Key Market Insights for December 11th, how much did you miss out on?

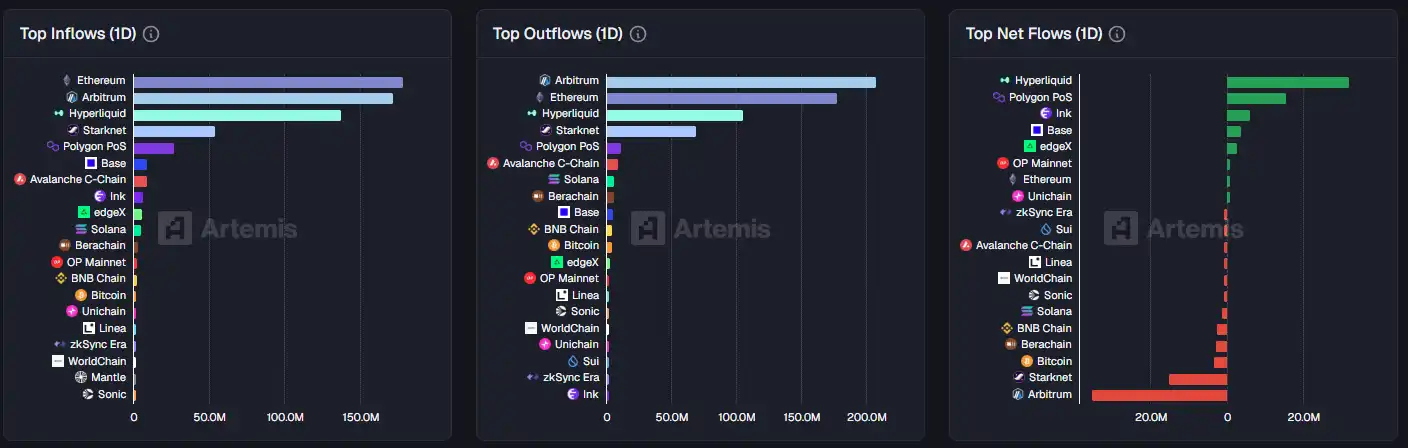

1. On-chain Funds: $32.1M USD flowed into Hyperliquid last week; $35.3M USD flowed out of Arbitrum 2. Highest Price Swings: $TRUTH, $SAD 3. Top News: Despite the market correction, some meme coins continued to surge, with JELLYJELLY defying the trend with a 37% price increase

Top News

1. During the market correction, some meme coins maintained their momentum, with JELLYJELLY surging 37% against the trend

2. Gemini's stock pre-market surged over 18%, after being approved to enter the prediction market

3. Solana's native Perp DEX Phoenix started internal testing today and opened applications for the waiting list

4. Binance has at least 236 user points eligible to claim 2,000 USDT airdrop

5. Coinbase's Bitcoin Premium Index has been in positive premium for 9 consecutive days, currently at 0.0222%

Trending Topics

Source: Overheard on CT, Kaito

Here is the Chinese translation of the original content:

[STANDX]

STANDX garnered attention today due to the launch of a trading points promotion. This activity allows users to earn points through their trading behavior and holding of $DUSD (an interest-generating stablecoin). The promotion also offers additional incentives to users using the Binance Wallet, with a 10% bonus on points available until January 7. The project, developed by a team with backgrounds in Binance Futures and Goldman Sachs, emphasizes a self-custody model and offers automated rewards through its Perp DEX platform. Due to its innovative approach to trading and rewards, as well as the potential for high returns, this activity has sparked widespread interest.

[FERRA]

FERRA is today highly focused on its dynamic liquidity layer on Sui and social DLMM DEX, a platform designed specifically for liquidity providers, yield farmers, builders, and speculators. The protocol's leaderboard is now live, with future plans to allocate 0.25% of the token supply to top creators and the Kaito ecosystem. The discussion revolves around FERRA's innovative DLMM and CLMM models, offering dynamic and centralized liquidity provision capabilities. The project has also secured a significant amount of seed funding and actively engages with the community through the leaderboard and token distribution plan.

[SEI]

SEI is today garnering attention due to its partnership with Xiaomi, the world's third-largest smartphone manufacturer. This collaboration will see SEI's crypto wallet and discovery app pre-installed on Xiaomi's new devices sold outside China and the U.S. starting in 2026. The integration aims to bring stablecoin payments and on-chain transactions to Xiaomi's global user base, marking a significant step towards cryptocurrency mainstream adoption. The partnership is expected to cover over 170 million new devices annually, greatly expanding SEI's presence and impact in the crypto space.

[KINDRED]

Discussions today about KINDRED are centered around its upcoming TGE (Token Generation Event) and its innovative AI companions. These AI companions are designed with emotional intelligence and personalized features. The community is eager about KINDRED's AI's ability to establish meaningful connections with users through licensed IP and original characters. With the TGE on the horizon, many users are discussing their strategies and expectations for the event. Additionally, KINDRED's AI emphasizes unique emotional resonance, setting it apart from generic AI models.

[MET]

Today's main discussions about MET revolve around Meteora's significant updates and strategic initiatives. Meteora announced a token buyback worth $10.6 million in MET, representing 2.3% of its total supply, and introduced Comet Points—a new MET staking reward system. The updates also include product improvements such as an automated treasury, limit orders, and a pool discovery page. These measures are seen as efforts to increase revenue, optimize expenses, and provide value back to token holders, aligning incentives between the company and users.

Featured Articles

1. "Trump Takes Over Federal Reserve, Impact on Bitcoin in the Coming Months"

Tonight will see the most anticipated interest rate cut decision of the year by the Federal Reserve. The market overwhelmingly expects a rate cut almost as a sure thing. However, what will truly determine the future trend of risk assets in the coming months is not another 25 basis point cut, but a more critical variable: whether the Federal Reserve will inject liquidity back into the market. Therefore, this time, Wall Street is not focused on the interest rate, but on the balance sheet.

2. "November Exchange Ranking: Both CEX Trading Volume and Usage Drop Month-on-Month"

In November 2025, the spot trading volume of mainstream CEXs decreased by 27% compared to October. The top three in terms of percentage change were Coinbase -5.42%, Kucoin -16.50%, and Crypto.com -17.72%. The bottom three were OKX -27.18%, Bybit -31.42%, and Gate -43.91%. In November, the contract trading volume of mainstream CEXs decreased by 26% compared to October. The top three in percentage change were HTX -14.21%, Kucoin -14.38%, and OKX -21.15%. The bottom three were Kraken -26.07%, Bybit -28.66%, and Bitget -48.47%.

On-chain Data

Blockchain Fund Flow Last Week on December 11

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interop roadmap "accelerates": After the Fusaka upgrade, Ethereum interoperability may reach a key milestone

a16z "Big Ideas for 2026: Part Two"

Software has eaten the world. Now, it will drive the world forward.

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.