Full text of the Federal Reserve decision: 25 basis point rate cut, $4 billion in Treasury purchases within 30 days

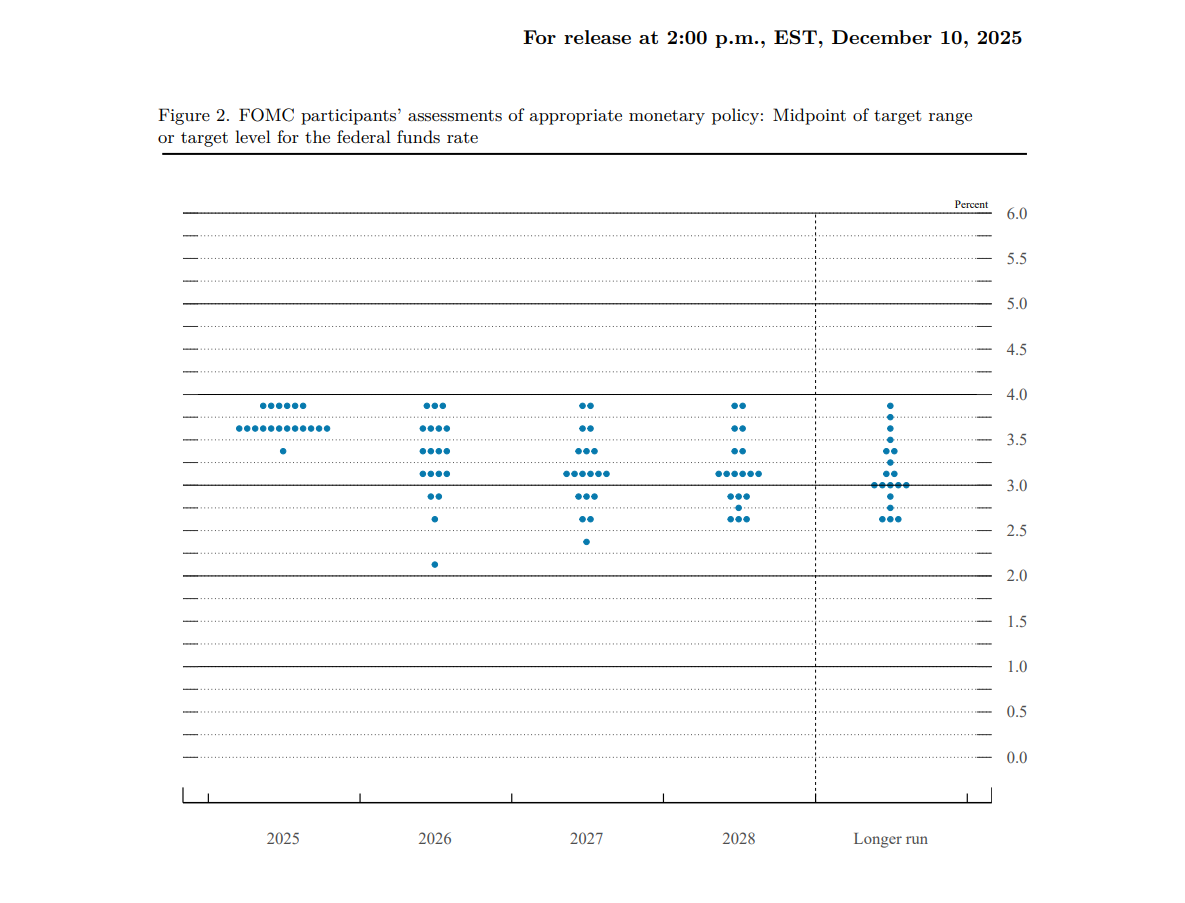

On December 10, 2025, local time, the Federal Reserve lowered the benchmark interest rate by 25 basis points to 3.50%-3.75% with a 9-3 vote, marking the third consecutive meeting with a rate cut. The policy statement removed the description of the unemployment rate as "low." The latest dot plot maintains the forecast of a 25 basis point rate cut in 2026.

In addition, the Federal Reserve will purchase $40 billion in Treasury securities within 30 days starting December 12 to maintain an ample supply of reserves.

