Nomura: Fed forecasts suggest future inflation may ease, increasing the likelihood of rate cuts

According to ChainCatcher, citing Golden Ten Data, Nomura Asset Management's Chief Investment Officer Matthew Parry stated in a memo that the latest data points to a slowdown in inflation and a weakening labor market, making another rate cut possible. He noted that new economic forecasts should reflect a moderation in inflation over the coming quarters, opening the door to further rate cuts. Parry also mentioned that the current Federal Reserve committee is more divided than ever on the path of monetary policy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

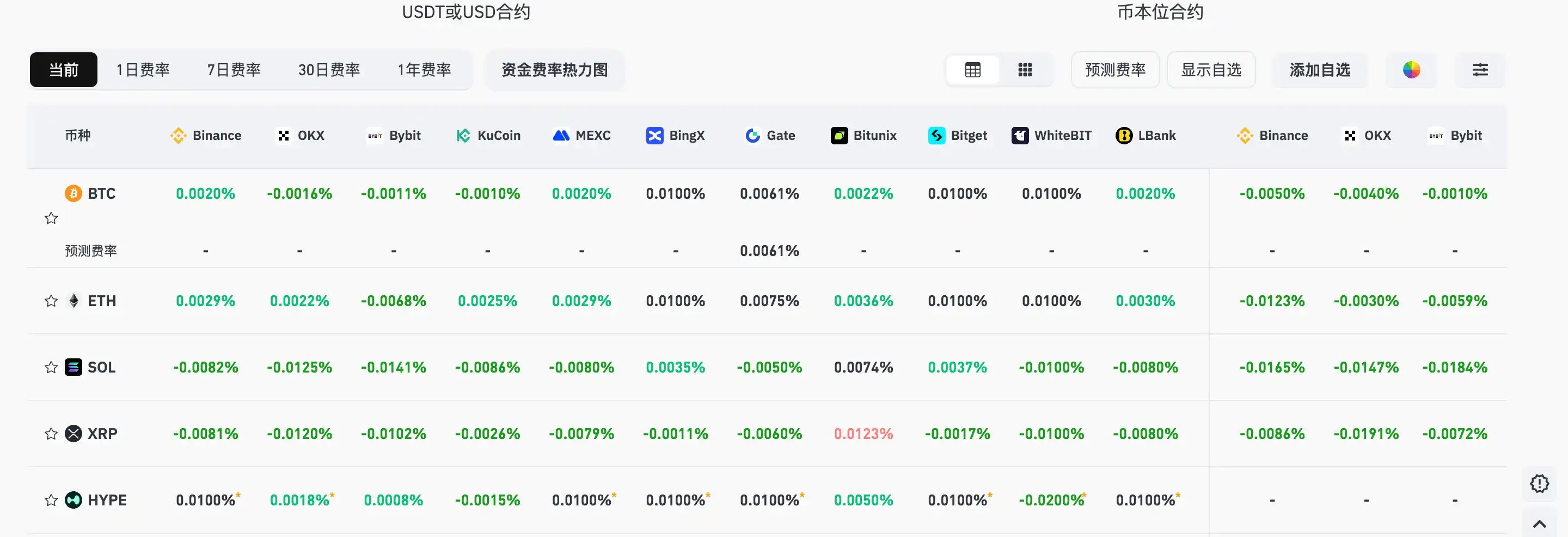

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.