Triple Pressure on the Crypto Market: ETF Outflows, Leverage Reset, and Low Liquidity

The crypto market stands at a crossroads of deep correction.

The crypto market stands at the crossroads of a deep correction.

Written by: Tanay Ved

Translated by: Luffy, Foresight News

TL;TR

- Major capital absorption channels such as ETF and DAT have recently shown weak demand. The ongoing deleveraging process since October and the macro risk-off environment continue to put pressure on the crypto asset market.

- The futures and DeFi lending markets have completed a comprehensive leverage reset, resulting in a cleaner position structure and reduced systemic risk.

- The spot liquidity of major coins and altcoins has not yet recovered, leaving the market in a fragile state and more susceptible to extreme price swings.

At the beginning of Uptober, bitcoin once soared to a new all-time high, but optimism quickly reversed, and the "10.11" flash crash severely damaged market confidence (Note: Uptober refers to the typical rise in the crypto market during October). Since then, the price of bitcoin has dropped by about $40,000 (a decline of over 33%), altcoins have suffered even greater blows, and the total market capitalization of the entire crypto market has fallen back to nearly $3 trillion. Even though there were multiple positive fundamental developments throughout 2025, price trends and market sentiment have still diverged significantly.

Currently, crypto assets are at the intersection of multiple external and internal factors. On the macro level, uncertainty about rate cuts in December and the recent weakness in tech stocks have further intensified risk-off behavior in the market; within the crypto market, ETFs and crypto asset treasuries (DAT), which once served as stable capital absorption channels, have seen capital outflows; meanwhile, the liquidation wave of "10.11" triggered one of the most intense deleveraging events in history, with its aftereffects still ongoing and market liquidity remaining sluggish.

This article will delve into the core driving factors behind the recent weakening of the crypto asset market, focusing on ETF capital flows, leverage conditions in perpetual futures and DeFi markets, and order book liquidity, to explore what these changes reveal about the current market landscape.

