The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.

Focus on building a good product, regardless of the application scenario.

Written by: Eric, Foresight News

Even NEAR itself probably didn't expect that the sudden rise of Zcash would bring attention to the intent-based trading protocol NEAR Intents, which launched at the end of last year.

But this surge in traffic was not without reason. Aside from US-based exchanges like Coinbase and Kraken, among the exchanges we are familiar with, only Binance and Huobi offer spot trading for ZEC. For chains that do not support smart contracts, decentralized cross-chain purchase channels are even more scarce, and NEAR Intents happens to be one of them.

A project born when intents were still a market hotspot proved its value a year later by supporting a coin that was almost forgotten.

How does NEAR Intents trade ZEC?

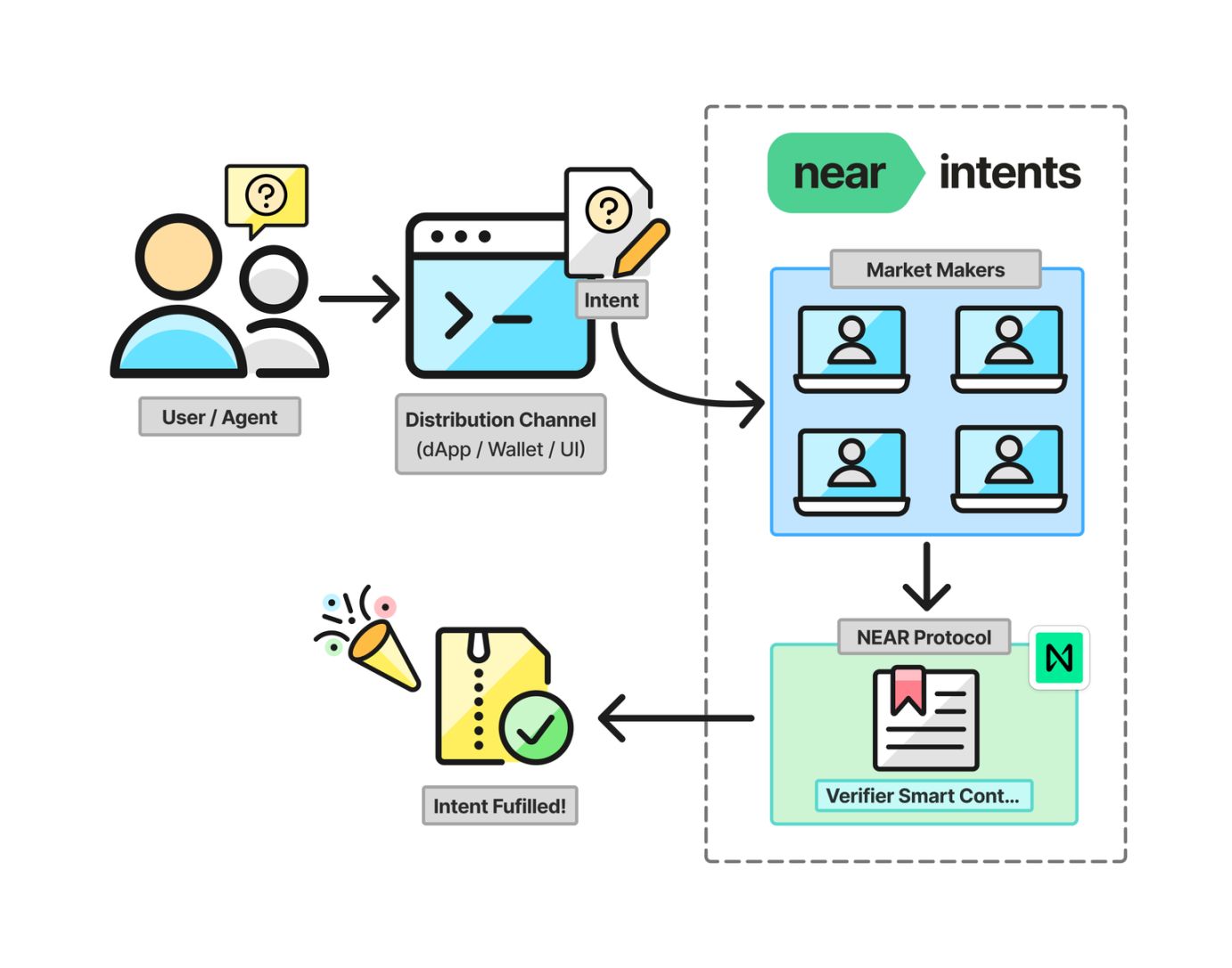

NEAR Intents is a significant achievement in NEAR’s push for chain abstraction. The very concept of intents is to allow users to specify the desired outcome without specifying the exact process, which means that cross-chain transactions do not require synchronizing the state of multiple chains. The process can be completed off-chain and then verified on-chain, with users only needing to receive the final result.

