Key Notes

- Pump.fun has repurchased more than $205 million worth of PUMP.

- PUMP buybacks are now the highest cumulative buybacks on Solana.

- PUMP is now trading near $0.00277, with a bullish target close to $0.005.

Pump.fun’s PUMP token has completed more than $205 million in cumulative buybacks, the highest among all Solana protocols. Pump.fun is now placed ahead of Raydium, which was the leader for years due to its deep liquidity pools.

The buyback engine has removed a massive 13.8% of the circulating supply in only five months, a clear indication of growing demand.

🚨BREAKING: @Pumpfun ’s $PUMP buybacks have exceeded $205M in total value, surpassing @Raydium and now ranking as the highest cumulative buybacks among all @Solana protocols. The program has already repurchased 13.8% of the circulating supply in just five months since launch. pic.twitter.com/MEqetWzGG8

— SolanaFloor (@SolanaFloor) December 11, 2025

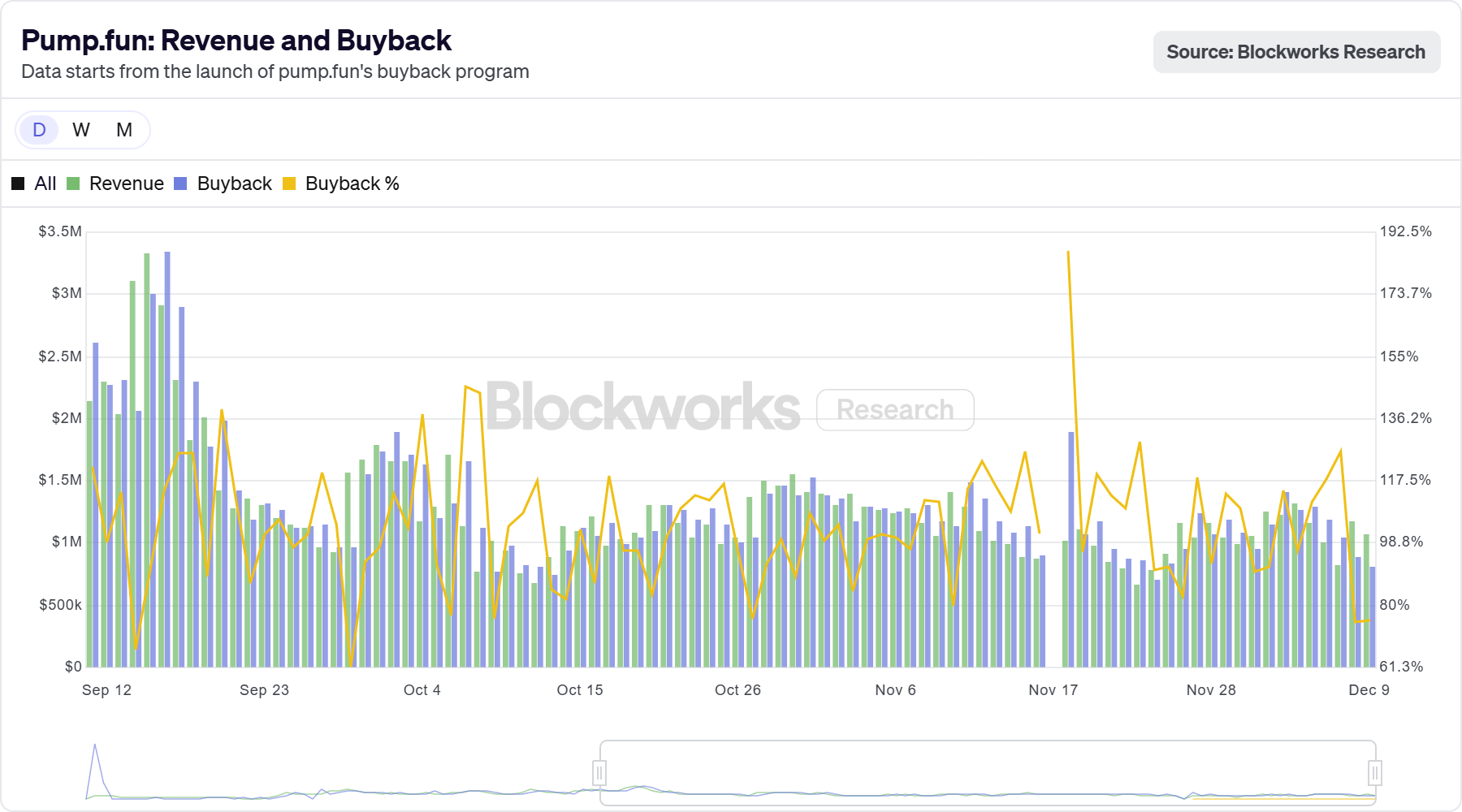

Pump.fun uses daily revenue to purchase PUMP directly from the open market. On-chain dashboards show how consistent these buybacks have been. On Dec. 10, the protocol repurchased 401.5 million tokens worth about $1.2 million using 8,750 SOL.

PUMP revenue and buyback | Source: Blockworks

The day before, it acquired 404.6 million tokens for a similar value. Even quieter days stayed active , including 287.6 million tokens purchased on Dec. 8.

Pump.fun’s Wider Impact on Solana

Pump.fun has become one of the most dominant forces on Solana. By mid-2025, it powered more than 80% of all token launches on the chain. The meme coin generator allows anyone to create a token in seconds for under two cents of SOL.

The platform also raised around $500 million in its July PUMP token sale, which reached a $4 billion fully diluted valuation in under 12 minutes. However, out of all the countless token launches, the majority collapsed soon after launch due to scams, bots, or lack of liquidity.

Price Analysis: PUMP Breaks Out of Its Downtrend

The PUMP chart below shows a long descending wedge formation with the token trading around $0.00277. A support zone has formed between the 0.382 and 0.5 Fibonacci levels. This support has held multiple times in recent trading sessions.

A bullish breakout from the wedge could push the price toward the major resistance zone at $0.005, an 89% increase from the current price.

PUMP price inside descending wedge | Source: TradingView

However, a bearish scenario remains possible if PUMP loses the wedge support. The next lower Fibonacci levels sit near $0.0015 and $0.0010. These areas would likely act as the next safety zones if PUMP dips.

next