Macro Shifts to Risk-Off Mode

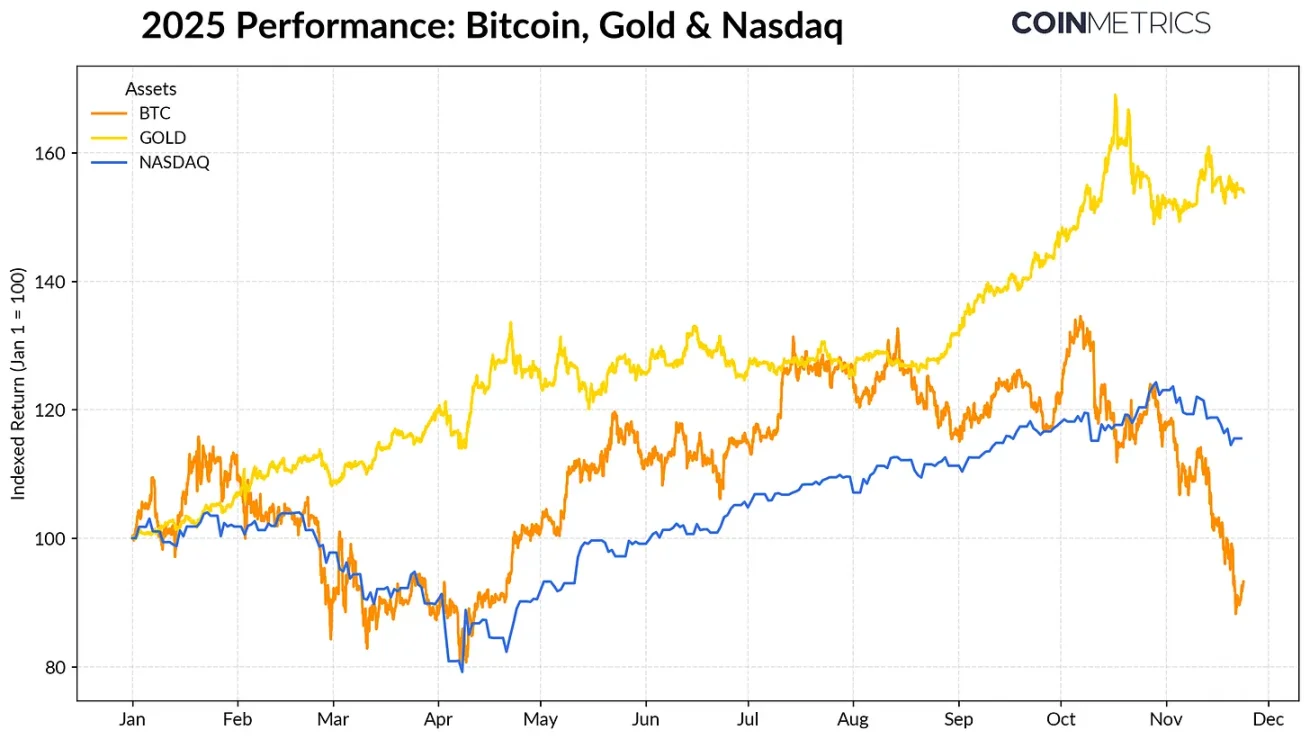

Bitcoin's performance has increasingly diverged from major asset classes. Against the backdrop of record gold purchases by central banks and ongoing trade tensions, gold has delivered a return of over 50% this year, surging ahead; meanwhile, tech stocks (Nasdaq Index) lost momentum in the fourth quarter as the market reassessed the likelihood of imminent Fed rate cuts and the sustainability of the AI-driven bull market.

As our previous research has shown, the relationship between bitcoin and "risk-on" tech stocks and "risk-off" gold is cyclical and adjusts with changes in the macro landscape. This makes bitcoin particularly sensitive to market shocks or catalytic events (such as the October flash crash and recent risk-off sentiment).

Performance of bitcoin, gold, and the Nasdaq Index in 2025. Data source: Coin Metrics and Google Finance

As the "anchor asset" of the entire crypto market, bitcoin's pullback has spread to other assets. Although privacy coins and other thematic sectors briefly outperformed, most coins remain highly correlated with bitcoin.