In terms of the overall process, users first submit an intent, such as using 1 bitcoin to purchase ZEC. This intent is broadcast to the network, and counterparties who receive it will provide their execution proposals. The client used by the user can then either automatically select the optimal proposal to present to the user or let the user choose for themselves.

Once a proposal is selected, the user's wallet will sign to form a commitment, which is then settled and confirmed on-chain. After that, the solver will execute the proposal, and the process is completed once the user confirms that their intent has been fulfilled. If the user is dissatisfied with the result, they can initiate a dispute. According to NEAR Intents’ terms of service, the agreement and commitment initially reached between the user and the system are legally binding, and in the future, disputes could even be resolved through appeals.

NEAR Intents consists of three core components: distribution channels, market makers, and smart contracts. Distribution channels include NEAR Intents’ own frontend as well as wallets, exchanges, and other applications that have integrated the product. Market makers here do more than just facilitate trades, as intents can involve not only trading but also shopping and other services, so they refer to any service provider that meets user needs. The contracts deployed on NEAR are used for verifying and settling transactions.

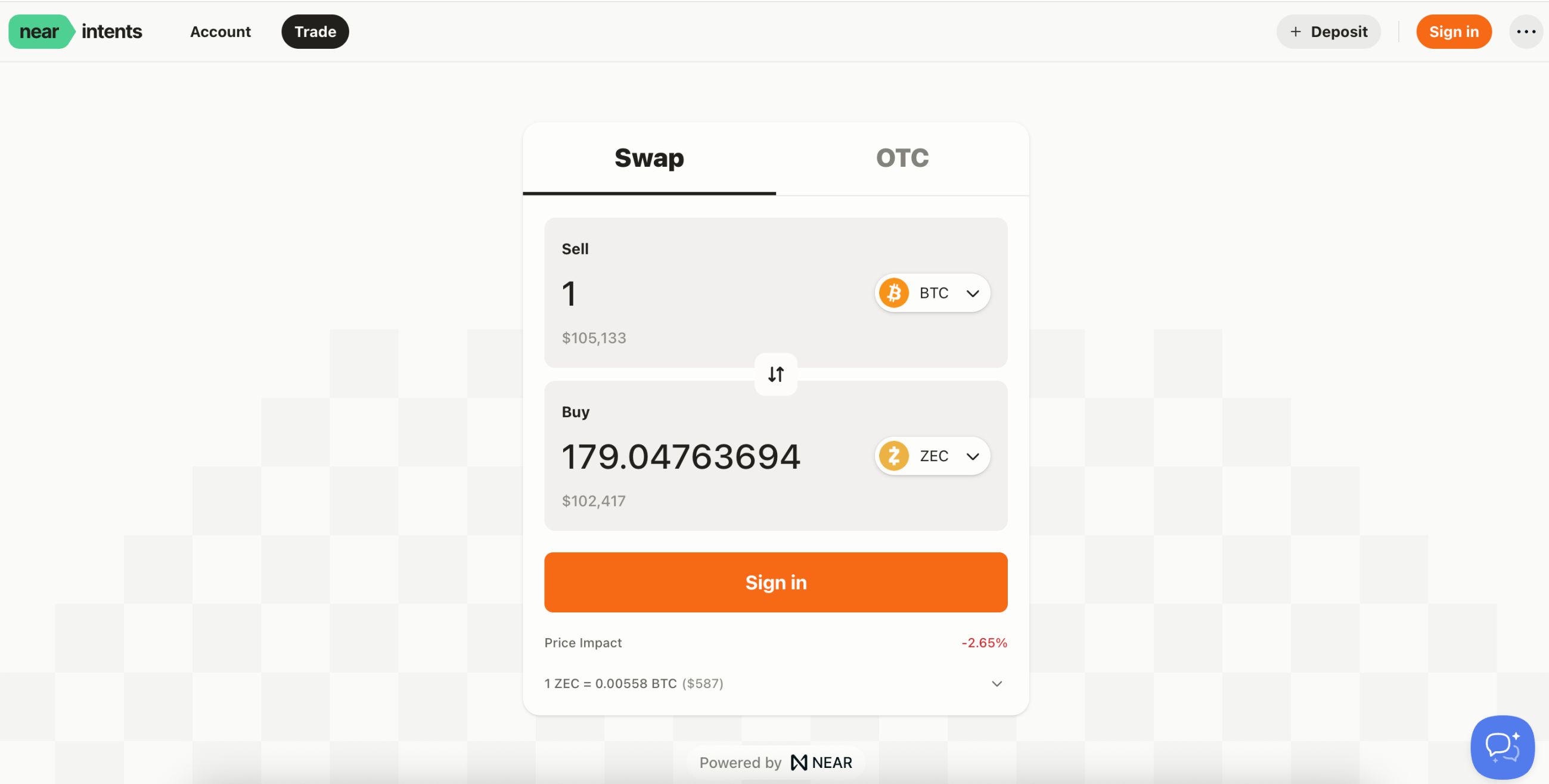

Overall, aside from on-chain verification, most steps of NEAR Intents occur off-chain. If you use 1 bitcoin to buy ZEC, you only need to deposit 1 bitcoin into the wallet provided by NEAR Intents. After the transaction is completed, NEAR Intents will transfer the corresponding amount of ZEC to your Zcash wallet. There is no asset wrapping or complex cross-chain process involved; it may simply be that a market maker behind the scenes transfers ZEC to you at the calculated exchange rate.

Based on this not-fully-decentralized model, NEAR Intents can theoretically support trading of all on-chain tokens. In addition to bitcoin and ZEC, coins like DOGE, DASH, XMR, and LTC—which also do not support smart contracts—pose no technical problem, as long as someone is willing to take the order. The order taker could even be a CEX itself, with the benefit that you don’t need to transfer assets from your wallet to the exchange and then back out again.

