Federal Reserve Governor Milan once again calls for a significant rate cut in December

BlockBeats News, November 11, Federal Reserve Governor Milan stated on Monday that given the softening labor market and declining inflation, the Fed should cut interest rates by 50 basis points in December. He believes that a 25 basis point rate cut is the "minimum" appropriate action.

Milan pointed out: "We have received new inflation data, and the results are better than expected, which means that compared to the September FOMC meeting, it is reasonable to adopt a more dovish policy stance. At that time, most policymakers believed that there should be a total of three rate cuts by the end of the year, each by 25 basis points."

The Federal Reserve had already cut rates by 25 basis points each in September and October. However, Milan emphasized that the unemployment rate is rising, "because the policy is too tight. Therefore, we must adjust the policy and continue to gradually lower rates to prevent this tightening from putting greater pressure on the economy, which would further push up the unemployment rate." (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bakkt's third-quarter profit reached $28.7 million, up 241% year-on-year.

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7

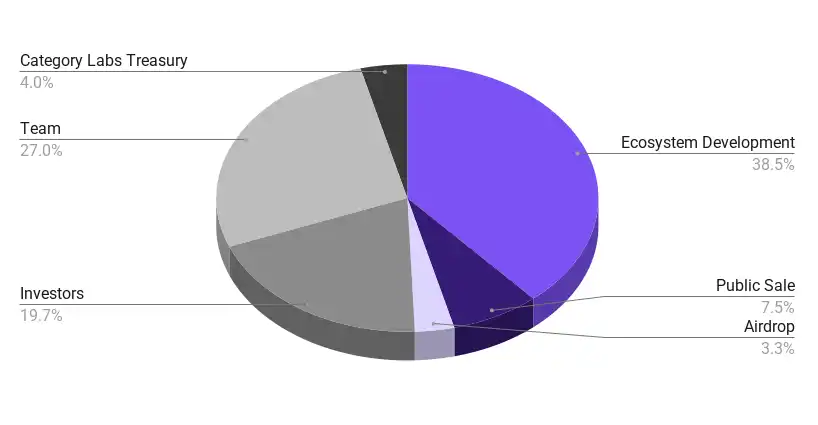

Monad announces tokenomics: total supply of 100 billions tokens, 3% to be distributed via airdrop

Trending news

MoreOverview of Monad Tokenomics: 49.4% of the total supply will be unlocked on the first day of mainnet launch, with 10.8% entering circulation through public sale and airdrop, and 38.5% managed by the Monad Foundation.

International Business Settlement: Acquired approximately 247 bitcoins between October 17 and November 7