The Diminished Capital Absorption of ETF and DAT

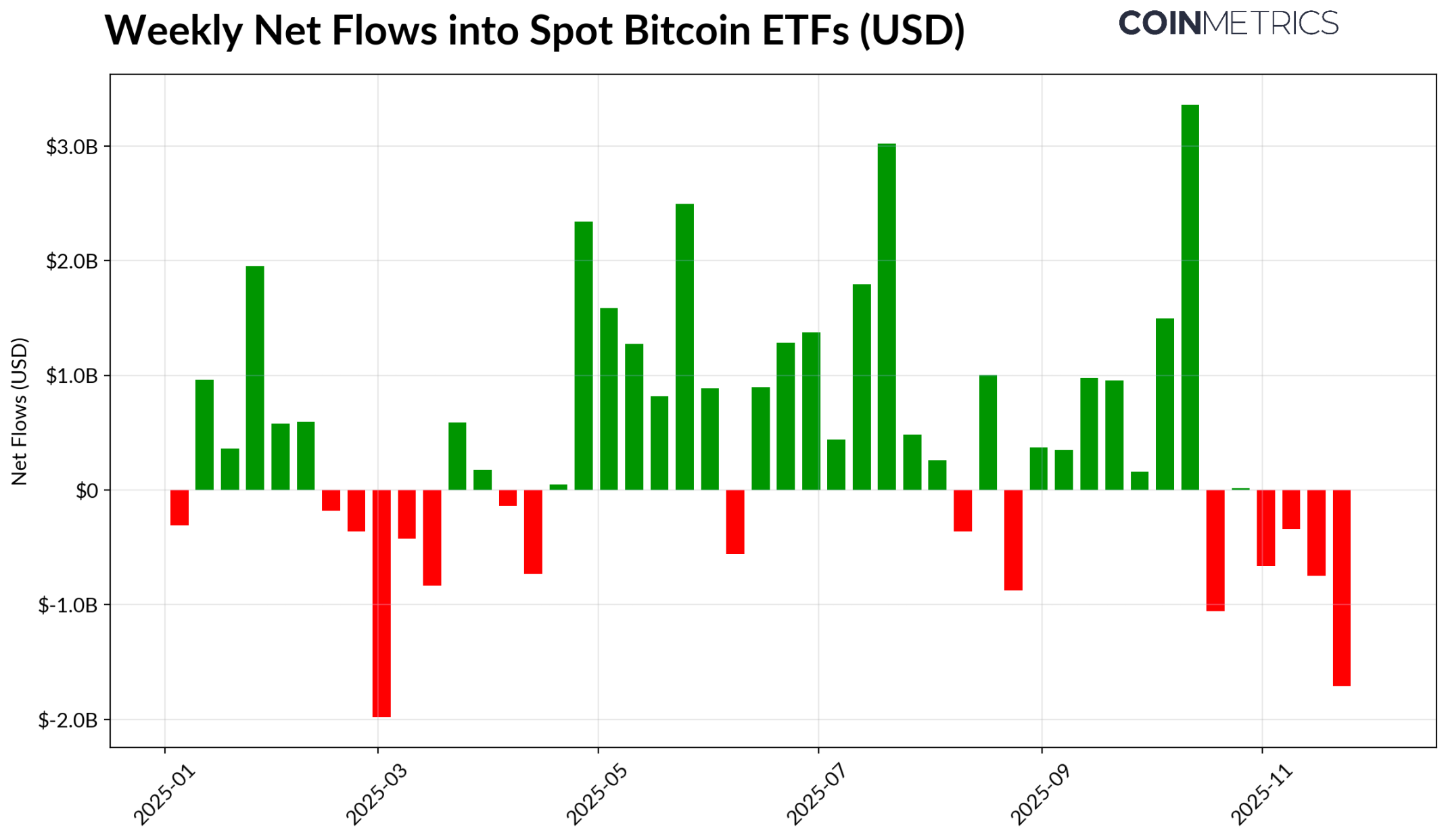

Bitcoin's recent weakness is partly due to a decline in demand from the core capital channels that supported its 2024-2025 trajectory. Since mid-October, ETFs have seen net outflows for several consecutive weeks, with a cumulative outflow of $4.9 billion—this is the largest redemption wave since bitcoin fell to $75,000 before the "Liberation Day" tariff announcement in April 2025. Despite short-term capital outflows, on-chain holdings are still trending upward, with BlackRock's IBIT ETF alone holding 780,000 bitcoins, accounting for about 60% of the current total spot bitcoin ETF holdings.

If ETF inflows recover, it will signal that this channel is stabilizing. Historical data shows that when risk appetite returns, ETF demand has been a key force in absorbing bitcoin supply.

Weekly net inflows of bitcoin ETFs. Data source: Coin Metrics

Crypto asset treasuries (DAT) are also starting to show signs of stress. As prices pull back, the stock value of DAT companies and the scale of their crypto asset holdings have shrunk, putting pressure on the net asset value premium that supports their growth flywheel. This weakens DATs' ability to raise new capital through equity issuance or debt financing, thereby limiting the growth of per-share crypto asset holdings. Smaller, emerging DATs are particularly sensitive to this, and changes in the market environment may make cost benchmarks and equity valuations unsuitable for further accumulation.

