DeFi Builders Program First Cohort Announced: Five Teams Officially Selected!

Velocity Labs has officially announced the first cohort of teams selected for the DeFi Builders Program (Cohort 1), with five teams standing out. They will build the next generation of innovative financial applications on Polkadot Hub.

The original intention of the DeFi Builders Program is simple — to provide truly high-potential teams with a support system that enables them to successfully launch and develop long-term on Polkadot Hub. Because helping outstanding teams succeed requires more than just funding. More importantly, it allows them to directly access guidance from core technical members, clear product implementation and growth strategies, support from liquidity partners, and an ecosystem network always ready to lend a helping hand.

This program aims to create an environment where builders can focus on what they do best: building the future of DeFi.

The DeFi Builders Program is a 12-week structured acceleration program jointly launched by Velocity Labs, Web3 Foundation, Parity Technologies, and other partners. It targets three major pain points commonly faced by DeFi projects: liquidity cold start, security challenges, and the difficulty of finding long-term sustainable product-market fit.

Compared to traditional grant models, this program offers a complete set of systematic support: funding, technical mentoring from core developers, security audit services, liquidity partnerships, and go-to-market strategy guidance, helping teams launch more competitive applications on Polkadot Hub.

The enthusiasm for applications this time exceeded expectations, with over 75 applications received from around the world. Every team demonstrated impressive strength, innovation, and vision, making the selection process extremely difficult. This also clearly shows that building high-performance, highly interoperable financial applications has become an increasingly strong common pursuit among global builders.

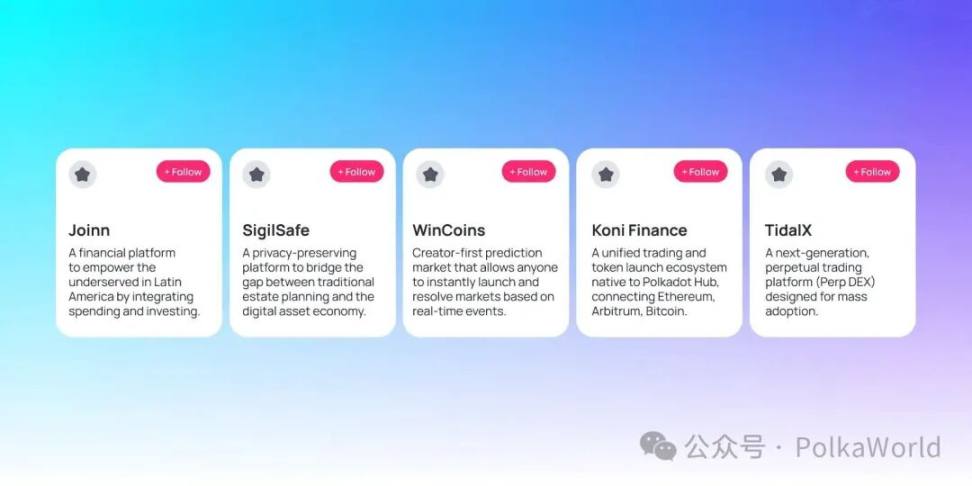

This article will share the five elite teams that were finally selected—they will form the first Cohort of the DeFi Builders Program and, over the next 12 weeks, will work with Polkadot Hub to advance the next stage of DeFi innovation.

Joinn

Joinn aims to solve a long-standing problem in Latin America: many people can save money but never invest. Over 98% of potential savers in the region have never participated in any investment products.

Joinn’s solution is to combine “spending” and “investing.” Their Joinn Pay is an interest-bearing wallet that automatically generates returns based on tokenized bonds or ETFs as users spend in their daily lives.

To lower the barrier to entry, Joinn uses a Web2-style simple interface, AI-assisted registration process, and gamified design, allowing ordinary users in Latin America to easily access inflation-resistant wealth growth methods.

In addition, HIC, an investment institution focused on the Polkadot ecosystem, also announced an investment in Joinn last month!

SigilSafe

SigilSafe aims to solve the “inheritance transfer” problem in the digital asset era. Crypto assets are becoming increasingly important, but traditional will systems cannot handle new things like “private keys.”

SigilSafe’s “inheritance map” allows users to securely organize their complete asset portfolio and, upon the occurrence of specific events, allows trustees to obtain “partial access,” but the private key is never exposed during the entire process.

It essentially establishes a secure bridge connecting on-chain assets and the offline legal system, ensuring assets are not lost during inheritance and reducing legal complexity.

WinCoins

WinCoins is a protocol that allows creators to “open prediction markets at any time.”

Traditional prediction markets are slow to create and have high barriers to entry, while WinCoins allows anyone to instantly open and settle markets around real-time trending events (social trends, gaming competitions, etc.).

Relying on AI and real-time data as oracles, creators can take 1% of all trading volume as revenue, turning “community participation” itself into a new economic model.

Koni Finance

Koni Finance, developed by the Subwallet team, aims to build a “one-stop token issuance + trading platform” on Polkadot Hub. It can connect Ethereum, Arbitrum, Bitcoin, and Polkadot, allowing users to complete the following on the same interface:

- Professional-grade chart analysis and trading

- Transparent, permissionless token issuance

Koni aims to cover the entire lifecycle of digital assets: from issuance, trading to management, all can be completed on a seamless experience platform.

TidalX

TidalX is building the next-generation perpetual contract trading platform for the masses. They hope to make leveraged trading simple, fast, and easy to use.

The platform has already passed security audits worth over $250,000, with a clear and user-friendly interface, yet still offers professional-level functionality.

With a focus on “zero gas, ultra-fast, easy to operate,” TidalX hopes to become the easiest entry point for the next wave of new DeFi users.

What’s next?

These five teams officially enter an intensive 12-week acceleration period this week, working closely with partners and core developers to continuously improve their products, security, and mainnet launch preparations.

We also look forward to seeing their final results at the Cohort 1 Investor Demo Day.

The addition of these teams marks an important milestone for Polkadot Hub. The innovation and energy they demonstrate also symbolize Polkadot’s future potential in the DeFi sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin yields collapse, marking the end of the high-yield DeFi era

The cryptocurrency sector must adapt to life "after the party."

Texas establishes Bitcoin reserves—why choose BlackRock BTC ETF as the first choice?

Texas has officially taken the first step and is poised to become the first state in the United States to list bitcoin as a strategic reserve asset.

Lowest Rating! Why Doesn’t S&P Recognize USDT?

S&P warns that Tether's bitcoin exposure has breached safety limits. Tether CEO responds defiantly: "We take pride in your disdain."

HyperLiquid ecosystem leader Kinetiq TGE tonight, what price is suitable to enter?

When in doubt, check Polymarket first.