Top 3 Price Predictions: Bitcoin, Ethereum, Ripple — As Bearish Momentum Increases, BTC, ETH, and XRP Corrections Deepen.

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) continue to be under pressure as the broader market continues its pullback this week. The price trends of these three major cryptocurrencies remain weak. Cryptocurrencies by market capitalization indicate that a deeper correction may be on the horizon, as momentum indicators are beginning to turn bearish.

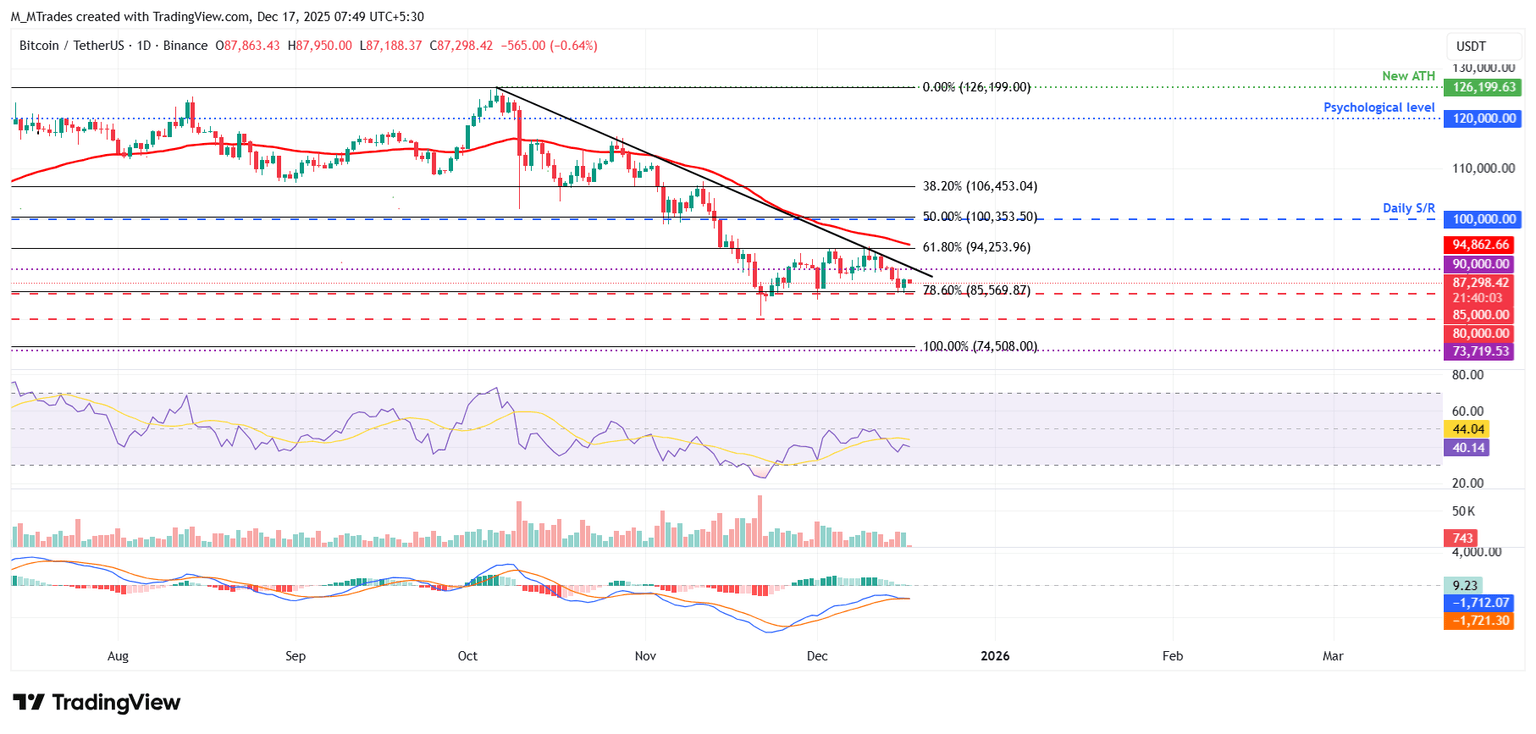

If Bitcoin closes below $85,569, the correction may deepen.

Bitcoin price was rejected at the descending trendline (formed by connecting multiple highs since early October) last Friday, subsequently dropping nearly 7% and retesting the $85,569 support level on Monday. However, after finding support near $85,569 on Tuesday, Bitcoin price rebounded slightly. As of Wednesday press time, Bitcoin price hovered around $87,300 (UTC+8).

If Bitcoin continues to pull back and closes the day below $85,569 (which coincides with the 78.6% Fibonacci retracement level), it could further decline to the psychological threshold of $80,000.

The Relative Strength Index (RSI) on the daily chart is at 40, below the neutral level of 50, indicating that bearish momentum is strengthening. In addition, the Moving Average Convergence Divergence (MACD) lines are converging, and if a bearish crossover occurs, it will further reinforce the bearish outlook.

If Bitcoin rebounds, its gains may continue toward the 61.8% Fibonacci retracement target at $94,253.