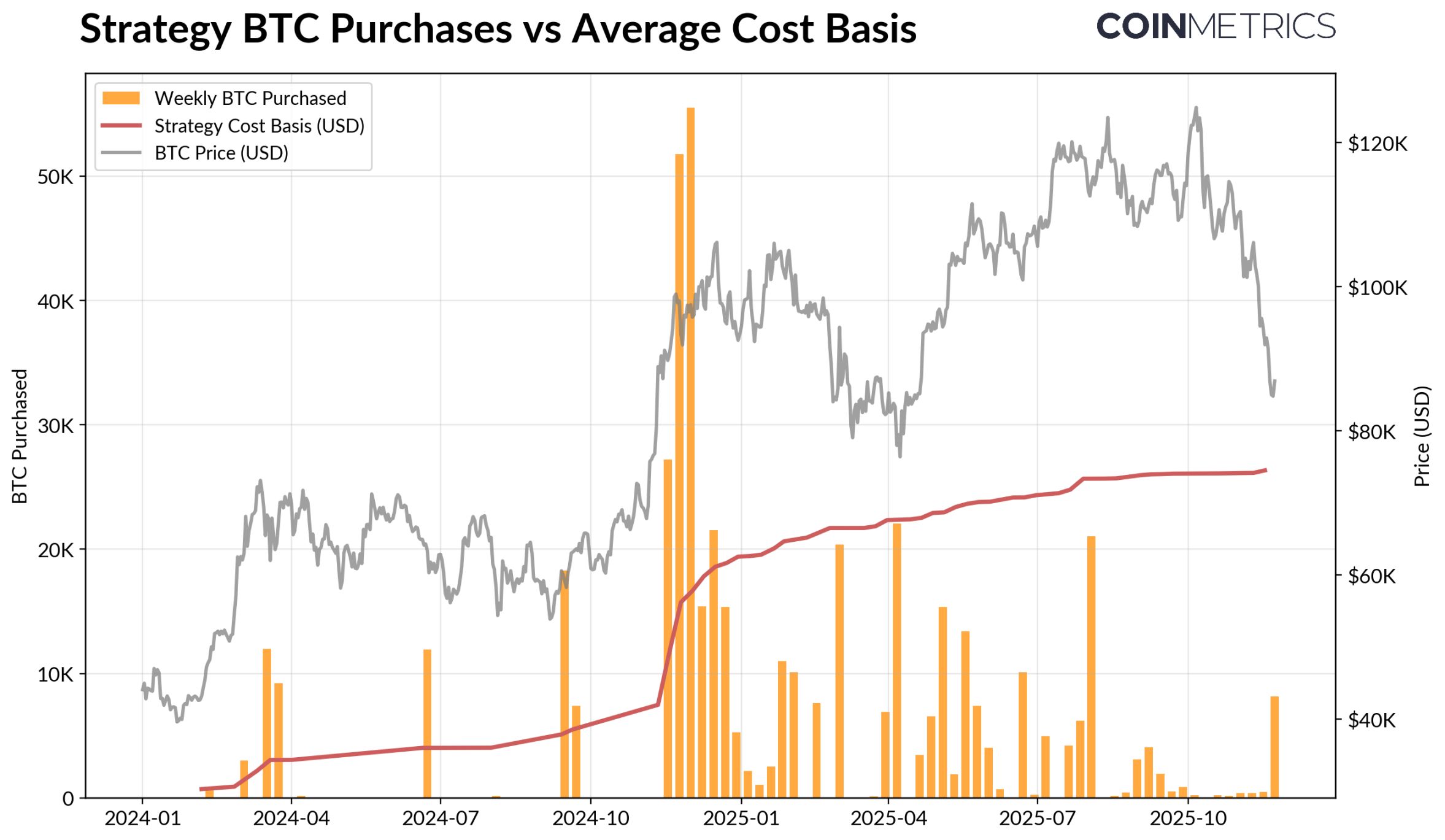

The largest DAT at present—Strategy—holds 649,870 bitcoins at an average cost of $74,333 (about 3.2% of bitcoin's current total supply). As shown in the chart below, when bitcoin prices rise and equity valuations are strong, Strategy's accumulation pace accelerates significantly, while the pace has slowed recently. Nevertheless, Strategy still holds unrealized profits, with its cost basis below the current market price.