Full Text of the Interest Rate Decision

Available data indicate that economic activity is expanding at a moderate pace. Since the beginning of this year, employment growth has slowed, and the unemployment rate has risen as of September. More recent indicators are consistent with this situation. Inflation has increased compared to the beginning of the year and remains at a relatively high level.

The Committee's long-term goals are to achieve maximum employment and 2% inflation. Uncertainty about the economic outlook remains high. The Committee is closely monitoring risks to both sides of its dual mandate and believes that downside risks to employment have increased in recent months.

To support these goals and considering changes in the risk balance, the Committee decided to lower the target range for the federal funds rate by 25 basis points to 3.50% to 3.75%. In assessing the extent and timing of any further adjustments to the target range for the federal funds rate, the Committee will carefully evaluate the latest data, evolving economic outlook, and risk balance. The Committee is firmly committed to supporting maximum employment and returning inflation to the 2% target.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the impact of the latest information on the economic outlook. If risks emerge that could impede the achievement of the Committee's goals, the Committee will be prepared to adjust the stance of monetary policy as appropriate. The Committee's judgment will take into account a wide range of information, including labor market conditions, inflation pressures and inflation expectations, as well as developments in financial and international conditions.

The Committee believes that reserve balances have declined to an ample level and will initiate purchases of short-term U.S. Treasury securities as needed to maintain an ample supply of reserves on an ongoing basis.

Voting in favor of this monetary policy action were: Chair Jerome H. Powell, Vice Chair John C. Williams, Michael S. Barr, Michelle W. Bowman, Susan M. Collins, Lisa D. Cook, Philip N. Jefferson, Alberto G. Musalem, and Christopher J. Waller. Voting against were Stephen I. Miran, who preferred to lower the target range for the federal funds rate by 1/2 percentage point at this meeting; and Austan D. Goolsbee and Jeffrey R. Schmid, who preferred to maintain the target range for the federal funds rate unchanged at this meeting.

Federal Reserve dot plot median: 25 basis points cumulative rate cut in 2026

Decision on Monetary Policy Operations

To implement the monetary policy stance announced in the Federal Open Market Committee's statement on December 10, 2025, the Federal Reserve made the following decisions:

The Federal Reserve Board unanimously voted to lower the interest rate on reserve balances to 3.65%, effective December 11, 2025.

As part of the policy decision, the Federal Open Market Committee voted to direct the Open Market Trading Desk at the Federal Reserve Bank of New York to execute transactions in the System Open Market Account in accordance with the following domestic policy directives until further notice:

"Effective December 11, 2025, the Federal Open Market Committee directs the Desk to:

Conduct open market operations as necessary to maintain the federal funds rate within the target range of 3.50% to 3.75%.

Conduct standing overnight repurchase agreement operations at an offering rate of 3.75%.

Conduct standing overnight reverse repurchase agreement operations at an offering rate of 3.50%, with a daily limit of $160 billion per counterparty.

Increase the System Open Market Account's holdings of securities by purchasing Treasury securities, and, as necessary, other U.S. government securities with remaining maturities of no more than three years, to maintain ample reserve balances.

Reinvest all principal payments from Federal Reserve holdings of U.S. Treasury securities at auction. Reinvest all principal payments from Federal Reserve holdings of agency securities into Treasury securities."

In related actions, the Federal Reserve Board unanimously voted to lower the primary credit rate by 25 basis points to 3.75%, effective December 11, 2025. In taking this action, the Board approved requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Philadelphia, St. Louis, and San Francisco to establish this rate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan Chase issues Galaxy short-term bonds on Solana network

The three giants collectively bet on Abu Dhabi, making it the "crypto capital"

As stablecoin giants and the world's largest exchange simultaneously secure ADGM licenses, Abu Dhabi is rapidly emerging from a Middle Eastern financial hub into a new global center for institutional-grade crypto settlement and regulation.

Bitcoin liquidity has been reshaped. Which new market indicators should we focus on?

Currently, the largest holders of bitcoin have shifted from whales to publicly listed companies and compliant funds. The selling pressure has changed from retail investors' reactions to the market to capital impact from institutions.

Strategy Confronts MSCI Head-On: The Ultimate Defense of DAT

Not an investment fund! Why is holding oil allowed but not crypto? How does Strategy criticize MSCI's proposal?