Nexus Ecosystem: The DeFi Goldmine in the New Market Cycle

At the beginning of this year, with the advancement of the GENIUS Act and the CLARITY Act, as well as policy initiatives such as allowing 401(k) retirement plans to allocate Bitcoin, traditional financial capital began accelerating its entry into the crypto sector. Meanwhile, rate-cut expectations have boosted market risk appetite, crypto ETFs continue to attract incremental capital inflows, and the DAT Treasury model provides long-term liquidity support—all together driving the market’s recovery.

Under the convergence of multiple forces, the total cryptocurrency market capitalization has rebounded and surpassed $4 trillion, becoming a key milestone for the return of market confidence. In this new wave, both users and capital are rapidly migrating from centralized systems to on-chain ecosystems. DeFi market activity has risen significantly, and TVL continues to hit new all-time highs.

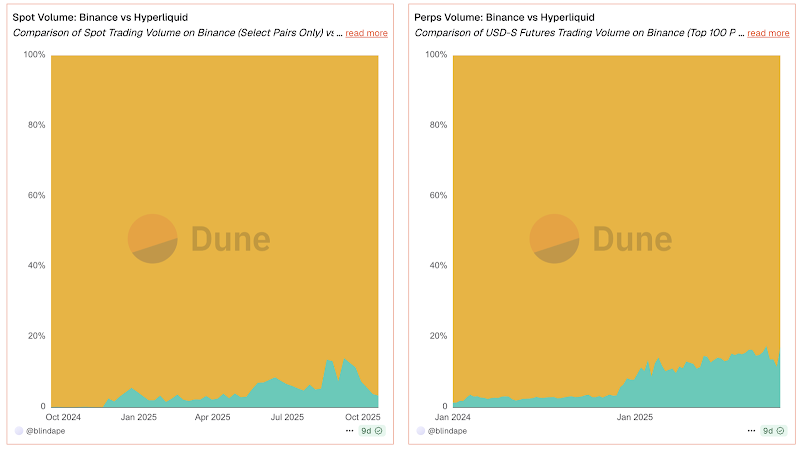

In fact, the recent performance of the on-chain derivatives market is already highly representative. By mid-2025, DEX perpetual contracts accounted for around 20%–26% of global perpetual trading volume—compared to single digits just two years earlier. The DEX-to-CEX futures trading volume ratio reached about 0.23 in the second quarter of 2025. This is a clear and directional signal indicating that liquidity and users are migrating on-chain.

Hyperliquid vs Binance — Source: https://dune.com/blindape/hyperliquid-vs-binance

Concerns Behind DeFi’s Rapid Growth

The rapid growth of DeFi represents the vibrant energy of a flourishing crypto market, but beneath that rapid rise, the structural bottlenecks of DeFi are becoming increasingly apparent.

The most critical issue lies in execution performance. In reality, the actual TPS of mainstream public chains today generally remains in the hundreds to thousands range—insufficient to support institutional-grade matching and high-frequency strategy execution. For example, Ethereum still relies on Layer 2 scaling, while Solana, under high-load scenarios, continues to face risks of halts and packet loss, making it impossible for on-chain order book systems to achieve true millisecond-level responsiveness. Insufficient performance directly leads to slippage premiums and unpredictable liquidations, which in turn deters large-scale institutional capital from entering the market.

The fragmentation of liquidity has become the biggest barrier to improving capital efficiency. Currently, assets are distributed across dozens of chains, and cross-chain transactions rely on third-party bridge protocols for secure custody. According to Chainalysis data, more than $2.5 billion in historical security losses have been related to cross-chain bridges—meaning that the bridge-based structure itself constitutes a systemic risk. Fragmentation not only increases transaction path costs but also prevents yield from circulating efficiently and regenerating within the market.

In addition, trading and investment scenarios are largely fragmented: users often have to move assets frequently between DEXs, lending protocols, and strategy platforms, keeping capital utilization rates persistently below potential. On-chain yield remains “window-based” rather than “structural,” with its lifecycle still dependent on incentives rather than market fundamentals.

Of course, we also observe hidden obstacles on the institutional side. Once high-speed strategies are executed on-chain, they are exposed to risks such as front-running, MEV extraction, and counterparty surveillance, while smart-contract-level risk control frameworks still lack sufficient flexibility. As a result, high-frequency trading institutions tend to migrate to semi-centralized platforms such as Hyperliquid, rather than operating fully within public blockchain environments.

