Bitcoin Rises to $91,000 While XRP ETFs Break Records

As the year draws to a close, a question lingers: could it finally be the hour of glory for ETFs? While corrections cast a shadow over November, the mood seems to be shifting. Between a bitcoin regaining ground and XRP ETFs attracting institutional investors, the crypto sphere is buzzing, but cautiously. The signals are multiple, sometimes contradictory, often intriguing. Markets are searching; investors are watching. And some products, they, explode. Decrypting an intense week between comeback, fund movements, and appetite for regulation.

In brief

- Bitcoin returns to $91,000 after a drop, benefiting from a more favorable monetary climate.

- XRP ETFs accumulate $676 million, signaling strong and growing institutional demand.

- Crypto whales adjust their positions, sending thousands of BTC to exchanges.

- Options and ETFs indicate a gradual return of risk appetite in the markets.

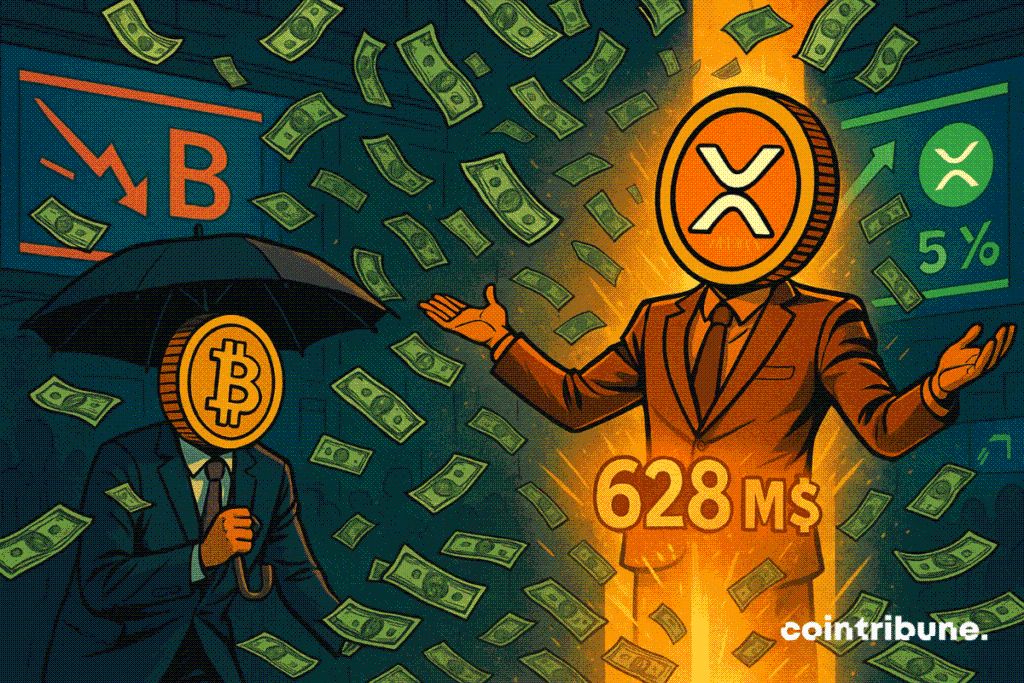

XRP, the new cash cow of crypto ETFs?

It is clear that ETFs have boosted the price of XRP . Right now, the numbers speak for themselves: $676.49 million assets under management for XRP ETFs as of November 26, with $21.81 million net inflows on that day alone. The market seems to validate a trend: institutions want their share of Ripple. Bitwise leads the dance with $7.46M inflows, followed by Canary Capital ($5.21M) and Franklin Templeton ($4.83M).

Even in a post-liquidation climate, the apparent calm of the XRP price (around $2.23) hides a structural dynamic. Funds multiply, volumes follow: $38.12M traded in one day. A clear sign according to SoSoValue analysts: demand is not weakening; it is settling. In less than a week, XRP ETFs attracted $230M . At this pace, the billion-dollar mark seems within reach.

In a comment relayed by specialized media, an analyst sums up the mood: massive inflows are not a simple windfall effect. They reflect a clear institutional strategy: to ignore volatility swings and bet on structured, regulated products calibrated to last. In other words, the game is no longer speed but depth.

Bitcoin, a rebound between relief and staging

After a drop to $82,000 , bitcoin bounced back to flirt with $91,000 . A breath or a real turnaround? According to Vincent Liu , CIO at Kronos Research, it’s a classic:

Bitcoin bouncing above $90K reflects a classic oversold snapback; after a brutal drawdown, buyers are stepping in. The broader risk-on mood, fueled by an 80% chance of a Fed cut in December, is giving markets the push they needed to stabilize and reclaim momentum.

Behind the scenes, the signals are mixed. On one side, the probabilities of a Fed rate cut approach 85%, supporting risk appetite. On the other, caution remains palpable. The market seems driven more by renewed optimism than by solid organic dynamics. Jeffrey Ding of HashKey speaks of a “natural recovery,” without a catalyst. Volumes remain low, as often during holiday periods in the United States.

BTC remains in volatile territory. But its return above the psychological threshold of $90,000 revives bullish scenarios. Other cryptos follow: ETH +3.1%, BNB +4%, SOL +3.3%, while ADA continues to take a hit with −7% over the week.

Whales, options, and XRP: the flip side of flows

Behind the rises, the mechanism remains complex. Whales moved : 700,000 BTC transferred by long-term holders, 9,000 BTC to exchanges in one day, and a sharp increase in average deposit size on Binance – from 12 BTC to 37 BTC. These figures are not trivial: they signal profit-taking, even a strategic lightening of portfolios.

On derivatives, the mood has changed. Options have abandoned protective puts (80K–85K) to target calls at 100K. A way of saying: we’re not there yet, but we believe in it. Funding rates turn green again, a sign that demand for long positions is coming back. Like a breath.

Meanwhile, ETFs continue to attract capital. On November 26, spot Bitcoin funds accumulated $21.12M net inflows, against $60.82M for Ethereum and $21.81M for XRP. Solana, meanwhile, shows an outflow of −$8.1M, proof that the party isn’t universal.

Figures marking the trend

- $91,458: bitcoin price at the time of writing;

- $676.49M: total assets of XRP ETFs as of November 26;

- 700,000 BTC: transferred by long-term holders in two days;

- $230M: amounts injected into XRP ETFs in one week;

- 3.8: long/short ratio of large accounts on Binance, a 3-year record.

One thing is certain: the crypto year will not end in indifference. Especially since Bitwise’s Dogecoin ETF has just been approved by the NYSE . The lingering question remains: will the market be ready to play along, or is it just another flash in the pan?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Forbes 2026 Crypto Trend Forecast: Where Will the Market Go After Volatility Decreases?

The stablecoin frenzy, the financialization of bitcoin, and cross-border capital flows are accelerating the restructuring of the industry.

Once the most lucrative application, is it now completely abandoned?

The four-year bitcoin cycle is invalidated—who will lead the new two-year cycle?

You may have misunderstood JESSE; this is an attempt to bring revenue to the Base chain.