S&P downgrades USDT to lowest rating, leading stablecoin stirs controversy

S&P downgraded USDT to the lowest rating, citing high-risk reserves and insufficient disclosure, while more transparent centralized stablecoins like USDC received higher ratings.

Original Title: "S&P Gives Tether the Lowest Rating—Which Other Stablecoins Does It Approve Of?"

Original Author: Azuma, Odaily

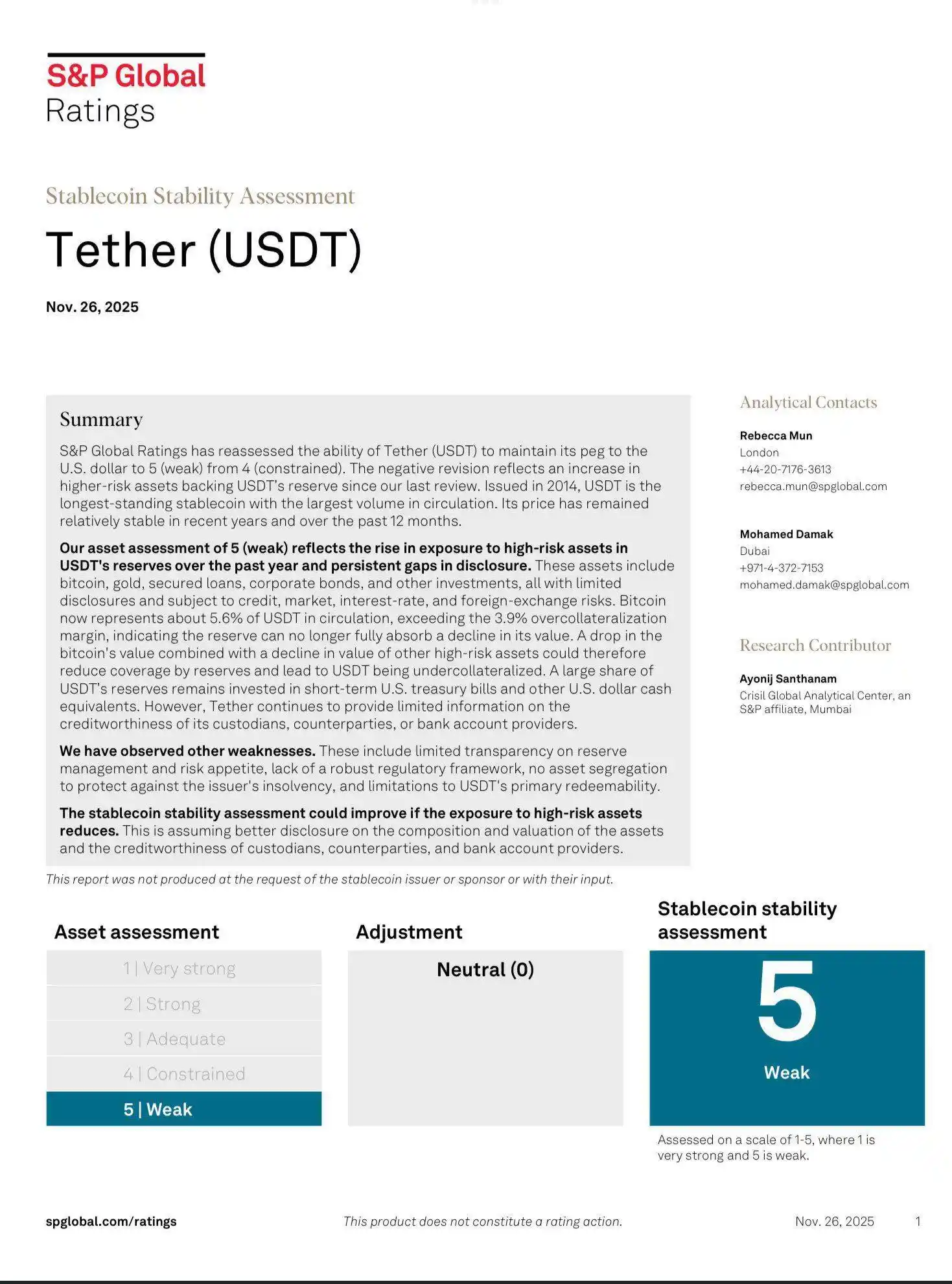

On November 26, Eastern Time, top rating agency S&P Global announced that it had downgraded the rating of stablecoin giant Tether (USDT) from "4" (Restricted) to "5" (Vulnerable), which is the lowest level in its rating system.

This marks the second time, following Strategy, that S&P has issued a jaw-droppingly negative rating for an industry leader.