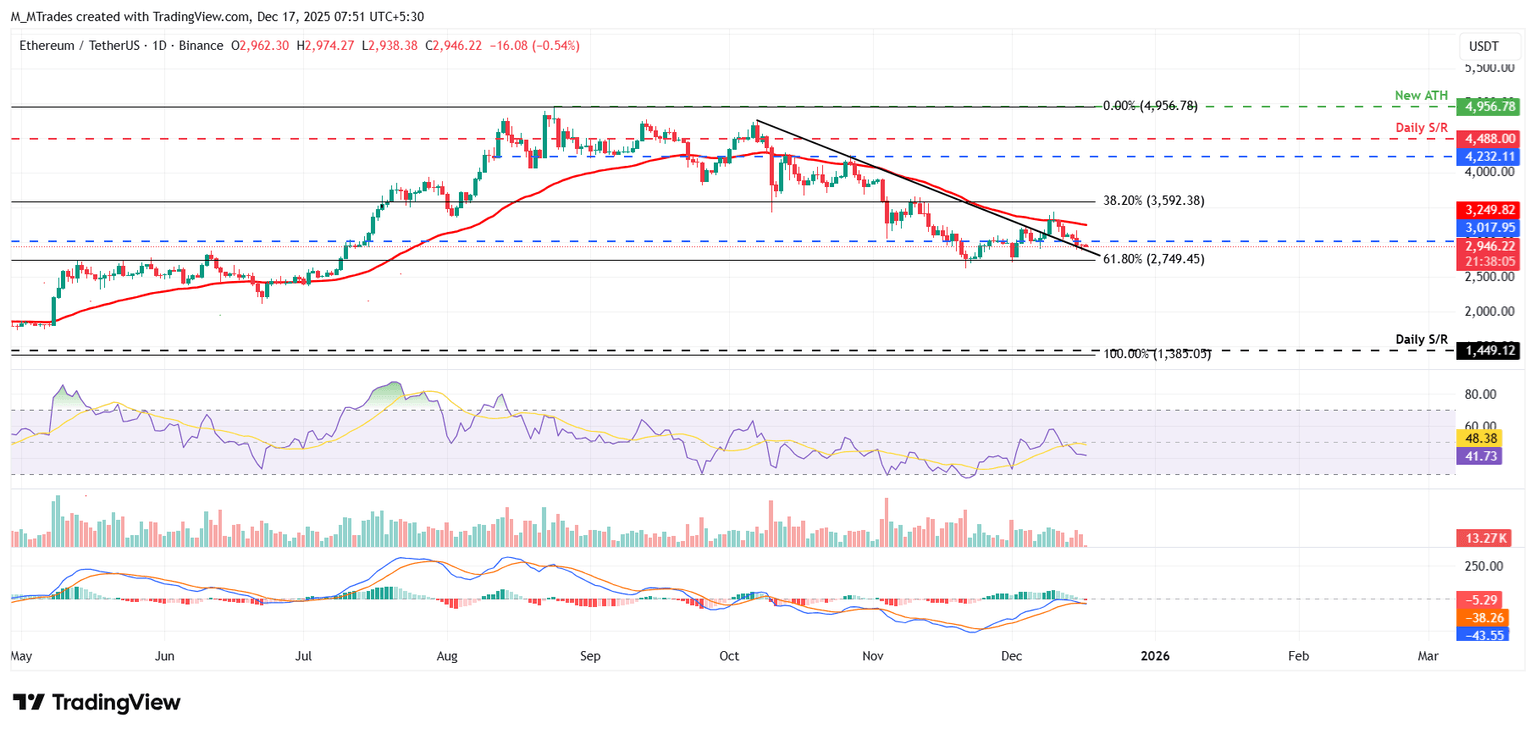

Ethereum momentum indicators show bearish signals.

On December 10, Ethereum price failed to close above the 50-day Exponential Moving Average (EMA) at $3,249, dropping 11% on Tuesday. As of Wednesday, Ethereum price continued to decline, trading below $2,946 (UTC+8).

If Ethereum continues to pull back, the decline may extend to the next support level at $2,749.

The Relative Strength Index (RSI) on the daily chart is at 41, below the neutral level of 50, indicating that bearish momentum is strengthening. In addition, the Moving Average Convergence Divergence (MACD) saw a bearish crossover on Wednesday, further reinforcing the negative outlook.

On the other hand, if Ethereum price recovers, it could further rise toward the 50-day moving average near $3,249.