If prices fall further or face the risk of index exclusion, Strategy may come under pressure; but an improved market environment could enhance its balance sheet and valuation, recreating favorable conditions for DAT accumulation.

Strategy's bitcoin purchase volume and average cost basis. Data source: Strategy and Bitbo Treasuries

This trend is consistent with on-chain profitability. The realized profit and loss ratio (SOPR) for short-term holders (holding period < 155 days) has dropped to about -23% in the loss range, a level that historically reflects capitulation selling pressure from the most price-sensitive group. Long-term holders are still on average in profit, but SOPR data shows a slight increase in profit-taking. If the SOPR for short-term holders rises above 1.0 while long-term holders slow their selling, it will indicate that the market is gradually stabilizing.

Crypto Deleveraging: Perpetual Futures, DeFi Lending, and Liquidity

The liquidation wave of "10.11" triggered a multi-layered deleveraging cycle in futures, DeFi, and stablecoin-collateralized leverage, with its aftereffects still reverberating throughout the crypto market.

Deleveraging in the Perpetual Futures Market

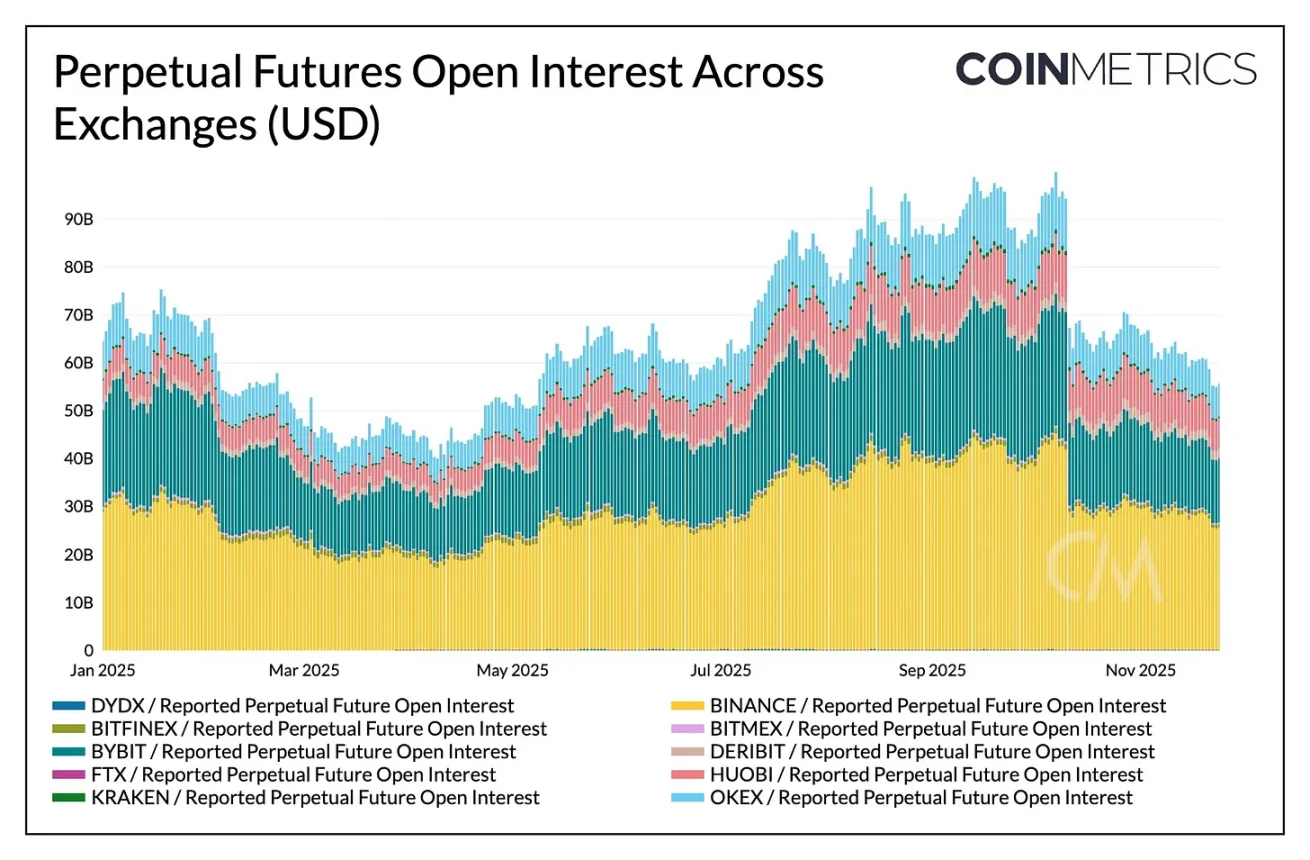

Within just a few hours, the perpetual futures market saw the largest forced liquidation in history, with open interest (OI) accumulated over several months dropping by more than 30%. The largest declines in open interest were seen in altcoins and exchanges with high retail trading activity (such as Hyperliquid, Binance, and Bybit), consistent with areas where leverage was concentrated before deleveraging. As shown in the chart below, current open interest remains well below the pre-crash peak of over $90 billion, and has continued to decline slightly, indicating that as the market stabilizes and readjusts, leverage in the system has been effectively cleared.

At the same time, funding rates have also weakened, reflecting a reset in long-side risk appetite. Recently, bitcoin funding rates have hovered at neutral or slightly negative levels, consistent with a market that has not yet fully rebuilt directional confidence.

Changes in perpetual contract open interest across exchanges. Data source: Coin Metrics

