Hydration will soon launch perpetual contracts and will launch the Rains APP in Q2 2026!

Over the past five years, Hydration has been focused on one thing—reconstructing the underlying logic of DeFi on Polkadot.

While many projects are still “deploying one protocol after another,” Hydration chose to rethink from the chain level: If we truly want to support open finance at a global scale, what should DeFi look like?

Thus, a super application chain born for DeFi from the ground up began to take shape: it unifies trading, lending, and stablecoin mechanisms on the same chain, with performance no longer constrained by general-purpose smart contracts, liquidity no longer fragmented, and risks no longer passively accepted.

More importantly, Hydration hasn’t stopped at “bringing traditional functions on-chain”—it is continuously adding innovative modules unseen in other ecosystems: cross-chain protection, protocol-level partial liquidation, native buyback token mechanisms, intent composability execution... making the whole system increasingly resemble a true “on-chain operating system” built for finance.

Now, Hydration is taking a crucial step forward: after perfecting security and performance, they are beginning to answer an even tougher question: How can the DeFi experience truly reach a level where hundreds of millions of users can use it directly?

From omnichain treasury, to yield vaults, to smart accounts that can be logged in with an email; from on-chain stablecoins to the soon-to-be-released Rains smart wallet app, Hydration is gradually turning the vision of “free finance” into reality.

Next, let’s take a look at Hydration’s speech at the Sub0 conference to see how Hydration is building a complete DeFi trinity, unlocking five chain-level native technologies, and how it plans to reshape user experience with a brand new product suite.

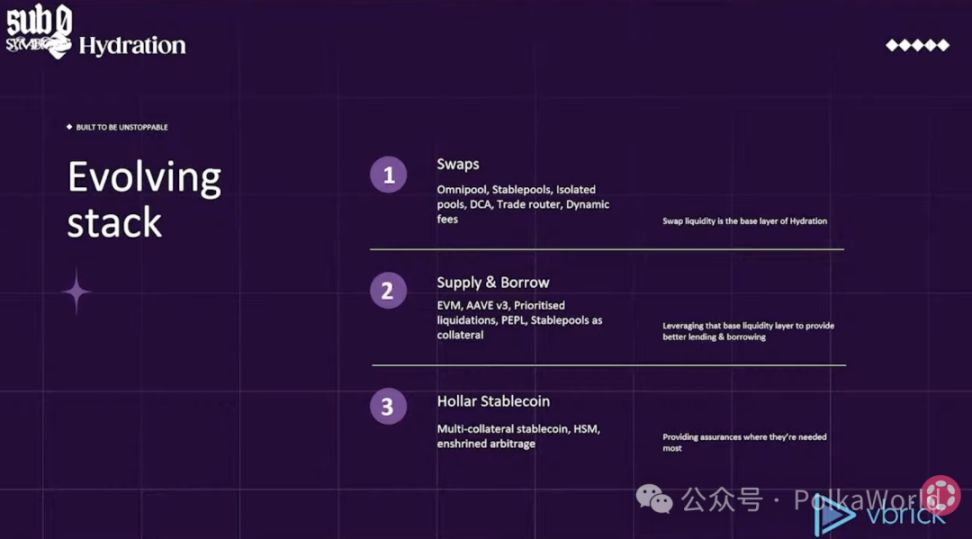

Hydration Builds a Complete DeFi Trinity

Hydration is a one-stop DeFi ecosystem built on Polkadot, integrating three key functions—trading, lending, and stablecoins—on a highly scalable application chain. This chain is tailor-made for DeFi scenarios from the ground up, with every design decision centered around DeFi needs, giving it a performance and adaptability edge over general-purpose smart contract chains that aren’t optimized for specific use cases.

The Hydration ecosystem wasn’t built all at once, but has been gradually refined through years of iteration. The “three pillars” we refer to were formed through continuous advancement:

1. Foundational Capability: Trading (Omnipool)

A few years ago, we launched the Omnipool all-asset pool, which disrupted the traditional Uniswap-style multi-pool model. We abandoned the fragmented multi-pool structure and instead allowed all assets to be exchanged with each other in a single pool.

