Morning News | Lighter 24-hour trading volume surpasses $11 billion; Circle Q3 financial report released; Strategy U.S. stock market value falls below its BTC holdings value

Overview of important market events on November 12.

Compiled by: ChainCatcher

Key News:

- Binance will discontinue its Binance Live platform service, while Binance Square will continue to provide live streaming services

- The largest Bitcoin treasury company, Strategy, sees its US stock market value fall below its BTC holdings value

- Data: Lighter's 24-hour trading volume surpasses $11 billion, ranking first among Perp DEXs

- Yellen: Trump's $2,000 payout is a tax rebate for low-income families, tariff dividends yet to be decided

- Data: US government shutdown causes the crypto market to lose $408 billion in growth potential

- Privacy blockchain Seismic completes $10 million financing, led by a16z crypto

- Circle Q3 financial report: USDC circulation up 108% year-on-year, net profit up 202%

What important events happened in the past 24 hours?

Binance will discontinue its Binance Live platform service, while Binance Square will continue to provide live streaming services

According to ChainCatcher and the official announcement, Binance will discontinue its Binance Live platform service on December 31, 2025. After that, Binance Square will continue to provide live streaming services for users. The Binance Live web and app will be inaccessible starting from January 1, 2026, 07:59 (UTC+8).

From the date of the announcement until December 1, 2025, 08:00 (UTC+8), any host who creates at least one Binance Live stream will automatically gain access to Binance Square Live at 08:00 on December 1, 2025 (UTC+8). All points, gifts, and vouchers on Binance Live will expire after January 1, 2026, 07:59 (UTC+8).

The largest Bitcoin treasury company, Strategy, sees its US stock market value fall below its BTC holdings value

According to ChainCatcher, US stock market data shows that Bitcoin treasury company Strategy (NASDAQ: MSTR) fell nearly 2% intraday, with the current share price at $227 and a market capitalization of about $65.2 billion, which has fallen below the value of its BTC holdings.

According to coinglass data, Strategy currently holds 641,692 Bitcoins, and at a Bitcoin price of $103,000, the value of its holdings is about $66 billion.

Data: Lighter's 24-hour trading volume surpasses $11 billion, ranking first among Perp DEXs

According to ChainCatcher, DefiLlama data shows that Lighter's 24-hour trading volume surpassed $11 billion, ranking first among Perp DEXs. The second and third places are Hyperliquid ($9.1 billion) and Aster ($8 billion), respectively.

ChainCatcher previously reported that Lighter announced the completion of a $68 million financing round, led by Founders Fund and others.

Yellen: Trump's $2,000 payout is a tax rebate for low-income families, tariff dividends yet to be decided

According to ChainCatcher and Golden Ten Data, US Treasury Secretary Yellen stated that President Trump is proposing a $2,000 tax rebate for families with incomes below $100,000, with large-scale rebates to be credited at the beginning of 2026.

There will be many options for distributing tariff dividends, and the issue is still under discussion with no decision made yet.

ChainCatcher previously reported that Trump posted on Truth Social: "Anyone who opposes tariffs is a fool! We are now the richest and most respected country in the world, inflation is almost zero, and the stock market has hit record highs. 401k retirement account balances are also at all-time highs.

We earn trillions of dollars every year and will soon begin to pay down our massive $37 trillion debt. US investment is at an all-time high, with factories and businesses springing up everywhere. Everyone will receive at least $2,000 in dividends (except for high-income earners!)."

Data: US government shutdown causes the crypto market to lose $408 billion in growth potential

According to ChainCatcher and CryptoQuant analysis, the US government shutdown has had a significant impact on the growth rate of the cryptocurrency market. From October 1 to November 10, the market growth rate slowed sharply, with the total market capitalization losing $408 billion in growth potential.

Market capitalization growth rate (MA Gap Ratio) data shows that Bitcoin's growth rate fell from 16.75% on October 1 to 6.60% on November 10; the top 20 assets (excluding BTC) saw their growth rate drop from 32.29% to 14.67%; small and mid-cap assets experienced the steepest decline, with growth rates plummeting from 18.57% to just 0.21%.

The government shutdown triggered significant macroeconomic uncertainty and delayed regulatory progress such as ETF approvals. Due to the lack of official economic data on inflation and employment, the Federal Reserve faces greater difficulties in formulating monetary policy, increasing investor caution. Although Bitcoin and Ethereum have maintained historical resilience, the unstable political environment and interruptions in financial regulatory services have heightened risk perception.