S&P's Rating Criteria

S&P, along with Moody's and Fitch, is known as one of the world's three major rating agencies and is recognized as one of the most authoritative credit rating institutions in the international financial market. According to S&P's official introduction, its stability assessment system for stablecoins aims to provide market participants with transparency regarding the stability of various stablecoins, with a particular focus on analyzing their depegging risks.

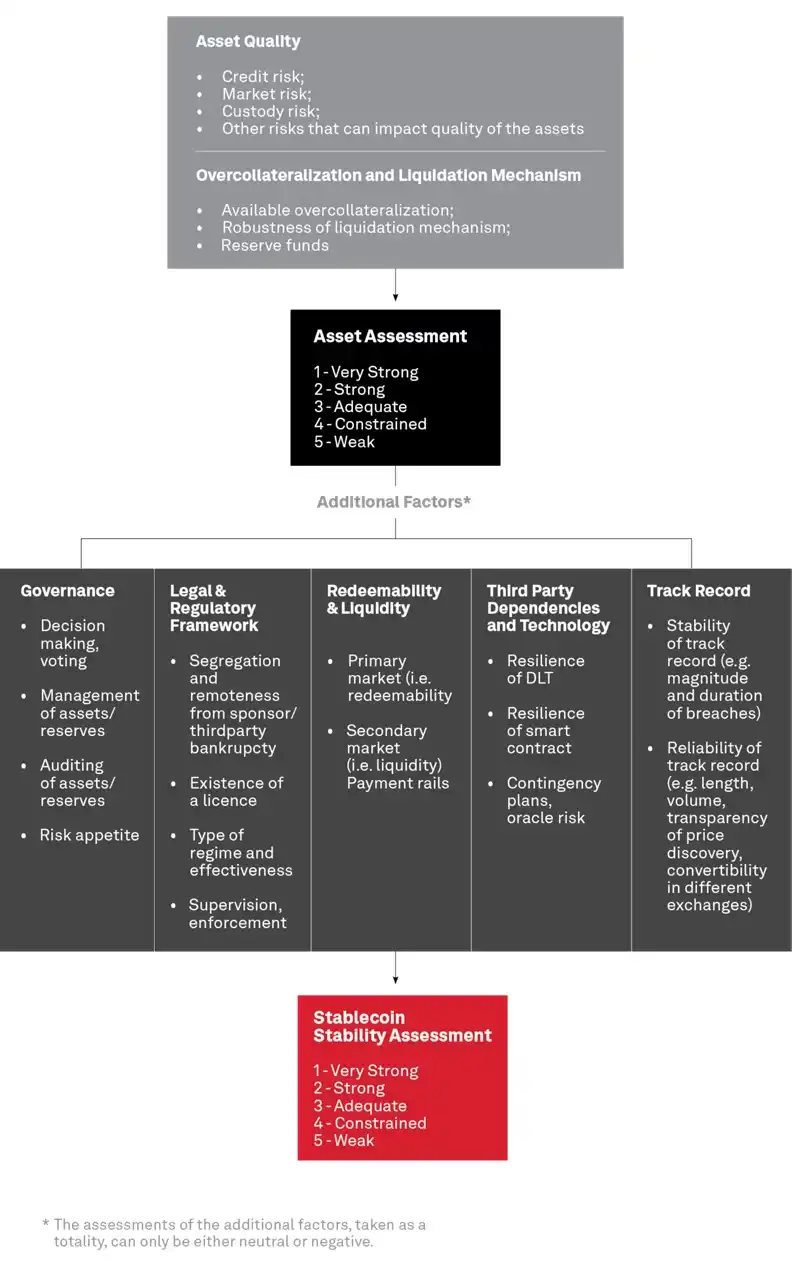

Specifically, S&P's analysis method consists of the following steps:

· First, a risk assessment of asset quality is conducted, including credit risk, market value, and custody risk;

· Next, the agency further analyzes the extent to which the over-collateralization requirements and liquidation mechanisms of major stablecoins can mitigate these risks (see the light gray box in the figure below);

· After considering these factors, S&P assigns each stablecoin an asset quality score from 1 to 5 (Very Strong, Strong, Adequate, Restricted, Vulnerable) (see the black box in the figure below);

· After completing the asset quality assessment, S&P also considers five additional dimensions: governance mechanisms, legal and regulatory frameworks, redemption ability and liquidity, technology and third-party dependencies, and track record (see the dark gray box in the figure below);

· The strengths and weaknesses of these five dimensions together form an overall risk assessment view, which in turn affects the final score of each stablecoin (see the red box in the figure below).

Reasons for Tether (USDT)'s Rating

In the announcement regarding the downgrade of Tether (USDT), S&P stated that the downgrade reflects the increase in high-risk assets in USDT's reserves since the last assessment, as well as ongoing issues with Tether's information disclosure.

