The latest SOL proposal aims to reduce the inflation rate, but what are the opponents thinking?

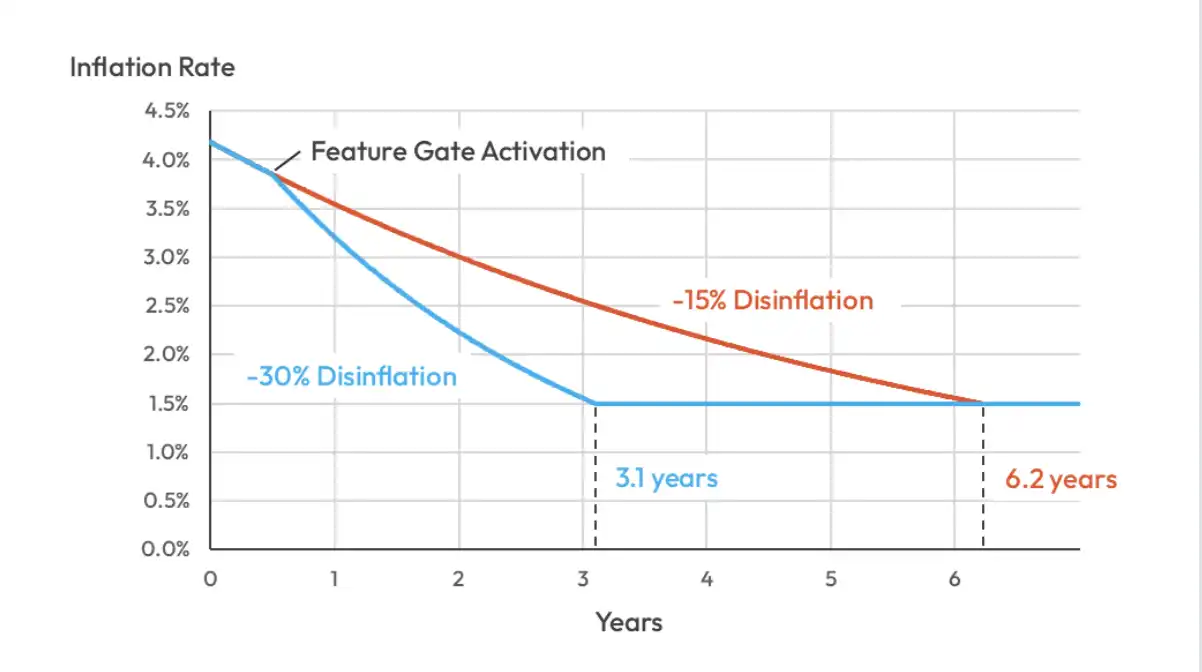

The Solana community has proposed SIMD-0411, which would increase the inflation deceleration rate from 15% to 30%. It is expected to reduce SOL issuance by 22.3 million over the next six years and accelerate the reduction of the inflation rate to 1.5% before 2029.

Original Title: "What Are Opponents Thinking About the Latest SOL Proposal to Reduce Inflation?"

Original Author: CryptoLeo, Odaily

Devoted SOL supporters have recently found some comfort, as the Solana community has put forward a new proposal called SIMD-0411 (translated as Double Inflation Suppression Rate, meaning not yet deflationary but the inflation rate is decreasing). This proposal was initiated by Solana community contributors Lostin and helius Dev Ichigo and is currently in the governance discussion phase, soon to enter the voting stage.

The proposal suggests doubling the SOL inflation reduction rate from -15% to -30%. With this parameter adjustment, the time for SOL's inflation rate to drop from the current 4.18% to 1.5% would be brought forward from early 2032 to early 2029, meaning it would only take 3.1 years to reach the 1.5% inflation target.

It is estimated that under this parameter, the total SOL issuance over the next 6 years will decrease by 22.3 million tokens (under the current mechanism, SOL supply after 6 years would be 721.5 million; under SIMD-0411, it would be 699.2 million). At the current SOL price of $140, this equates to approximately $3.12 billion.

Simplified and Safer Version of SOL SIMD-0228: What's Different About SIMD-0411?

Let’s first review the SOL token inflation plan, which was originally designed as follows: an initial inflation rate of 8%, an inflation reduction rate of 15%, gradually decreasing to a final inflation rate of 1.5%. The current rate is 4.18%.

SIMD-0411 is not the first proposal to improve the SOL inflation mechanism. Earlier this year, early SOL investor Multicoin Capital and others released a proposal called SIMD-0228, also aimed at modifying the Solana inflation model. By adjusting the SOL issuance rate to a dynamic and variable model, the proposal set a 50% target staking rate to enhance network security and decentralization. If more than 50% of SOL is staked, the inflation rate decreases, suppressing further staking by reducing rewards; if less than 50% is staked, the inflation rate increases, boosting rewards and encouraging staking. According to the then-current Solana network conditions, the final inflation rate would be set at 0.87%.

However, this proposal was ultimately unsuccessful due to its complexity and strong community opposition. Most community members opposed it due to conflicts of interest between large and small validators:

Large validators supported SIMD-0228, as rapidly lowering inflation would drive up token prices and yield greater returns for them;

Small validators worried that reduced staking rewards would significantly cut their income, and some DeFi projects were concerned about liquidity issues. If small validators exited, Solana’s power would concentrate in the hands of a few large validators, impacting the network’s decentralization.