Afterwards, we continued to expand capabilities based on asset characteristics, for example:

- Setting up isolated pools for less mature assets to reduce system risk

- Designing stable pools for highly correlated assets

- Adding more mechanisms to improve liquidity utilization efficiency

All these designs have one goal: to maximize the efficiency of users’ liquidity.

2. Core System: Lending Protocol (Supply & Borrow)

In November last year, we launched the lending module.

Hydration is a hybrid chain:

- It uses the Polkadot SDK at the base layer

- It also has a built-in EVM-compatible layer

We chose not to reinvent the wheel, but directly integrated the market-proven Aave V3. Aave V3’s TVL has long remained stable at the $7 billions level, and its product-market fit is extremely high, allowing us to avoid the risks of developing a lending protocol from scratch.

On this basis, we also leveraged the advantages of a customizable chain to add:

- Priority liquidation mechanism

- PEPL (Protocol Executed Partial Liquidation)—I’ll explain this in detail later

- Support for a wider range of asset types as collateral

3. Complete Loop: Stablecoin (Hollar)

The final key piece is the Hollar stablecoin, which officially launched in the past month or two. Hollar is a multi-collateral asset stablecoin pegged to $1.

We have built a complete set of native on-chain stabilization mechanisms for it, including the Hollar Stability Module. Unlike most stablecoins that rely on external institutions to adjust prices, Hollar’s stabilization mechanism is fully built into the chain, with transparent and public rules, automatic execution, and no need for manual intervention.

Our strategy has always been to advance steadily: launch first, let the market test, then optimize and iterate based on feedback.

So far, growth has been good. The last time I showed data, daily trading volume was about $60 millions to $80 millions. With the launch of the “Giga of Hydration” campaign earlier this year, the overall scale has grown even more significantly.

5 Native Technologies Unique to Hydration: From Cross-Chain Protection to Smart Liquidation

Next, I want to highlight some of Hydration’s coolest and most unique features—these capabilities are rarely seen elsewhere and will help you intuitively understand that Hydration is not just about putting common protocols on-chain, but about continuous innovation at the native level.

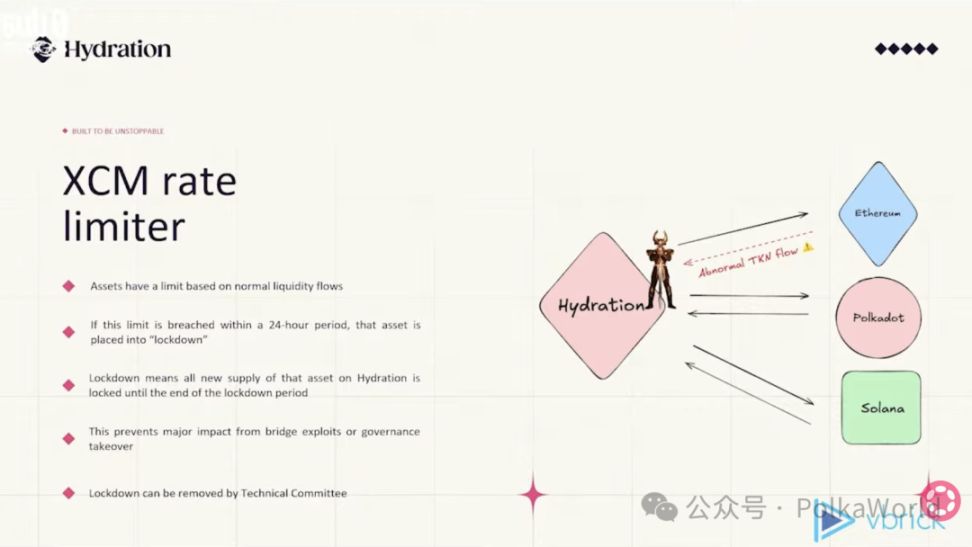

1. XCM Rate Limiter

I originally wanted to name it Heimdall, but the team generally didn’t like that name, so I’ll just use this cool illustration to show it.