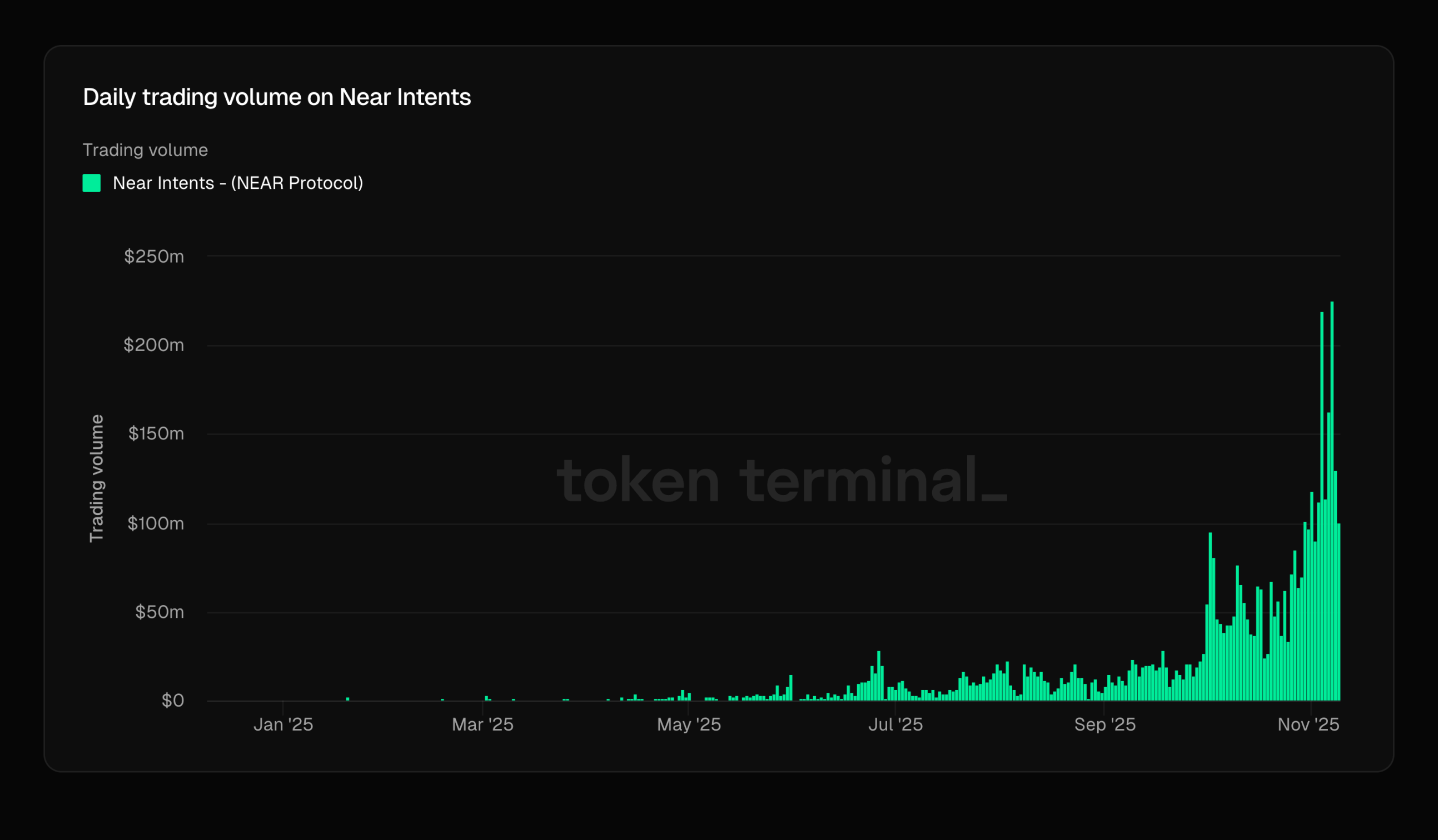

According to the data, NEAR Intents, which launched in November last year, saw lackluster trading volume at first. It only started to pick up in May this year, and after October, trading volume soared due to strong demand for ZEC transactions. However, even before ZEC, NEAR Intents had already seen trading volumes ranging from several millions to tens of millions, which at least shows that there is still market demand for trading cryptocurrencies like bitcoin and DOGE directly from wallets on DApps. Especially as trust issues with CEXs become more severe, this type of demand may continue to grow.

Intents are not limited to cross-chain trading

After years of development, not being obsessed with decentralization has become one of the directions of innovation in the Web3 industry in recent years. At the current stage of Web3, the main battlefield for intent-based products may still be meeting the demand to buy ZEC directly with ETH from a wallet. Perhaps one day in the future, if ADA becomes popular, it could happen again. But the application scenarios for intent-based products like NEAR Intents are by no means limited to this.

Meituan recently launched an app called Xiaomei to help users order takeout via AI. You enter your request in Xiaomei’s chat box, such as “a light late-night snack,” and the AI will combine your needs, your order history, and restaurant reviews on the platform to give you several options. You can pay and order directly without switching to the Meituan Waimai app.