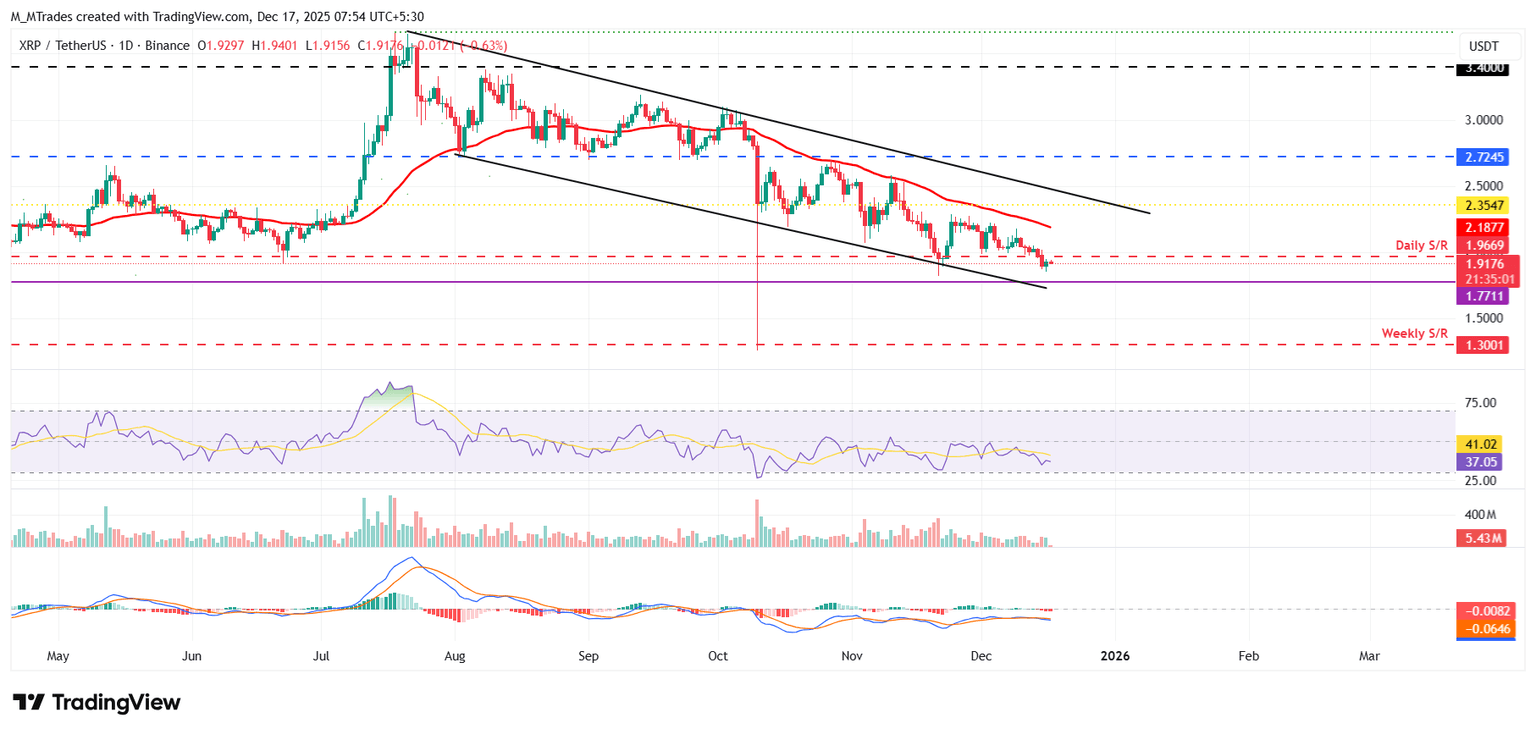

XRP bears are targeting $1.77 as XRP closes below a key support level.

XRP price has declined for the second consecutive week, dropping 3.22%, and retested the key daily support at $1.96 on Sunday. As of this week Monday, XRP continued its pullback, closing below this support level. However, XRP rebounded slightly on Tuesday, and as of Wednesday, the price hovered around $1.91 (UTC+8).

If XRP continues to pull back, it may drop to the next daily support level at $1.77.

The Relative Strength Index (RSI) on the daily chart is at 37, below the neutral level of 50, indicating that bearish momentum is strengthening. In addition, the Moving Average Convergence Divergence (MACD) also saw a bearish crossover on Sunday, and this pattern remains valid, further supporting the bearish outlook.

However, if XRP recovers, it may continue to rise until it reaches the daily resistance at $1.96.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

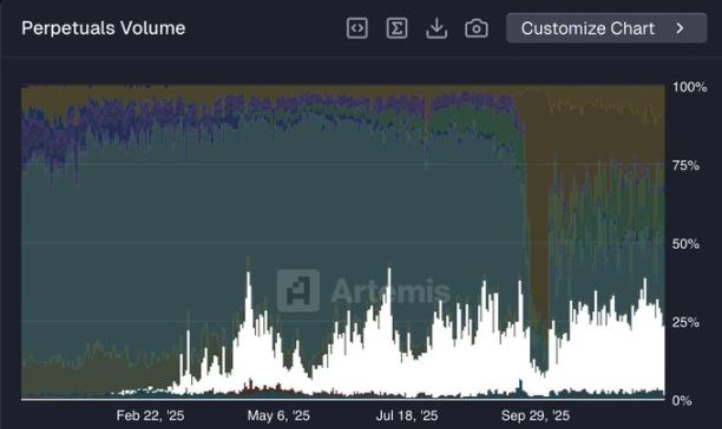

With its market share plummeting by 60%, can Hyperliquid make a comeback?

Russia Rules Out Bitcoin Payments "Under Any Circumstances"