Privacy blockchain Seismic completes $10 million financing, led by a16z crypto

According to ChainCatcher and Fortune, privacy blockchain Seismic announced the completion of a $10 million financing round, led by a16z crypto, with participation from Polychain, Amber Group, TrueBridge, dao5, and LayerZero.

Seismic is partnering with a fintech company called Brookwell, which provides stablecoin accounts for clients. When clients transact on Brookwell, payments are made via Seismic's private blockchain, ensuring that data is not leaked or publicly displayed.

Circle Q3 financial report: USDC circulation up 108% year-on-year, net profit up 202%

According to ChainCatcher, Circle Internet Group, Inc. (NYSE: CRCL) today released its Q3 2025 financial report. USDC circulation reached $73.7 billion, up 108% year-on-year. Total company revenue and reserve income were $740 million, up 66% year-on-year; net profit reached $214 million, up 202% year-on-year.

At the same time, Circle announced the successful launch of the Arc public testnet, attracting participation from over 100 financial and technology companies, and is exploring the possibility of launching a native Arc network token. The company also raised its FY2025 other income forecast to $90 million to $100 million.

Criminal involved in illegal blockchain financing project, She Zhijiang, extradited back to China today

According to ChainCatcher, She Zhijiang (also known as She Lunkai, Tang Kriang Kai), a Chinese national from Cambodia involved in illegal blockchain financing projects, was escorted by Thai police to Bangkok Suvarnabhumi Airport and extradited back to China today.

Previously, on November 10, the Office of the Supreme Prosecutor of Thailand stated that the Court of Appeal upheld the lower court's decision to extradite She Zhijiang for trial on charges of illegal casino operations and other violations of Chinese law.

She Zhijiang's main crime was creating and operating 239 illegal gambling websites, with funds involved exceeding 12.63 trillion Thai baht (about 2.77 trillion RMB). He has long been engaged in gambling and telecom fraud activities in Myanmar's Myawaddy KK Park and "Asia Pacific New City," luring Chinese citizens into illegal transactions through online platforms.

She Zhijiang also built Asia Pacific New City in the Shui Gou Gu area on the Thai-Myanmar border, claiming it was the first global financing project using blockchain technology, but in reality, it was engaged in online gambling and telecom fraud operations.

Fed mouthpiece: Internal disagreements on December rate cut widen

According to ChainCatcher and Golden Ten Data, "Fed mouthpiece" Nick Timiraos said that internal disagreements within the Federal Reserve have cast a shadow over the path to rate cuts.

Such a degree of disagreement is almost unprecedented during Fed Chair Powell's nearly eight-year tenure. Officials are divided over whether persistent inflation or a sluggish labor market poses a greater threat. Although investors still believe a rate cut at the next meeting is likely, this division complicates what once seemed like a feasible plan.

Coinbase and stablecoin startup BVNK cancel $2 billion acquisition deal

According to ChainCatcher and Fortune, a spokesperson for crypto exchange Coinbase confirmed that Coinbase and UK-based stablecoin startup BVNK have canceled acquisition talks. It is unclear why the two companies shelved the deal, which had reached the due diligence stage. In October, Coinbase and BVNK had signed an exclusivity agreement, meaning BVNK could not accept offers from other bidders.

A Coinbase spokesperson said in a statement: "We are constantly seeking opportunities to expand our mission and product offerings. After discussing the possibility of acquiring BVNK, both parties agreed not to proceed." BVNK helps clients use stablecoins for payments, cross-border transactions, and other applications. Its acquisition price was about $2 billion. If completed, the deal would have been nearly twice the $1.1 billion paid by fintech giant Stripe to acquire stablecoin startup Bridge in February this year.

Sharplink CEO: Firmly believes Ethereum will be the underlying infrastructure for digital finance on Wall Street

According to ChainCatcher, Sharplink co-CEO and former BlackRock head of digital assets Joseph Chalom said in an interview that he firmly believes Ethereum will be the underlying infrastructure for digital finance on Wall Street. The three main qualities financial institutions care about—trust, security, and liquidity—are all embodied in the Ethereum network. For this reason, he has staked his entire post-BlackRock career on it.