If there were a similar Web3 application, it could easily integrate NEAR Intents’ API and the API of a large language model to achieve this functionality. For example, if I get tired while writing and want to order a coffee, I could connect MetaMask to this app and use the remaining CRV in my wallet to buy a coffee. The market makers mentioned above would help me find the optimal trading path and the lowest-fee off-ramp channel to pay for my order. All I would need to do is confirm receipt after the delivery person brings me my hot latte.

In the Web3 industry, there are many such imaginative ideas for the future, but few persist just because they see the future.

NEAR Intents is fortunate. When it initially supported the Zcash network, it probably didn’t expect a day like this would come, but this luck actually comes from day-in, day-out persistence. OpenSea, pump.fun, Polymarket, and even Internet Computer were not products born by following the crowd, but they all endured until their own moments in the spotlight.

In an industry where hot topics can change in just a week, sticking to your track might lead to obscurity due to being “outdated.” But if you persist until the future you believe in arrives, you’ll be the brightest star on the street.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News: ETF Launch Dates Confirmed as Wall Street Turns to Ripple’s Token

Bitcoin (BTC) Climbs on Economic Optimism: Here Are 5 Things to Know This Week

Stablecoins Can’t Kill XRP — Here’s What Most Critics Miss

IOTA Integrates Stablecoins to Drive Real Transactions and Ecosystem Adoption