DeFi Deleveraging

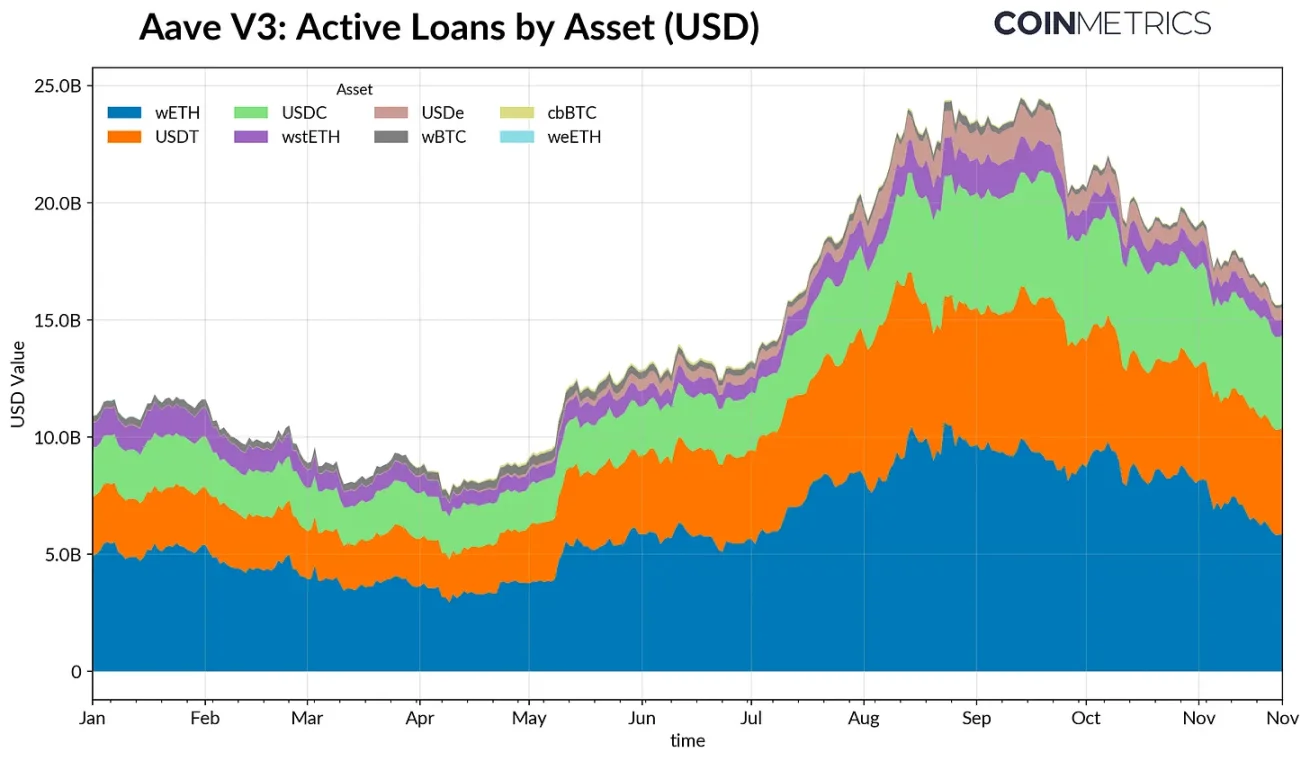

The DeFi credit market has also undergone gradual deleveraging. Since peaking at the end of September, active loan volume on Aave V3 has continued to decline. Against a backdrop of weak risk appetite and collateral repricing, borrowers have reduced leverage and repaid debts. The contraction in stablecoin-denominated lending has been the most severe, with the Ethena USDe depegging event causing USDe-related lending to plummet by 65%, triggering a comprehensive unwinding of synthetic dollar leverage.

Ethereum-related lending has also contracted: WETH and liquid staking token (LST) loan volumes have dropped by about 35%-40%, reflecting a reduction in looped lending strategies and yield-bearing collateral strategies.