He defines Ethereum as a "multi-purpose" platform—not only supporting financial transactions but also lending, trading, NFTs, and complex applications. In contrast, he calls Bitcoin an "excellent store of value." Joseph Chalom sees Sharplink as a continuation of his BlackRock mission: to bridge traditional finance and the crypto ecosystem. "We spent decades building financial pipelines full of intermediaries, but Ethereum gives us the opportunity to rebuild these pipelines—faster, cheaper, and more securely." He does not see Ethereum as a speculative technology, but as the cornerstone of the new wave of digital finance. "One day, we will no longer say DeFi or TradFi, but simply finance. And Ethereum will be the underlying infrastructure supporting it all."

Goldman Sachs: Assuming the US government shutdown ends this week, October jobs report expected early next week

According to ChainCatcher, Goldman Sachs economists Elsie Peng and Ronnie Walker said in a report: "The US federal government shutdown delayed the release of almost all federal economic data for September and October. Although the shutdown appears to be ending, statistical agencies need time to process the backlog of data."

Goldman Sachs expects that if the US government reopens before the end of this week, the Bureau of Labor Statistics will release the latest October jobs data early next week (Tuesday or Wednesday). However, the release of other major data is expected to be delayed. Goldman Sachs said this means the November jobs report and inflation report may be "delayed by at least a week." (Golden Ten Data)

Visa launches stablecoin payment pilot, allowing creators and freelancers to receive USDC directly

According to ChainCatcher, global payments giant Visa has officially launched a stablecoin payment pilot program, allowing creators, freelancers, and businesses to receive USDC issued by Circle directly via Visa Direct, enabling instant cross-border settlement.

Visa stated that during the pilot phase, businesses can initiate payments in fiat currency in the US, while recipients can choose to receive USDC directly, with funds arriving in minutes. This will benefit users in regions with currency volatility or limited banking access. Chris Newkirk, President of Visa Commercial and Money Movement Solutions, said: "The launch of stablecoin payments means truly 'minute-level' fund settlement, allowing any user worldwide to quickly and securely receive income."

This pilot is a further expansion of Visa's stablecoin program. In September this year, Visa conducted a "stablecoin pre-funding" pilot, allowing businesses to fund Visa Direct accounts with stablecoins. This time, end users can receive stablecoins directly for the first time. Recipients must have a stablecoin wallet that meets Visa standards and pass KYC/AML verification. Visa said it plans to roll out the program to more partners in the second half of 2026, currently only supporting USDC. Since 2020, Visa has facilitated over $140 billion in crypto and stablecoin transactions and launched more than 130 stablecoin-linked card projects in 40 countries.

Foreign media: OpenAI burns up to $15 million daily for Sora video generation, annualized losses may exceed $5 billion

According to ChainCatcher and Forbes, OpenAI's video generation app Sora, despite surpassing 4 million downloads, has extremely high operating costs, spending about $15 million per day on AI video generation, with annualized spending exceeding $5 billion. Analysts estimate that generating a 10-second video costs an average of $1.3, far higher than the current level of free user usage.

The report points out that OpenAI is still in an aggressive expansion phase, not yet focusing on profitability, aiming to expand its user base and acquire video training data. Company executives admit that Sora's economic model is "completely unsustainable at present" and may reduce free usage in the future while exploring paid or advertising monetization paths.

