US Bitcoin Corp rapidly accumulates bitcoin, ranking among the world’s top 20 bitcoin treasury companies—here are its highlights

- American Bitcoin currently holds 5,098 bitcoins, ranking among the top 20 publicly listed bitcoin treasury companies worldwide.

- These reserves have been built through mining, purchases, and structured agreements with Bitmain.

- New metrics such as Satoshis Per Share are designed to increase transparency for stock investors.

American Bitcoin has quietly entered the top 20 list of publicly traded companies holding bitcoin, according to a report by a treasury management firm. As of December 14, 2025, the company holds a reserve of 5,098 bitcoins. At current prices, this bitcoin stash is worth approximately $447 million, placing it among the growing number of publicly traded companies that treat bitcoin as a strategic balance sheet asset. Considering the company has not been listed for long, the growth rate of its bitcoin reserves is particularly noteworthy.

How American Bitcoin Built Its Bitcoin Reserves

According to the company’s latest disclosures, its bitcoin holdings have been acquired through a combination of mining output and targeted market purchases. Some of the bitcoins have also been pledged under agreements with mining giant Bitmain, adding a structured layer to its acquisition strategy. Unlike companies that rely solely on spot purchases, American Bitcoin appears to be combining operational production with strategic partnerships to achieve faster scale expansion than many of its peers.

New Metrics Aim to Increase Investor Transparency

In addition to reserve updates, American Bitcoin has introduced two new metrics specifically designed for shareholders. The first is Satoshis Per Share (SPS), which measures the indirect bitcoin exposure per share of ABTC stock, giving investors a clearer picture of how much bitcoin backs their equity. The second is Bitcoin Yield, which tracks changes in SPS over time, providing insight into whether shareholder exposure is increasing or being diluted. Together, these metrics reflect the broader efforts by bitcoin-focused public companies to enhance transparency.

Leadership Highlight: Execution Speed

Co-founder and Chief Strategy Officer Eric Trump emphasized the speed at which American Bitcoin has expanded its treasury. He noted that since listing on Nasdaq, the company has surpassed dozens of competitors in less than four months. This statement highlights a strategy centered on rapid accumulation and positioning. ABTC is emerging as a strong contender in the bitcoin treasury space, rather than a passive participant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Pi Network stock price remains under pressure, momentum weakens

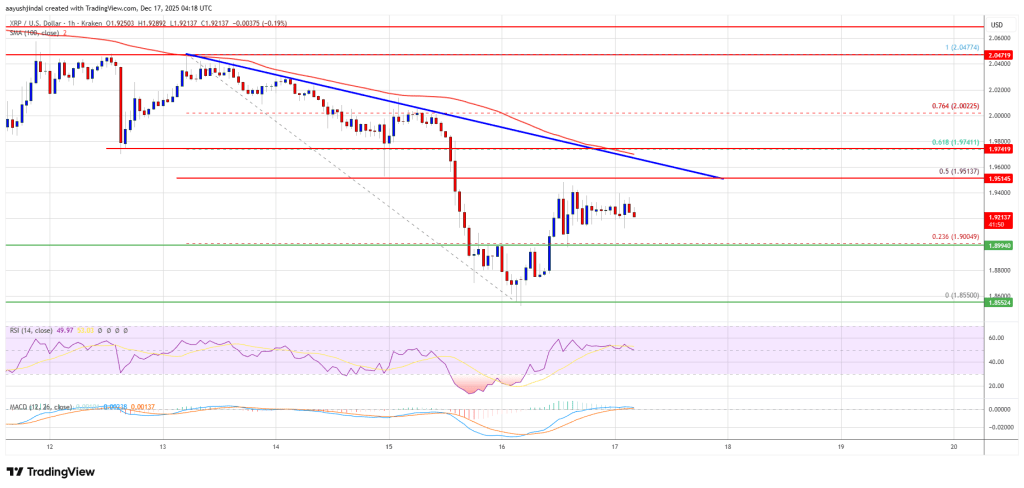

XRP price recovery appears fragile—can bulls break through the price ceiling?

Pantera: 2025 will be a year of structural progress for the crypto market