S&P elaborated that these so-called high-risk assets include bitcoin, gold, secured loans, corporate bonds, and other investments, all of which have limited disclosure and are subject to credit, market, interest rate, and foreign exchange risks. Currently, Tether's bitcoin reserves account for about 5.6% of USDT's total circulation, exceeding USDT's own over-collateralization rate of 3.9%. This means that other low-risk reserve assets can no longer fully support the value of USDT. If the value of BTC and other high-risk assets declines, it could weaken the coverage of USDT's reserves, leading to insufficient collateralization of USDT. As for other low-risk reserve assets, a large portion is invested in short-term U.S. Treasury bonds and other U.S. dollar cash equivalents. However, Tether has consistently had disclosure issues regarding custodians, counterparties, or bank account providers.

S&P further stated that, in addition to the main reasons above, it believes Tether (USDT) also faces other issues such as limited transparency in reserve management and risk appetite, lack of a sound regulatory framework, absence of asset segregation to protect against issuer bankruptcy, and restrictions on USDT's redeemability.

At the end of the rating, S&P also added the possibility of a rating adjustment for Tether (USDT)—if USDT's exposure to high-risk asset reserves decreases and Tether can improve its information disclosure, its stability assessment may improve.

Ratings of Other Stablecoins

In addition to Tether, S&P has also rated several mainstream stablecoins such as USDC and USDe. The specific results are as follows:

· Circle (USDC): 2 (Strong);

· Circle (EURC): 2 (Strong);

· First Digital USD (FDUSD): 4 (Restricted);

· TrueUSD (TUSD): 5 (Vulnerable);

· Gemini USD (GUSD): 2 (Strong);

· Paxos USD (USDP): 2 (Strong);

· EUR Coinvertible (EURCv): 3 (Adequate);

· Mountain Protocol USD (USDM): 3 (Adequate);

· Ethena (USDe): 5 (Vulnerable);

· Sky Protocol (USDS/DAI): 4 (Restricted);

· Frax (FRAX): 5 (Vulnerable);

As can be seen from the chart above, S&P clearly favors centralized stablecoins with over-collateralization models and high transparency (such as USDC), while it holds a relatively pessimistic view of mainstream decentralized stablecoins (such as USDe and USDS)—which is understandable. As seen from the rating logic in the previous sections, S&P classifies BTC and other crypto assets as high-risk categories, which are often the main collateral for decentralized stablecoins.

