Mizuho bearish on Circle's shares, sees stock falling to $70 amid earnings and competition risks

Quick Take Mizuho Securities maintained an “underperform” rating on Circle’s stock while lowering its share price target to $70. Trading at roughly $82, CRCL shares are down nearly 40% over the past month.

Mizuho Securities grew slightly more bearish on Circle Internet Group’s shares on Friday.

The firm's analysts reduced their base case price target to $70 from $84. Circle's shares (ticker CRCL) were trading at roughly $82 on Friday, down nearly 40% over the past month.

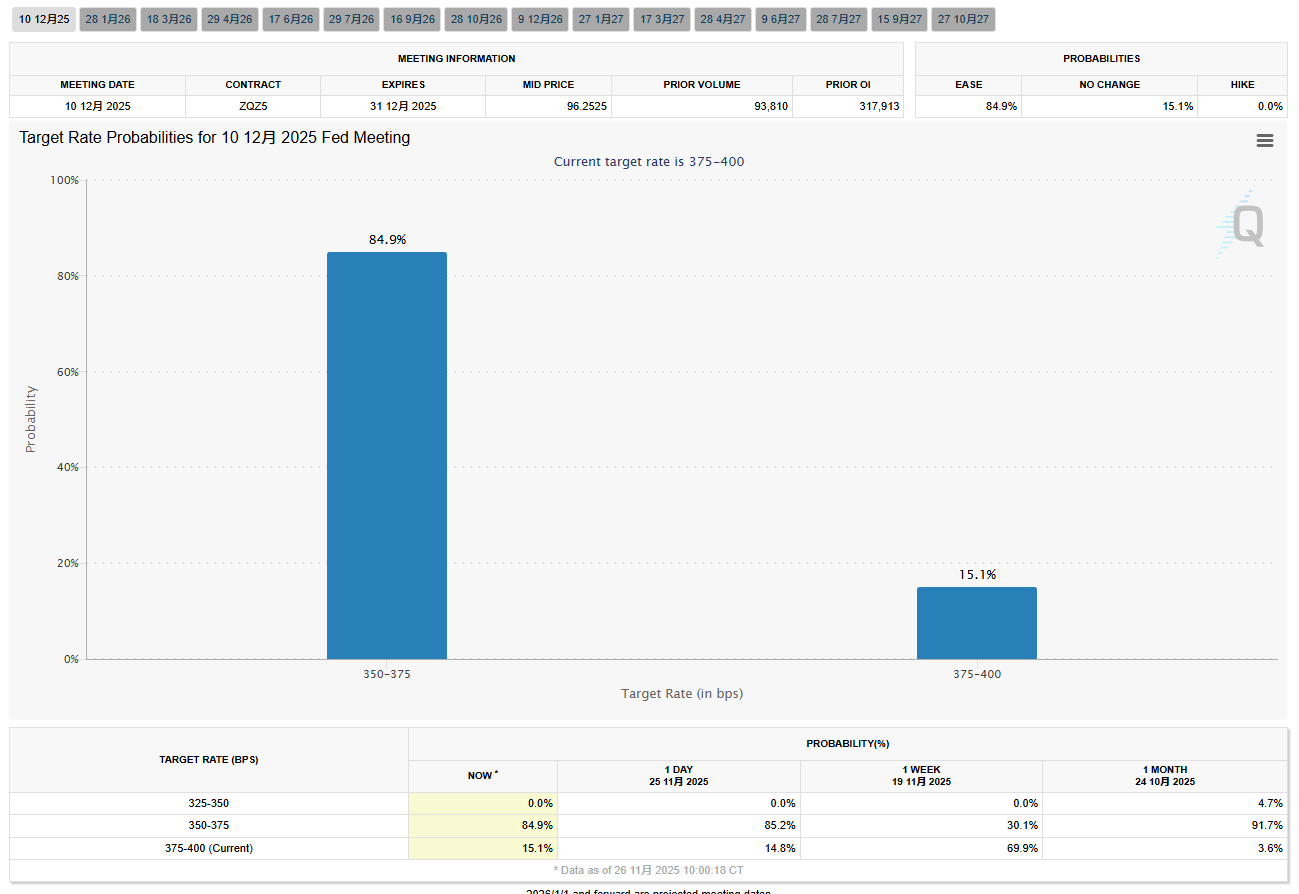

"We do not believe CRCL's valuation appropriately reflects key risks to the earnings over the medium-term," Mizuho analysts said in a research note. The analysts also said looming risks include "looming interest rate cuts, relatively stagnant USDC circulation, and structurally high (and growing) distribution costs," and increasing competition among stablecoins.

Measured by supply, USDC is the world's second-largest stablecoin behind Tether's USDT.

Circle's shares began trading in June in a blockbuster IPO , with the stock rocketing over 200% to over $90 per share on its first trading day. At one point, the company's shares hit about $250.

Mizuho's prediction contrasts sharply with JPMorgan analysts , who this week upgraded the company's shares to "overweight," issuing a new stock price target for Circle of $100 by December 2026.

"CRCL is likely to see downward revisions to consensus estimates over the coming years amid declining rates, less stellar proliferation than many are hoping for of its USDC stablecoin, and growing costs to distribute the coin," Mizuho also said.

Mizuho's bull case price target for Circle's stock is $251, while its bearish target is $38.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the four-year cycle of Bitcoin coming to an end?

Bitcoin breaks the Thanksgiving curse, returns to the $90,000 mark!

Altcoin ETF Acceleration Race: Six Months to Complete Bitcoin’s Ten-Year Journey

![[Bitpush Daily News Highlights] JPMorgan expects the Federal Reserve to cut rates in December, overturning last week's forecast; Bloomberg analyst: Nasdaq ISE proposes to raise IBIT options position limit to 1 million contracts; the US extends some China tariff exemptions until November 10, 2026; Opinion: Gold price to approach $5,000 in 2026, will break another historic milestone in 2027](https://img.bgstatic.com/multiLang/image/social/36cf6fca0c010535f81683c20d2ea6141764227343223.png)