The core idea of this mechanism is: We set thresholds based on the normal daily on-chain flow of certain assets. For example, a certain asset typically has about $10 millions of cross-chain inflow and outflow on the Hydration chain each day. If cross-chain flow suddenly exceeds this limit on any given day, the excess assets will automatically be locked; during the lock-up period, all new liquidity exceeding the threshold will also be paused.

The significance of this feature is: When a cross-chain bridge is attacked or there is abnormal capital flow, the system can immediately self-protect, giving the community ample time to investigate and, if necessary, pause related processing.

2. PEPL: Protocol Executed Partial Liquidation

In traditional lending markets, once your position triggers the liquidation line, liquidators often liquidate half your position at once because it’s most profitable for them, and you bear significant losses.

PEPL takes a completely different approach: it calculates the minimum liquidation amount needed to return the position to the safe zone and only executes that necessary portion.

More importantly, liquidation is executed directly by Hydration’s sequencer or collator nodes, so the trigger speed is definitely faster than external liquidators. This brings several benefits:

- Protects users and reduces unnecessary losses

- Improves liquidity security

- Allows us to offer higher LTV (loan-to-value) ratios than Aave

- Keeps as much value as possible in users’ hands, not liquidators’

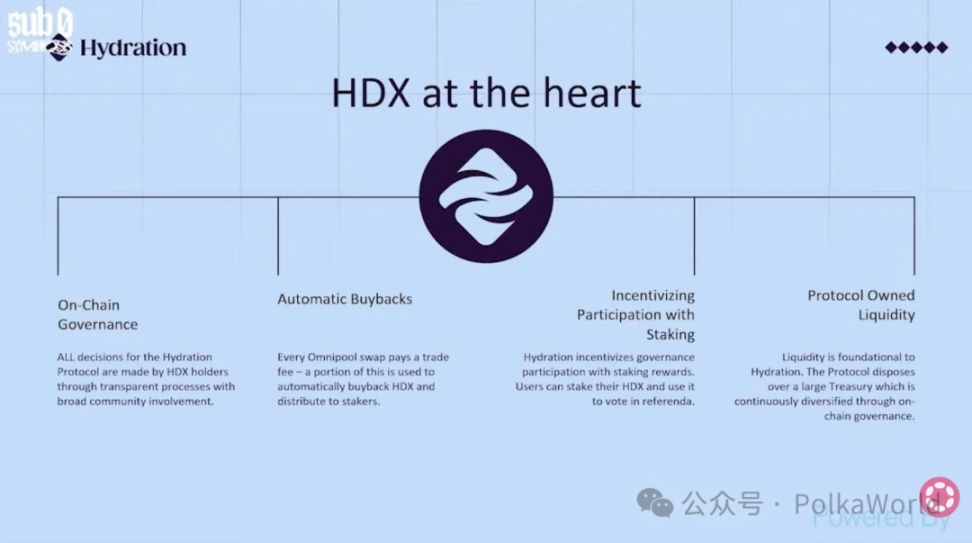

3. HDX: Hydration’s Core Token

HDX is not just a governance token.

We have built a continuous automatic buyback mechanism on-chain—in every block’s idle time, the system continuously performs small buybacks. This means that the HDX/H2O trading chart on Dex Screener will show many small trades, which is itself a strong bullish signal.

Additionally, HDX is also the pillar of protocol-owned liquidity. According to the latest data I saw, Hydration holds about $20 millions–$30 millions in non-HDX assets as reserves.

But we are still improving: we are currently exploring a mechanism called GigaHDX, which gamifies the current HDX staking system, allowing the most bullish HDX users to lock up their tokens and borrow against their positions.

4. Perpetual Contracts (Perpetuals)

The “trading, lending, stablecoins” we mentioned earlier are the three classic pillars of DeFi, and perpetual contracts are considered the “fourth pillar.” Recently, you’ll see very active user activity on protocols like Hyperliquid, Lighter, Aster, etc.

