24-hour cryptocurrency market update: Morpho, Monero, and Kaspa lead the gains

Latest Cryptocurrency Market Updates Today: FTC Nomad Hack Incident and US Job Market

Overall Latest Cryptocurrency Market Dynamics: December 17, 2025

Main Highlights:

Total cryptocurrency market cap increased by 1.3%, reaching $3.06 trillion. The Fear and Greed Index remains at extreme fear level (16).

Bitcoin saw a slight rise, while mid-cap tokens and network meme tokens experienced a surge in volatility.

Clarity in regulatory policies, funding rounds, and the development of stablecoins all influenced industry sentiment.

Summary The cryptocurrency recovery remains sluggish, with Bitcoin leading the gains. Despite heightened market panic, the performance of other cryptocurrencies is mixed, mainly influenced by regulatory news and increased attention to stablecoins, DeFi, and institutional Bitcoin initiatives.

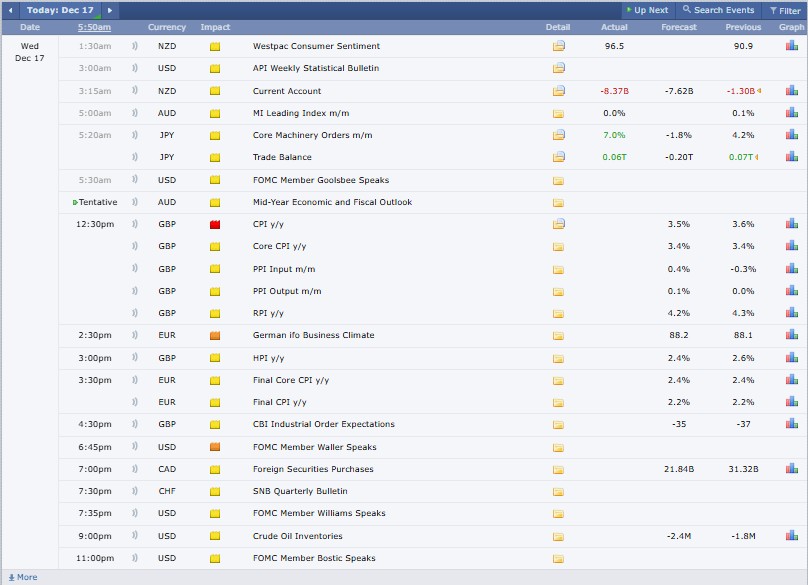

Major Cryptocurrency Events Today

Source: Forex Factory

Latest 24-Hour Cryptocurrency Market Updates: Prices, Trading Volume, and Trends

This global cryptocurrency market today saw the total crypto market cap reach $3.062 trillion, up 1.3% over the past 24 hours. The total trading volume for all cryptocurrencies was $116.34 billion, indicating stable market activity.

Bitcoin (BTC) remains the largest cryptocurrency, accounting for 57.1% of the market share, while Ethereum (ETH) holds 11.6%. Currently, 19,148 cryptocurrencies are being tracked, with Polkadot and XRP Ledger tokens seeing the largest gains in the past day.

Bitcoin (BTC) and Ethereum (ETH) Prices:

Today's Bitcoin (BTC) price is $87,601.89, up 1.42% over the past 24 hours, with a trading volume of $41.98 billion and a market cap of $1.74 trillion.

Source: CMC

Ethereum (ETH) price is $2,950.85, down 0.8% in 24 hours, with a trading volume of $22.3 billion and a market cap of $356 billion.

Source: CMC

Note: Historically, BTC and ETH are considered less volatile, but risks still exist.

Top 5 Hottest Cryptocurrencies in 24 Hours:

Bitcoin (BTC) is trading at $87,443.60, up 1.43%, with a trading volume of $42.2 billion.

Yooldo Esports (YOOLDO) is priced at $0.4063, down 0.76%, with a trading volume of $663.55 million.

SentismAI (SENTIS) is priced at $0.3295, down 11.57%, with a trading volume of $237.86 million.

Theoriq (THQ) is priced at $0.08903, plunging 50.53%, with a trading volume of $47.63 million.

ELLIE (ELLIE) is trading at $0.0007868, up 27.52%, with a trading volume of $1.2295 million.