Active loan volume on Aave V3. Data source: Coin Metrics

Spot Liquidity Remains Sluggish

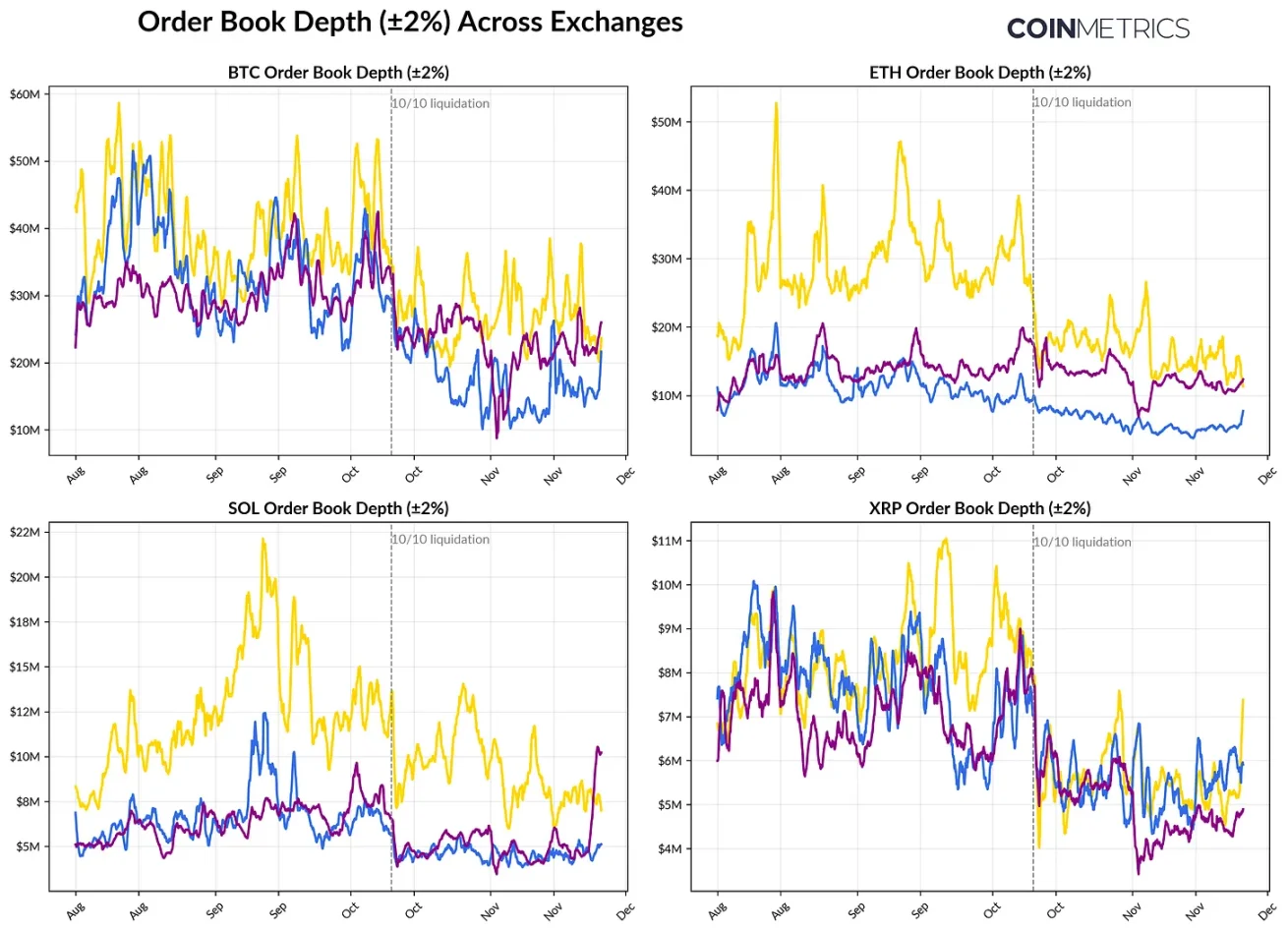

After the "10.11" liquidation wave, spot market liquidity has remained tight. On major exchanges, the trading depth (±2%) for bitcoin, ethereum, solana, and other coins is still 30%-40% lower than early October levels, indicating that liquidity has not recovered in tandem with prices. With fewer orders on the books, the market remains fragile, and small trades can trigger disproportionate price swings, amplifying volatility and the impact of forced selling.

The liquidity situation for altcoins is even worse. Order book depth outside major coins has seen a more severe and prolonged decline, reflecting continued market aversion to risk assets and reduced market maker activity. A comprehensive improvement in spot liquidity would help reduce price shocks and stabilize the market, but so far, insufficient depth remains one of the clearest signs that systemic pressure has not been fully alleviated.

Changes in exchange order book depth. Data source: Coin Metrics

Conclusion

The crypto asset market is undergoing a comprehensive adjustment, jointly affected by weak demand for ETF and DAT, leverage resets in futures and DeFi markets, and sluggish spot liquidity. While these dynamics put pressure on prices, they also make the market system healthier, with lower leverage, more neutral positions, and a growing return to fundamentals-driven behavior.

At the same time, the macro environment remains the main headwind. Weak AI stocks, shifting expectations for rate cuts, and an overall risk-off tone are suppressing market demand. If major capital channels (ETF inflows, DAT accumulation, stablecoin supply growth) recover and spot liquidity rebounds, it will lay the foundation for market stabilization and eventual reversal. Until then, the market will remain in a tug-of-war between the macro risk-off backdrop and the internal structure of the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Southeastern Freight Lines partners with other regional carriers to expand operations into the Mexican market

Dutch court hears arguments in Nexperia mismanagement case that upset the global auto industry

Ramsden: How the Bank’s strategy for resolution has developed over time

YouTube now has a way for parents to block kids from watching Shorts