Perpetual contracts allow users to bet on market trends without holding the underlying asset. Seamlessly integrating perpetuals into our one-stop DeFi ecosystem will bring many new innovative use cases.

If you’re interested in the deep value of perpetual protocols, you can check out our co-founder Jakub’s talk at Sub0, where he will break it down systematically.

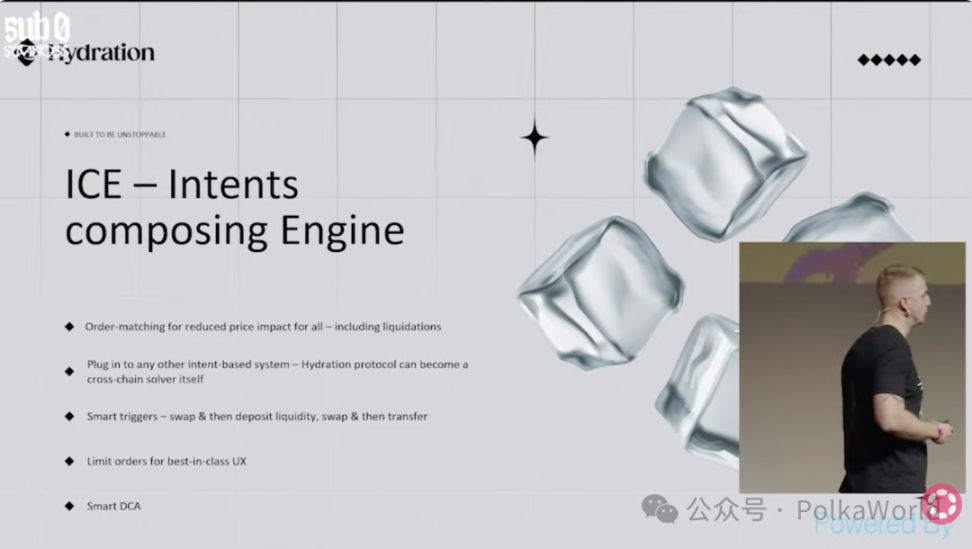

5. Intents Composition Engine

Recently, the concept of “Intents” has become very popular on-chain, such as direct cross-chain swaps, or getting the price of another chain on a given chain—these needs are becoming more frequent.

In fact, Hydration started developing related systems as early as last year—you may have seen a preliminary introduction in our CTO’s speech.

But our approach goes further than most protocols: the Hydration protocol itself can act as a Solver and supports smart triggering.

Here are a few examples:

- Complete a swap, then automatically deposit the result into liquidity mining

- Swap first, then automatically repay a loan

- Combine multiple steps into a “one-click” operation

This greatly improves user experience and execution efficiency, and opens up space for more complex DeFi composable strategies.

Hydration Announces Three Disruptive Features

For the past five years, we have been building the infrastructure to support “unstoppable free finance.” As you just heard, we have built many underlying modules around security and have already integrated a large number of core DeFi components into the protocol.

But for us, another equally important direction is: user experience (UX).

Next, I’ll share three new capabilities built to improve user experience.

1. Omnichain Treasury

The goal is simple: expand Hydration’s protocol treasury to multiple chains.

Not just on the Hydration main chain, but also including:

- Ethereum L2

- Polkadot Asset Hub

- More chains in the future

This brings very powerful capabilities, such as:

- “Cross-chain instant execution” on different chains

- Managing yields on the user’s chain

- And synchronizing yields back into the Hydration ecosystem

This opens up huge possibilities for future cross-chain applications.

2. Yield Vaults

This concept is similar to GigaDot or other “Giga strategies,” but we do it at a deeper level and with more security.

We will:

- Create strategic yield vaults for different tokens

- Users deposit funds

- The protocol automatically and steadily generates yields for users

Simply put, this is a protocol-driven, automated, and secure “on-chain wealth management infrastructure.”