This reveals a clear reality: institutions are not unwilling to move on-chain—DeFi simply cannot yet safeguard their strategic capabilities and core competitiveness.

The Transformation Brought by the Nexus Ecosystem

In fact, from our perspective, innovation in a single dimension is no longer enough to push DeFi into its next phase. While many products are designed with forward-thinking concepts, their advantages are often constrained by limitations in base-layer chain performance, asset interoperability, and execution efficiency — preventing true potential from being realized.

At the same time, we’ve also observed a common phenomenon: a wave of so-called “high-performance” new public chains often launch with strong momentum, only to quickly lose steam in competition due to a lack of ecosystem depth, capital capacity, and user growth mechanisms — becoming representative cases of “excess performance, insufficient applications.”

We believe that true market breakthroughs must come from a comprehensive enhancement of ecosystem synergy — a complete loop of performance, liquidity, execution systems, user experience, and financial infrastructure. Every part matters. Therefore, the Nexus Ecosystem’s strategic direction is to build a new generation of on-chain financial systems through full-stack capabilities, redefining the paradigm.

So, what exactly is the Nexus Ecosystem?

At its core, the Nexus Ecosystem is designed to achieve unified cross-chain liquidity and natively efficient on-chain execution — ensuring that transactions are no longer constrained by base-layer limitations. It is composed of a “Trinity” structure: Nexus Chain (a high-performance public chain), Nexer DEX (a derivatives trading engine), and NexBat (an AI-native smart wealth management platform). This architecture deeply links public-chain performance, derivatives liquidity, and intelligent capital management into one cohesive system.

Through self-developed high-performance L1, chain-level orderbook matching, ZK-Proof-based cross-chain communication, and an AI-powered liquidity engine, Nexus is not merely solving performance and security issues — it is providing institutional and high-frequency traders with a fully on-chain, trustless, CEX-grade full-stack financial infrastructure. The goal is clear: to become the execution base and value center of the next-generation DeFi super ecosystem.

The Superhighway of Web3: Nexus Chain

Nexus Chain is a next-generation high-performance Layer 1 launched by the Nexus Ecosystem — we describe it as the superhighway of the Web3 world.

Through an architecture specifically designed for trading scenarios, Nexus Chain equips blockchain with the foundational capacity for CEX-level financial execution. Its core mission is to reconstruct the decentralized finance execution layer with real-time responsiveness, native cross-chain interoperability, and verifiable security.

The high performance of Nexus Chain comes from our self-developed NexusBFT consensus algorithm, an optimized variant based on HotStuff and CometBFT. It achieves second- to millisecond-level finality, enabling real-time on-chain matching and settlement without missing market price windows. Meanwhile, its parallelized virtual machine architecture (EVM + WASM / RISC-V zkVM) significantly enhances strategy and trade execution capabilities — fully compatible with mainstream ecosystems while supporting off-chain proof computation, achieving both high performance and verifiability.

While ensuring high performance, Nexus Chain also features a native cross-chain interoperability layer. Through a zk-proof-powered global communication protocol, Nexus Chain enables truly native interoperability — without bridges or multi-custodial trust layers. Its “Native Mesh” asset layer allows multi-chain assets to be directly injected into execution flows, drastically reducing cross-chain costs and attack surfaces, providing institutions with stronger capital security guarantees.

To simplify the complexity inherent in crypto-native interactions, Nexus Chain integrates gas abstraction, signature-free operations, and CEX-level user experience optimization, making it truly accessible to mainstream users. Strategy execution becomes transparent, fast, and trustworthy — every transaction achieving maximum efficiency under system-level safeguards.

With its verifiable performance, robust security, and universal design, Nexus Chain is far more than just another blockchain. We see it as the execution engine and trusted coordination layer for the future of on-chain finance. Its unleashed performance and connectivity will form the solid foundation for derivatives markets, multi-chain financial products, intelligent strategy execution, and institutional capital inflows.

NexBat Protocol: An AI Agent–Powered Native Intelligent Yield System

NexBat is the native yield-generation and strategy-execution component within the Nexus Ecosystem, powered by a self-developed AI strategy engine. Its goal is to transform on-chain liquidity from traditional static staking models into an intelligent execution system with sustainable yield generation and integrated risk management. By deploying the AI strategy engine directly at the chain-level execution layer, NexBat ensures that yield sources are both real-time responsive and transparently verifiable, addressing one of DeFi’s key problems today — dependency on subsidy-driven, non-sustainable yields instead of market-driven returns.

