Bitwise rolls out Dogecoin ETF on the NYSE: 'Against the odds, it has kept its relevance'

Quick Take Bitwise launched its Bitwise Dogecoin ETF (ticker BWOW) on Wednesday. “You’re surprised. We’re surprised. Much wow, you might say,” Bitwise said in a statement on Tuesday.

Crypto fund manager Bitwise launched its Dogecoin exchange-traded fund on Wednesday, debuting the product — built around a picture of a cute dog — on the New York Stock Exchange.

"DOGE began as a joke and came to become an icon of the crypto movement. It doesn't purport to transform global capital markets or convince you it has fundamentals or utility," said Bitwise CEO Hunter Horsley in a statement . "DOGE is simply a 12-year-old coin based on a picture of a cute dog, people doing good, and the common ideal in crypto that people should have the freedom to do as they choose."

"And, against the odds, it has kept its relevance—and its value—longer than just about anything else in crypto," Horsley added, and said that Bitwise launched its ETF because DOGE holders want the benefits of such a fund.

Dogecoin is the 10th largest crypto by market capitalization at $23 billion. The coin started as a meme featuring the Shiba Inu dog that later caught billionaire Elon Musk's attention as the billionaire regularly posted about the memecoin. Later in 2025, Musk and former presidential candidate Vivek Ramaswamy led the Department of Government Efficiency, or DOGE , which helped push the coin north of $0.40 at one point, although it has come all the way back down to the $0.15 area. This past week, Reuters reported the department had been disbanded earlier than expected.

The Bitwise Dogecoin ETF (ticker BWOW) joins a growing field of DOGE-based funds. The Grayscale Dogecoin ETF began trading on Monday and the REX-Osprey DOGE ETF launched in September. The latter one took a different approach since it is registered under the Investment Company Act of 1940 — a federal law that regulates investment funds that pool capital from investors to pursue a common investment strategy.

Grayscale's GDOG saw $1.4 million in day-one trading volume, which Bloomberg's Eric Balchunas said was "solid for an avg launch but low for a 'first-ever spot' product. Not too surprising tho."

NYSE Arca, a subsidiary of the NYSE Group, certified Bitwise's listing on Tuesday, setting BWOW up for launch. The Bitwise Dogecoin ETF looks to provide exposure to the memecoin's value and said Coinbase Custody Trust Company, LLC will serve as the custodian, according to a previous registration statement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

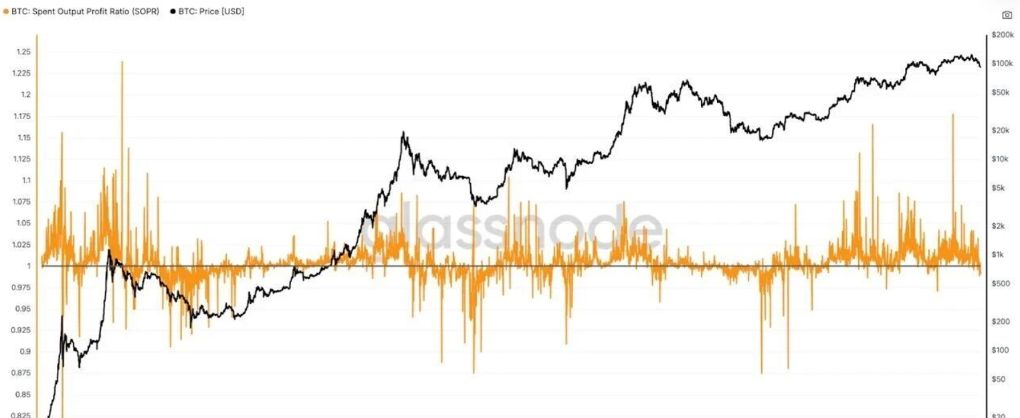

Has the four-year bitcoin cycle failed under institutional participation?

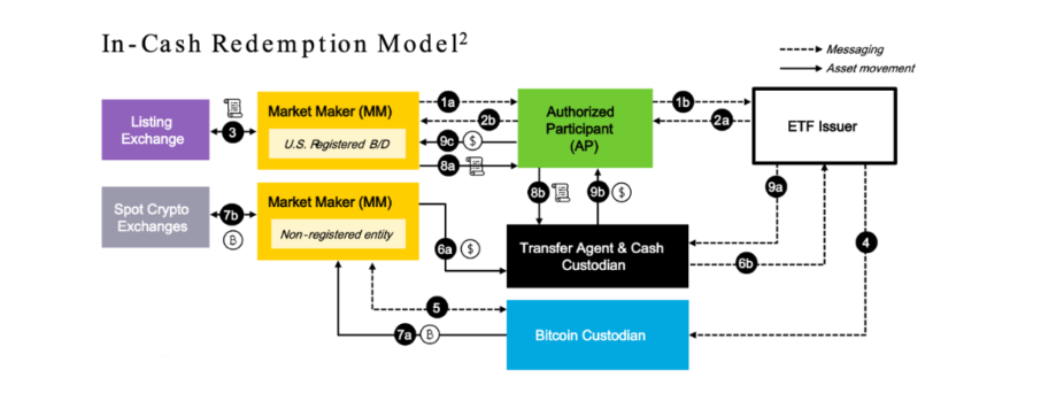

The truth behind BlackRock's "dumping": user redemptions rather than institutional selling

Bitcoin miners, are they reaching their limit?

![[Bitpush Daily News Selection] Bloomberg: Hassett is a top candidate for Federal Reserve Chair and previously led the development of the crypto regulatory framework; Bitwise Dogecoin ETF BWOW may be listed on NYSE Arca as early as Wednesday; Texas invests $10 million in BlackRock Bitcoin ETF; Bitcoin sees its worst January in nearly three years, with a record $3.7 billion ETF outflow in a single month](https://img.bgstatic.com/multiLang/image/social/01582b32c50c68df86392683edeac2ba1764167940940.png)