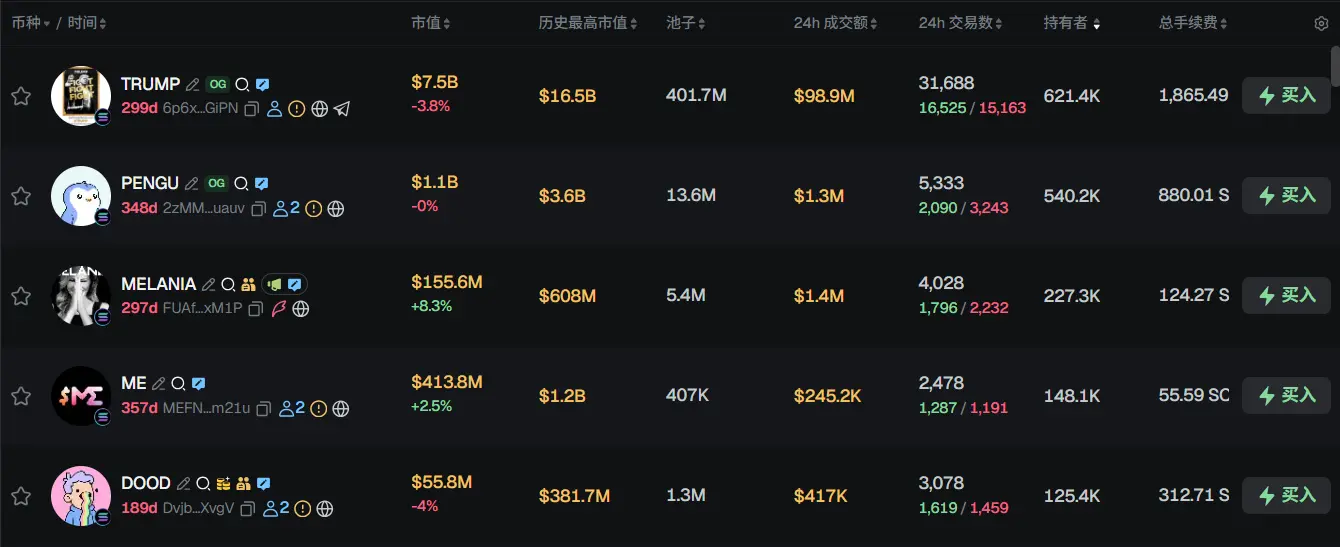

Meme Hot List

According to data from the Meme token tracking and analysis platform GMGN, as of November 13, 09:00 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, MELANA, ME, DOOD

The top five trending Base tokens in the past 24h are: ZORA, VIRTUAL, TOSHI, BRETT, AERO

What are some must-read articles from the past 24 hours?

How did he make a 100% profit shorting MSTR?

Editor's note: When Strategy turned "holding Bitcoin via a company" into a belief, Jim Chanos chose to bet in the opposite direction: shorting MSTR, going long BTC.

Seemingly divergent, but essentially the same: both sides are exploiting structural market biases, one leveraging belief, the other rationally dissecting the bubble. In this contest of valuation and liquidity, faith and skepticism are not strictly opposed, but rather two choices reflecting each other.

Has an on-chain "subprime crisis" emerged? The road to maturity for DeFi structured products

DeFi has entered a new structured phase, with institutional trading strategies being abstracted into composable, tokenizable assets.

It all began with the emergence of liquid staking tokens, and the tokenized basis trade launched by Ethena Labs became a key turning point for DeFi structured products. This protocol packages a delta-neutral hedging strategy that requires 24-hour margin management into a synthetic dollar token, allowing users to participate with a single click, thus redefining their expectations of DeFi.

Yield products once exclusive to trading desks and institutions have now entered the mainstream. USDe became the fastest stablecoin to reach $10 billion in total value locked.

Coin Metrics: Why has Bitcoin's current cycle been extended?

As long-term holders sell in batches and new participants absorb supply, Bitcoin's supply turnover rate gradually slows, showing a smoother ownership transfer state.

Since the beginning of 2024, just spot Bitcoin ETFs and crypto treasuries (DATs) have absorbed about 57% of the short-term holder supply increase, now accounting for nearly a quarter of the total circulating Bitcoin in the past year.

Realized volatility continues to stabilize, marking the maturation of market structure, characterized by institutional demand dominance and extended cycle rhythms.

Dissecting Monad's 18-page sales document: How does 0.16% market making capital underpin a $2.5 billion FDV?

As Monad (MON) tokens are about to be publicly sold on Coinbase, its 18-page disclosure document has become a market focus.

This document, provided by Monad Foundation subsidiary MF Services (BVI), Ltd., comprehensively reveals Monad's full picture, from project architecture to financing, token allocation to sales rules, transparent market maker information, and security risk warnings, providing investors with the key information needed for informed decisions and reflecting the project's commitment to transparency.

In addition to widely cited key data such as "$2.5 billion FDV," "$0.025 unit price," and "7.5% public sale ratio," the document also systematically discloses legal pricing, token release schedule, market making arrangements, and risk warnings—details that should not be overlooked.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Latest Speech by US SEC Chairman: Farewell to a Decade of Chaos, Crypto Regulation Enters an Era of Clarity

The US SEC Chairman further elaborated on the "Project Crypto" initiative, outlining new boundaries for token classification and regulation.

Circle Q3 report released: Is there a bigger game ahead?

What are the highlights of Circle's Q3 financial report, the first listed stablecoin company?

Exodus' Q3 net profit increased more than 20 times, with Bitcoin revenue accounting for over 60%.