SIMD-0411 can be considered a simplified and safer version of SIMD-0228. Based on this, the solution proposed by SIMD-0411 is more targeted: it doubles the rate of inflation reduction while maintaining the already agreed-upon final inflation rate of 1.5%. It only adjusts a single parameter, rather than redesigning the entire inflation system like SIMD-0228. This provides a minimal, predictable, and low-risk way to strengthen SOL’s inflation design without increasing protocol complexity. It’s simpler and easier to govern.

What Does the Community Think?

Opinions on SIMD-0411 remain mixed:

Bullish Views: Institutional Optimism, Encouraging Innovation and DeFi Activity

SOL treasury company DeFi Dev Corp (DFDV) has also expressed support for SIMD-0411. DFDV’s analysis states:

1. In addition to the reduction of 22.3 million SOL, SIMD-0411 applies a single, easy-to-understand parameter adjustment, avoiding any complex or dynamic monetary logic and enhancing predictability. Furthermore, SIMD-0411 includes a 6-month activation grace period for network participants to prepare;

2. Regarding staking yields, DFDV notes that high staking yields are reasonable in the early stages of blockchain network development, as they help attract developers, accelerate decentralization, and stimulate token demand, but Solana has already passed that stage. For comparison:

"Solana’s protocol revenue grew from $29 million in 2023 to $1.42 billion in 2024, and so far in 2025 has reached about $1.38 billion: nearly a 50-fold increase in one year. By 2025, Solana’s protocol revenue is more than double that of Ethereum. Solana reached $1 billion in about 4 years (Ethereum took 6 years)."

"Solana’s DEX trading volume grew from $12 billion in 2022 to $55 billion in 2023, then to $694 billion in 2024, and is expected to reach $1.45 trillion in 2025. This year, Solana’s processing volume is about 1.6 times that of Ethereum’s DEX trading volume."

"From 2023 to 2025, Solana processed about 68.6 billion transactions, while Ethereum processed only 1.27 billion—a gap of 50 times. Solana’s annual transaction count grew from 12.3 billion in 2023 to 25.9 billion in 2024, and has reached 30.5 billion so far this year, while Ethereum’s annual transaction volume has always been below 500 million. Solana has achieved scale (while Ethereum has not)."

Solana has outperformed Ethereum for several consecutive years in almost all key metrics, including network revenue, transaction data, DEX trading volume, and new wallets;

3. Currently, high inflation is also dragging down SOL token price performance and urgently needs to be addressed;

4. Institutional investors, DAT, and ETF issuers prefer assets with predictable, reliable long-term economic benefits and structurally lower inflation;

5. Lower staking yields will also drive more SOL into DeFi products, such as lending, LP, and stablecoins;

6. Reducing reliance on token inflation encourages innovation among network validators.

Concerns: A Series of Issues Triggered by Reduced Staking Rewards

According to Pine Analytics, after SIMD-0411 is passed, the nominal SOL staking yield will steadily decline as follows:

· About 5.04% in the first year;

· About 3.48% in the second year;

· About 2.42% in the third year.

Additionally, according to 0xSpade, after SIMD-0411 is passed, 10 validators will move from profit/breakeven to unprofitable in the first year, 27 in the second year, and 47 in the third year.

In response, DFDV also stated:

1. A lower inflation rate will make the economics for validators more challenging, reduce staking participation, lower economic security, and trigger short-term volatility;

2. As yields decrease, some validators may incur losses or even shut down;

3. The uncertainty of a sudden adjustment to Solana’s inflation plan may lead to market volatility;

5. Yields for ETFs, staking products, and DAT will decrease;

6. Intervening in the token mechanism may set a bad precedent—not all networks can follow this mechanism, and most network dynamics and token designs should remain unchanged.

With DAT, ETFs, and Lower Inflation, Is SOL Ready to Take Off?

Although SOL token price performance has not been great this year, there has been clear substantive progress: first, the DAT treasury—while SOL’s treasury is not as high-profile as BTC and ETH, it is still making continuous purchases;

Second, the SOL ETF. According to SOSOValue data: SOL spot ETF had a net inflow of $128 million in a single week (from November 17 to November 21, Eastern Time). As of press time, the total net asset value of the SOL spot ETF is $719 million, with an ETF net asset ratio (market cap as a percentage of Bitcoin’s total market cap) of 1.01%, and a historical cumulative net inflow of $510 million.

According to Strategic SOL Reserve data, SOL treasury companies and ETFs hold a total of 25.581 million SOL, worth about $3.55 billion. While other crypto assets are being abandoned and continue to bleed, SOL has gained a stronger backing, with a well-funded institutional buying base already formed.

In the eyes of SOL supporters: "Better to have short-term pain than long-term pain. Since we’re going to reach a 1.5% inflation rate anyway, I’m optimistic about SIMD-0411. Of course, the reduction in staking yields may affect ETF data, and concerns are reasonable, but in the long run, the 'new transparent and predictable inflation mechanism' will attract more retail and institutional investors, which will far outweigh the risks brought by 'some leaving due to lower staking yields.' Moreover, after the short-term potential selling pressure and volatility, the future is likely to see 'continuous new highs.'"

Hopefully, SIMD-0411 will pass the voting stage soon and not end in failure like SIMD-0228.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HIP-3 projects are transforming the Hyperliquid ecosystem

U.S. stocks, Pokémon cards, CS skins, pre-IPO companies—a diversified, all-weather liquidity capital market.

Crypto Market at a Crossroads: Top KOLs Debate Rebound vs. Reversal

The rise of paid communities: Information barriers are reshaping investment class disparities

How Zcash went from low-profile token to the most-searched asset in November 2025