BTC Market Pulse: Week 48

Bitcoin extended its decline, breaking below the prior $90K support region and trading down toward $80K before staging a modest rebound.

Overview

The move last week deepened the ongoing drawdown and carried the asset further into a zone where historical demand has tended to strengthen. While the prevailing trend remains decisively to the downside, the recent defence of the mid-$80K range suggests potential stabilisation should selling pressure continue to moderate.

Momentum indicators remain stretched, with the 14-day RSI holding in oversold territory before turning higher, signalling sustained pressure but emerging signs of exhaustion. Derivatives data echo this: Futures and Perpetual CVD remain deeply negative, while stable Open Interest suggests the decline is being driven by position unwinds rather than new leveraged shorts.

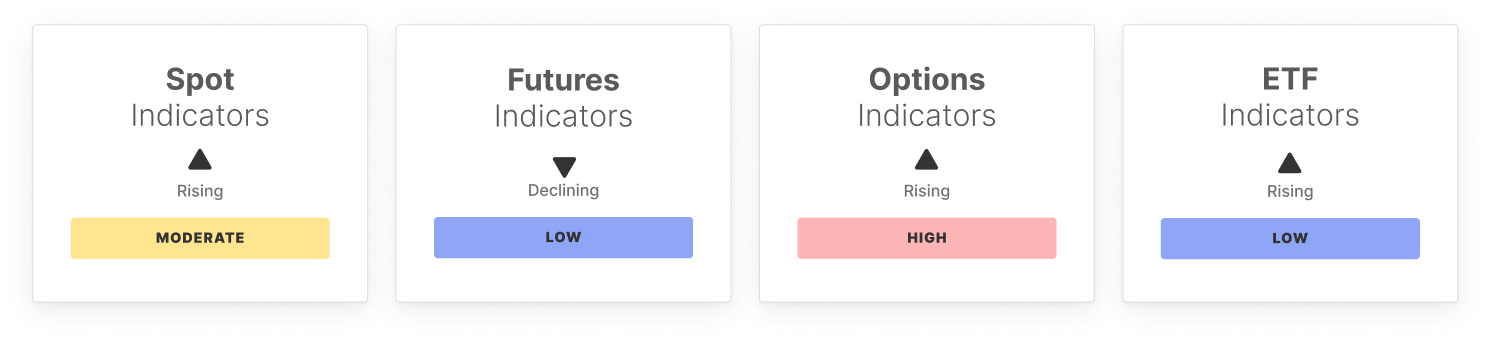

Spot activity stayed muted as volumes softened and ETF outflows persisted, indicating a shift from aggressive selling to a more orderly de-risking phase. Options markets remained defensive, with elevated skew and a tightening volatility spread pointing to expectations of further turbulence but reduced signs of panic.

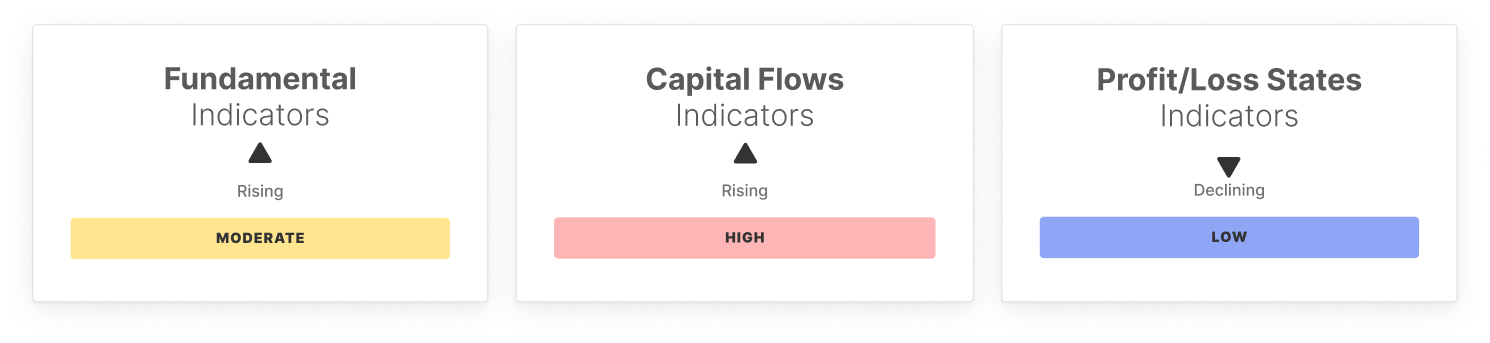

On-chain activity remained muted as well. Transfer volumes, fee revenue, and Realized Cap Change all softened, pointing to quieter network conditions. Profitability metrics deteriorated further: NUPL and Realized P/L reflect deeper unrealized losses and a rising concentration of short-term holder supply, a pattern consistent with late-stage corrections.

In sum, Bitcoin continues to navigate a controlled drawdown into deeply oversold and high-stress conditions. While profitability remains under pressure, the moderation in outflows, stabilisation in momentum, and lack of speculative leverage build-up suggest the market may be forming an early bottoming structure within the $84K–$90K range.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe now- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Please read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The likelihood of a bitcoin short squeeze to $90,000 increases as funding rates turn negative

After dropping from $106,000 to $80,600, Bitcoin has stabilized and started to rebound, sparking discussions in the market about whether a local bottom has been reached. While whales and retail investors continue to sell, mid-sized holders are accumulating. Negative funding rates suggest a potential short squeeze. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

TGE tonight: A quick look at the ecosystem projects mentioned by Monad on the first day

Including prediction markets, DeFi, and blockchain games.

In-depth Conversation with Sequoia Capital Partner Shaun: Why Does Musk Always Defeat His Rivals?

Shaun not only led the controversial 2019 investment in SpaceX, but is also one of the few investors who truly understands Elon Musk's operational system.

11 million cryptocurrencies stolen, physical attacks are becoming a mainstream threat

A man posing as a delivery driver stole $11 million worth of cryptocurrency this weekend, while incidents of burglary are also on the rise.