Fed Decision Preview: Balance Sheet Expansion Signals More Important Than Rate Cuts

Jinse Finance reported, citing foreign media analysis, that the Federal Reserve officially ended its balance sheet reduction on December 1. As a result, bank reserves have fallen to levels historically associated with funding stress, and the Secured Overnight Financing Rate (SOFR) has periodically tested the upper bound of the policy rate corridor. These developments indicate that the US banking system is gradually entering a state of liquidity stress. In this context, the most important signal from the FOMC may not be a 25 basis point rate cut, but rather the direction of its balance sheet strategy. The Federal Reserve is expected to clarify, either explicitly or through its implementation note, how it intends to transition to a Reserve Management Purchase (RMP) program. According to Evercore ISI, this program could begin as early as January 2026, with approximately $3.5 billion invested monthly in Treasury purchases, resulting in annual balance sheet growth of over $400 billions. (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

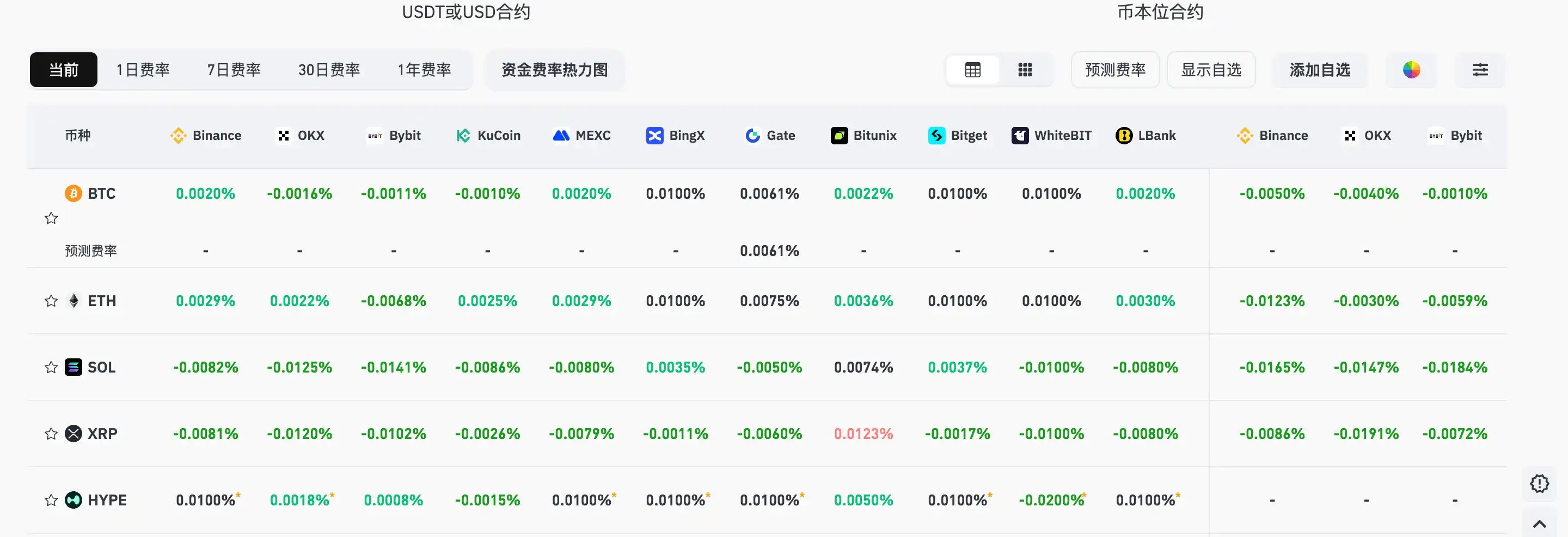

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.