Google Gemini Predicts XRP Could Hit $120 if This Happens

2025/12/16 23:33

2025/12/16 23:33Speculation around XRP’s long-term valuation has resurfaced following renewed attention to earlier remarks from Ripple’s leadership about cooperating with, rather than displacing, existing global payment infrastructure.

Central to this discussion are comments made by Ripple co-founder Chris Larsen, who outlined a vision in which Ripple’s technology could complement established systems such as SWIFT. While these statements were made years ago, they continue to shape how some analysts evaluate XRP’s possible role in global finance and its implications for price.

Ripple’s Original Position on Legacy Payment Networks

In a 2015 interview with Global Finance Magazine, Larsen, then Ripple’s chief executive, described the company’s strategic approach to international payments.

He emphasized that Ripple was not designed to dismantle legacy financial rails like SWIFT or ACH. Instead, Ripple aimed to function as an interoperability layer capable of connecting different financial networks while enabling faster settlement.

Larsen contrasted this approach with earlier blockchain models, particularly Bitcoin. While acknowledging Bitcoin’s innovation in enabling peer-to-peer transfers without centralized intermediaries, he argued that its structure posed challenges for institutional use.

According to Larsen, Bitcoin either requires universal adoption as a single currency or forced constant conversion between digital assets and national currencies, exposing users to foreign exchange risk. In his view, these limitations made Bitcoin less practical for large financial institutions operating across multiple currencies.

Ripple’s solution, as Larsen explained, focused on providing a neutral settlement layer that could facilitate real-time value transfer between existing systems. Under this model, Ripple’s technology, and by extension XRP, could operate alongside SWIFT’s messaging framework rather than replacing it.

Revisiting the XRP–SWIFT Discussion

More than a decade later, members of the XRP community have revisited Larsen’s comments as debates around blockchain integration within traditional finance intensify. Market analyst Chart Nerd recently highlighted the potential scale of such cooperation by referencing SWIFT’s operational footprint.

According to publicly available data cited by the analyst, SWIFT supports approximately 40,000 payment corridors and facilitates an estimated $150 trillion in cross-border transaction value annually.

This scale has prompted renewed discussion about what role XRP could play if it were used as a liquidity bridge within or alongside SWIFT-connected payment flows. While there is no indication that such an integration is imminent, the hypothetical scenario has attracted attention due to its potential impact on demand for XRP.

To explore this possibility, some commentators have turned to scenario-based projections. In one such exercise, Google’s Gemini AI model suggested that if XRP were adopted as a key liquidity asset within SWIFT-related settlement processes, its valuation dynamics would change significantly.

Under that assumption, XRP would transition from being primarily speculative to serving a functional role within global financial infrastructure.

Based on this premise, Gemini estimated a theoretical price range between $80 and $120 per XRP. The projection assumed that XRP would capture a meaningful share of the liquidity required to support a substantial portion of the $150 trillion in annual cross-border flows.

It is important to note that this estimate is purely hypothetical and depends on multiple variables, including adoption levels, regulatory clarity, and liquidity distribution.

Current Developments and Practical Constraints

Despite ongoing speculation, recent developments suggest that SWIFT is pursuing its own blockchain-based initiatives without direct involvement from XRP. In late 2024, SWIFT announced plans to conduct live trials for digital asset and currency transactions, emphasizing interoperability across tokenized assets, stablecoins, and central bank digital currencies.

These efforts expanded further in 2025 with the introduction of a shared digital ledger developed in collaboration with major banks and blockchain firms.

As a result, while the concept of XRP operating alongside SWIFT remains a topic of discussion, there is currently no confirmation that such cooperation will materialize. Any price projections tied to this scenario should therefore be viewed as exploratory rather than predictive, reflecting potential outcomes rather than established trajectories.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Pi Network stock price remains under pressure, momentum weakens

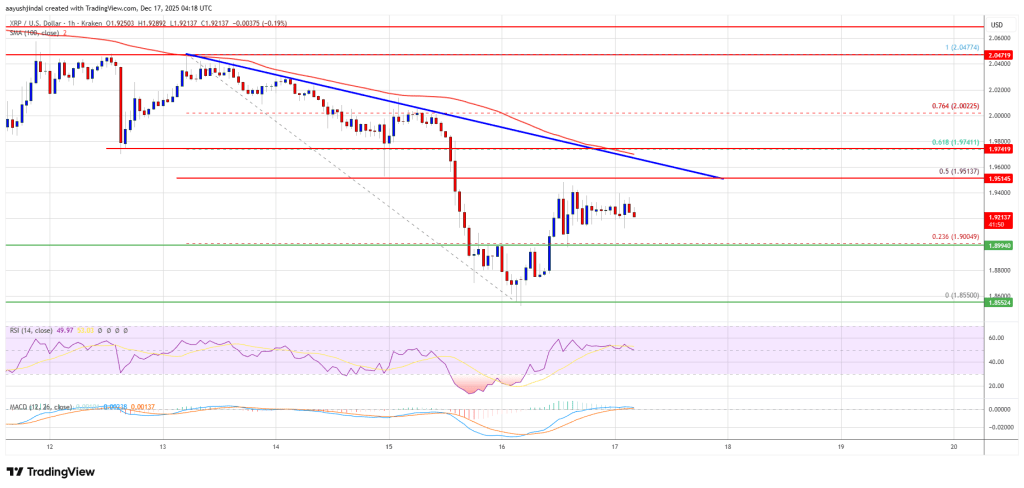

XRP price recovery appears fragile—can bulls break through the price ceiling?

Pantera: 2025 will be a year of structural progress for the crypto market