Novogratz’s Galaxy Digital Negotiates Liquidity Deals with Polymarket and Kalshi

Quick Breakdown:

- Galaxy Digital is negotiating with Polymarket and Kalshi about providing institutional market-making services.

- This move represents a strategic step for both the company and the sector, promising improved liquidity, greater regulatory engagement, and greater credibility.

- Experts say Wall Street’s involvement could significantly boost user confidence in crypto-powered prediction markets.

Galaxy Digital targets prediction market liquidity

Galaxy Digital’s CEO, Mike Novogratz, is reportedly in talks with Polymarket and Kalshi Inc. to become a liquidity provider for their prediction markets. If it goes through, Galaxy Digital would play a key role as a market maker, regularly offering two-way quotes to boost liquidity and tighten the bid-ask spread. Novogratz points out that these platforms function more like traditional financial markets than simple betting sites, setting them up for steady, long-term growth. These discussions are part of Galaxy Digital’s bigger plan to connect decentralized crypto markets with regulated, traditional finance.

Source:

Google

Source:

Google

Diverse prediction market models

Polymarket and Kalshi take two very different paths to event trading: Polymarket is decentralized and crypto-native, while Kalshi runs as a fully regulated U.S. exchange. Galaxy Digital’s involvement in both highlights how blockchain-driven markets are starting to meet traditional finance. By stepping in as a market maker, Galaxy could help deepen liquidity and boost institutional confidence, making prediction markets more stable and approachable for traders. These platforms also tend to react quickly to political or economic news, which can shape crypto sentiment and open up fresh arbitrage opportunities.

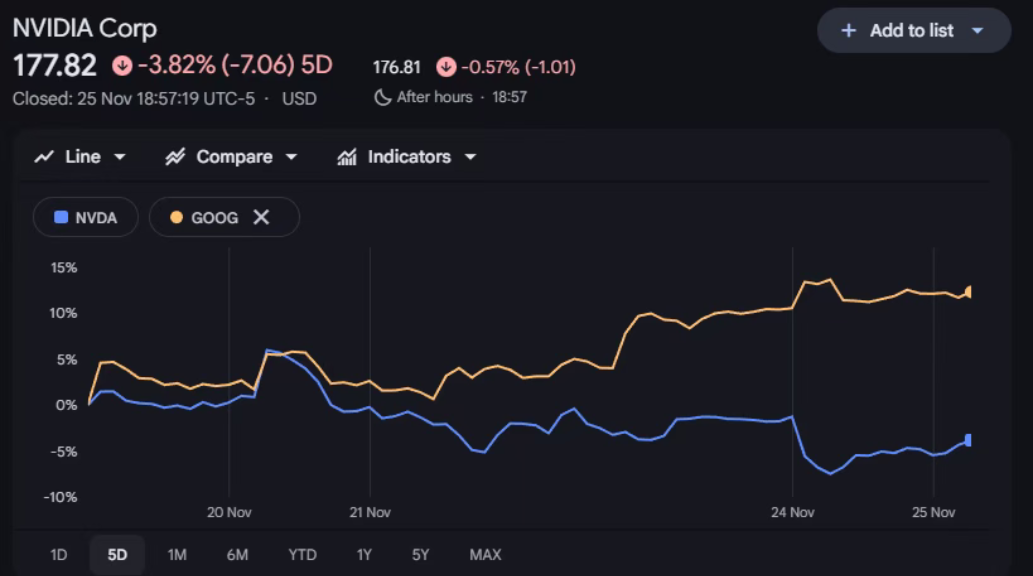

The talks between Galaxy Digital and prediction market platforms like Polymarket and Kalshi reflect a broader trend toward bringing event-based trading into the mainstream. This shift is further highlighted by Google Finance’s recent decision to integrate prediction market data from both Kalshi, the regulated U.S. exchange, and the decentralized Polymarket.

This integration, first rolled out to Google Labs users, now lets the public see real-time odds on everything from economic indicators to political events right in their search results. By combining both regulated data and crypto-native forecasts, Google Finance is blending traditional financial info with crowd-sourced predictions, giving prediction markets a big boost in credibility as useful tools for both finance and information. Galaxy Digital’s push for institutional market-making and Google’s data integration collectively demonstrate a future in which prediction markets are recognized as vital components of the broader financial and informational ecosystem.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Irys (IRYS)

Morning Brief | Bitcoin Sharpe Ratio Drops Below 0; Google Plans to Sell TPUs Directly to Meta; Paxos Announces Acquisition of New York Crypto Wallet Startup Fordefi

Overview of major market events on November 25.

Is Nvidia getting anxious?

Bitcoin wavers under $88K as traders brace for $14B BTC options expiry