Thanks to the high-performance architecture of Nexus Chain, NexBat achieves millisecond-level execution feedback, higher capital utilization, and a more resilient liquidation environment at the base layer. Compared to other AI strategy protocols built on generic public-chain infrastructure, NexBat offers far stronger execution determinism in latency control, matching priority, and on-chain risk management synchronization. This ensures that strategy performance is no longer limited by network congestion or cross-chain friction, providing capital with a truly institutional-grade execution environment.

NexBat adopts a PoLW (Proof of Liquidity Work) mechanism — a liquidity work-proof model that quantifies capital value through actual execution contribution. Its yield sources span a wide range of activities, including on-chain quantitative strategies, MEV capture, arbitrage execution, smart-money tracking, and external strategy integration, all fully verifiable through on-chain receipts. This structure not only expands the yield universe, but also ensures that strategies remain low-correlated and risk-diversified.

At the same time, NexBat introduces an open strategy collaboration framework, enabling institutional quant teams, third-party strategists, and AI market-making systems to connect through standard interfaces — forming a multi-entity, multi-path liquidity network for collective yield growth. The data generated from strategy execution continuously feeds back into model training, allowing the system to self-optimize over time and achieve a compounding scalability effect.

Of course, NexBat’s role extends far beyond being just an “intelligent yield engine.” With its AI-driven strategy execution framework and Nexus Chain’s native cross-chain capabilities, it is rapidly evolving into the liquidity hub of the entire network. NexBat can aggregate and intelligently route capital from multiple chains and protocols, continuously capturing on-chain yield opportunities while transforming liquidity into a schedulable and reusable base resource.

As a result, NexBat not only enhances the overall capital efficiency of the Nexus Chain but also establishes a self-compounding liquidity foundation for the on-chain financial world — one that grows, adapts, and evolves along with the ecosystem itself.

Nexer DEX: A Decentralized Trading Engine with CEX-Level Performance

Within the Nexus ecosystem, Nexer DEX plays a core role in executing on-chain financial transactions. Its goal is clear and unwavering: to bring the performance and experience of centralized exchanges back to a decentralized world where users truly own their assets.

Unlike most DEXs that still rely on off-chain matching or are constrained by public chain performance, Nexer chooses to operate on the Nexus Chain using a native on-chain order book. Leveraging the NexusBFT consensus and parallel execution architecture, order processing and price matching can be completed in milliseconds, ensuring that professional traders and strategy systems do not miss market opportunities due to on-chain latency. All trades, settlements, and fund changes are recorded on-chain in real time, guaranteeing transparency and completely avoiding the black-box risk control and order manipulation risks common in centralized architectures.

Beyond performance, Nexer DEX also considers liquidity the lifeline of its on-chain market structure. The platform features an AI-enhanced intelligent liquidity engine that dynamically manages order depth, market-making parameters, and risk exposure through a strategy learning model. Asset liquidity from multiple chains is aggregated and enters the market through a native mesh interoperability mechanism, enabling Nexer to achieve more sustainable funding without relying on external bridges or custody. Slippage in typical scenarios can be reduced to below 0.05%.

With hedge funds and quantitative institutions exploring on-chain execution, privacy protection is becoming crucial for decentralized exchanges to attract institutional funds. To address this, Nexer introduces a zero-knowledge proof mechanism at the matching layer, supporting order hiding and fair bidding. This maintains market transparency while preventing front-running and malicious tracking strategies, creating an institutional-grade crypto trading environment. Furthermore, a unified margin and multi-asset collateral system maximizes capital efficiency, making on-chain risk management more aligned with the habits of traditional finance and professional participants.

In the new market cycle, DeFi is a hotbed for investment.

In fact, in this new market cycle, the real growth of DeFi is returning to a more fundamental question: why should funds flow on-chain?

They should flow in scenarios with higher win rates, lower costs, and proven correct execution, returning to execution efficiency and unit economics.