Top 3 Gainers in 24 Hours

Monero (XMR) rose 4.65% to $428.21, with a trading volume of $168.4 million.

Morpho (MORPHO) rose 3.79%, priced at $1.18, with a market cap of $36.6 million.

Kaspa (KAS) rose 3.50% to $0.04455, with a trading volume of $30 million.

Top 3 Losers in 24 Hours

MemeCore (M) dropped to $1.64, down 7.84%, with TVL at $14.46 million.

Pump.fun (PUMP) fell to $0.002315, down 7.57%, with a market cap of $123.87 million.

AB (AB) dropped to $0.005008, down 5.32%, with TVL at $15.92 million.

Note: Data sourced from CoinMarketCap.com

Latest Stablecoin and DeFi Updates:

Stablecoins fell 0.3% in the past 24 hours, with a market cap of $312.8 billion and a trading volume of $89.2 billion.

The decentralized finance (DeFi) market fell 0.5% in the past 24 hours, with a market cap of $105.8 billion and a total value locked (TVL) of $5.15 billion.

Today's Fear and Greed Index

Source:Another Me

The current cryptocurrency Fear and Greed Index is 16 (Extreme Fear), indicating a very high risk of price drops and low buying volume. Yesterday's index was 11 (increased fear), last week was 26 (fear eased), and last month was 14. This suggests a long-term bearish sentiment, short-term panic selling, and investor caution in the face of uncertainty.

Latest Cryptocurrency Market News Today, December 17

1. US SEC ends investigation into Aave, boosting DeFi transparency.

Aave founder Stani Kulechov confirmed that the US Securities and Exchange Commission has ended a four-year investigation, removing regulatory pressure on DeFi and giving developers a clearer understanding of operating conditions, allowing further progress.

2. Tether leads $8 million Speed funding round.

Tether led Speed1's $8 million funding round. Speed1 is building instant global payment rails using the Bitcoin Lightning Network and stablecoins to enable fast BTC and USDT settlements.

3. RedotPay completes Series B funding, raising $107 million.

Stablecoin payment company RedotPay raised $107 million in an all-equity Series B round led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, Circle Ventures, and HSG.

4. US job market sends mixed signals in November

The US unemployment rate rose to 4.6% in November, the highest since 2021 and above expectations. Nonfarm payrolls increased by 64,000, higher than the previous forecast of 50,000.

5. Hyperscale Data's Bitcoin investment nears market cap

Hyperscale Data reported its Bitcoin vault has reached $75.5 million, close to its entire market cap, holding 498.46 Bitcoins and reserving $31.5 million for future purchases.

6. FTC takes action on Nomad hack

In 2022, the US Federal Trade Commission recommended a settlement with Nomad bridge operator Illusory Systems over a 2022 cryptocurrency scam incident, requiring security reforms, audits, truthful disclosures, and the return of unclaimed recovered funds to affected users.

7. MoonPay and Exodus to launch USD stablecoin.

In January 2026, Exodus partnered with MoonPay to launch the fully reserved USD stablecoin Exodus Pay, enabling digital dollar payments directly within its self-custody wallet without the need for centralized exchanges.

Note: All these updates impact liquidity, market sentiment, and potential returns, so close attention is warranted.

Comparative Perspective

Despite a price rebound, market sentiment is worse than last week, when the panic index reached 26. Bitcoin's dominance remains high, while other cryptocurrencies have experienced sharper corrections, highlighting a flight to safe-haven assets amid ongoing uncertainty.

What This Means for Cryptocurrency Users

Cryptocurrency users are advised to prepare for increased price volatility, as panic will dominate the market even if prices rise. Bitcoin's high dominance calls for defensive strategies, while altcoins carry higher risks. Clear regulations and stablecoin development provide long-term security, but short-term precautions are still necessary.

CoinGabbar's View

The wise approach is to hold fundamentally strong assets for the long term, avoid blind chasing, and closely monitor macroeconomic and regulatory indicators. During periods of extreme market panic, patience often pays off. However, in uncertain environments, risk management and portfolio diversification are crucial.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Collably Network Partners with Flipflop to Revolutionize Fair Token Distribution

Bitcoin Exchange Netflow Signals Big Shift Ahead