Key Notes

- Franklin Templeton stated that it will waive off management fee for the first $5 billion coming to its Solana ETFs.

- Spot Solana ETFs saw significant demand with Bitwise’s BSOL crossing the $500 million asset milestone.

- Analysts expect a potential SOL price recovery, citing technical setups and targets of up to $175.

Asset manager Franklin Templeton is now planning to introduce its Solana ETF in the US market, amid strong response and inflows into this fund. As a result, it will compete with players like Fidelity, Bitwise, VanEck, Grayscale, etc. This has also made market analysts hopeful for an SOL SOL $137.2 24h volatility: 0.7% Market cap: $76.71 B Vol. 24h: $4.89 B price recovery ahead.

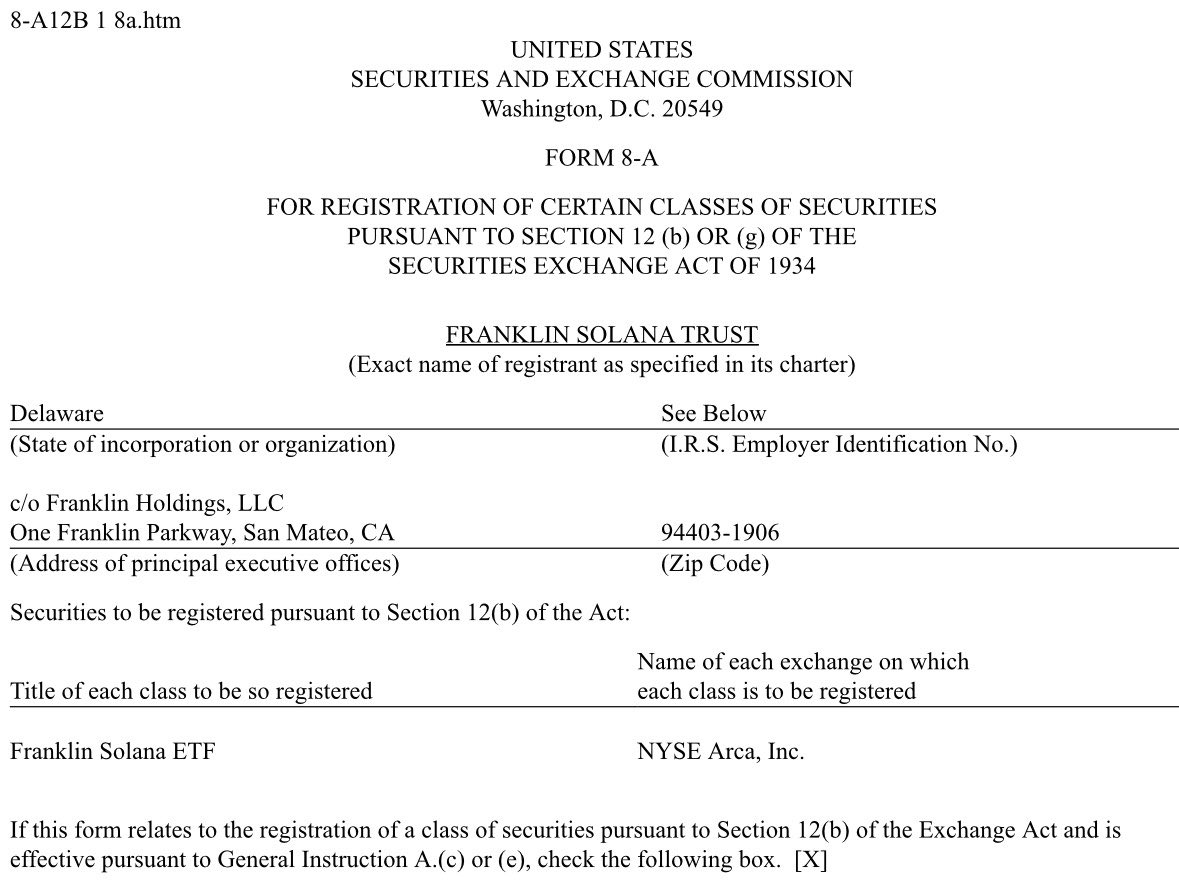

Franklin Templeton Submits Solana ETF Filing

Asset manager Franklin Templeton has submitted its final regulatory filing to the US Securities and Exchange Commission to launch its Solana ETF in the US market. The firm filed a Form 8-A for its Solana product, indicating that it could debut soon in the market. This filing comes soon after the asset manager tasted recent success with its spot XRP ETF listing.

The filing marks the final administrative step required for listing, with Form 8-A widely regarded within the ETF industry as the “green light” signal. The Solana ETF from Franklin will trade under the ticker SOEZ on NYSE Arca. Previously, the product experienced delays as the SEC extended its review period multiple times throughout the year.

Franklin Templeton Solana ETF filing | Source: SEC

Franklin Templeton’s Solana ETF will be a passive fund tracking the CF Benchmarks Index and will charge a 0.19% management fee. Besides, the company will also waive fees on the first $5 billion in assets until May 31, 2026.

Inflows into spot Solana ETFs have continued with another $53 million recorded on Nov. 25. Bitwise Solana ETF (BSOL) recorded the most inflows at $31 million, while crossing $500 million milestone, according to data from Farside Investors .

Market experts believe that this could eventually lead to a strong SOL price recovery after dropping by 30% over the past month.

SOL Price on the Cusp of Strong Breakout

Over the past month, SOL price corrected by 30% amid the broader crypto market crash. However, after finding a base at $125 last week, the Solana altcoins seem to be on the path to recovery.

Popular crypto analyst Captain Faibik showed that the SOL price is positioning for a significant multi-trendline breakout pattern with a Fibonacci-based price target of $175.31. Thus, the altcoin could see another 25% upside from the current levels.

$SOL #SOLANA is Ready for the +25% Recovery Rally so Don't miss the RIDE..🚀 pic.twitter.com/uNDXbLVhcY

— Captain Faibik 🐺 (@CryptoFaibik) November 26, 2025

Another crypto analyst Daan Crypto Trades reported that Solana has been trading in a prolonged downturn but is beginning to show early signs of recovery. The analyst noted renewed activity among SOL-based memecoins.

According to the analysis, the key near-term resistance sits around $145. A successful move above this level could open the door for a further advance toward the $155 zone.

next