On-chain finance truly possesses the ability to compete with traditional markets only when transactions and settlements can be completed at millisecond speeds, when assets can migrate seamlessly across multiple chains, and when strategy execution has engineering-grade privacy and risk protection. Subsidies and narratives can only drive short-term hype, while systems that can accumulate auditable returns can consistently outperform the cycle.

We believe this shift has already shown a clear structural path:

- The source of returns is shifting from inflation incentives to the real capture of transaction fees and strategy PnL;

- Capital is shifting from passive competition on a single chain to a high-turnover system with unified settlement across the entire chain;

- Transaction triggering mechanisms are moving from manual responses to automated execution synchronized with the consensus layer.

These three upgrades together constitute the competitive moat of DeFi in the next stage: high-certainty execution capability, sustainable liquidity enhancement, and institutional-grade risk control standards.

In this market context, the Nexus ecosystem is seen as a "gold mine" for the next cycle primarily because it vertically integrates the chain (Nexus Chain), the trading system (Nexer DEX), and the yield-driven layer (NexBat), converging all key elements affecting win rates and cash flow into a single, verifiable execution system.

- The NexusBFT consensus and parallel virtual machine structure enable millisecond-level finality in matching and settlement;

- The Native Mesh interoperability architecture reduces cross-chain risks, ensuring execution paths remain within the platform's security boundaries;

- Privacy verification capabilities and execution auditing mechanisms provide a unified balance of transparency and trust for high-frequency strategies and institutional funds.

Within this architecture, NexBat forms the yield hub. Through AI-driven market detection, fund allocation, and yield repatriation, the execution structure becomes self-reinforcing: transaction data, market feedback, and model training form a closed loop, making subsequent executions smarter and more precise. Rewards no longer rely on a mining-withdrawal-selling cycle, but rather on real transaction fees, strategy PnL, and the return of price spreads from structured products, driving the continuous expansion of the protocol treasury and liquidity pools.

Simultaneously, Nexer DEX directly translates this structure into trading efficiency and profitability. On-chain order books increase liquidity density, a unified margin system amplifies capital utilization, a smart routing mechanism dynamically optimizes slippage and depth, and ZK technology maintains fair matching, ensuring no preemption in high-frequency and high-volume trading environments. Reward sources are clearly calculated and fully recovered, forming a positive cycle: stronger execution leads to higher fees and rewards; a deeper treasury results in better execution efficiency.

In summary, Nexus constructs a sustainable DeFi unit economic model: rapid execution improves transaction quality, fees and PnL are more stable, pool expansion reduces costs, win rates and returns are further enhanced, and an industry chain centered on verifiable cash flow and cross-chain funding efficiency is formed. Funds entering Nexus are continuously activated and dynamically allocated, seeking higher marginal returns across the entire chain.

Therefore, Nexus provides the foundation for the next DeFi cycle's growth. It's not a temporary refuge for capital, but a value haven tightly coupled with a robust return mechanism and execution system. If DeFi is to redefine its growth logic, we believe the Nexus ecosystem represents where this answer is taking shape.

Our Future

As core infrastructure gradually matures, Nexus is expanding toward a broader financial landscape.

Whether it is monetizing RWA (Real-World Assets) on-chain, implementing structured derivatives at scale, or integrating emerging scenarios such as prediction markets and payment networks, these developments will further extend the protocol’s value capture.

Nexus’s goal is not merely to provide trading and yield opportunities for crypto assets; it aims to build an intelligent financial infrastructure network capable of supporting global multi-asset pricing, settlement, and strategy execution.

If traditional finance can be seen as a dual system of information and capital flow, Nexus is driving a new industry paradigm: enabling assets, computing power, and intelligence to collaborate freely on-chain.

Here, execution efficiency represents competitiveness, strategy intelligence represents growth potential, and capital efficiency ultimately determines the ecosystem’s scale. A more deterministic path is emerging — Nexus aspires to become the intersection of Bloomberg, Nasdaq, and BlackRock in the Web3 world, serving as the hub of a global intelligent financial network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rebuilding Order Amid Crypto Chaos: Where Will the Next Wave of Liquidity Come From?

Jesse Pollak Launches Controversial JESSE Coin on Base App

In Brief Jesse Pollak's JESSE coin is set to launch through the Base App. Pollak warns against scams and ensures only official announcements are credible. The launch reignites debate on digital identity and security in decentralized protocols.

BlackRock prepares a new Ethereum ETF with integrated staking