediction: AAVE Falls Below $186 Due to Bearish Factors, Impact of SEC Investigation Conclusion Weakens.

The price of Aave (AAVE) continues to decline, falling below $186 (UTC+8) as of Wednesday's press time, after encountering resistance at a key level. Derivatives positions and momentum indicators show that bearish forces remain dominant in the short term, overshadowing the positive impact of the U.S. Securities and Exchange Commission (SEC) ending its long-term investigation into the Aave protocol.

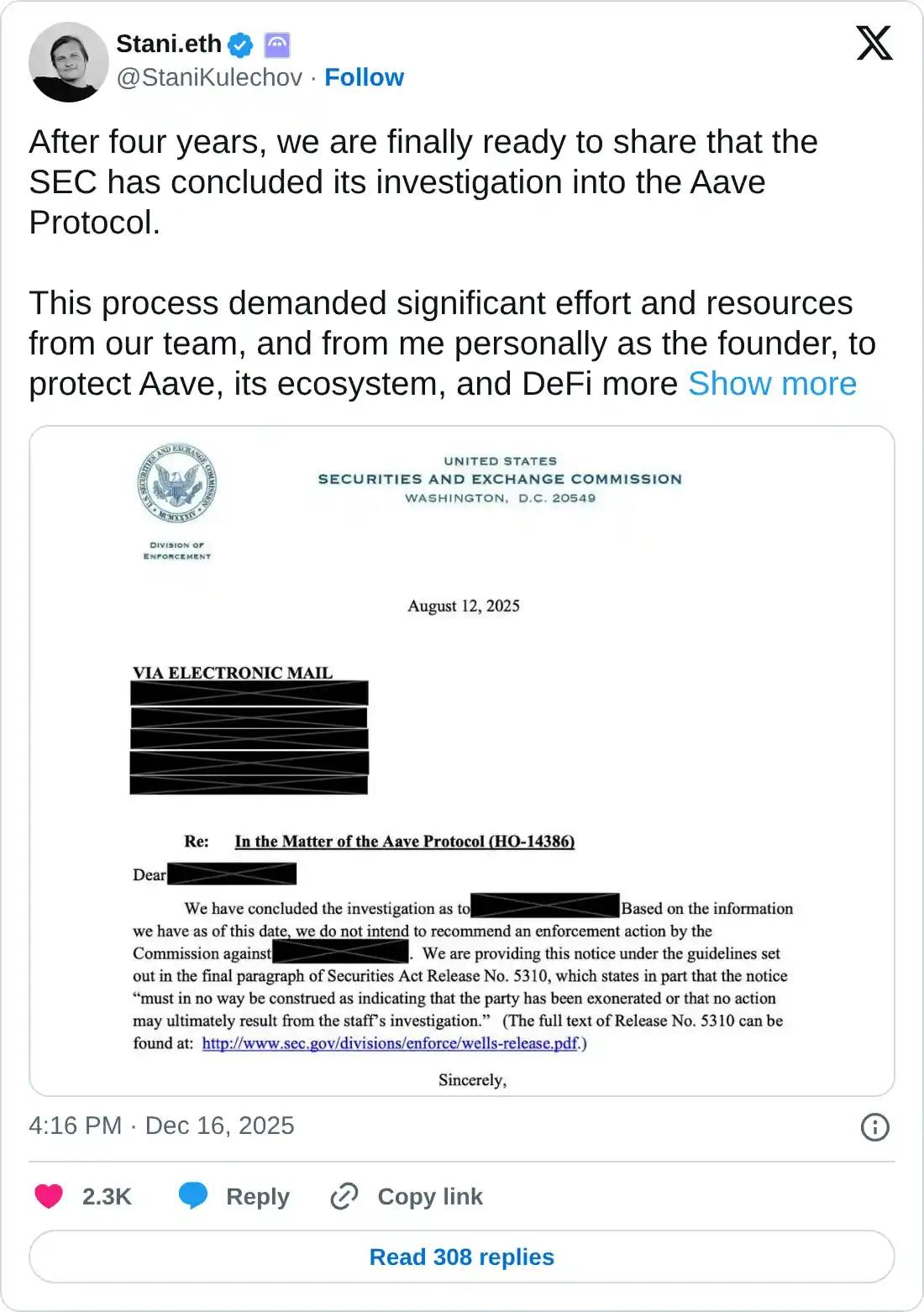

Aave Founder Announces End of Four-Year Investigation

Stani Kulechov, founder and CEO of the Aave protocol, announced on his X account on Tuesday that the U.S. Securities and Exchange Commission had ended its four-year investigation.

Kulechov stated: "In recent years, DeFi has faced unfair regulatory pressure. We are pleased to be free from this predicament and to enter a new era where developers can truly build the future of finance."

This news is a positive development for AAVE in the long run, as the closure eliminates a key regulatory uncertainty, boosts investor confidence, and allows the protocol to focus on growth and promotion without legal constraints. However, in the short term, AAVE's price continues to fall, dropping by 3.48% on the day (UTC+8).

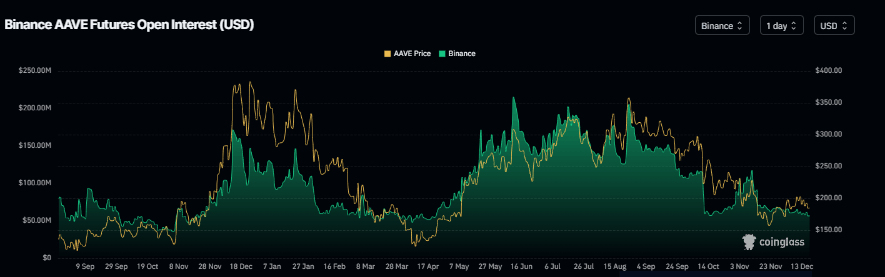

Derivatives Data Shows Bearish Bias.