3. Smart Accounts

This is a feature we value highly. Smart accounts give users truly programmable account systems, but the operation is very simple and intuitive. You can use:

- Wallet

- Mobile phone

to directly control this account.

The reason we are doing these three things is that the user experience of the entire DeFi industry is still very poor and far from the threshold for mass adoption.

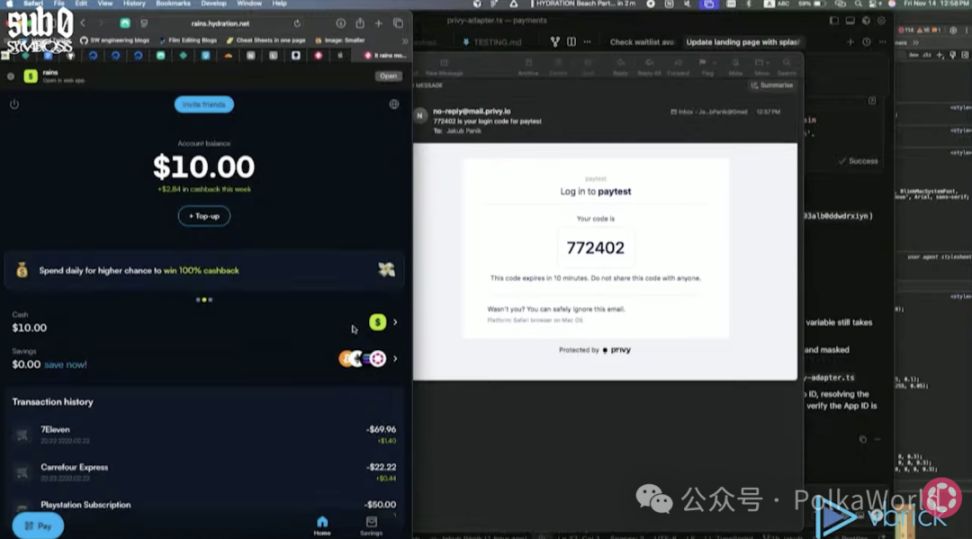

Therefore, I would like to officially introduce our new product: Rains.

Rains Makes a Grand Debut, Expected Full Launch in Q2 2026

Rains is simultaneously:

- A self-custodial smart wallet

- An automated yield-generating savings app

- An on-chain collateralized credit line

We have already brought the app—just install it and you’ll see a beautiful interface and very smooth interactions. I just created an on-chain wallet on the Hydration mainnet and received a $10 airdrop. The app is now running live on the mainnet.

With Rains, users can:

- Make payments

- Save

- Borrow

- Spend

- Even win rewards (with some gamification elements, though this part is still pending compliance approval)

If you want to try it, as long as you have a stable internet connection, you can scan the code to register and use it right now. Maybe you can even use it to buy a beer upstairs later, haha.

As for the launch timeline, our plan is

- Q1: Launch QR code payments in Latin America, including Argentina and Brazil

- Q2: Full-featured version of Rains to be released

That’s the end of my sharing. Thank you all very much for listening, and you’re welcome to experience Rains for yourselves! Hope you’ll like it!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The rate cut illusion is shattered, the AI bubble is shaking, and Bitcoin leads the decline: this round of plunge is not a black swan, but a systemic stampede.

Global markets experienced a systemic decline, with U.S. stocks, Hong Kong stocks, A-shares, bitcoin, and gold all falling simultaneously. The main reasons were a reversal in Federal Reserve rate cut expectations and Nvidia's positive earnings failing to boost prices. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Bitcoin drops from 120,000 to 90,000: I didn’t sell at the top, but these five major signals tell me—the bull market isn’t dead yet

Bitcoin's price has recently dropped sharply, causing panic in the market. However, comprehensive analysis indicates this is a short-term bearish correction rather than a full-scale bear market, and the long-term bull market may continue until 2026. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

From "Too Early" to "Just Right": Polkadot Is Welcoming Its Perfect Timing!