Tether's Response

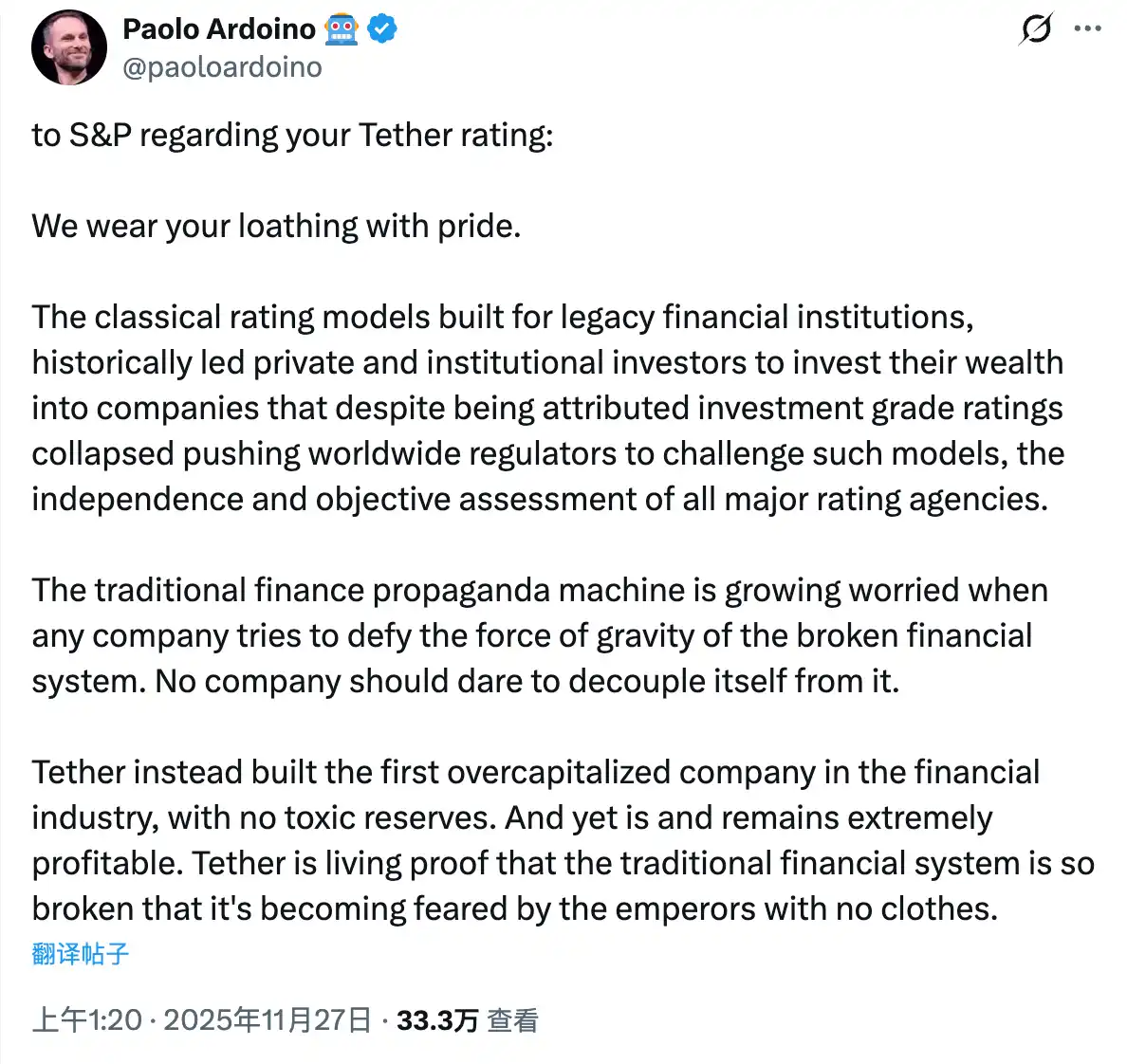

After S&P released its rating adjustment for Tether (USDT), Tether CEO Paolo Ardoino responded forcefully on X, stating: "We wear your hate as a badge of honor."

Paolo Ardoino further stated that the classical rating models used by traditional financial institutions have led countless private and institutional investors to invest their wealth in companies that, despite having investment-grade ratings, ultimately collapsed. This has prompted global regulators to question the independence and objectivity of these models and all mainstream rating agencies. When companies attempt to break free from the gravitational pull of a flawed financial system, the propaganda machine of traditional finance becomes increasingly anxious. No company dares to break away from this system. Against this backdrop, Tether has built the first capital-surplus company in the financial industry, with no toxic asset reserves, and remains highly profitable. Tether's facts prove that the traditional financial system is riddled with holes, to the point that even the "emperor with no clothes" is afraid.

Will This Affect USDT?

Looking back at S&P's rating statement for Tether (USDT), aside from changes in the proportion of BTC reserves, S&P repeatedly mentioned Tether's information disclosure issues.

Due to its offshore nature and some historical operational factors, Tether has always faced certain criticisms regarding transparency. Compared to its biggest competitor USDC, USDT's lack of disclosure in reserves and audits is an objective fact. However, thanks to its unmatched liquidity (especially since almost all CEXs use USDT as the base settlement currency), combined with an excellent track record and strong financial condition, the market still highly trusts and even relies on USDT—supported by a powerful network effect, USDT remains the king of the stablecoin track.

As overseas KOL Novacula Occami commented: "...insufficient information disclosure has been a long-standing issue for Tether, but they are neither able nor willing to solve it."

Clearly, S&P's attitude alone is not enough to shake USDT's market position. However, it is worth noting that Tether has previously announced that it will launch the USAT stablecoin for the U.S. market in December. The GENIUS Act has already imposed strict requirements on reserves, regulatory registration, disclosure mechanisms, and redemption terms, all of which are highly consistent with S&P's rating standards. If Tether wants to successfully promote USAT in the U.S. in the future, it may still need to pay some attention to S&P's rating.

Today, after Paolo Ardoino's strong response to S&P, Tether's USAT business head Bo Hines also lashed out, saying "institutional dysfunction breeds systemic jealousy." However, while venting is one thing, Paolo Ardoino may not need to care about S&P, but Bo Hines really needs to think about how to address the issues raised by S&P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A New Paradigm for AI Data Economy: Exploring DIN's Ambitions and Node Sales through Modular Data Preprocessing

AI is undoubtedly one of the hottest sectors globally today. From Silicon Valley's OpenAI to domestic players like Moonshot and Zhipu Qingyan, both emerging entrepreneurs and traditional tech giants are joining this AI revolution.

Solana analysis: SOL price unlikely to break $150 for now

Bitcoin has a 75% chance of short-term rally, says trader Alessio Rastani

Bitcoin trades above $90K: Here’s what bulls must do to extend the rally