Trump Launches Fed Auditions: Who Will Replace Powell?

This week, Donald Trump begins interviews with finalists for the position of Fed president. A decision that could disrupt markets, including crypto. Between political tensions and economic stakes, bitcoin finds itself at the center of the storm. Who will be the winners and the losers?

In brief

- Donald Trump begins this week the interviews with finalists to replace Jerome Powell at the Fed.

- Tensions between Trump and Powell suggest a future Fed president might be either compliant or openly in conflict, with risks of increased politicization of the institution.

- The decision of the next Fed president will directly impact bitcoin and could trigger extreme volatility in the crypto market.

Donald Trump launches the auditions with finalists for the Fed

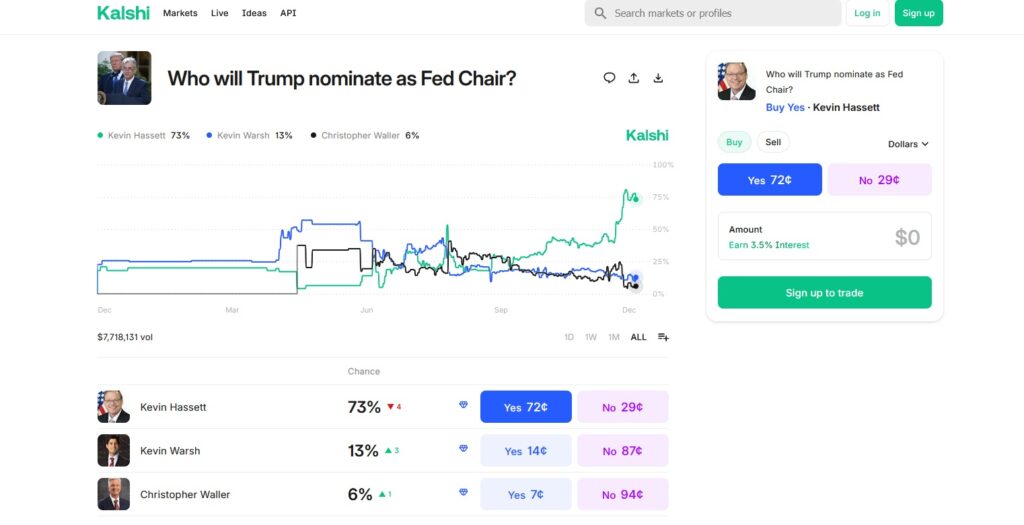

Donald Trump is set to meet the finalists for the presidency of the Fed this week. After months of speculation, names are circulating, and markets are already betting on their favorites. Kevin Hassett, director of the National Economic Council, leads with a 73% chance according to prediction platforms. Close to Trump, he embodies an accommodative monetary policy aligned with the president’s wishes: low interest rates to stimulate the economy.

Kevin Warsh, former Fed governor, follows with 13% chances. His profile, halfway between independence and political alignment, could appeal to those fearing a Fed too submissive to the executive. Christopher Waller, current governor, is only given 6%, but his experience could play in his favor. Finally, Michelle Bowman and Rick Rieder, though less cited, remain in the race. Their nomination would surprise markets, but Trump likes theatrics.

Predictions for the next Fed president.

Predictions for the next Fed president.

The stake is clear: Donald Trump wants a successor to Jerome Powell able to cut rates quickly. A decision that will have repercussions far beyond Wall Street, especially on cryptos, which are sensitive to changes in monetary policy.

Fed: Does Trump want a puppet or an adversary?

Jerome Powell has often been the target of sharp criticisms from Donald Trump. Insults flew, illustrating a more than tense relationship. Powell, accused of hindering growth by maintaining rates too high, embodies for Trump everything a Fed president should not be: independent, sometimes disagreeing with the White House. This is why Trump would not want to renew his term, besides the fact he was appointed by former US president Joe Biden.

The question is: will Trump seek a compliant ally to replace Powell, or a more independent profile, risking repeating the same conflicts? Kevin Hassett, market favorite, seems to fit the first scenario. His alignment with Trump’s positions could ease tensions but at the cost of a Fed seen as politicized. Conversely, a candidate like Kevin Warsh, although less likely, could embody some continuity with Powell, with the associated risks of friction.

Who will pay the bill in the Trump vs Fed war?

The appointment of the next Fed president by Donald Trump concerns not only traditional markets. The crypto ecosystem, especially bitcoin, will be directly impacted. Fed announcements and Trump’s reactions have always had an immediate effect on cryptocurrencies. An appointment perceived as too political could trigger increased volatility with sharp and unpredictable price moves.

If the Fed opts for a rate cut this December as Trump wishes, BTC could benefit. A weakened dollar and increased appetite for non-traditional assets could push investors toward crypto. Conversely, a divided or independent Fed could exert downward pressure on markets. Investors, fearing instability, might therefore turn to safer assets.

The appointment of the next Fed president by Donald Trump is a major event, with consequences far beyond monetary policy. For crypto, and especially bitcoin, it is a time of risks and opportunities. Between a compliant Hassett and an independent Warsh, scenarios are multiple for Jerome Powell’s successor. And you, do you think Trump will choose a compliant ally or a more independent profile?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.