The short-term downtrend is further supported by the decline in open interest for AAVE on Binance. On Wednesday, AAVE's open interest stood at $56.6 million (UTC+8), close to its yearly low. The decrease in open interest indicates that traders are closing positions and speculative interest is waning, rather than new buying inflows.

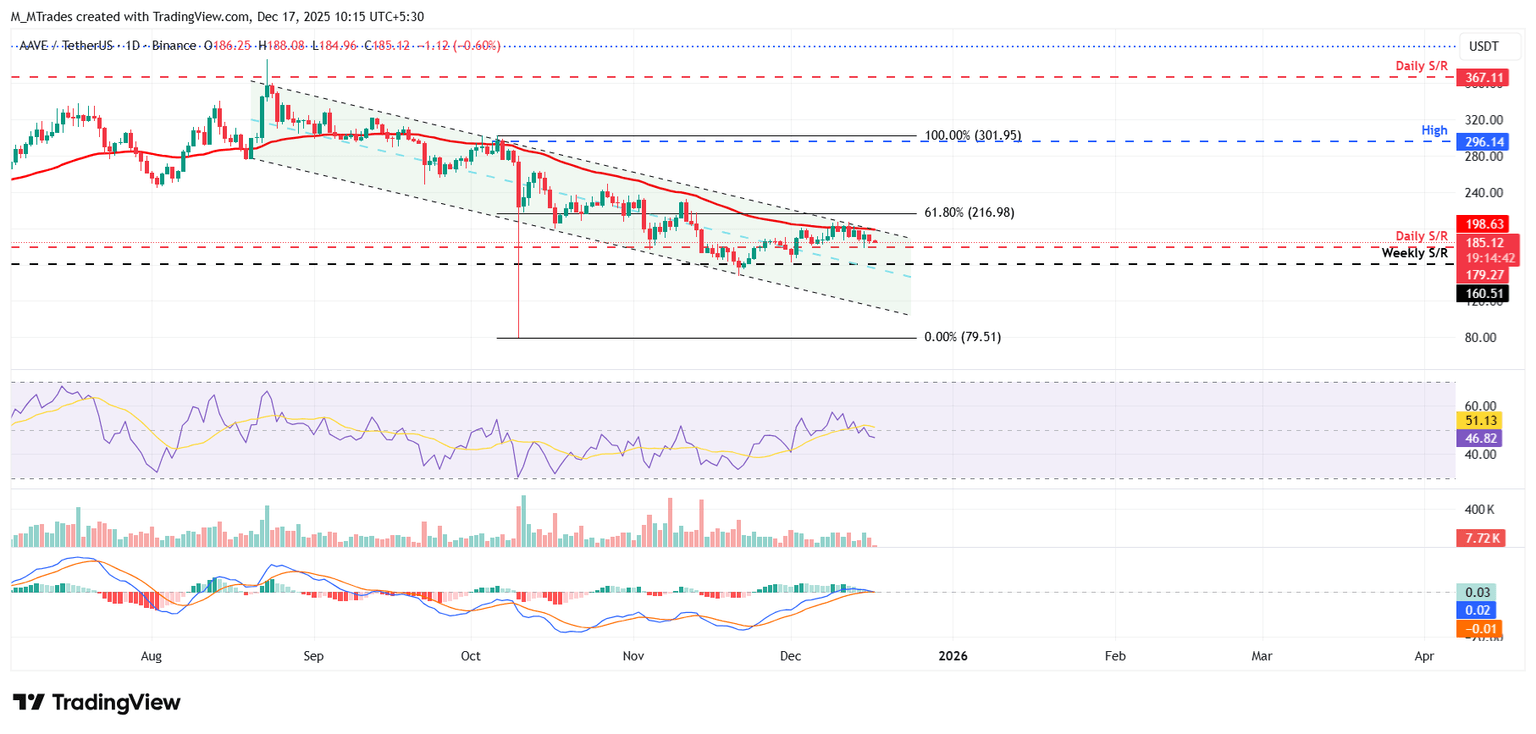

AAVE Price Prediction: Momentum Indicators Show Early Bearish Signals

On December 10, AAVE's price was blocked near the 50-day Exponential Moving Average (EMA) at $198.64 (UTC+8), and as of Tuesday, it had dropped 8% (UTC+8). This price level coincides with the upper boundary of the descending channel, thus forming a key resistance area. As of Wednesday, AAVE was trading at $185.47 (UTC+8).

If AAVE continues to decline, the downtrend may extend to the daily support level at $179.27 (UTC+8). If the closing price falls below this level, the pullback could further test the weekly support at $160.51 (UTC+8).

The Relative Strength Index (RSI) is at 47, below the neutral level, indicating strong early bearish momentum. The Moving Average Convergence Divergence (MACD) lines are converging, and if a bearish crossover occurs, it will further support the bearish outlook.

On the other hand, if AAVE rebounds, it may move toward the 50-day moving average at $198.64 (UTC+8).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin miner Hut 8 secures $7 billion Google-backed AI data center lease

Shiba Inu Price Prediction: CoinGecko Attributes Meme Coin Volatility to Political Tokens as DeepSnitch AI Eyes Major Upswing

DTCC begins limited onchain Treasury test on Canton Network after SEC greenlight